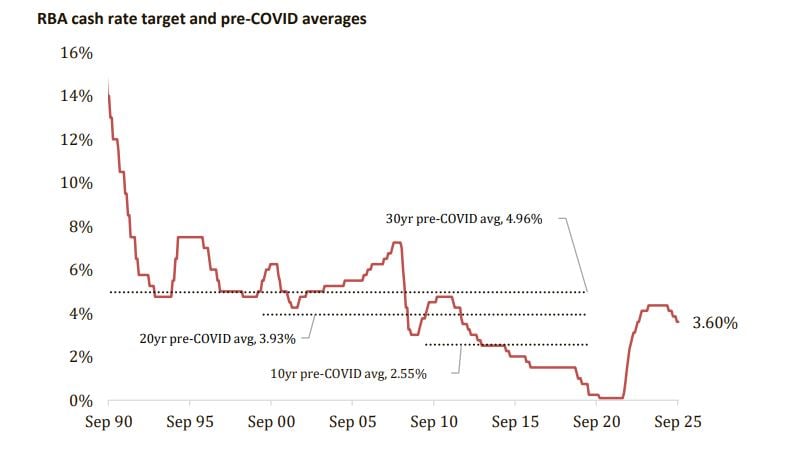

After reducing rates of interest by 75 foundation factors since February, the RBA has chosen the cautious path on the September board assembly, holding the money fee at 3.6%.

The choice was extensively anticipated, after the month-to-month inflation indicator hinted at some ‘upside’ threat to the inflation trajectory, particularly from housing prices.

Nonetheless, the RBA is more likely to look forward to the ‘full’ quarterly inflation replace, due for launch on the 29th of October (per week forward of the November board assembly), quite than studying an excessive amount of into the partials of the month-to-month inflation indicator.

Persistently tight labour market circumstances, the place the unemployment fee held at 4.2% in August, was one other issue weighing on the RBA Board’s choice.

Nonetheless, with job development slowing and vacancies trending decrease, it’s doubtless that labour markets will steadily loosen, taking some strain off wage development and lessening the necessity for the RBA to maintain charges on maintain.

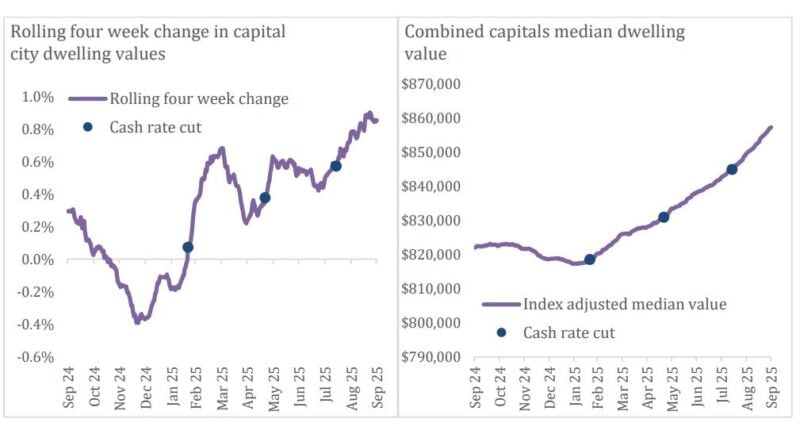

There’s a good likelihood that accelerating housing costs had been additionally a characteristic of RBA discussions.

For the reason that first fee minimize in February, housing markets across the nation have seen a optimistic inflection, sending values 4.7% greater for the reason that first minimize of the cycle on February 18th, in line with Cotality’s every day Dwelling Worth Index.

The positive factors may be seen throughout each capital metropolis and remainder of state area, reversing a softening development in dwelling values that was usually evident previous to February.

Whereas rates of interest have supported the broad-based rise in housing values, different components are additionally at play, particularly from the availability facet.

The variety of houses on the market in September was hovering round report lows, with whole marketed provide down 14.7% on the identical time final 12 months and monitoring nearly 20% under the earlier five-year common for this time of the 12 months.

Beneath-average ranges of obtainable housing provide are a characteristic of housing circumstances throughout each capital metropolis.

On the similar time, housing demand stays robust.

Preliminary estimates on dwelling gross sales present volumes monitoring 2.7% greater than a 12 months in the past and 4.2% above the earlier five-year common.

This disconnect between obtainable provide and demonstrated housing demand is key to understanding the upward development in housing values.

Though charges are on maintain, there’s a good likelihood of one other fee minimize over the approaching months.

The RBA subsequent meets on the threerd and 4th of November.

At this assembly, the board will get pleasure from the September quarter CPI knowledge, which will probably be central to their decision-making.

An extra minimize to rates of interest is probably going to offer extra assist to housing demand from a rise in borrowing capability and serviceability assessments, but additionally by way of greater shopper sentiment.

The expanded Dwelling Assure Scheme, which matches reside on October 1, that includes greater value caps and no limits on revenue or locations, is one other supply of extra housing demand.

As first dwelling consumers benefit from the stimulus, we anticipate to see elevated competitors for the restricted quantity of inventory available in the market, including to cost pressures available in the market, particularly across the higher restrict of the value caps.