Although it’s more affordable than traditional homes, it’s still not cheap. Like a traditional house, there are various ways to finance your mobile home. Suppose you’re considering buying a mobile home in South Carolina and researching financing options. In that case, you may have noticed that the mortgage rates for mobile homes tend to be higher than traditional homes. Various factors contribute to those higher rates.

In this post, we’ll explore why mortgage rates for mobile homes are higher.

Let’s dive in.

Factors Influencing Mortgage Rates for Mobile Homes

Several factors influence the mortgage rates of mobile homes. Factors like associated risk, loan structure, and permanent foundation play a major role in deciding the mortgage rates of mobile homes. Some of those factors include:

Higher Risk

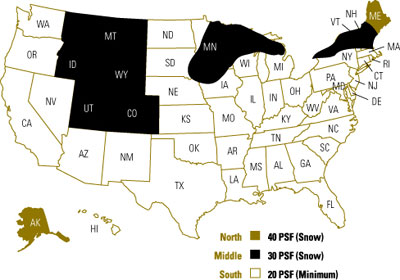

The higher mortgage rates for mobile homes in South Carolina are mainly caused by the perceived risk of these properties. Lenders view mobile homes as higher-risk investments because of their vulnerability to natural disasters such as hurricanes and tornadoes. These are rather common in South Carolina.

Also, mobile homes can be more vulnerable to risks such as theft, vandalism, and fire. Also, potential buyers of mobile homes often have lower credit scores, lower incomes, or less stable employment histories compared to other homebuyers. These factors contribute to heightened risk levels for lenders when offering mortgages for mobile homes.

Types Of Property Loan Structure

Mortgage rates for mobile homes also depend on the property type the home classifies as. Real property refers to land and permanent structures like houses, while personal property includes movable assets like cars or boats. Unless a mobile home is placed on a permanent foundation and registered as real property, it is typically considered personal property.

Personal property loans carry higher interest rates as they lack collateral. In contrast, real property loans offer lower interest rates as they are secured by collateral. If a borrower defaults on a real property loan, the lender can foreclose on both the land and the mobile home, increasing their chances of recovering the loan amount.

Permanent Foundation

A permanent foundation plays a big part in increasing the mortgage rates of a mobile home. The lack of a permanent foundation in mobile homes is a factor that leads to higher mortgage rates.

Lack of permanent foundation increases the risk for lenders caused by the lack of stability and higher susceptibility to damage. Lenders are reluctant to offer loans at lower interest rates due to these factors. Additionally, the absence of a permanent foundation makes it more challenging for lenders to secure collateral, adding to the overall increase in mortgage rates for mobile homes.

Tips to Lower Your Mortgage Rate

To secure a lower mortgage rate when purchasing a mobile home in South Carolina, consider the following strategies:

- Establish a permanent foundation. Placing your mobile home on a permanent foundation and registering it as real property can make you eligible for real property loans. Real property generally offers lower interest rates.

- Improve your credit score. Lenders heavily rely on credit scores when determining mortgage rates. By consistently paying bills on time, reducing debt, and rectifying any errors on your credit report, you can enhance your creditworthiness and potentially secure a more favorable rate.

- Shop around for lenders. Different lenders may offer varying rates and terms for mobile home loans. Take the time to compare multiple offers and select the one that aligns best with your needs and financial situation.

To Wrap It Up

Buying a mobile home in South Carolina can be a great option for anyone looking for affordable, low-maintenance living. But you need to be aware of the higher mortgage rates of these properties. The right finance plan is essential to get the best possible rates on your home.

This post will help you get insight into why the mortgage rates are higher for mobile homes. Following the simple tips above, you can lower your mortgage rate and get a better financing deal on your mobile home.