August historically is a quieter month for leases in Singapore as a result of cultural and education causes, resulting in decrease leasing exercise.

In response to Mr. Luqman Hakim, Chief Information & Analytics Officer at 99.co, “This seasonal lull tends to suppress short-term worth development as demand softens quickly. Including to this, some tenants is perhaps holding off renewals or new leases, anticipating an inflow of recent provide from initiatives later this yr.“

Let’s break down what occurred in August 2025 in each the condominium and HDB rental markets.

Desk of Contents

Rental rental market: Steady costs, decrease volumes

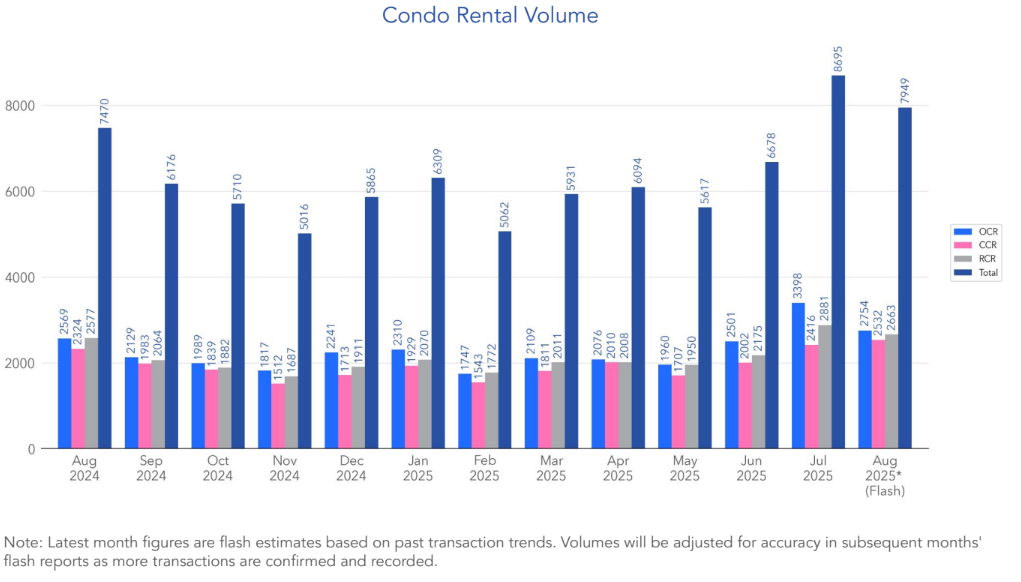

August noticed secure costs for apartment leases regardless of decrease volumes. An estimated 7,949 items have been rented in August 2025, in comparison with 8,695 in July 2025.

Nevertheless, regardless of the dip, rental volumes have been 6.4% greater than in August 2024 and 4.7% above the 5-year August common.

