Key takeaways

94.8% of sellers made a nominal revenue throughout Australia, with a record-high median revenue of $315,000… up from $305,000 within the earlier quarter.

Extra sellers incurred losses regardless of stronger promoting circumstances: The proportion of loss-making gross sales elevated to five.2% within the June quarter, up from 5.0% within the March quarter.

NSW dominates listing of most worthwhile markets: Over the June quarter, New South Wales (NSW) accounted for six of the highest ten most worthwhile Native Authorities Areas (LGAs) within the nation by median good points.

Regional markets keep edge however hole narrows: Regional Australia has continued to outperform capital cities by way of profitability, a pattern now sustained for greater than 5 years.

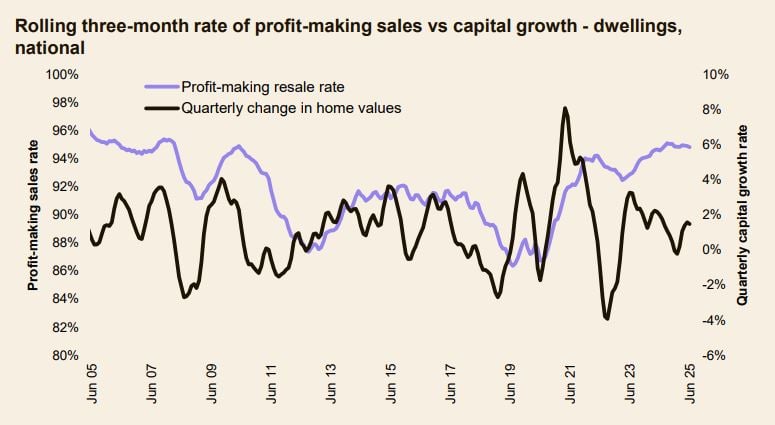

Australian property sellers continued to see sturdy good points within the June quarter, though the speed of profit-making resales eased barely from the beginning of the yr.

Cotality’s Q2 2025 Ache & Achieve report analysed roughly 97,000 resales over the interval, revealing 94.8% of transactions recorded a nominal achieve within the three months to June.

Whereas nonetheless above the last decade common of 91.5%, this marks a slight decline from 95.0% of resales within the March quarter.

Regardless of the slight dip in profitability, the median nominal achieve from resales rose to a brand new document excessive, whereas median losses shrank.

Throughout all profit-making resales nationally, we noticed a median nominal achieve of $315,000 for sellers recorded within the June quarter.

This was a document excessive, up from $305,000 within the earlier quarter, and the last decade common of $250,000.

In the meantime, the nationwide median loss fell to $42,000, down from $44,000 within the March quarter and a excessive of $45,000 within the December quarter of final yr.

Extra sellers incurred losses regardless of stronger promoting circumstances

The proportion of loss-making gross sales elevated to five.2% within the June quarter, up from 5.0% in March quarter.

Nearly 60% of that improve got here from resales of Sydney and Melbourne items, which totalled about 2,500 transactions bought at a loss.

The rise in loss-making exercise in these areas displays a mix of things.

Many of those losses are concentrated in markets that also haven’t returned to their peak values.

The highest ten markets for loss-making resales accounted for a 3rd of all losses within the quarter, in comparison with one quarter over the last decade common.

Some homeowners may be reducing their losses as circumstances enhance, selecting to promote after holding for lengthy intervals.

Nevertheless the pattern could already be shifting.

Between June and August of this yr, the probability of a loss-making resale has broadly diminished as nationwide house values rose 1.3%, and fewer markets on the suburb-level recorded quarterly falls throughout Australia.

NSW dominates listing of most worthwhile markets

Over the June quarter, New South Wales (NSW) accounted for six of the highest ten most worthwhile Native Authorities Areas (LGAs) within the nation by median good points.

In Kiama, on the NSW South Coast, distributors recorded a median nominal achieve of $758,000, with sellers holding on for a interval of virtually 12 years.

Over that point, the median dwelling worth within the Kiama LGA has elevated by 120%.

Woollahra Council in Sydney’s Jap Suburbs additionally ranked among the many prime ten, recording a median nominal achieve of $575,000.

The council space spans from Paddington to Watsons Bay in Sydney’s Jap Suburbs, with pockets containing among the most prestigious housing markets within the nation.

