On the time of penning this piece, the Singapore authorities has reinstated a stricter Vendor’s Stamp Obligation (SSD) framework, rising the holding interval from three to 4 years and elevating the tax throughout all tiers by 4 share factors.

Sellers now face a 16% tax in the event that they promote inside one yr, and 4% even within the fourth yr, a transfer clearly geared toward discouraging speculative flipping. Listed below are the brand new SSD charges as of 4th July, 2025:

| Holding Interval | Previous SSD (≤ 3 Jul 2025) | New SSD (≥ 4 Jul 2025) |

|---|---|---|

| ≤ 1 yr | 12% | 16% |

| > 1 – 2 years | 8% | 12% |

| > 2 – 3 years | 4% | 8% |

| > 3 – 4 years | 0% | 4% |

| > 4 years | 0% | 0% |

Whereas this transfer is seen as a cooling measure to curb market hypothesis, in search of to tame the rise in sub-sale transactions, the large image deserves extra readability – this SSD revision ought to have minimal affect on the broader market.

Let’s perceive why.

Desk of Contents

- Sub-sales: Small slice of the pie, not the entire property market

- SSD modifications are designed to take away extra hypothesis from the market. Right here’s why new launch patrons is not going to be impacted

- What this implies for patrons and builders

Sub-sales: Small slice of the pie, not the entire property market

Let’s begin with what the SSD is actually focusing on. Up to now few years, sub-sales—the place somebody resells a unit earlier than the undertaking is accomplished or shortly after TOP—have been on the rise.

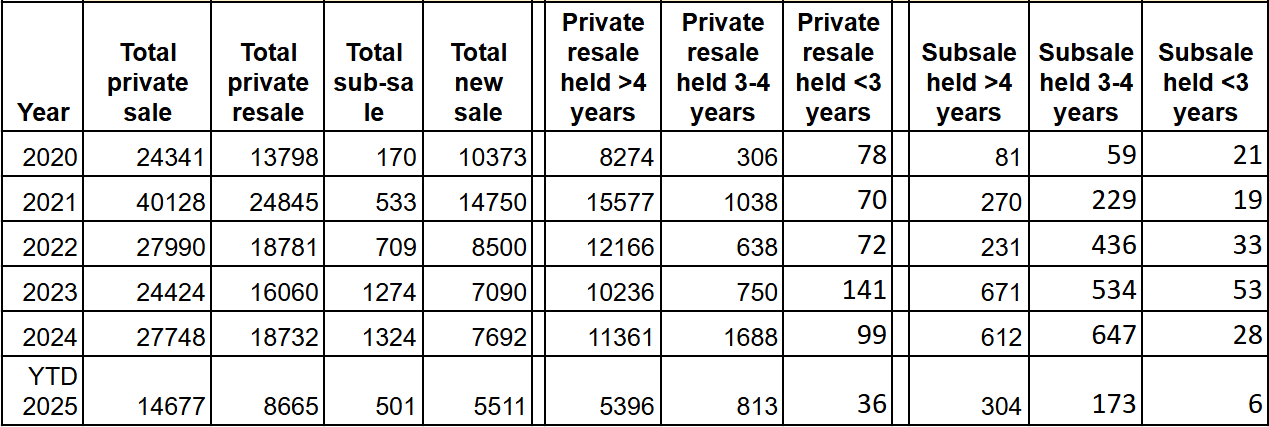

A better have a look at sub-sale information from 2020 to YTD 2025 reveals that almost all of sub-sale transactions already fall exterior the brand new SSD penalty window. In 2024, for example, 647 out of 1,324 sub-sales have been made after holding the property for 3–4 years, whereas 612 sub-sales have been held for greater than 4 years. Solely 28 sub-sales have been held for lower than three years, the place SSD charges are actually steepest.

This sample holds true in YTD 2025 as nicely: simply 6 of 501 sub-sales occurred inside the first three years of holding. Against this, 173 sub-sales (34.5%) fell into the three–4 yr window, and 304 (60.6%) have been held longer than 4 years. This proves that almost all sellers are already aligned with the brand new insurance policies and solely a small part can be impacted by the rule change.

SSD modifications are designed to take away extra hypothesis from the market. Right here’s why new launch patrons is not going to be impacted

Some context helps right here. The SSD isn’t new. In truth, what simply occurred is a reversion to guidelines that have been already in place between 2011 and 2017. For a time, they have been relaxed (down to 3 years of holding, and a 12% prime tier) when the market wanted extra respiratory room.

Right here’s how the SSD guidelines have modified during the last decade:

| Interval | Holding Interval | Max SSD (≤ 1 yr) | Notes |

|---|---|---|---|

| 2011–2017 | 4 years | 16% | Launched to clamp down on flipping |

| 2017–Jul 2025 | 3 years | 12% | Relaxed throughout cooling section |

| From Jul 2025 | 4 years | 16% | Restored to pre-2017 framework |

There’s a typical concern that elevating SSD may deter patrons from getting into new tasks, particularly those that see property as a wealth-building device. However that fear is overstated as a result of even underneath the extra lenient SSD regime, sellers have been holding longer because of rising financing and tax prices. Most buyers have been already pivoting to a “purchase and hire” technique, specializing in rental revenue moderately than short-term resale income.

What this implies for patrons and builders

For patrons: When you’re planning to carry for greater than 4 years, as most patrons already do, the SSD hike is a non-issue. If something, it protects your funding from speculative froth, serving to stabilise costs and protect worth.

In truth, shopping for now may place you advantageously within the coming future. Consumers who buy new models in 2025 can be in a singular place by 2028. Those that buy later will nonetheless be inside the SSD holding interval in 3 years, and there could also be much less competitors at resale, thus permitting early patrons to take pleasure in a stronger exit window.

For sellers: When you purchased pre-July 2025, you’re not topic to the brand new SSD construction. Nevertheless, if you happen to’re a vendor who must right-size urgently, the added price of the brand new stamp responsibility is now an actual consideration. Many buyers will seemingly maintain and lease their models till the SSD expires.

We perceive that any coverage change can have an effect on your shopping for or promoting selections—whether or not you’re a first-time home-owner, an upgrader, or an investor planning your subsequent transfer. When you’re uncertain how the brand new SSD guidelines may affect you, attain out to the crew at 99.co for personalised insights and assist. We’re right here that can assist you navigate the property market with readability and confidence.

The submit Sure, the SSD charges have been hiked. But it surely’s unlikely it should upset the larger market… appeared first on .