Key takeaways

The RBA is evident: worldwide college students weren’t a significant driver of the post-pandemic surge in rents or inflation.

A lot of the rental worth development occurred earlier than borders reopened, that means the scholar return wasn’t the set off.

Years of under-building, planning delays, and investor fatigue have left Australia with power undersupply.

Worldwide college students could focus demand in particular areas (inner-city hubs), however they’re not the basis trigger.

There’s been no scarcity of finger-pointing with regards to Australia’s rental disaster.

One of many extra fashionable scapegoats lately? Worldwide college students.

In any case, when you could have tons of of hundreds of scholars flooding again into the nation after the pandemic, it’s straightforward to imagine they’d be pushing up rents, tightening provide, and even fuelling inflation.

However in response to the Reserve Financial institution of Australia’s newest Quarterly Bulletin, as reported by ABC information, that narrative doesn’t stack up.

Their evaluation suggests worldwide college students performed solely a minor function within the post-pandemic surge in rents and inflation.

Let’s take a look at what the RBA really mentioned, and what it means for property traders, coverage makers, and the broader housing dialog.

Sure, scholar numbers surged, however timing issues

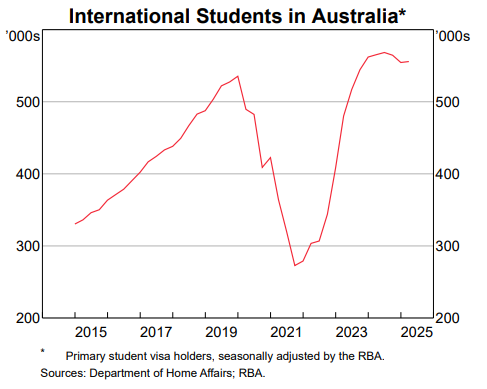

There’s no denying the numbers are massive.

In 2022, there have been slightly below 300,000 worldwide college students in Australia.

By the top of 2023, that determine had ballooned to 560,000.

Supply: RBA

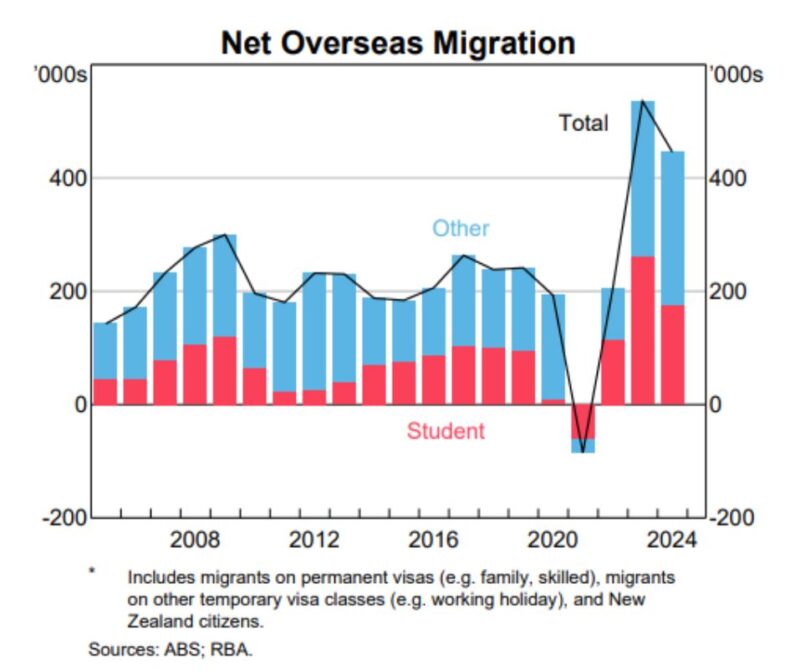

So sure, worldwide college students had been a significant driver of internet abroad migration throughout that interval, accounting for roughly half of it.