Regional markets keep edge however hole narrows

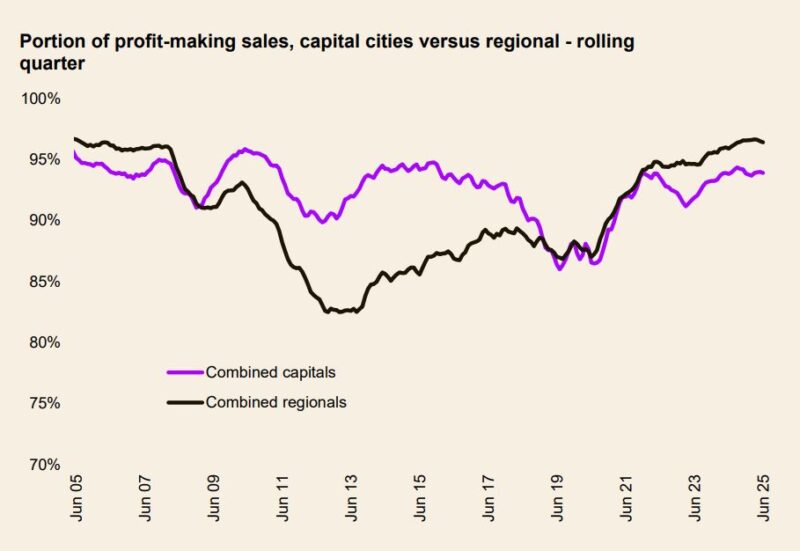

Regional Australia has continued to outperform capital cities by way of profitability, a pattern now sustained for greater than 5 years.

Within the June quarter, 96.4% of regional resales made a nominal achieve, in contrast with 93.9% in capital cities.

Of the regional LGA markets analysed, 62 recorded a 100% fee of profit-making resales led by regional South Australia.

Solely 9 capital metropolis LGA markets noticed 100% profitability, six of which have been in Adelaide.

The hole in profitability between capital cities and areas continued to slender within the June quarter.

The distinction within the fee of profit-making gross sales between capital cities and areas fell 250 foundation factors within the June quarter, down from 270 foundation factors in March and a excessive of 340 foundation factors in early 2023.

Within the three months to August, capital metropolis values rose 1.9%, overtaking the 1.6% rise in regional Australia, pointing to an additional narrowing forward.

Throughout the capital cities, Brisbane had the very best fee of profit-making gross sales at 99.7%, in addition to the very best nominal achieve from resale at $400,000.

This was adopted by a 99.1% fee of revenue in Adelaide and 98.0% throughout Perth.

On the different finish of the spectrum, Darwin had the very best fee of loss-making gross sales (20.6%) however had the largest enchancment within the fee of profitability amid latest capital good points.

Melbourne had the next-highest fee of loss-making gross sales at 10.6%, adopted by Sydney (7.7%), Hobart (7.2%) and the ACT (6.7%).

Key findings for Ache & Achieve, June Quarter 2025

- Profitability fell quarter-on-quarter: The portion of profit-making resales eased from 95.0% of resales within the March quarter to 94.8% within the three months to June, however stays above the last decade common of 91.5%.

- Regardless of the speed of profitability declining, the median nominal achieve from resales rose to a document $315,000, and the median loss declined to $42,000.

- The best nominal achieve of LGA markets throughout Australia was within the sea-change area of Kiama alongside the south coast of NSW, with a median gross resale revenue of $758,000.

- The mixed worth of good points within the June quarter was $36.6 billion, up from $33.3 billion within the March quarter and $33.8 billion a yr in the past. Nevertheless, consistent with the carry in loss-making resales, the mixed loss for sellers deepened to $292 million, from $265 million within the earlier quarter.

- Brisbane was essentially the most worthwhile of the capital cities for the third consecutive monetary quarter, with 99.7% of resales making a nominal achieve. Brisbane sellers additionally noticed the very best median nominal achieve of $400,000.

- Homes continued to outperform items within the June 2025 quarter, with 97.2% of home resales delivering a revenue, in comparison with 89.8% of unit gross sales.

- The speed of nominal good points in regional Australia continued to outpace the capitals, however the distinction is narrowing. Of the regional resales, 96.4% made a nominal achieve, down from 96.6% within the earlier quarter. The mixed capitals had a gradual fee of profitability over the quarter at 93.9%.

- Maintain intervals fell barely for resales in June, to eight.7 years. Two-to-four yr maintain intervals have been the commonest at 15.3% of resales, incurring higher-than common loss, however nonetheless first rate nominal resales good points of $175,000.