Key takeaways

Up to now, every technology improved economically: extra training, higher jobs, homeownership, and longer lives.

That upward trajectory is now in query, particularly for Millennials and Gen Z.

Younger Australians are more and more skeptical that they’ll be wealthier or safer than their mother and father.

Recognising generational shifts permits savvy buyers to anticipate modifications in housing demand, household formation, and asset preferences.

Don’t rely out younger Australians—they’ll nonetheless construct wealth, however on totally different timelines and phrases.

As at all times in property, the sooner you perceive the macro tendencies, the higher positioned you’re to profit from them.

Will immediately’s youthful generations find yourself wealthier, happier, and safer than their mother and father?

That was a no brainer.

For a lot of Australia’s trendy historical past, every technology climbed the financial ladder increased than the one earlier than it. Extra training, higher jobs, larger properties, longer lives.

However that narrative is now being questioned, particularly by the very folks meant to reside it.

So, are younger Australians nonetheless on observe to be higher off? Or has the promise of generational progress quietly slipped away?

Let’s take a better take a look at what the proof actually says—and what it means for us as property buyers and wealth builders.

Let’s begin with some context

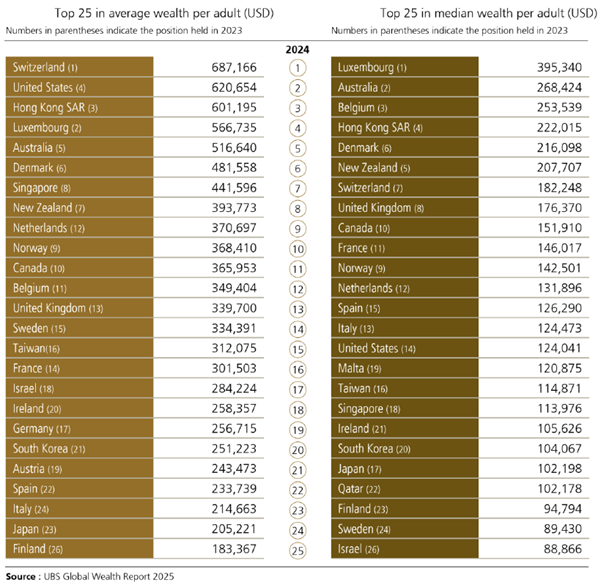

In line with the 2025 UBS World Wealth Report, our wealth elevated by 11% in 2024, and Australia ranks second globally by way of median wealth per grownup.

Nevertheless, most of Australia’s wealth is concentrated within the palms of Child Boomers, and there are just a few clear the reason why.

Firstly, Boomers have merely had time on their facet.

Many entered the workforce throughout an period of robust wage development, reasonably priced property costs, and beneficiant superannuation reforms.

They have been in a position to purchase properties within the Seventies, 80s and even early 90s—when median home costs have been just some occasions the typical earnings, not 8 to 10 occasions like they’re immediately.

Because the many years rolled on, rising property values and beneficial tax insurance policies supercharged the wealth of owner-occupiers and buyers alike.

Secondly, Child Boomers benefited from stability.

They lived by way of a interval of financial enlargement, decrease training prices, and safer full-time employment.

Many now have constructed up sizable fairness of their properties, usually being mortgage free.

Add to that the rise in share market participation by way of superannuation, and for some, inheritances from their very own mother and father, and it’s simple to see why this technology holds a disproportionate slice of the nation’s wealth.

At present, Boomers management greater than half of Australia’s non-public wealth, regardless of representing solely 1 / 4 of the inhabitants.

This isn’t unfair – it displays a lifetime of accumulation, but it surely raises vital questions on intergenerational fairness and the way that wealth shall be transferred within the many years forward.

So again to the unique query – will younger Australians be higher off than their mother and father?

E61 Institute checked out this and got here up with some fascinating findings…

A technology that’s extra educated and extra indebted

There’s little doubt that younger Australians are essentially the most extremely educated technology in our nation’s historical past.

They’re greater than twice as prone to maintain a college diploma as their mother and father have been on the similar age, and so they’re far much less prone to drop out of faculty early.

That’s a win.

However training hasn’t come low cost.

Greater than 30% of Australians underneath 35 now carry a scholar debt, up from 20% a decade in the past, and the typical HELP debt has ballooned to over $26,000.

Many are nonetheless paying off that debt properly into their mid-30s, proper once they’re making an attempt to save lots of a deposit or begin a household.

It’s not simply the scale of the debt—it’s the timing.

And it’s holding them again.

Incomes extra… however taking dwelling much less?

Younger Aussies are incomes comparable actual wages to those that got here earlier than them.

The truth is, early-career earnings are broadly akin to these of Gen X.

However after the International Monetary Disaster, earnings development for under-40s has fallen dramatically behind that of older Australians.

