Key takeaways

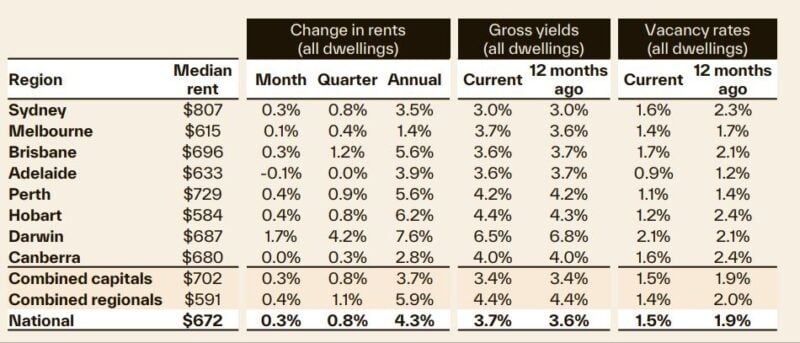

The median weekly rental worth throughout Australia’s mixed capital cities is now $702 per week.

By comparability, regional rents stay considerably extra inexpensive, holding beneath the $600 mark, with the everyday regional dwelling renting for $591 per week.

Restricted provide continues to be a serious catalyst in rising rents, with the variety of rental listings monitoring roughly 25% beneath the earlier five-year common nationally for this time of 12 months.

Australia’s rental market is seeing renewed energy as nationwide emptiness charges attain a brand new record-low, in accordance with Cotality’s newest Quarterly Rental Evaluate.

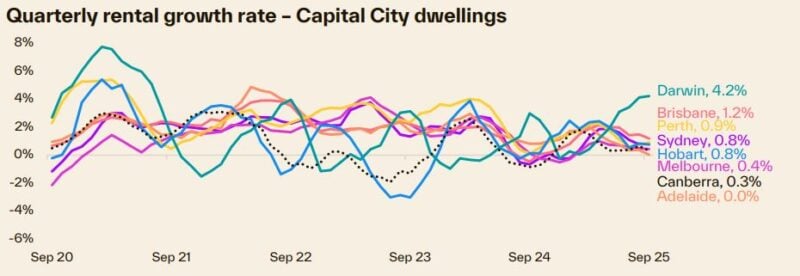

Cotality’s seasonally adjusted Rental Worth Index noticed nationwide dwelling rents submit a 1.4% rise in Q3, its largest three-month improve since June 2024, and a big uptick from the 1.1% elevate recorded in Q2.

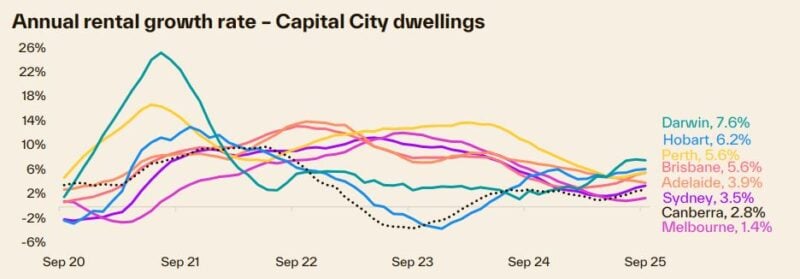

This reacceleration was additionally obvious within the annual development, with the 4.3% improve in rents seen over the 12 months to September up 90 foundation factors from the four-year low of three.4% recorded over the 12 months to Might.

Brisbane and Sydney led the uptick within the tempo of annual rental progress, up 1.7 and 1.5 share factors respectively in comparison with June, whereas Adelaide was the one metropolis to see progress ease, down 90 foundation factors.

This elevated momentum in rental progress was being spurred on by a persistent scarcity in rental provide, highlighted by the record-low emptiness fee seen nationally in September.

Ongoing shortage in ‘for hire’ listings, coupled with continued energy in rental demand has pushed the nationwide emptiness fee to a brand new document low of 1.47%— lower than half the pre- COVID decade common of three.3%.

Restricted provide continues to be a serious catalyst in rising rents, with the variety of rental listings monitoring roughly 25% beneath the earlier five-year common nationally for this time of 12 months.

Provide is especially tight within the unit sector, particularly in Sydney, which recorded each a brand new document low emptiness fee throughout its unit sector and broader dwelling rental market in September at 1.35% and 1.64% respectively.

Whereas buyers have comprised an elevated portion of dwelling lending over the previous two years, this hasn’t translated into extra obtainable rental inventory.

Capital metropolis rents exceed $700 per week

The median weekly rental worth throughout Australia’s mixed capital cities surpassed the

$700 mark for the primary time in August, earlier than touchdown at $702 per week in September.

By comparability, regional rents stay considerably extra inexpensive, holding beneath the $600 mark, with the everyday regional dwelling renting for $591 per week.

This hole has narrowed in recent times.

With the areas outperforming the capitals by way of the second half of 2024 and into 2025 the affordability benefit supplied by regional rental markets has decreased from $123 in Might 2024, to $111 in September.

Throughout the capitals, Sydney stays by far the costliest rental capital, with the everyday dwelling renting for $807 per week, whereas Hobart maintained its title because the nation’s most inexpensive metropolis to hire in, with a median weekly rental worth of $584 per week.

Inflation and money fee stress

The latest uptick in hire progress shouldn’t be solely unhealthy information for tenants, nevertheless it may additionally complicate the inflation and money fee outlook.

The information that rents are as soon as once more rising at a better fee will probably be unwelcome information for renters already fighting the 43.8% or $204 per week improve in rents seen nationally over the previous 5 years.

However it’s in all probability additionally undesirable information for householders and landlords servicing a mortgage.”

With “rents paid” a key part of the Shopper Worth Index (CPI), the elevated tempo of rental worth progress seen in latest months may push inflation greater.

Together with some renewed upwards stress from the price of new dwellings, this renewed momentum in rents could result in inflation exceeding RBA forecasts, which may maintain the money fee elevated for longer.

![[PODCAST] Energy {Couples} in Enterprise & Property: The right way to Keep Aligned With out Shedding Your Relationship [PODCAST] Energy {Couples} in Enterprise & Property: The right way to Keep Aligned With out Shedding Your Relationship](https://i0.wp.com/cdn.propertyupdate.com.au/wp-content/uploads/2025/10/729_Power_Couples_in_Business_and_Property-M_-Youtube-cover.jpg?w=768&resize=768,0&ssl=1)