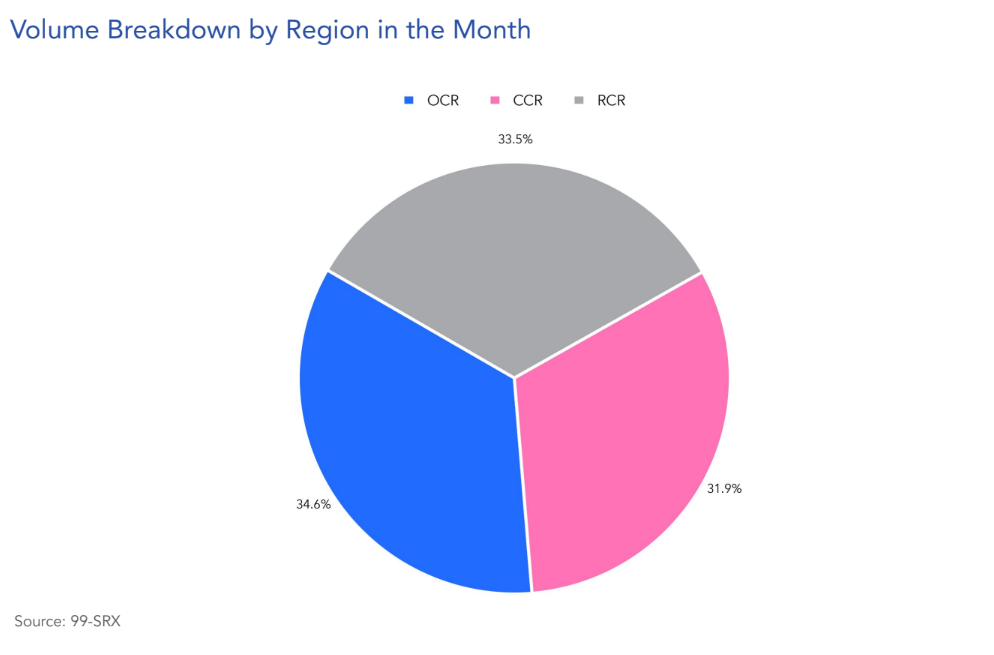

Breaking it down by area, in August 2025, 34.6% of the overall apartment rental quantity was from Exterior Central Area (OCR), 33.5% from Remainder of Central Area (RCR), and 31.9% from the Core Central Area (CCR).

This comparatively even unfold suggests constant demand throughout all areas, with OCR sustaining a marginal lead, probably pushed by affordability and rising suburban curiosity amongst tenants.

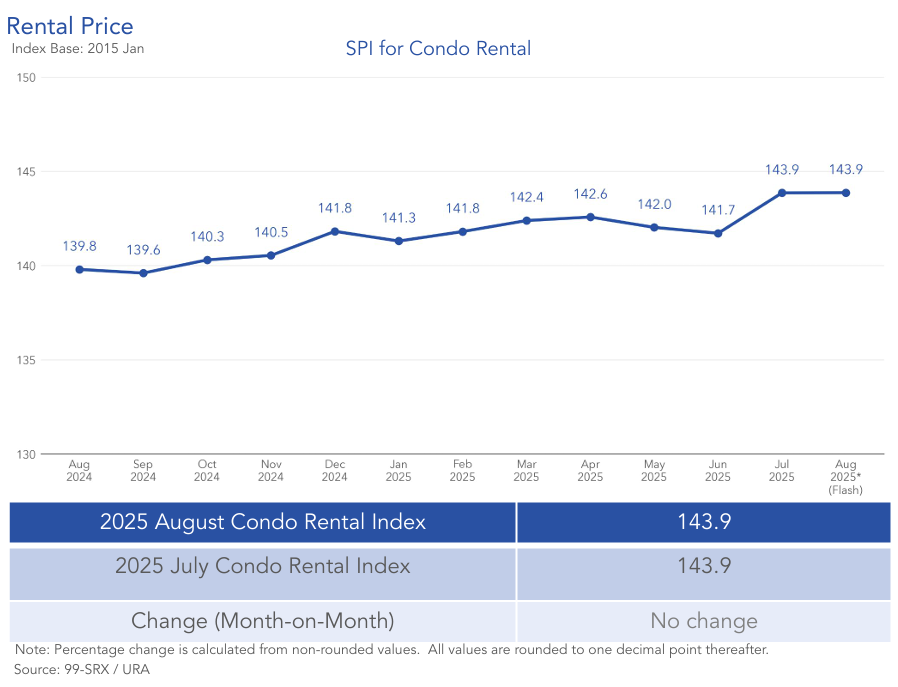

General, the apartment rental costs remained secure, as seen above. The CCR and RCR skilled slight month-on-month rental will increase of 0.4% and 0.8%, respectively, whereas the OCR noticed a minor 0.1% dip.

On a year-on-year foundation, rental costs rose by 2.9% total, with CCR up 3.4%, RCR up 3.2%, and OCR up 2%.

