Insurers within the U.S. paid out about $1 billion in claims for lightning-related harm in 2024, down 16.5% from the quantity paid in 2023, based on the Insurance coverage Info Institute (Triple-I).

The tally was $1.04 billion in 2024 in comparison with $1.24 billion in 2023.

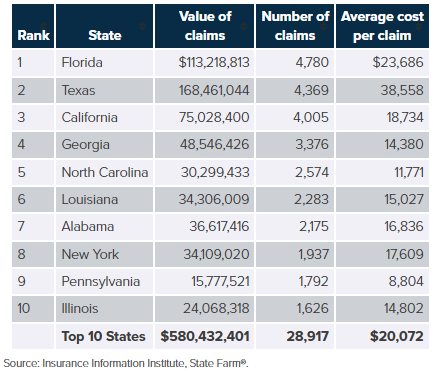

Greater than half of the claims have been filed within the prime 10 states—with Florida, Texas and California the highest 3—however the whole variety of lightning-caused claims fell 21.5% to 55,537 in 2024.

Triple-I mentioned this was the bottom variety of claims since earlier than 2017. The excessive mark since 2017 was 2020 with practically $2.1 billion paid on 71,551 claims—a mean of $28,885 per declare.

Information was compiled by Triple-I to coincide with Nationwide Lightning Security Consciousness Week (June 22-28).

“Lightning stays a expensive and unpredictable risk, with floor surges inflicting practically half of all claims,” mentioned Michal Brower, media spokesperson for State Farm, in an announcement. “These occasions could cause in depth harm to electrical programs, home equipment and even structural points. The harm underscores the vital want for householders to pay attention to the dangers, spend money on protecting measures, and keep ready, particularly in high-risk areas the place lightning strikes are most frequent and damaging.”

Harm brought on by lightning, similar to fireplace, is roofed by customary householders, rental, renters and enterprise insurance coverage insurance policies. Some householders insurance policies present protection for energy surges which are the direct results of a lightning strike, mentioned Triple-I.

Subjects

Claims

Was this text precious?

Listed below are extra articles it’s possible you’ll take pleasure in.

Eager about Claims?

Get automated alerts for this subject.