Key takeaways

The Australian housing market stays way more sophisticated than many painting it to be.

The Australian housing cycle is popping up once more; falling rates of interest are the important thing driver, together with a continual undersupply of houses of 200,000-300,000 dwellings.

This partly displays a surge in constructing instances; poor affordability is a key constraint although, but it surely varies considerably between cities; and eventually, mortgage arrears stay low.

Common costs are anticipated to rise 5-6% this yr boosted by falling charges however constrained by poor affordability.

By now, you’ve most likely seen the resurgence in our property markets.

Headlines are shifting from concern to FOMO once more, and as soon as extra we’re listening to daring predictions from each extremes, the everlasting optimists touting the drained “property doubles each seven years” mantra and the perennial bears warning of a crash.

The fact, as all the time, lies someplace in between.

Australia’s housing market isn’t damaged. However it’s complicated.

And if you wish to construct lasting wealth via property, that you must reduce via the noise and perceive what’s actually driving the tendencies – not simply at present, however into the longer term.

Dr Shane Oliver, AMP’s well-respected Chief Economist, has not too long ago shared seven insightful charts that assist make sense of what’s occurring beneath the headlines.

Let’s unpack them collectively.

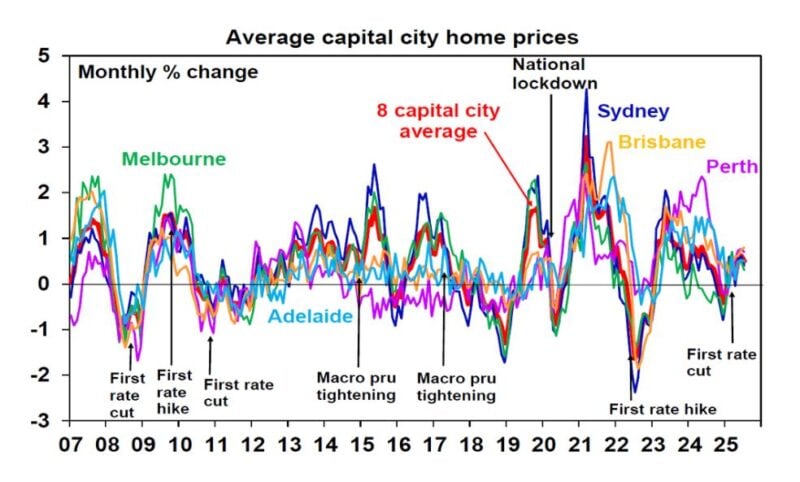

1. The property cycle is popping up—once more

After a minor pause earlier this yr, Australia’s property market is again on an upswing.

In line with CoreLogic information, nationwide dwelling values are rising once more, with a probable 0.5% acquire this month alone.

Supply: AMP

What’s notable is that this isn’t simply the beforehand sturdy performing cities of Brisbane, Adelaide in Perth anymore.

Cities that had been beforehand lagging: Melbourne, Hobart, Canberra, Darwin, are becoming a member of the celebration.

This sort of broad-based upswing is a transparent signal of a market cycle in movement – not a one-off blip in accordance with Shane Oliver.

And savvy traders know that this section of the property cycle create alternative.

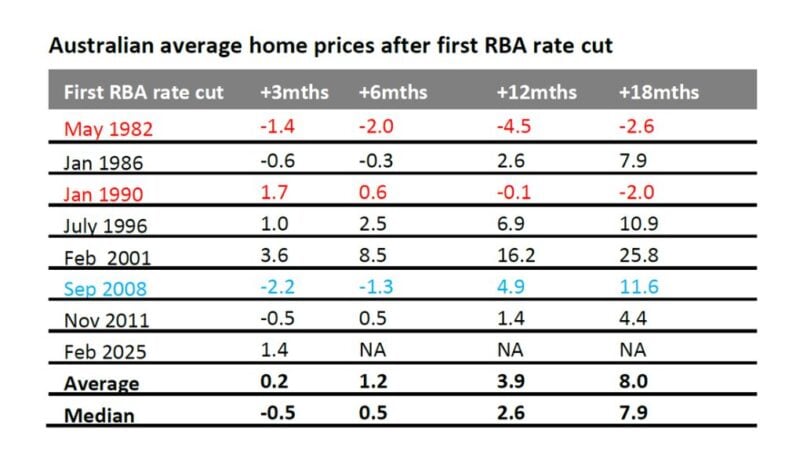

2. Rates of interest are (nonetheless) a key driver

To place it merely: when rates of interest fall, borrowing capability rises, and property turns into extra enticing.

