Key takeaways

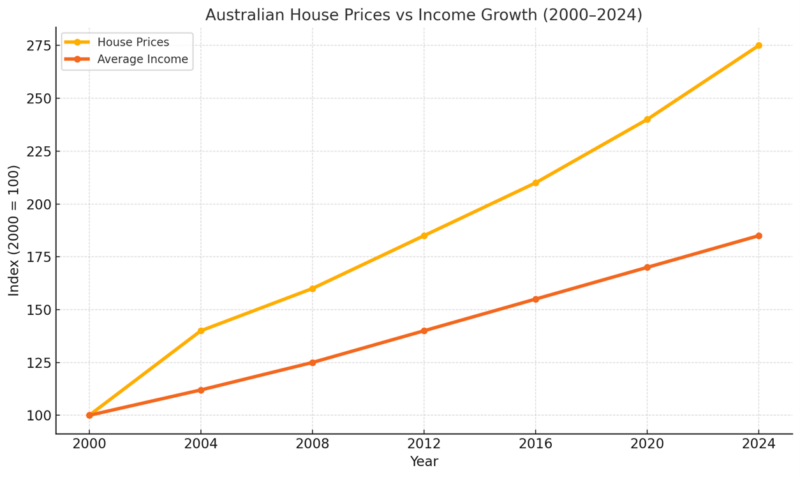

Revenue development has stagnated, whereas asset values—significantly property—have surged.

This has created a tilted enjoying subject, favouring those that already personal property or different appreciating belongings.

The median house value in Australia has surpassed $1 million, highlighting how far out of attain property is for a lot of Australians, particularly youthful generations.

If you happen to’re feeling prefer it’s getting more durable to get forward financially, you’re not imagining issues.

Whereas incomes have inched up slowly, property values, and by extension, family wealth, have skyrocketed.

The enjoying subject isn’t simply uneven anymore—it’s tilting sharply towards those that already personal belongings.

You see…within the grand theatre of Australian prosperity, we’ve simply witnessed a defining act: In response to the ABS, the median Australian house has now cracked the $1 million mark.

Now that’s nice information for property homeowners, however for everybody else, particularly first-home patrons and the youthful generations, it’s a stark reminder that the ladder to wealth is being pulled additional out of attain.

And the reality is, this isn’t nearly housing affordability.

It’s about wealth inequality and the way proudly owning property is quickly changing into the nice divide in Australian society.

The wealth hole is rising, and quick

Wealth inequality in Australia is accelerating at a tempo that ought to make us all pause.

Supply: ABS Information

Let’s put issues in perspective: the mixed wealth of Australia’s 200 richest people has ballooned to $667.8 billion, which now makes up a staggering 24.5% of our nationwide GDP.

Twenty years in the past, that determine sat at simply 8%.

[note] That’s not simply financial development—that’s wealth focus on steroids. [/notes]

On the identical time, wealth throughout Australian households is rising, however not evenly.

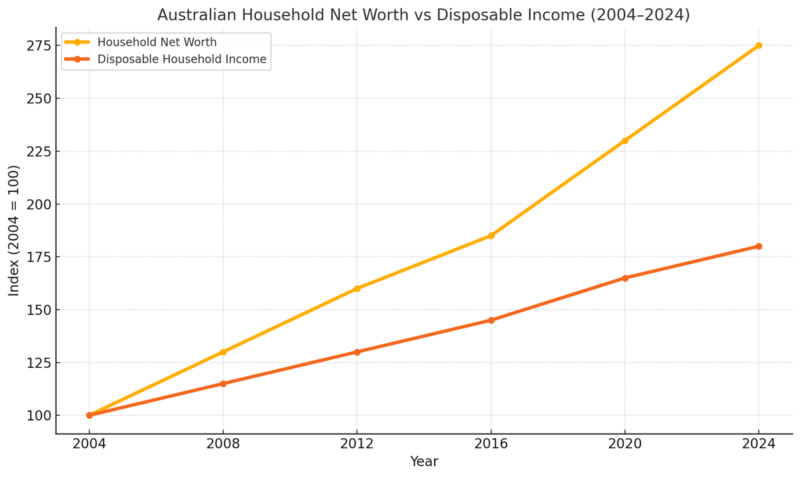

In response to ABS knowledge, the web price of the common family has surged from round $530,000 in 2004 to nicely over $1.4 million in 2024.

Disposable incomes, in contrast, have grown at a snail’s tempo.

