Key takeaways

The actual value of a 5% deposit: Whereas the scheme helps patrons leap the deposit hurdle, the trade-off is a 95% loan-to-value ratio, which means tens of 1000’s in further curiosity over the lifetime of a 30-year mortgage.

Further curiosity or time within the rental market?: Even greater than LMI financial savings are the time first house patrons might save within the rental market. Massive will increase in hire values imply a scheme that cuts down time to avoid wasting a deposit turns into extra fascinating.

A much bigger scheme, a much bigger enhance to demand: The coverage helps people purchase sooner, however it’s finally a demand-side stimulus that does little to deal with why deposits — and now rents — are so unaffordable within the first place.

Increased rental prices are reshaping the worth proposition of the First House Assure, with new evaluation from Cotality evaluating the extra value of time within the rental market and potential LMI prices, with the extra curiosity value of a 5% deposit house mortgage.

Whereas the scheme comes with greater curiosity prices, the financial savings on hire – notably in cities like Sydney and Brisbane – could outweigh the long- time period mortgage burden.

Since its inception, federal house assure schemes have helped over 168,000 eligible house patrons into house possession.

Underneath the First House Assure, eligible patrons can buy a house with only a 5% deposit, whereas the federal government ensures the hole to an ordinary 20% deposit – serving to them keep away from lenders mortgage insurance coverage, which is sometimes within the tens-of-thousands of {dollars}.

Nevertheless, for the reason that scheme’s introduction because the ‘First House Mortgage Deposit Scheme’ in January 2020, rising hire prices have put the scheme in a brand new gentle.

Since January 2020, the median weekly hire throughout Australian dwellings has elevated an estimated $200 per week, to $669. That’s an uplift of over $10,000 per yr.

The actual value of a 5% deposit

First house assure schemes come at a value, each to people who take them up, and the broader housing system.

The principle value for people is further curiosity paid over the lifetime of a mortgage.

The flipside of a 5% deposit on a house buy is a 95% mortgage to worth ratio on the house mortgage.

Taking out the additional debt means paying further curiosity in comparison with the normal 20% deposit (Determine 1 reveals an illustrative instance primarily based on the median dwelling worth in Australia).

Mortgage assumptions: a 30-year principal and curiosity mortgage time period paid month-to-month, with long-run rate of interest assumption of 5.5% every year over the lifetime of the mortgage. The mortgage charge relies on the present, new owner-occupier common, adjusted for the August charge reduce and is topic to alter.

Over the lifetime of a 30 yr mortgage, the additional curiosity prices will be tens-of-thousands, or hundreds-of-thousands costlier than a 20% deposit house mortgage.

Though a smaller deposit means paying extra curiosity over time, it might nonetheless work out cheaper for renters.

Moving into a house sooner could imply spending much less time paying hire, and people financial savings can add up.

The most important financial savings throughout the capital cities are estimated to be in Sydney, the place a 5% deposit reduces time to avoid wasting a deposit by an estimated six years, and $251,000 on hire at $801 per week.

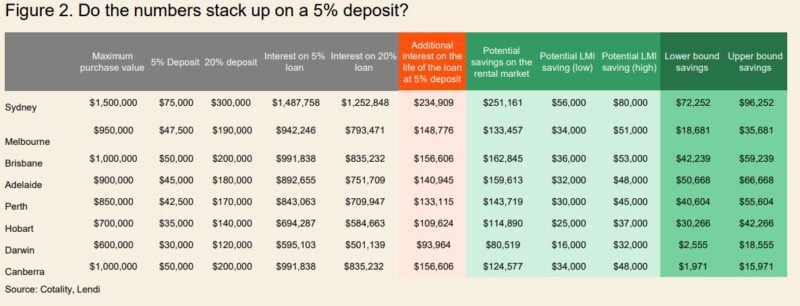

Determine 2 compares the extra curiosity value of a 5% mortgage with potential LMI and rental financial savings. On this state of affairs, buying on the high of the scheme works out higher than spending further time within the rental market to avoid wasting up a 20% deposit.

In truth, the rental financial savings far outweigh the financial savings on LMI.

The evaluation has loads of assumptions (detailed beneath) and must be taken as extra illustrative than recommendation as as to if the scheme works for all people.

For instance, somebody who doesn’t have rental prices would possibly discover it extra useful to avoid wasting up a full 20% deposit, saving on each LMI and further curiosity prices.

However there are different concerns to keep in mind even for non-renters, corresponding to getting into the market sooner to get forward of additional potential market upswings.

Buy worth relies on the restrict of worth caps in every metropolis.

Mortgage assumptions: a 30-year principal and curiosity mortgage time period paid month-to-month, with long-run rate of interest assumption of 5.5% every year over the lifetime of the mortgage. The 5.5% determine relies on the most recent new owner-occupier charge reported by the RBA, adjusted for the August charge reduce, and is topic to alter.

Observe on LMI calculations: primarily based on Lendi LMI Calculator (accessed 2nd September 2025). While each effort has been made to make sure the accuracy of this calculator, the outcomes must be used as indication solely. They’re neither a quote nor a pre-qualification for a mortgage.

Lendi’s LMI Calculator will be accessed right here: https://www.lendi.com.au/calculators/lmi-calculator/

Potential financial savings on the rental market: Assumes the distinction within the time to avoid wasting a 5% and 20% deposit, multiplied by present median rental charges. Time to avoid wasting a deposit assumes a 15% financial savings charge.

It is vital to notice this evaluation represents the utmost buy worth and the minimal deposit. People contemplating the scheme could have a unique cost-benefit state of affairs relying on their buy worth and deposit measurement and may keep in mind their very own particular person circumstances.

A much bigger scheme, a much bigger enhance to demand

When the First House Assure was launched, we identified that the revenue thresholds for accessing the scheme had been comparatively excessive, giving an extra enhance to pretty excessive revenue earners who could have saved up their 20% deposit in time.

However focusing on the scheme particularly to decrease revenue households can also have been a problem to its take-up, as a result of even when decrease revenue households had their deposit, they could not have certified for a house mortgage.

With enlargement of the schemes locations, worth caps and incomes, there’ll nearly actually be a short-term enhance to house values as much as the edge of the scheme, coinciding with rate of interest falls and tight ranges of housing provide.

Whereas people on the scheme might leap over the deposit hurdle quicker, this coverage is finally a requirement aspect stimulus which fails to deal with why deposits – and now rents – are so unaffordable within the first place.