While there’s no law dictating that a mobile home built before a certain year can’t get insured. But if the home was built before 1976 your options of insuring will be a bit different than a modern manufactured home (manufactured homes built after 1976). Securing insurance for old mobile homes is a bit more challenging because of the need for manufacturing standards during that period. Insurance policies for older manufactured homes include the standard protections of a typical homeowners policy and specialized coverage explicitly crafted for mobile homes.

In this article, we’ll discuss what’s the oldest mobile home that can be insured and how to do it.

Let’s dive in.

What’s The Difference Between Insuring An Old Mobile Home Vs A New One?

While there’s no time limit on how old a mobile home can be to get insured, there are differences between insuring an old manufactured home and a new manufactured homes. Mobile homes built after 1976 are referred to as manufactured homes and manufactured homes are referred to as properties built pre-1976.

A manufactured home insurance policy differs from manufactured home insurance because manufactured homes before 1976 were unregulated and didn’t follow certain standards. After 1976 Housing and Urban Development (HUD) created mobile home construction and safety standards. So, both have different types of insurance. But insuring old manufactured homes covers your dwelling, any possible liability you could incur, and your personal belongings. Insurance for an older home may cost more than a newer one.

What Does Mobile Home Insurance Cover?

Mobile home insurances are quite similar to traditional or manufactured homes. Generally, you can even customize your policy by adjusting the coverage limits. Manufactured home coverage usually includes:

Dwelling

Dwelling coverage takes care of expenses associated with rebuilding or repairing the structure of your manufactured home, along with any attached structures like decks or awnings, in case of a covered loss.

An older home might have a higher cost for the policy as an older home may need more repairs.

Physical Damage

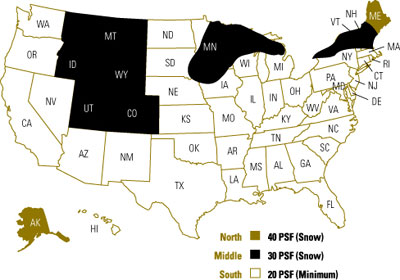

Insurance also covers any accidental damage to your house, attached deck, structures like outbuildings, and belongings caused by events like fire, theft, hail, wind, and falling objects. However, the coverage can vary based on the insurance provider’s policies.

One important thing to note is that regular manufactured home insurance doesn’t cover flood damage. So, if you live in a high-risk zone for natural disasters such as floods, earthquakes, and wildfires, you might need to pay for additional coverage.

Personal Liability

Mobile home insurance also covers you if someone gets hurt on your property. For example, if a tree branch on your property injures your neighbor, and he holds you responsible, he may take legal action. But with this coverage, your insurance company will handle all legal defense costs and any damages awarded in case of liability. Your insurance provider will furnish financial protection up to the coverage limit.

Personal Property

The coverage also protects personal belongings if they’re damaged or stolen. Although your stolen or damaged property is covered, you must pay a deductible when filing a claim.

How To Insure Older Mobile Homes?

Before you buy insurance for your manufactured home, get ready to do your research. You need to understand what coverage option best suits your needs and how to get it for the best price. Here are a few steps you can follow:

- Estimate how much your old mobile home is worth

- Check your home inventory to estimate your personal property coverage

- Consider asking about extra endorsements that can be included in your policy to secure the right level of protection for your older manufactured home.

- Look at the deductible to understand your out-of-pocket expenses associated with filing a claim.

- Finally, make it a priority to obtain and compare quotes from different companies. Assess the coverage and pricing to pinpoint the home insurance company that delivers the best value for your insurance policy on an older mobile home.

To Wrap It Up

Protecting your investment with insurance is always a good idea, and manufactured homes are no exception. Even though it’s not legally obligatory, insuring your manufactured home is a great decision.

This post will help you learn if a mobile home is too old to get insured and how to insure older homes.