In July, each condominium resale costs and transaction volumes confirmed an uptick. That constructive pattern carried into August, though the tempo was a bit of slower. The market remained lively with worth positive aspects, extra transactions, and robust capital returns throughout a number of areas.

Desk of contents

Fast abstract

- ✨ Costs: Rental resale costs climbed in August 2025, with CCR rising 3.7%, whereas RCR and OCR grew 0.4% every.

- 📊 Gross sales quantity: About 1,088 resale items had been offered, up 5% from July.

- 🏠 Standout offers: The priciest unit was a S$15.8M condominium in Geylang. Within the CCR, Boulevard 88 noticed the highest resale at S$11.08M, whereas Elliot at East Coast led OCR at S$5.02M.

- 💵 Capital positive aspects: Median achieve rose to S$390,000, with Jurong (D22) main at S$663,000.

- 📈 Returns: Median unlevered return stood at 29.6%. Jurong posted the strongest returns at 48.5%.

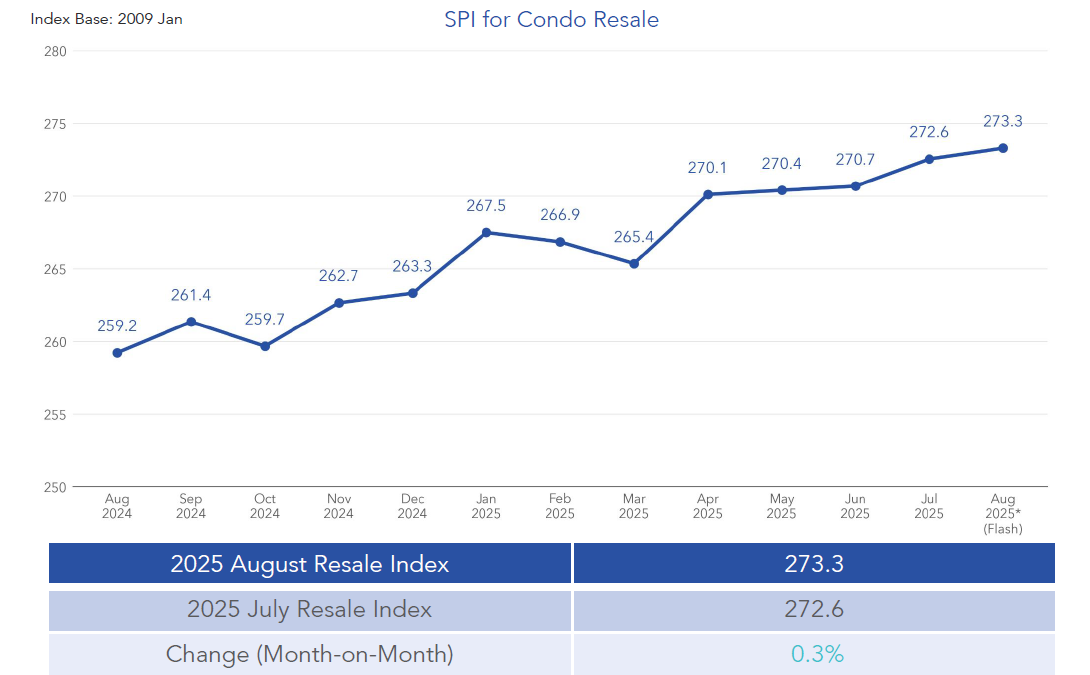

Rental resale costs stored rising in August 2025

While you have a look at condominium resale August 2025 figures, costs throughout all three areas pushed upward. Within the Core Central Area (CCR), costs jumped 3.7%, whereas each the Remainder of Central Area (RCR) and Exterior Central Area (OCR) posted smaller positive aspects of 0.4%.

Month-on-month, total resale condominium costs had been up by 0.3%. When in comparison with the identical interval final yr, costs climbed 5.4% throughout Singapore. Yr-on-year development was additionally regular inside every area – CCR rose 7.1%, RCR went up 4.1%, and OCR superior by 5.8%.