HDB rental market: Slight worth dip with quantity decline

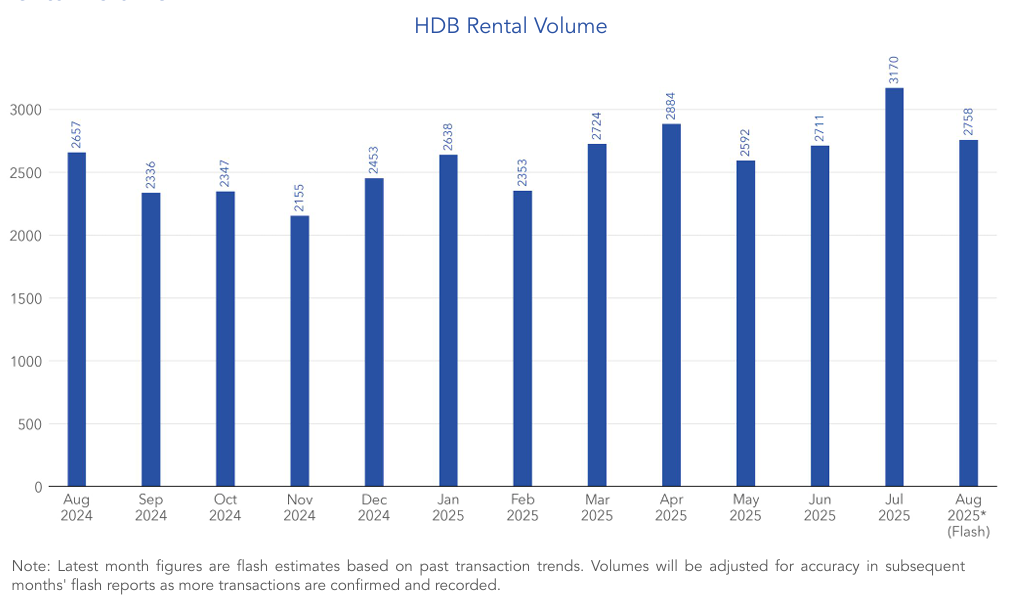

Rental volumes for HDB flats decreased by 13% month-on-month in August 2025, with an estimated 2,758 items rented in comparison with 3,170 in July. Regardless of this dip, rental volumes remained 3.8% greater year-on-year in comparison with August 2024, and above the five-year common for the month by 3.9%.

As per Mr. Mr. Luqman Hakim, this means that whereas there was a short-term slowdown in leasing exercise, underlying demand for HDB leases continued to develop steadily over the long term.

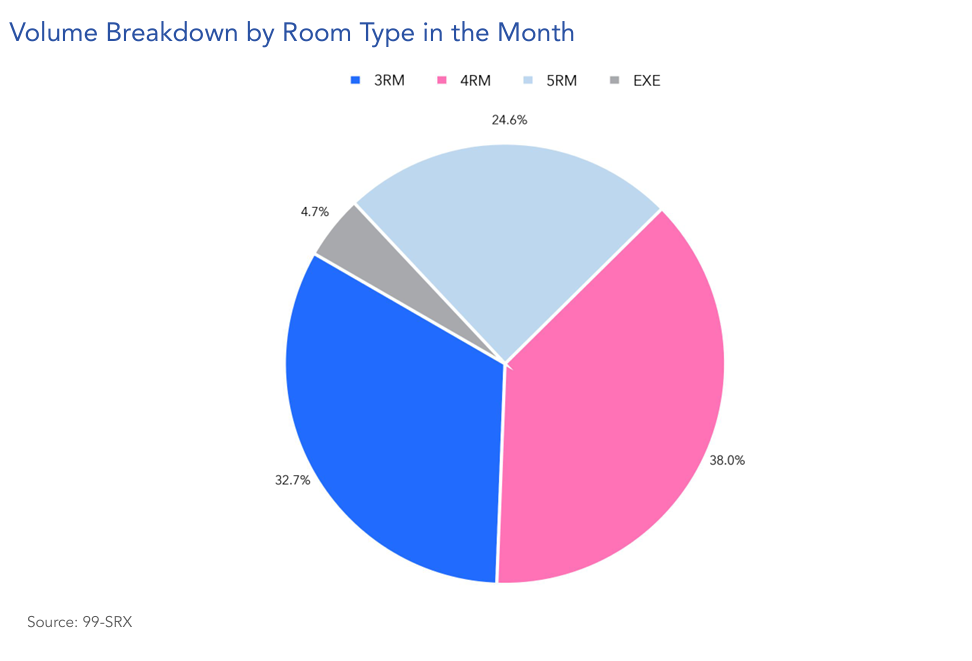

Breaking down by flat sort, we see that:

- 4-room flats accounted for the biggest share of leases in August 2025 at 38%,

- 3-room flats had the second-largest share at 32.7%,

- 5-room flats accounted for twenty-four.6% of all leases,

- and Government flats contributed 4.7% of the rental quantity.

