Key takeaways

Stamp responsibility is without doubt one of the most damaging taxes in Australia, it distorts housing choices, penalises mobility, and locks individuals out of residence possession.

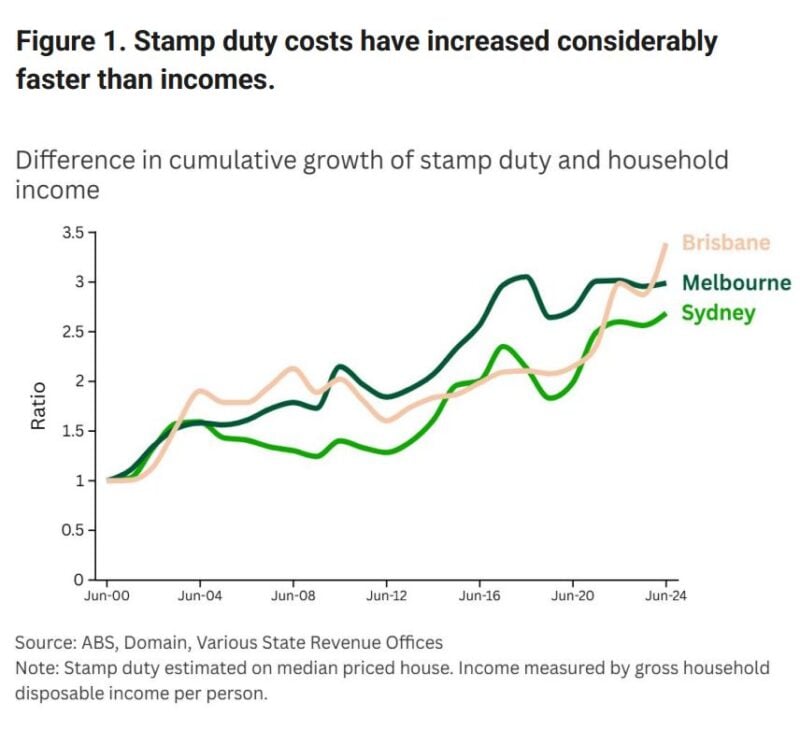

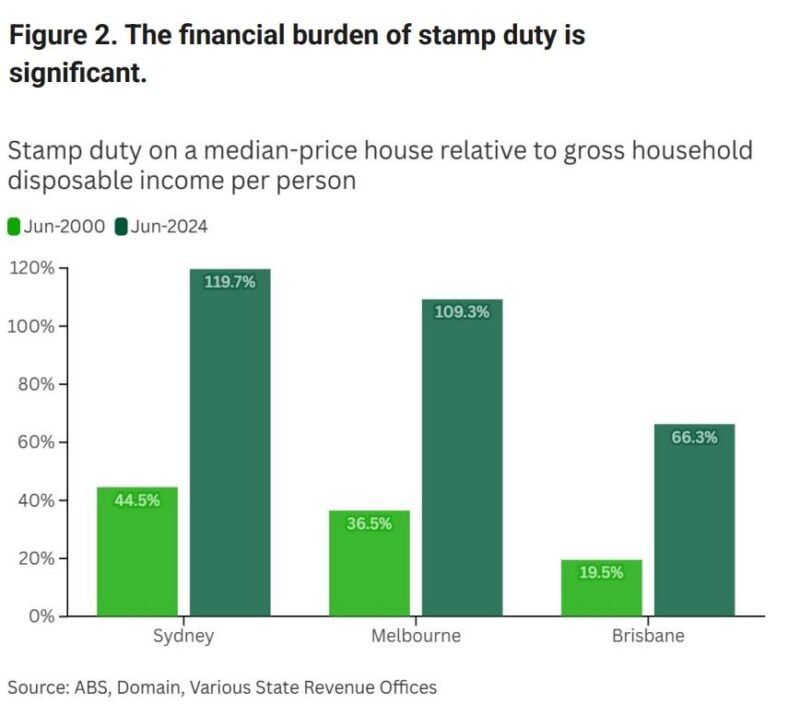

The burden has skyrocketed: In Sydney, stamp responsibility on a median-priced residence rose from 45% of annual revenue in 2000 to 120% in 2024. Comparable traits exist in Melbourne and Brisbane, the place stamp responsibility has grown 2.7–3.4 occasions sooner than incomes.

Australians are staying put longer: The common maintain interval for homes has stretched from 6 years to 9 years, pushed by the excessive value of transferring.

Changing stamp responsibility with a broad-based land tax is without doubt one of the clearest reforms obtainable to enhance affordability, mobility, and productiveness.

For years, stamp responsibility has been the elephant within the room after we speak about housing affordability and financial reform.

Everybody is aware of it’s an issue; economists, consumers, sellers, and buyers alike.

But, regardless of infinite opinions and repeated requires reform, we’re nonetheless caught with a tax that just about nobody is prepared to defend.

Dr Nicola Powell, Area’s Chief of Analysis and Economics, places it plainly:

“It’s onerous to search out an economist who will defend stamp responsibility. It is without doubt one of the most damaging taxes in Australia, distorting housing choices, penalising mobility, and locking individuals out of residence possession.”

And he or she’s proper.