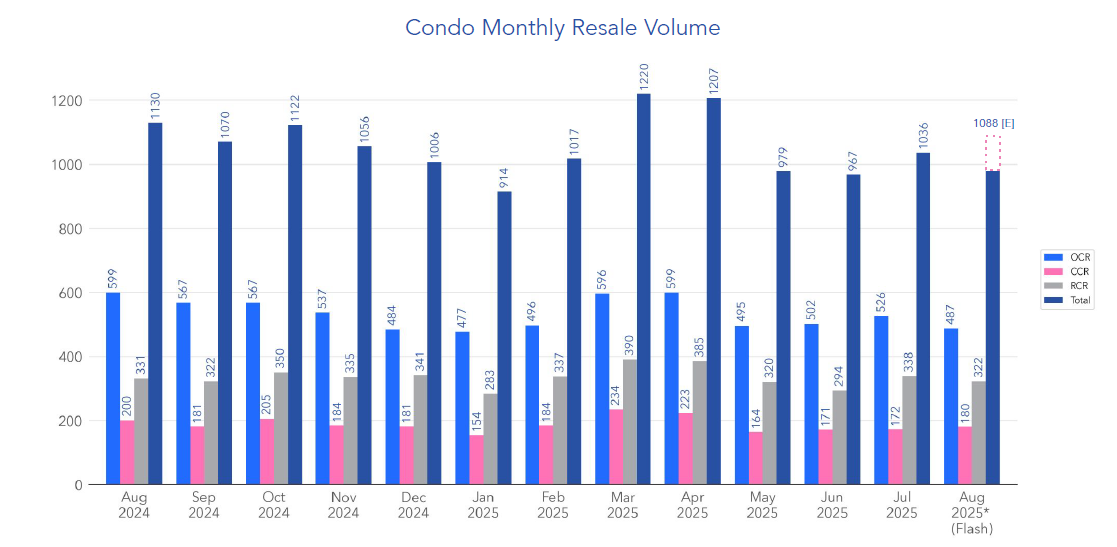

Resale volumes rose however stayed beneath final yr’s ranges

In August 2025, an estimated 1,088 resale condominium items modified arms.

This was 5% greater than the 1,036 items offered in July. Even so, volumes had been nonetheless 3.7% decrease in comparison with August 2024. On the brilliant aspect, resale numbers lined up intently with the five-year common for the month, exhibiting that the market is sustaining a wholesome rhythm.

Mr. Luqman Hakim, Chief Information & Analytics Officer at 99.co, shared that “August is often a slower month for the property market, with faculty holidays and the Hungry Ghost month holding again some patrons. As soon as that interval passes, exercise often tends to bounce again.”

Wanting on the breakdown by area, the OCR dominated with 49.2% of resale offers, whereas the RCR and CCR made up 32.6% and 18.2%, respectively.