So it’s no coincidence that property costs began to rebound as charges began easing earlier this yr.

Dr Oliver makes a robust level: in 5 of the previous seven RBA rate-cutting cycles since 1982, dwelling costs rose considerably over the next 12 to 18 months, supplied we didn’t fall into recession.

The AMP base case now features a sequence of 0.25% charge cuts beginning in August, then once more in November, February and Could.

Supply: AMP

Dr. Oliver means that if the labour market continues to melt, we may even see back-to-back cuts ahead of anticipated.

Nonetheless, the earlier two charge cuts and the expectation of simpler financial coverage are already fueling renewed purchaser confidence.

However keep in mind, these tailwinds received’t profit everybody equally. Location, property kind, and technique nonetheless matter.

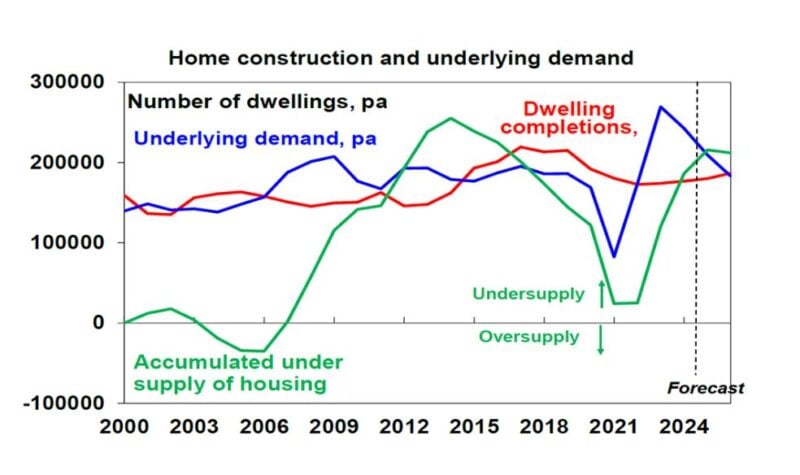

3. Continual undersupply is the actual elephant within the room

Neglect the populist blame sport about detrimental gearing or traders, Australia’s largest housing situation presently is lack of provide and never property hypothesis.

Because the mid-2000s, our inhabitants has grown quickly due to sturdy immigration, however housing completions simply sorry okay thanks very a lot. I loved my lunch.haven’t saved tempo.

Dr Oliver estimates the nationwide housing shortfall is not less than 200,000 dwellings, and presumably nearer to 300,000 relying on family formation assumptions.

Supply: AMP

This persistent imbalance between demand and provide is the structural drive behind long-term value development.

Reality is, property costs don’t simply rise due to investor sentiment – they rise when extra individuals need houses than there are houses to go round.

