Key takeaways

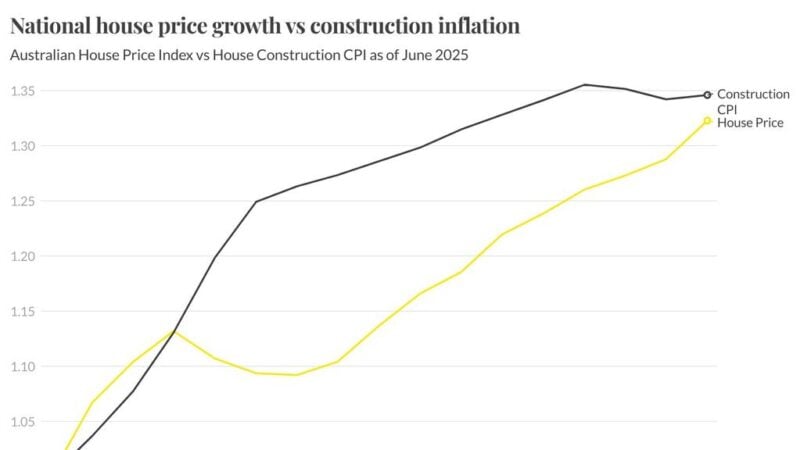

From 2021 to 2025, building prices rose 35%, whereas home costs climbed 32%.

This 2.3% hole is a big enchancment in comparison with the 16% hole recognized in December 2023.

Markets like Perth, Adelaide and Brisbane are higher positioned for brand spanking new housing provide.

Sydney, Melbourne and Canberra are prone to face continued provide challenges as a result of new building stays uneconomical.

For the primary time in years, home costs and building prices are shifting nearer collectively — a optimistic signal for future housing provide.

Not way back, it was clear-cut: constructing new simply didn’t make monetary sense.

As Nerida Conisbee, Ray White’s Chief Economist identified again in December 2023, “building prices had dramatically outpaced home worth development, making it cheaper to purchase a longtime dwelling than construct new.”

At the moment, the numbers have been stark.

Capital metropolis home costs had risen simply 11% over two years, whereas building prices had surged 27%.

The hole was so extensive that purchasing established wasn’t simply cheaper, it was actually the one logical choice.

Nonetheless, now analysis from Ray White , reveals that whereas it stays cheaper to purchase than construct in most markets, the hole between the price of shopping for versus constructing has narrowed considerably.

In truth, in some capitals, home worth development is now outstripping building price escalation; a whole reversal of the pattern we’d seen for years.

Nationwide image: convergence ultimately

Over the 4 years from 2021 to 2025, building prices have risen 35% based on Ray White evaluation in the meantime, home costs have risen by 32%.

That’s only a 2.3 share level distinction, in contrast with the large 16-point hole that Ms Conisbee recognized lower than two years in the past.

What this reveals is that the runaway building price development of the pandemic period has slowed, whereas home costs have caught up.

For the primary time in years, the strains are converging, and that’s crucial for the economics of latest housing provide.

Supply: Ray White

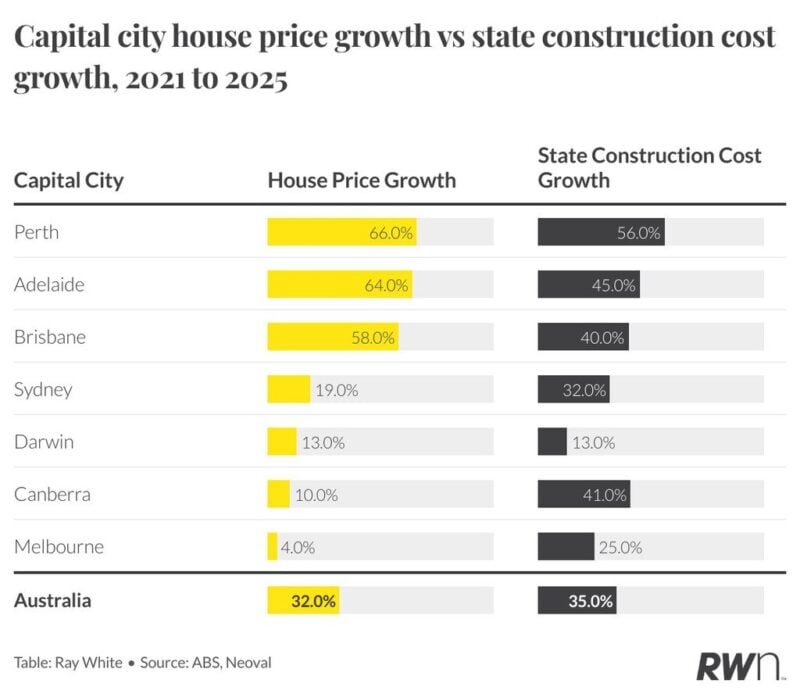

Perth, Adelaide and Brisbane flip the tables

The standout story is Perth.

