Many individuals in South Carolina prefer to live in mobile homes. They offer affordable mobile housing that can be moved from one location to another and is frequently located in mobile home parks or private land. Mobile homes, like any other type of housing, are subject to their own set of taxes and fees. These taxes and fees vary by the county in South Carolina, so knowing what you’ll be paying when you buy or move into a mobile home is vital.

In this blog, we’ll look at the various types of taxes and fees that South Carolina mobile homeowners can expect to pay and how those taxes and fees differ from county to county.

Types of Mobile Home Taxes and Fees

Mobile homeowners in South Carolina may expect to pay various taxes and fees. These are some examples:

Property Taxes

Mobile homes, like any other property, are subject to property taxes. Property taxes in South Carolina are assessed by the county in which the mobile home is located. Your property tax bill will be determined by the assessed value of your mobile home and the millage rate in your county.

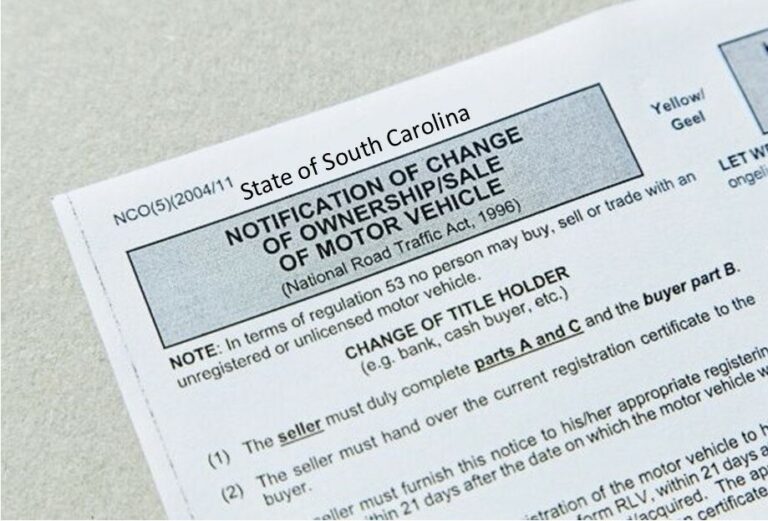

Vehicle Registration Cost

Because mobile homes are considered vehicles in South Carolina, they must be registered. The registration fee for a mobile home is determined by the weight of the home and the year it was built.

Sales Tax

You must pay sales tax if you purchase a new or used mobile home in South Carolina. South Carolina levies a 6% sales tax.

Moving Permit Cost

You must get a moving permit if you need to relocate your mobile home to South Carolina. The cost of obtaining a relocation permit varies by county.

Park Costs

You may be forced to pay a monthly park fee if you live in a mobile home park. This charge supports the expense of maintaining the park and providing services such as garbage removal and grass care.

Now that we’ve examined the various taxes and fees that South Carolina mobile homeowners may anticipate paying, let’s look at how those taxes and fees differ by county.

| County Name | Tax Rate | Cost per Thousands Rate |

|---|---|---|

| Anderson County | 6% | $15 |

| Beaufort County | 4% | $12 |

| Berkeley County | 6% | $10 |

| Charleston County | 6% | $12 |

| Dorchester County | 6% | $10 |

| Greenville County | 6% | $15 |

| Horry County | 6% | $10 |

| Lexington County | 6% | $15 |

| Richland County | 6% | $12 |

| Spartanburg County | 6% | $15 |

- Anderson County Taxes: The property tax rate for mobile homes in Anderson County is 6% of the assessed value. The charge for registering a mobile home is $15 per thousand pounds of weight. Anderson County’s sales tax rate is 6%. A relocating permission costs $10

- Beaufort County Taxes: The property tax rate for mobile homes in Beaufort County is 4% of the assessed value. The charge for registering a mobile home is $12 per thousand pounds of weight. Beaufort County’s sales tax rate is 7%. A relocating permission costs $50

- Berkeley County Taxes: The property tax rate for mobile homes in Berkeley County is 6% of the assessed value. The charge for registering a mobile home is $10 per thousand pounds of weight. Berkeley County’s sales tax rate is 6%. A relocating permission costs $25

- Charleston County Taxes: The property tax rate for mobile homes in Charleston County is 6% of the assessed value. The charge for registering a mobile home is $12 per thousand pounds of weight. Charleston County has a 7% sales tax. A relocating permission costs $25

- Dorchester County Taxes: The property tax rate for mobile homes in Dorchester County is 6% of the assessed value. The charge for registering a mobile home is $10 per thousand pounds of weight. Dorchester County has a 6% sales tax. A relocating permission costs $25

- Greenville County Taxes: The property tax rate for mobile homes in Greenville County is 6% of the assessed value. The charge for registering a mobile home is $15 per thousand pounds of weight. Greenville County has a 6% sales tax. A relocating permission costs $15

- Horry County Taxes: The property tax rate for mobile homes in Horry County is 6% of the assessed value. The charge for registering a mobile home is $10 per thousand pounds of weight. Horry County’s sales tax rate is 7%. A relocating permission costs $50

- Lexington County Taxes: The property tax rate for mobile homes in Lexington County is 6% of the assessed value. The charge for registering a mobile home is $15 per thousand pounds of weight. Lexington County’s sales tax rate is 6%. A relocating permission costs $10

- Richland County Taxes: The property tax rate for mobile homes in Richland County is 6% of the assessed value. The charge for registering a mobile home is $12 per thousand pounds of weight. Richland County’s sales tax rate is 8%. A relocating permission costs $25

- Spartanburg County Taxes: The property tax rate for mobile homes in Spartanburg County is 6% of the assessed value. The charge for registering a mobile home is $15 per thousand pounds of weight. Spartanburg County has a 6% sales tax. A relocating permission costs $10

**It should be noted that these tax rates and levies are subject to change, so always check with your local county government for the most up-to-date information.

To Wrap It Up

Many individuals in South Carolina find mobile homes an economical and flexible housing choice, but it’s vital to understand the taxes and fees that come with owning a mobile home. Mobile homeowners in South Carolina must pay property taxes, car registration fees, sales taxes, relocation permit costs, and park fees.

These taxes and fees might differ by county, so do your homework and learn what you can anticipate paying in your area.