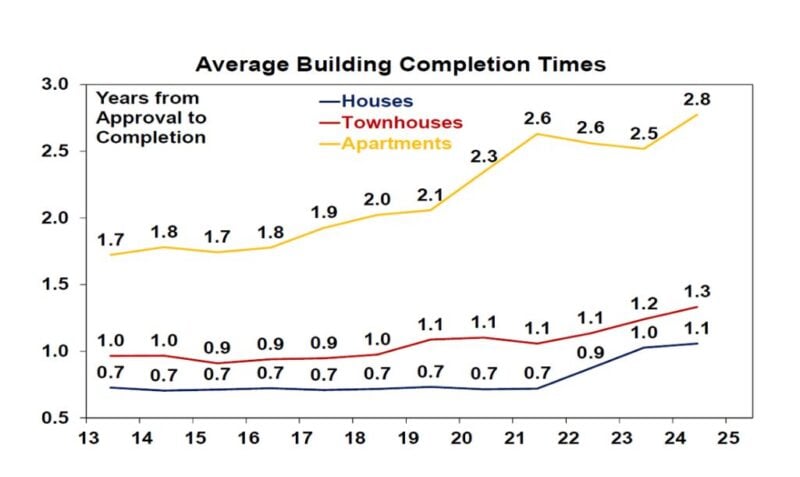

4. Dwelling constructing instances are blowing out

To repair this undersupply, we don’t simply want extra houses, we have to construct them sooner and extra effectively.

But the time it takes to finish a dwelling has ballooned.

Over the previous decade, home building timelines have grown by 57%, and unit builds have taken 65% longer.

Supply: AMP

Why? A poisonous mixture of planning crimson tape, larger building prices, and labour shortages.

Sure, immigration has been moderating recently. However that alone received’t repair the issue.

We’d like significant reforms to spice up building capability, issues like streamlining approvals, encouraging smaller dwellings, and smarter materials use like sample plans or timber over brick and concrete.

And critically, governments want to stay to their promise underneath the Nationwide Housing Accord: constructing 1.2 million new houses over 5 years.

5. Sure, Australian property is dear, however that’s solely a part of the story

Affordability is clearly deteriorating, and it has been for many years.

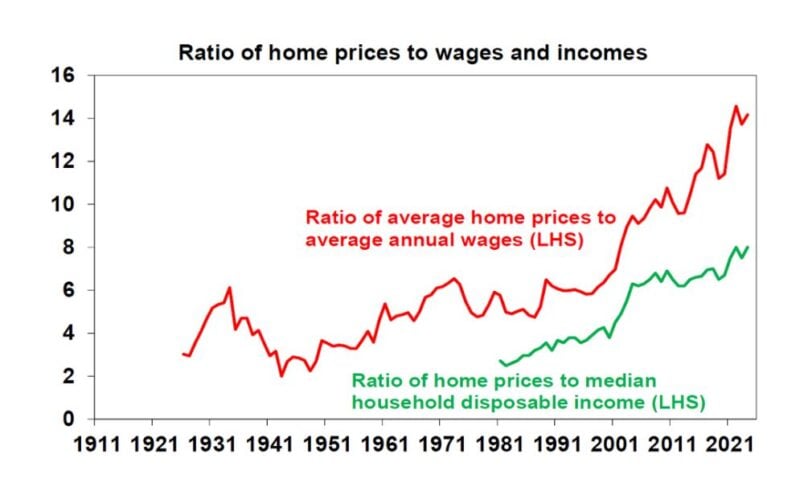

In his article Dr. Oliver factors out that:

It now takes the common Aussie almost 10 years to save lots of a 20% deposit, in comparison with simply 4 years within the Nineteen Eighties.

Home costs relative to wages and family incomes have surged.

The home price-to-rent ratio (our model of a “P/E” for property) is about 30% above its long-term common.

Supply: AMP

This value strain doesn’t imply a crash is imminent. Nevertheless it does imply the upside within the present cycle might be capped.

Excessive costs mixed with excessive debt ranges create monetary vulnerability if unemployment rises or if mortgage stress will increase.

However for property traders, particularly these with stable fairness and buffers in place, this isn’t a crimson mild, it’s a yellow one.

Be selective, keep on with investment-grade belongings, and concentrate on long-term efficiency relatively than short-term noise.

6. It’s not one property market, it’s many

We love to speak about “the Australian property market” prefer it’s one huge beast.

Nevertheless it’s actually a whole bunch of micro-markets transferring at completely different speeds.