If we need to construct a extra dynamic property market and a stronger financial system, stamp responsibility has to go.

The rising burden on homebuyers

Stamp responsibility was by no means meant to be such an enormous barrier.

As soon as upon a time, it was simply one other upfront value: annoying, sure, however manageable.

That’s now not the case.

In Sydney, the stamp responsibility on a median-priced residence has exploded from 45% of annual family revenue in 2000 to 120% in 2024.

In Melbourne and Brisbane, the story is analogous, with stamp responsibility prices rising 2.7 to three.4 occasions sooner than incomes since 2000.

Supply: Area

Dr Powell highlights what this implies in follow:

“What was as soon as a comparatively manageable upfront expense is now a big barrier, forcing consumers to avoid wasting for longer and pay extra, on prime of already steep deposits.”

This rising burden explains why Australians are staying of their properties longer.

The common maintain interval for homes has stretched from six years within the mid-2000s to round 9 years at the moment.

And that stickiness has penalties: fewer downsizers promoting, fewer households upgrading, and fewer employees relocating for job alternatives.

Supply: Area

The ripple results throughout the financial system

Stamp responsibility doesn’t simply harm particular person consumers, it undermines the entire housing market and financial system.

In keeping with financial modelling, for each $1 raised in stamp responsibility, round 70 cents of potential financial exercise is misplaced.

In contrast, elevating the identical quantity by way of a broad-based land tax prices the financial system lower than 10 cents.

That’s a staggering inefficiency.

In a latest Area report, “Why changing stamp responsibility with a fairer, extra environment friendly land tax ought to be prime of the Financial Roundtable’s agenda” Dr Powell factors out, the influence is far-reaching:

It blocks first-home consumers: Stamp responsibility provides a big upfront value, particularly for first-home consumers who already face excessive deposit hurdles.

It reduces housing mobility: Folks keep put relatively than transferring to be nearer to jobs, faculties, or household.

It exacerbates mismatches: Massive properties stay within the fingers of downsizers who’d like to maneuver, whereas households squeeze into smaller dwellings. In truth, analysis suggests stamp responsibility deters almost 25% of potential downsizers.

It discourages funding: Patrons are penalised for upgrading or renovating, as improved values imply larger stamp responsibility on the subsequent transfer.

It weakens productiveness: Employees are much less more likely to transfer to the place their expertise are most wanted, which drags on each wages and financial progress.

It makes state revenues risky: As a result of stamp responsibility is tied to the property cycle, revenues swing wildly, making state budgets much less steady.

It deepens inequities: It falls hardest on youthful Australians and frequent movers, whereas long-term homeowners pay nothing extra regardless of big windfalls in property worth.

Put merely, stamp responsibility locks individuals into the unsuitable properties, distorts decision-making, and stifles alternative.

A case examine: the ACT reveals it may be accomplished

Whereas most states have shied away from tackling this challenge, the ACT has been quietly displaying the best way ahead.

In 2012, the ACT authorities launched into a 20-year reform program to step by step section out stamp responsibility and exchange it with larger annual property charges, basically a broad-based land tax.

This staged strategy has:

And it’s working. The system is fairer, extra predictable, and fewer distortive.

As Dr Powell notes, this sort of mannequin reveals what’s potential when governments decide to long-term reform.

In contrast, NSW’s experiment with an “opt-in” system for first-home consumers in 2020 was scrapped in 2023 after a change of presidency, displaying simply how fragile piecemeal reforms may be with out bipartisan help.

Why nationwide management is important

So, if the ACT has confirmed it may be accomplished, why haven’t different states adopted?

The reply is easy: cash and politics.

Dr Powell explains:

“The core barrier is fiscal. Stamp responsibility delivers massive, fast revenues to state governments, whereas land tax produces smaller, extra predictable flows over time. Bridging that short-term income hole is tough for states to handle alone.”

And he or she’s proper.

States love the sugar hit of billions flowing in throughout increase occasions.

However when the property market cools, so do revenues, leaving finances holes.

The answer? Federal management.

Canberra might present transitional funding to assist states bridge the hole, whereas establishing a nationwide framework to make sure consistency.

And let’s not overlook the upside: larger labour mobility, higher use of our housing inventory, and stronger, extra predictable authorities revenues.

Will it push up costs?

Some fear that eradicating stamp responsibility would possibly inflate property costs.

However based on the Area report the proof suggests the impact can be small.

Sure, decrease transaction prices might enhance buying energy, however this might largely be offset by the brand new annual land tax costs.

In the long term, the reform might really assist cool sure segments, particularly bigger properties that downsizers are clinging to purely as a result of promoting is simply too costly.

By liberating up this inventory, we might enhance housing effectivity and affordability.

A second for braveness

In my thoughts, Stamp responsibility is a relic.

It was designed in a time when property values have been modest and when individuals didn’t want to maneuver round as a lot for work or way of life.

It now not matches trendy Australia.

The upcoming Financial Roundtable is the right alternative for our leaders to point out ambition.

In the event that they’re critical about housing affordability and productiveness, that is one reform that may make an infinite distinction.

The query is now not if we must always exchange stamp responsibility , it’s when.

And the earlier we act, the earlier Australians can take pleasure in a fairer, extra environment friendly, and extra dynamic housing market.