Add to {that a} shift towards insecure, lower-paid work and diminished job mobility, and also you get a technology struggling to construct monetary momentum.

And whereas older Australians take pleasure in tax-free beneficial properties on their properties and capital beneficial properties reductions on their investments, youthful employees carry the rising burden of earnings tax, courtesy of bracket creep.

And whereas some Gen Zs will profit from the most important wave of inheritances in Australian historical past, as I discussed above, these windfalls usually come too late, normally of their 50s.

That doesn’t assist a lot while you’re 30, renting, and making an attempt to boost children.

The homeownership dream is fading

Nowhere is the generational hole extra seen than in housing.

Homeownership charges amongst 25–34-year-olds have plummeted.

Even {many professional} millennials now view homeownership as a pipe dream, significantly in Sydney and Melbourne.

In consequence, extra younger adults are staying of their household dwelling longer – practically 60% of 18- to 24-year-olds nonetheless reside with their mother and father, and fewer are forming relationships or having kids earlier than the age of 30.

This isn’t only a life-style alternative.

It’s a response to affordability pressures and financial precarity.

The standard life path – job, associate, dwelling, children – is being delayed, or in some instances, rewritten fully.

Diverging experiences: gender and geography matter

There’s no single “youth” expertise in Australia anymore.

For instance , younger girls are incomes greater than their male friends in early careers, pushed by increased instructional attainment and development in female-dominated sectors like healthcare.

However they’re additionally experiencing declining psychological well being and better ranges of loneliness and hospitalisation.

In the meantime, some younger males, significantly in regional areas, are falling behind, dealing with increased unemployment, decrease training charges, and rising charges of disengagement.

And the divide doesn’t cease there.

In some distant areas, as much as 30% of 20–24-year-olds usually are not in employment, training or coaching. That’s an enormous pool of untapped potential.

The psychological well being and know-how double-whammy

Younger Australians are additionally the primary technology to develop up absolutely on-line.

They’ve gained entry to extra info, extra alternative, extra alternative.

However they’ve additionally inherited a collection of latest issues: social media dependancy, elevated anxiousness, and declining psychological well-being.

Psychological well being scores for younger girls have fallen considerably during the last decade.

And younger males are displaying indicators of dangerous behaviour in different areas – playing, as an example, has doubled amongst younger males since 2015, and surprisingly, it’s not simply on-line betting – it’s pokies.

In different phrases, know-how has reshaped how younger Australians work together, kind relationships, and take dangers, however not at all times for the higher.

The inheritance financial system however just for some

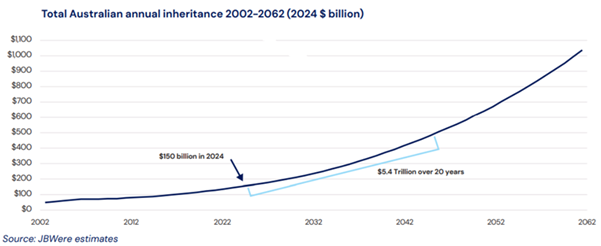

Australia is on the point of the most important wealth switch in its historical past.

Inheritances are anticipated to quadruple by 2050.

Nevertheless, these beneficial properties shall be inconsistently distributed; many will obtain little or nothing, and so they usually arrive too late to assist early monetary milestones.

JBWere estimates that some $5.4 trillion of this wealth shall be transferred to youthful generations over the following 20 years.

Nevertheless, this received’t be handed on to Gen Z or millennials anytime quickly – will probably be handed on to their mother and father.

And whereas some younger Australians will ultimately catch up by way of bequests and asset appreciation, others received’t.

And that might cement a brand new type of inequality, not simply between generations, however inside them.

So… are they higher off?

That relies upon.

If we’re measuring in uncooked training ranges, life expectancy, or entry to digital instruments – sure, younger Australians have gotten an edge.

But when we’re speaking about monetary independence, homeownership, relationship stability, or psychological wellbeing, many younger Australians are dealing with a a lot rougher highway.

In actuality, the story isn’t considered one of decline, however delay.

Life milestones are being pushed again, reshaped, and in some instances, reimagined.

In line with the E61Institute report , the problem for policymakers is knowing these shifts and getting ready for what comes subsequent.

Remaining ideas for property buyers and enterprise house owners

Why does this matter to you as a property investor or enterprise proprietor?

As a result of understanding generational change provides you perception into tomorrow’s housing market, workforce, and financial system.

Younger Australians could also be shopping for later, renting longer, and beginning households of their 30s- however that doesn’t imply they received’t construct wealth.

They’ll simply do it in another way. Some will inherit, some will make investments, others will co-buy or rentvest.

However they’ll nonetheless want properties. They’ll nonetheless chase monetary independence. They usually’ll nonetheless be searching for alternatives in a quickly altering world.

Your job is to see the tendencies early, adapt, and make investments accordingly.