Key takeaways

Nationwide rental values noticed their lowest second quarter improve since 2020 within the three months to June – up by 1.3%.

Over the previous 5 years, rents have elevated by 42.7% nationally, taking the median weekly rental worth virtually $200 larger to $665 per week. Annualised out, that is equal to an extra $10,350 per 12 months, spent on lease.

Pre-tax earnings directed to rental funds rose from round 26% in June 2020 to simply below 33% in December 2024.

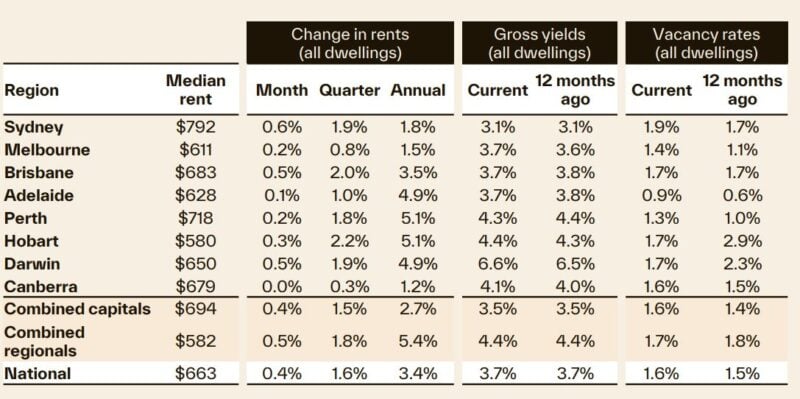

Sydney maintained its place because the nation’s most costly rental capital in June, with a median weekly rental worth of $796 – adopted by Perth ($721) and Brisbane ($687).

The areas continued to ship stronger rental progress in comparison with the capitals.

Nationwide rental values noticed their lowest second quarter improve since 2020 within the three months to June, in accordance with Cotality’s newest Quarterly Rental Assessment.

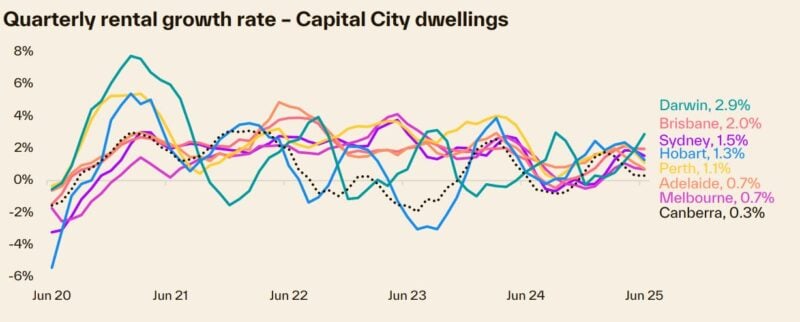

After shifting larger by means of the seasonally busy first quarter (1.7%), the rolling quarterly change in nationwide rental values is as soon as once more trending decrease, with rents up 1.3% over the three months to June 2025.

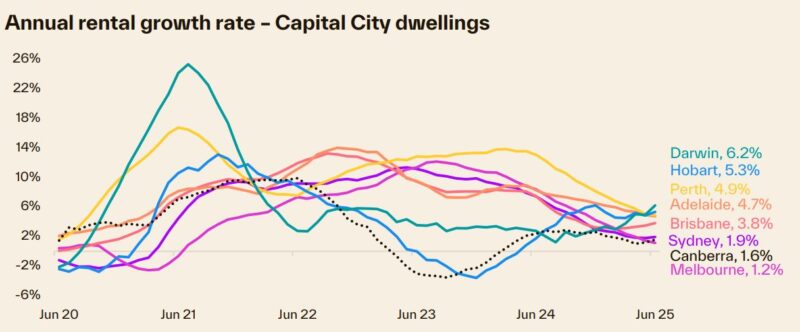

An identical easing was additionally seen within the annual rental pattern, with nationwide rents rising 3.4% over the 2024-25 monetary 12 months — the bottom yearly improve because the 12 months to February 2021 (3.0%).

On the median stage, that’s equal to a $22 per week or $1,134 per 12 months improve in rents.

The current moderation in lease progress has occurred regardless of out there rental provide remaining exceptionally low.

Over the 4 weeks to June 29, Cotality noticed round 100,000 rental listings nationally, roughly 23% under the earlier five-year common, or round 29,000 fewer itemizing than we normally see this time of 12 months.

The shortfall in rental listings has seen the nationwide emptiness price slip to 1.6% in June, solely barely above the document lows seen in early 2024 (1.5%), and fewer than half the pre-COVID decade common of three.3%.

The slowdown in rental progress as a substitute continues to be pushed by a tempering in demand, with the normalisation of internet abroad migration and an increase in common family measurement serving to to dampen rental demand.

Affordability stays difficult

Whereas the moderation within the tempo of rental progress is welcome information to many tenants, rents are nonetheless rising, and affordability stays a key problem for a lot of.

Over the previous 5 years, rents have elevated by 42.7% nationally, taking the median weekly rental worth virtually $200 larger to $665 per week.

Annualised out, that is equal to an extra $10,350 per 12 months, spent on lease.

Contemplating wages, as measured by the ABS wage worth index, are up lower than half this price (15.8%) over the 5 years to March 2025, it’s no surprise family formation tendencies are skewing bigger as a manner of spreading out the extra rental price.

The disproportionate will increase in rents and wages have seen the portion of pre-tax earnings directed to rental funds rise from round 26% in June 2020 to simply below 33% in December 2024.

Throughout the nation

With a median weekly rental worth simply shy of $800 per week, Sydney maintained its place because the nation’s most costly rental capital in June, with a median weekly rental worth of $796.

Perth took out a distant second place with the standard dwelling renting for $721 per week, whereas Brisbane ($687 per week) overtook Canberra ($677 per week) to assert the third-highest median lease.

The numerous modifications seen throughout the chief board lately, pushed by diversified rental circumstances.

Just below three years in the past, Canberra held the title for the nation’s most costly metropolis to lease in, however weaker progress circumstances, and a compositional shift in the direction of items, have seen the nationwide capital land firmly in the course of the pack.

On the different finish of the size, Hobart stays the one capital with a median weekly rental worth below the $600 mark, at $581 per week, whereas Melbourne maintains its place because the second most inexpensive rental capital, with the standard dwelling renting for $613 per week.

Smaller capitals and areas ship stronger rental progress

Taking a look at progress charges throughout the nation, the mixed areas continued to ship stronger rental progress in comparison with the capitals, up 1.5% over the quarter and 5.3% over the 12 months, with regional rental progress persevering with to be supported by larger charges of internet inside migration.

By comparability, the mixed capitals recorded a softer 1.3% quarterly and a pair of.7% annual improve.

Throughout the person capitals, Darwin led the tempo of annual rental progress, with dwelling rents rising 6.2%, adopted by Hobart (5.3%), with each markets seeing an uptick within the tempo of rental progress relative to this time final 12 months.

This was adopted by Perth (4.9%) and Adelaide (4.7%), with the annual change in rents easing from 13.0% and eight.3% respectively.

Whereas down in comparison with this time final 12 months (7.5%), at 3.8%, Brisbane’s annual improve in rents has accelerated from a current low of three.1% over the three months to February.

On the different finish of the spectrum, change in rents throughout Melbourne, Canberra and Sydney eased to 1.2%, 1.6% and 1.9% over the 12 months, with all three cities now recording an annual rental rise under their respective pre-COVID averages.