What we’re seeing is a divergence: incomes slowly ticking up, whereas asset costs, significantly residential property, shoot into the stratosphere.

Check out the chart under (primarily based on ABS figures), and the sample turns into painfully apparent:

- Family wealth has practically tripled over 20 years.

- Family disposable revenue has not even doubled.

That hole? That’s the place property lives.

Supply: ABS Information

Property: the nice wealth accelerator

In Australia, actual property is not only a roof over your head, it’s the inspiration of long-term monetary safety.

Round 55% of Australian family belongings are tied up in land and dwellings.

Which means most of our wealth development is tied to the housing market, not wages, not shares, and never financial savings accounts.

And that’s the place the issue lies for these overlooked.

Those that bought into the property market early, child boomers, Gen X, and even Millennials who scraped into their first houses a decade in the past, have benefited immensely from a long time of capital development and leveraged fairness.

In the meantime, these nonetheless renting or ready to “save a bit extra” are watching the ladder get taller, sooner than they’ll climb.

This dynamic is what’s driving inequality: those that personal property are compounding their wealth, whereas those that don’t are falling behind.

No, don’t blame this on “ugly, grasping, property buyers” as a result of 70% of properties are owned by owners, atypical mums and dads, so it’s actually the roof over their head that’s changing into extra worthwhile over time.

A tax system tilted towards the wealthy

What amplifies this wealth hole is a tax system that, whether or not deliberately or not, rewards those that have already got wealth or personal property.

Let’s break it down:

- Capital positive factors tax reductions reward long-term asset holders (particularly these in property). However whereas lots is spoken about the advantages buyers obtain, the greatest capital acquire low cost is for owners who can improve their house and do not pay any capital positive factors tax in any respect once they promote!

- Unfavourable gearing continues to favour buyers and enterprise homeowners who take a threat with their capital and at instances have extra bills than revenue. By the best way.. I believe it is a truthful benefit that those that take monetary threat obtain.

- Superannuation tax concessions profit these Australians who put cash apart to safe their monetary future in retirement.

[note] What this implies is: when you personal belongings, the system helps you develop and shield that wealth extra effectively than revenue alone ever may. [/note]

The lesson? Don’t simply work to your cash, make it be just right for you

The message right here isn’t to vilify the rich. Removed from it!

What I’m making an attempt to get throughout is that it’s vital to know our capitalist system, to be taught from what’s labored for the rich and to know the best way to play the sport with the foundations we’ve been given.

If you happen to’re not but a property investor, now’s the time to significantly contemplate changing into one.

This isn’t about hypothesis, it’s about strategically utilizing actual property as a instrument to construct wealth over time.

As a result of regardless of all of the noise: rates of interest, media panic, politics, the basics haven’t modified:

- Australia’s inhabitants is rising.

- We have now a persistent housing scarcity.

- Demand continues to outstrip provide.

- Rising development prices imply all new dwellings will probably be significantly costlier

- And land in our capital cities (which is the place most individuals wish to dwell) is finite.

These are the elements that make residential actual property such a robust long-term asset.

It’s not too late, however it’s getting more durable

Sure, affordability is a matter. Sure, borrowing capacities are tighter.

However the price of ready could be even larger than the price of entry.

That’s why sensible buyers aren’t sitting on the sidelines, they’re considering strategically:

- Shopping for investment-grade properties in tightly held suburbs

- Leveraging fairness to develop a portfolio over time

- Working with property strategists (like our workforce at Metropole) to construct intergenerational wealth.

As a result of in 10 or 20 years, in the present day’s costs will appear to be a discount. And those that acted will probably be on the appropriate aspect of the wealth divide.

Wealth in Australia isn’t simply rising, it’s compounding.

However solely for many who perceive that proudly owning property is not optionally available if you wish to create a financially safe future.

The info is obvious. The chance continues to be there.

Now the query is: will you are taking motion, or maintain ready whereas others construct their wealth?

That’s the place our Complimentary Wealth Discovery Session is available in. We’re providing you a 1-on-1 chat with a Metropole Wealth Strategist that will help you:

- Make clear your monetary objectives

- Perceive how macro tendencies have an effect on your place

- Construct a personalised, data-driven property technique

- Get forward of the curve — earlier than everybody else piles in

There’s no value, no obligation — simply sensible, tailor-made steering primarily based on a long time of expertise.

Click on right here now to e-book your free Wealth Discovery Session.