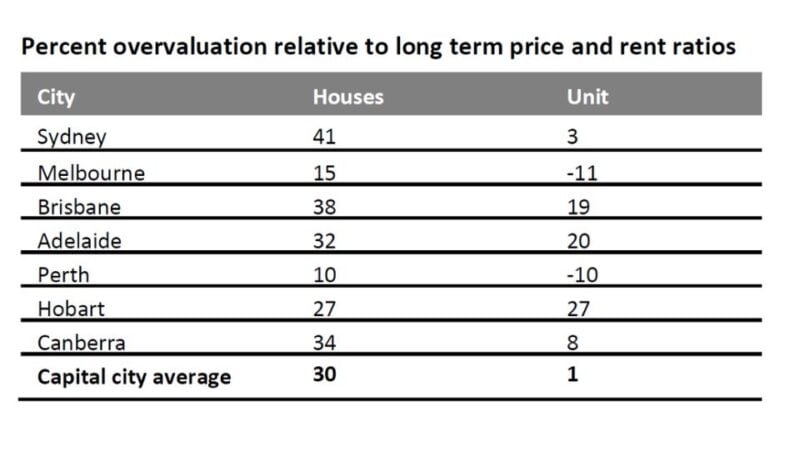

Supply: AMP

Dr Shane Oliver’s valuation desk reveals this clearly. He believes:

Homes are round 30% overvalued on a price-to-rent foundation.

Items, alternatively, are solely 1% overvalued—which suggests higher worth and fewer draw back threat.

Perth and Melbourne now seem like the least overvalued capital metropolis markets for homes.

Each cities present undervaluation within the unit sector.

This form of dispersion is gold for traders.

It means you don’t want to attend for a nationwide upswing – you simply want to seek out the proper metropolis and the proper asset kind.

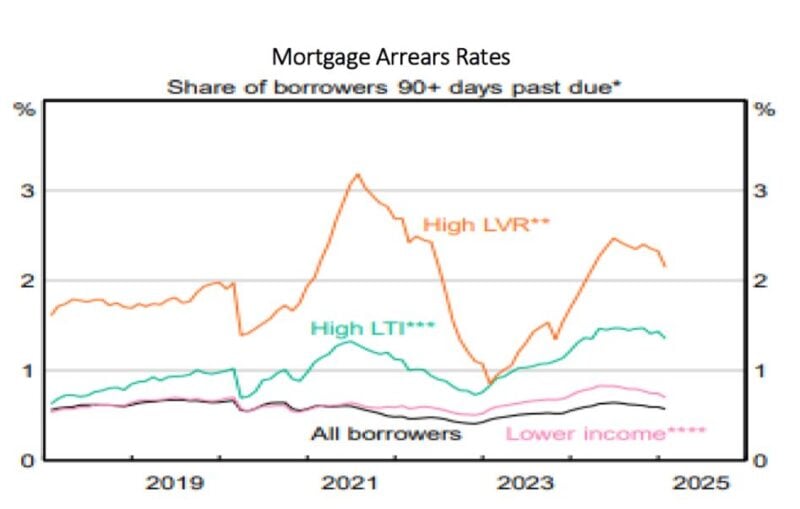

7. Mortgage arrears stay low

Regardless of all of the discuss of mortgage stress, precise arrears stay extraordinarily low, sitting beneath 1% on common, and nonetheless low even for prime LVR or excessive debt-to-income debtors.

This displays a number of issues:

Prudent lending requirements

Robust employment ranges (up to now)

Giant family financial savings buffers from the COVID interval

Until we see a pointy spike in unemployment, we’re unlikely to get a wave of compelled gross sales that will push costs down meaningfully.

So the place are we headed?

Dr Oliver’s base case? A 5–6% acquire in nationwide property costs this yr, underpinned by decrease rates of interest and structural undersupply, however restricted by poor affordability.

There are dangers each methods:

For traders, this atmosphere rewards technique, not hypothesis.

Purchase well-located properties with sturdy fundamentals and respectable rental yields.

Keep away from the froth, ignore the spruikers, and don’t fall for the doom-and-gloomers both.

This market isn’t low cost, however for the strategic, it’s nonetheless filled with alternative.