The dominance of 3- and 4-room flats displays ongoing robust demand from households and mid-sized households who kind nearly all of HDB tenants.

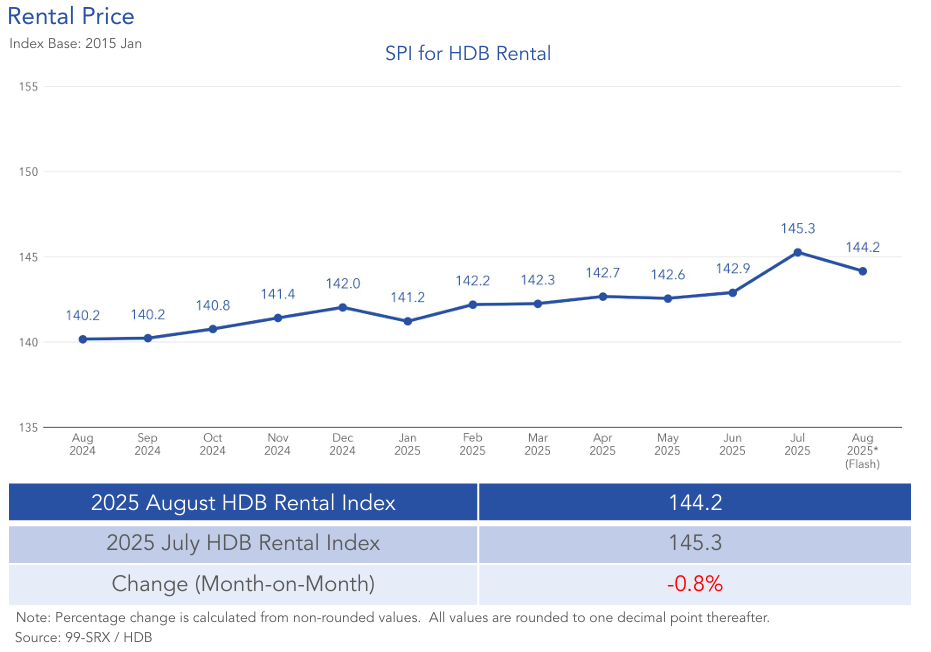

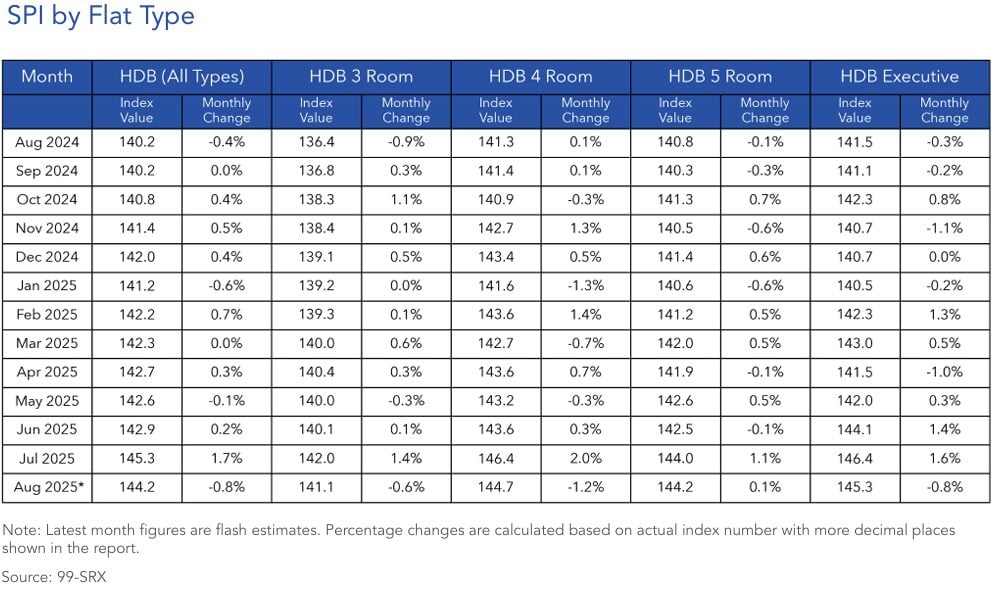

HDB rental costs noticed a slight month-on-month decline of 0.8% final month. The seasonal lull and potential enhance in accessible flats raises supply-side stress, which might weigh on month-to-month lease costs, and the market is reflecting this short-term softening.

