Key takeaways

Nationwide dwelling costs rose 0.5% in September, marking the ninth consecutive month of progress and taking dwelling values to a file excessive.

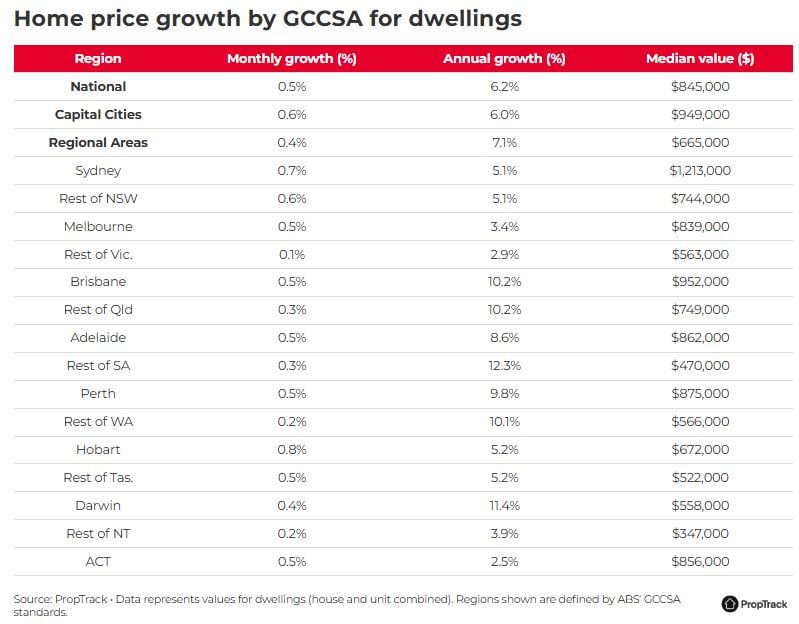

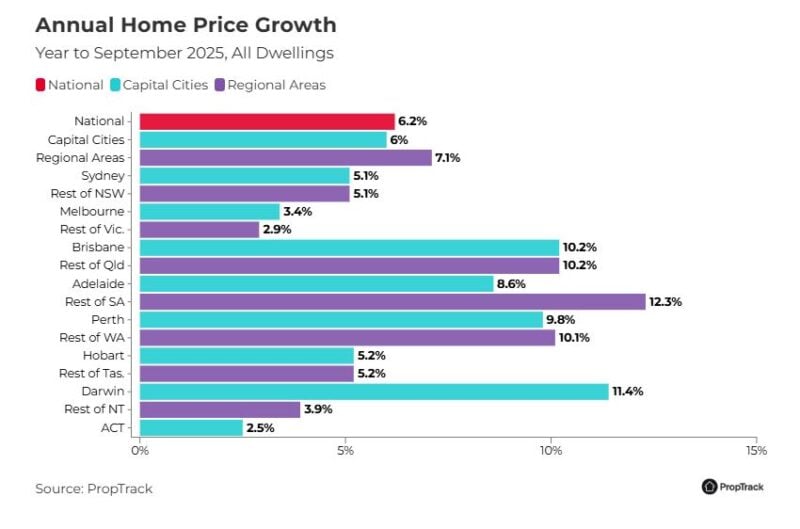

Nationwide dwelling costs are up 6.2% over the previous 12 months, including round $54,100 to the worth of the median dwelling, and have surged 50.6% up to now 5 years.

Capital metropolis costs rose 0.6% in September and are up 6.0% year-on-year, with values at file highs.

Among the many capitals, Hobart (+0.8%) and Sydney (+0.7%) led month-to-month progress. All capitals other than Hobart (–5.4% under peak) and Canberra (–1.3% under peak) are actually sitting at file highs.

Over the previous 12 months, Darwin (+11.4%), Brisbane (+10.2%), regional South Australia (+12.3%), and regional Queensland (+10.2%) recorded the strongest features.

Melbourne costs have now absolutely recovered their 2022 peak, returning to file highs after a number of years of underperformance.

Hobart is rebounding after a interval of underperformance, main month-to-month features in September and exhibiting one of many sharpest annual accelerations in worth progress throughout the capitals.