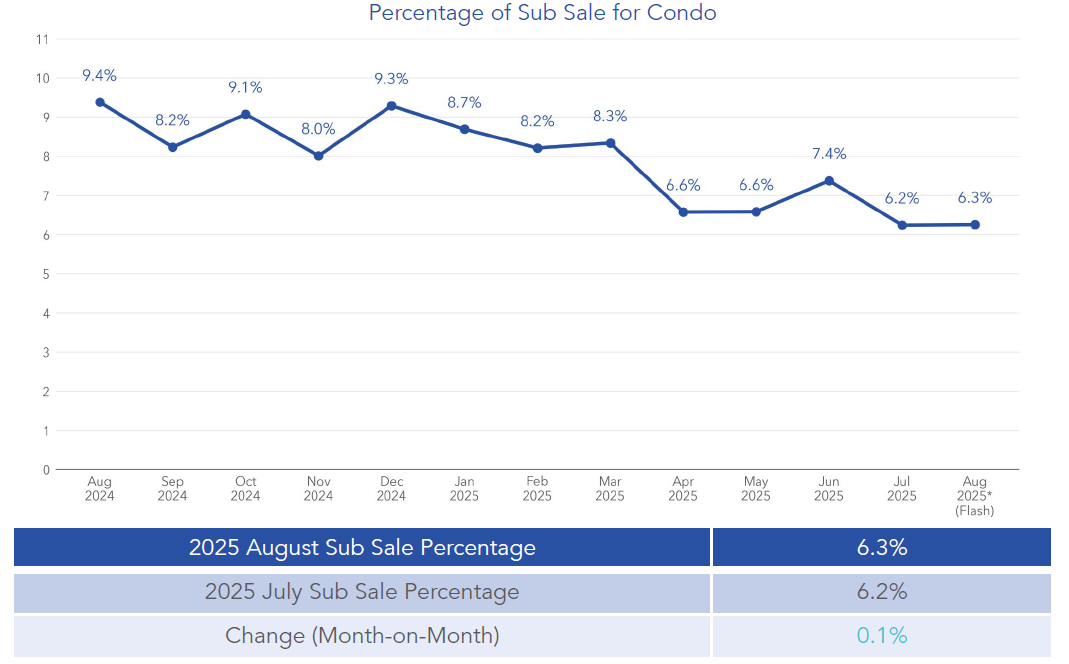

One other element price noting is the share of sub-sales, that are secondary transactions made earlier than a mission’s completion. In August 2025, sub-sales made up 6.3% of complete secondary transactions, a slight improve from July.

Excessive worth condominium resale transactions in August

Each month, a couple of standout transactions seize consideration, and August was no exception. The priciest resale condominium went for S$15.8 million in Geylang.

Within the CCR, the highest deal was a unit at Boulevard 88 that resold for S$11.08 million. This mission additionally had the best transaction in July at S$13 million.

In the meantime, in OCR, the costliest transaction got here from Elliot on the East Coast, with a unit reselling for S$5.02 million. Accomplished in 2013, Elliot is a freehold improvement with 119 items unfold throughout 9 mid-rise blocks. You’ll discover a mixture of 1- to 4-bedroom flats within the improvement, with sizes starting from about 506 to 2,766 sq. ft. Residents right here get pleasure from a variety of amenities, together with swimming pools, a jacuzzi, a clubhouse, BBQ pits, health corners, and even perform rooms. It’s additionally near way of life spots like Bedok Mall, Parkway Parade, 112 Katong, and the East Coast Lagoon Meals Village. For each day wants, you’ll discover medical clinics, faculties, and loads of eateries close by. Transport hyperlinks are robust too, with Bedok, Kembangan, Tanah Merah, and Siglap MRT stations inside attain, together with easy accessibility to East Coast Park.

Capital positive aspects grew stronger

The median capital achieve rose to S$390,000, which is S$15,000 greater than in July.

Among the many totally different districts, Jurong/Tuas/Boon Lay (District 22) posted the best median capital achieve at S$663,000. On the opposite finish of the spectrum, the Marina/Boat Quay/Raffles Place space (District 1) recorded the bottom, with a destructive median capital achieve of -S$124,000.

Unlevered returns reached practically 30%

The general median unlevered return stood at 29.6%. District 22 as soon as once more led the way in which, with returns hitting 48.5%. In the meantime, District 1 posted the weakest exhibiting with a median return of -6%.

It’s essential to notice that these figures are primarily based on matched transactions of the identical unit, evaluating its present resale worth in opposition to its earlier buy worth. To make sure accuracy, solely districts with at the very least ten matching transactions had been thought-about.

What to anticipate within the upcoming months

In keeping with Mr. Luqman Hakim, “patrons over the subsequent few months could also be keeping track of the brand new launch market. With about 5 new launches, together with The SEN, Zyon Grand, and Skye at Holland, presumably previewing between late September and October, some patrons could favor to carry off the resale market till then.”

Past that, he identified that some patrons is also monitoring SORA rates of interest earlier than making selections. If new launches find yourself priced too excessive, the resale market may even see extra exercise as patrons search for higher worth. Alternatively, if builders handle to cost their items competitively, resale demand may soften. In brief, upcoming launches and financing situations are prone to create extra fluctuations within the resale market over the subsequent few months.

The put up Rental resale market positive aspects slight momentum in August 2025 with larger costs and gross sales appeared first on .