In late 2023, Ms Conisbee famous Perth had seen home costs rise 20% whereas building prices jumped 40%. That imbalance discouraged new constructing.

However by mid-2025, Perth has flipped the script. Home costs are up an unimaginable 66% since 2021, outpacing WA building prices, which have risen 56%.

As Nerida highlights,

“Perth has not solely closed the hole however reversed it – lastly reaching substitute price ranges that encourage new dwelling building.”

Adelaide and Brisbane inform the same story:

Notice: These cities have reached the purpose the place new builds make sense once more, a crucial shift for future provide.

Jap Capitals: nonetheless behind the curve

The image is much much less encouraging in Sydney, Melbourne and Canberra.

Sydney property worths are up simply 19% since 2021, whereas building prices rose 32%.

Melbourne property values have barely moved with solely 4% home worth development towards a 25% leap in prices.

Canberra reveals the worst mismatch: 10% worth development versus a 41% surge in constructing prices.

In these markets, the economics of latest building stay poor.

Builders and consumers alike will wrestle to justify new builds till costs climb additional or prices come down.

Supply: Ray White

Provide implications

Now this divergence issues.

The Federal Authorities’s Housing Accord goals to ship 1.2 million new houses within the subsequent 5 years. That was bold at the perfect of occasions.

In markets like Perth, Adelaide and Brisbane, we might now see extra building exercise, as a result of the economics lastly stack up.

However in Sydney, Melbourne and Canberra, the equation continues to be damaged, which means restricted new provide and extra strain on established housing inventory.

As Ms Conisbee concludes:

“Regardless of the narrowing hole, it stays cheaper to purchase a longtime dwelling than construct new in most markets.

Nonetheless, the momentum is clearly shifting.”

Closing ideas

Australia’s housing market is at a turning level.

Whereas established houses are nonetheless cheaper in most cities, the convergence of home costs and building prices alerts a more healthy steadiness is returning.

For buyers, that is price watching intently as there are nonetheless alternatives, significantly in Melbourne and Sydney, to purchase established properties with appreciable inbuilt fairness (as they’re considerably beneath substitute prices).

For those who’re like many property buyers, you are most likely questioning what’s the fitting factor to do at current.

Do you have to purchase, do you have to promote, or do you have to simply wait?

You possibly can belief the staff at Metropole to offer you route, steerage, and outcomes.

Whether or not you’re a newbie or an skilled investor, at occasions like we’re presently experiencing you want an advisor who takes a holistic method to your wealth creation and that’s precisely what you get from the multi-award-winning staff at Metropole.

We assist our purchasers develop, defend and cross on their wealth by a variety of companies together with:

- Strategic property recommendation – Permit us to construct a Strategic Property Plan for you and your loved ones. Planning is bringing the long run into the current so you are able to do one thing about it now! Click on right here to be taught extra

- Purchaser’s company – As Australia’s most trusted consumers’ brokers we’ve been concerned in over $4Billion price of transactions creating wealth for our purchasers and we are able to do the identical for you. Our on the bottom groups in Melbourne, Sydney, and Brisbane deliver you years of expertise and perspective – that’s one thing cash simply can’t purchase. We’ll show you how to discover your subsequent dwelling or an investment-grade property. Click on right here to find out how we might help you.

- Property Growth – We allow you to turn into an “armchair developer” and get all the advantages of property growth with out getting your fingers soiled. We take the hassles out of your funding by helping you with all of the experience you want, from idea to completion, together with building. Click on right here to see if it’s the fitting means so that you can develop your portfolio.

- Wealth Advisory – We will offer you strategic tailor-made monetary planning and wealth recommendation. Click on right here to be taught extra about we might help you.

- Property Administration – Our stress-free property administration companies show you how to maximise your property returns. Click on right here to seek out out why our purchasers get pleasure from a emptiness price significantly beneath the market common, our tenants keep a mean of three years, and our properties lease 10 days sooner than the market common.