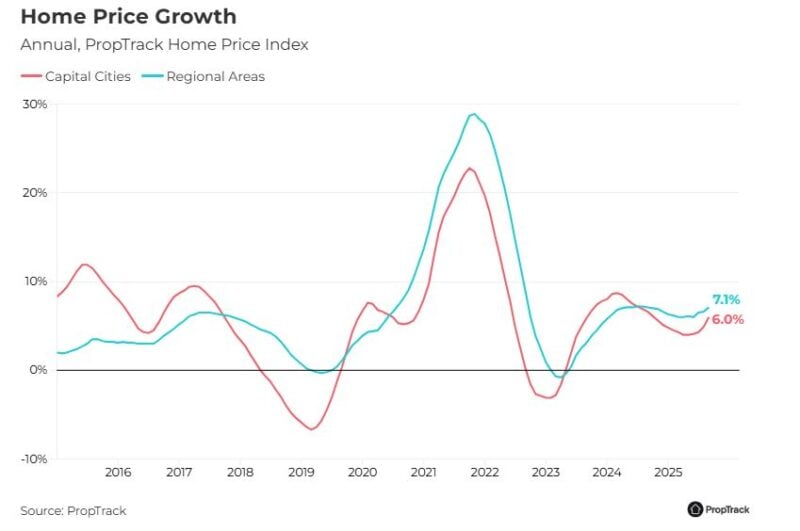

Regional costs climbed 0.4% in September and are up 7.1% year-on-year, outpacing the capitals over the previous 12 months and 5 years (64.4% vs 46.5%), bolstered by relative affordability and life-style attraction.

Nationwide dwelling costs rose 0.5% in September, extending the upswing to a ninth straight month and lifting values 6.2% larger than a 12 months in the past, based on PropTrack.

PropTrack information reveals that the housing market stays on a agency upward trajectory this spring promoting season.

Nationwide dwelling costs rose 0.5% in September, extending the upswing to a ninth straight month and lifting values 6.2% larger than a 12 months in the past.

Eleanor Creagh, Senior Economist at PropTrack mentioned:

“The mix of elevated borrowing capacities and decrease borrowing prices, stronger purchaser confidence and renewed competitors is underpinning a broad and synchronised uplift.

Dwelling values are lifting in each capital metropolis and regional space, however momentum is shifting.

Value progress in Sydney and Melbourne is re-accelerating, Hobart is rebounding, and Darwin is main annual features amid surging investor exercise.”

Home and unit costs elevate in September

The report additionally reveals that nationally, home and unit costs are actually rising at the same tempo, home costs lifted 0.5% in September, whereas unit costs nationally rose 0.6%.

Nationwide home costs have lifted 6.3% over the previous 12 months, whereas progress in unit values (6.1% year-on-year) has been comparable.

Ms Creah additional mentioned:

“For the reason that pandemic onset, home values are up 54.1% vs. simply 40.5% for models. This highlights the stronger efficiency of homes over the medium time period, pushed by elevated demand for area and land throughout and after the pandemic.”

Key findings from the September 2025 Report:

- Nationwide dwelling costs rose 0.5% in September, marking the ninth consecutive month of progress and taking dwelling values to a file excessive.

- Nationwide dwelling costs are up 6.2% over the previous 12 months, including round $54,100 to the worth of the median dwelling, and have surged 50.6% up to now 5 years.

- Capital metropolis costs rose 0.6% in September and are up 6.0% year-on-year, with values at file highs.

- Among the many capitals, Hobart (+0.8%) and Sydney (+0.7%) led month-to-month progress. All capitals other than Hobart (–5.4% under peak) and Canberra (–1.3% under peak) are actually sitting at file highs.

- Over the previous 12 months, Darwin (+11.4%), Brisbane (+10.2%), regional South Australia (+12.3%), and regional Queensland (+10.2%) recorded the strongest features.

- Melbourne costs have now absolutely recovered their 2022 peak, returning to file highs after a number of years of underperformance.

- Hobart is rebounding after a interval of underperformance, main month-to-month features in September and exhibiting one of many sharpest annual accelerations in worth progress throughout the capitals.

- Regional costs climbed 0.4% in September and are up 7.1% year-on-year, outpacing the capitals over the previous 12 months and 5 years (64.4% vs 46.5%), bolstered by relative affordability and life-style attraction.

Outlook

PropTrack experiences that with rates of interest transferring decrease this 12 months, momentum within the housing market has strengthened, and nationwide annual progress has picked up by 0.8 proportion factors because the begin of the 12 months, marking a turnaround from the slower circumstances noticed in late 2024.

The experiences additionally highlights that the present upswing is a synchronised enlargement, underpinned by decrease charges and constrained provide, with a broad-based elevate in costs throughout the nation.

Ms Creagh notes:

“Stretched affordability stays a brake on the tempo of progress, which has accelerated however is broadly according to the previous decade’s common, under the 30-year annual common, and much beneath the 20–30% surges that outlined earlier booms.

Trying forward, the collection of rate of interest cuts delivered this 12 months, improved sentiment and the October enlargement of the Dwelling Assure Scheme will add help. And with inventory on market constrained and new provide challenged, demand-side stimulus is prone to intensify competitors.

The October enlargement of the Dwelling Assure Scheme and removing of earnings caps will pull ahead some first-home purchaser demand by reducing the deposit hurdle, with no commensurate elevate in provide responsiveness.

Consequently, the housing market is poised for additional features all through spring, although the tempo will differ throughout cities as momentum shifts.”