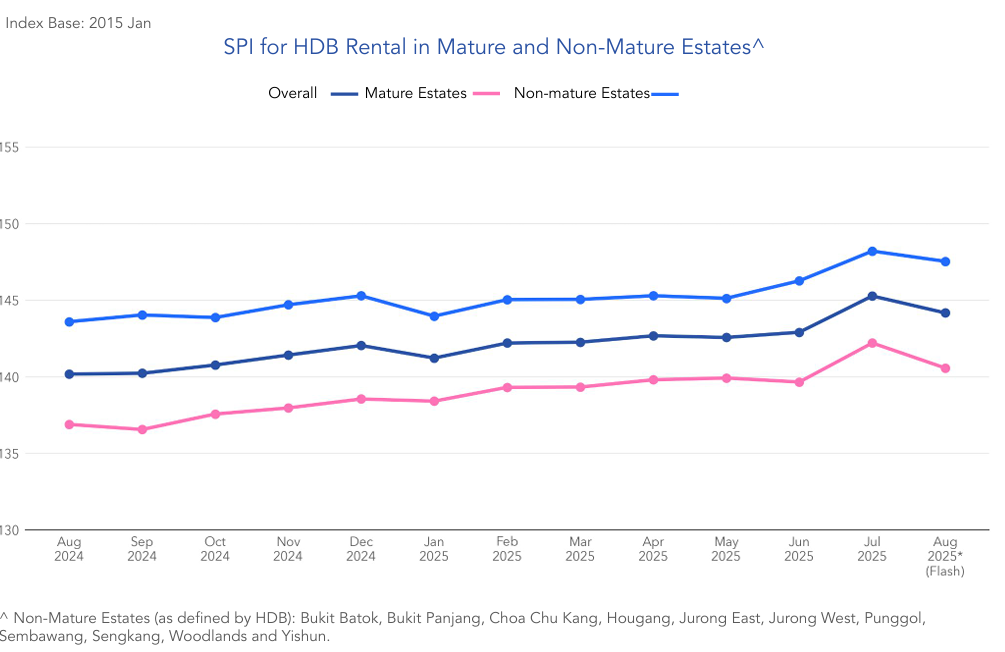

The lower was extra pronounced in Mature estates, the place rents fell by 1.1%, in comparison with a smaller 0.4% dip in Non-Mature estates.

Regardless of these short-term worth changes, year-on-year rental costs remained constructive. General, HDB rents have been up 2.8% in comparison with August 2024. Each Mature and Non-Mature Estates skilled equal year-on-year rental development of two.7%.

By flat sort, rental costs for 3-room, 4-room, and Government flats decreased by 0.6%, 1.2%, and 0.8%, respectively, whereas 5-room flats bucked the development with a marginal 0.1% enhance.

All flat varieties additionally recorded year-on-year worth will increase, led by 3-room flats with a 3.4% rise, adopted by Government flats at 2.7%, and 4-room and 5-room flats each up by 2.4%.

Market outlook

Whereas leasing volumes for each condos and HDB flats present typical seasonal moderation, the broader image displays regular demand and worth stability throughout the board. The balanced unfold of apartment leases throughout core and suburban areas highlights various tenant preferences, whereas sustained year-on-year development in HDB rents underscores ongoing demand amidst managed provide.

Trying ahead, the upcoming wave of recent housing provide slated for late 2025 shall be a key issue to observe. It might present tenants with extra selections to improve, and reasonable rental development, whereas landlords might face heightened competitors. For tenants and landlords alike, staying knowledgeable about these evolving dynamics shall be essential to creating savvy housing selections because the market shifts from seasonal pause into renewed exercise.

The put up Seasonal slowdown in apartment and HDB leases in August; costs maintain regular year-on-year appeared first on .