Supply: RBA

However right here’s the kicker: the largest soar in marketed rents occurred earlier than borders even reopened.

In different phrases, by the point most worldwide college students returned, the rental market was already underneath important strain.

The squeeze wasn’t about newcomers arriving, it was a couple of extreme undersupply of rental properties, years of underbuilding, and a fast-recovering native inhabitants post-lockdown.

How a lot did they actually add to rental demand?

The RBA did the maths.

Let’s say 50% of recent worldwide college students hire privately.

A further 100,000 college students would imply about 50,000 new renters.

Primarily based on RBA housing fashions, this would possibly carry rents by round 0.5%, hardly sufficient to elucidate the double-digit rental will increase we’ve seen in lots of markets.

And sure, worldwide college students do have a tendency to pay attention round training hubs, suppose inner-city Melbourne, Sydney, Brisbane.

However even there, a lot of the sharp rental hikes had been effectively underway earlier than they returned in power.

Pupil spending: a spike, not a surge

One other criticism is that worldwide college students drive inflation by spending massive after they arrive.

There’s some fact to that, but it surely’s short-lived.

New visa necessities imply college students should show they’ve practically $30,000 in financial savings to help themselves.

That results in a burst of spending on arrival: furnishings, electronics, setup prices, however then their consumption tapers off.

Excluding tuition charges, the RBA discovered that worldwide college students spend about the identical as residents.

So sure, they briefly added to demand pressures as borders reopened, however they had been simply one among many elements contributing to inflation from 2022 to early 2023.

The actual situation? Provide, not college students

Right here’s the place we have to shift the dialog.

Be aware: Sure, worldwide college students hire. Sure, they spend cash. However they’re not the explanation we’re dealing with a housing crunch.

The actual culprits?

Years of underneath funding in housing provide, significantly within the personal rental sector.

Planning bottlenecks and crimson tape slowing down new developments.

A shrinking pipeline of recent dwellings, at the same time as inhabitants development resumed post-COVID.

And a rental market already stretched skinny by locals returning to cities, falling family sizes, and investor disengagement because of regulatory burdens.

Blaming college students is politically handy, however economically lazy.

They’re additionally boosting the economic system in different methods

It’s straightforward to neglect that worldwide college students are a large financial asset.

In truth, training is now Australia’s fourth-largest export, price round $50 billion.

They not solely help universities, but additionally inject demand into retail, hospitality, and housing.

They contribute to the labour power, particularly in industries like hospitality and care work.

Supply: RBA

And in the long term, some will turn into expert migrants, including to our workforce and tax base whereas, within the brief time period, supporting our economic system by means of their consumption.

Sure, latest visa adjustments are tightening eligibility to cut back migration for its personal sake, however that should not obscure their broader worth.

What it means for property traders

For these of us concerned within the property markets, this RBA report reinforces what we’ve identified for some time:

The rental disaster is structural, not cyclical. It’s not about sudden demand shocks, it’s about power undersupply and an absence of coordinated nationwide housing technique. Which implies it will not go away any time quickly!

Worldwide college students are a long-term demand driver, not a short-term drawback. Particularly in key academic hubs, they help rental yields, retail foot visitors, and purpose-built lodging tasks. They’re an necessary a part of Australia’s economic system, offering export earnings from their charges and likewise from their inside consumption.

Rental markets stay tight—and if provide doesn’t reply ( and there’s no cause to see this taking place anytime quickly), rents will proceed to climb, no matter scholar numbers.

The underside line

The RBA’s analysis is evident: worldwide college students didn’t break the rental market.

They usually didn’t trigger inflation.

Blaming them distracts us from the true coverage and planning failures which have led to at present’s housing challenges.

We have to cease searching for scapegoats and begin specializing in options, like unlocking land, fast-tracking approvals, and inspiring extra funding in housing.

As a result of whether or not it is college students, expert migrants, or native Aussies, everybody wants someplace to reside.

And that’s one thing we will’t ignore any longer.