A just lately TOP-ed condominium in Tampines has caught our consideration after a 3-bedroom unit was bought for greater than double its buy value in simply two years. The resale deal, recorded in Treasure at Tampines, not solely delivered the vendor a million-dollar revenue but in addition set a brand new report for the undertaking.

Whereas such worthwhile transactions are eye-catching, the story behind the numbers reveals how timing, market developments, and undertaking dynamics can all play a job in shaping outcomes for each patrons and sellers.

Desk of contents

Treasure at Tampines’ 3-bedder bought for S$1.92M

A 3-bedroom unit at Treasure at Tampines just lately modified fingers with the official transaction dated 15 August 2025. The 1,033-sqft unit, situated on the sixth ground, fetched a value of S$1.92 million, or S$1,859 psf. This psf determine is considerably above the undertaking’s present common of S$1,761 psf. In different phrases, the client paid round a 5.6% premium to safe the unit.

Latest uptick in value for the 1,033-sqft, 3-bedders

Nevertheless, that is already a standard value seen for the unit sort in Treasure at Tampines. In June 2025, three comparable 1,033-sqft models have been transacted between S$1.9 million and S$1.93 million. Earlier than that, these models usually modified fingers for much less, beneath the S$1.9 million mark.

As an example, a 4th-floor unit fetched S$1.8 million in March 2025, whereas again in September 2024, the identical structure went for simply S$1.68 million. Sellers clearly sense the rising demand for this unit sort and modify their pricing, pushing resale costs greater in latest transactions.

Don’t guess your promoting value – comprehend it. Use 99.co’s Property Worth Device for a quick, dependable estimate in underneath a minute, with as much as 98% accuracy.

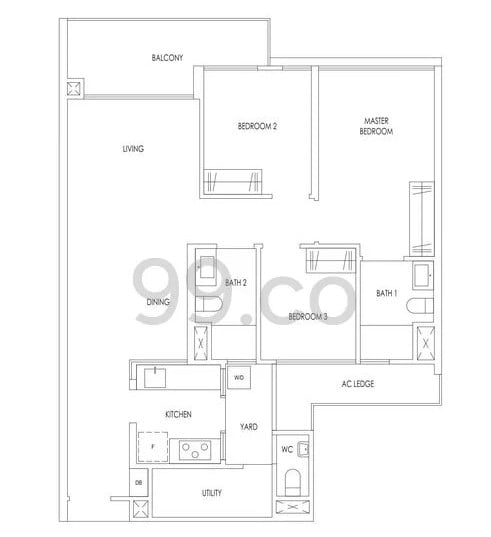

Treasure at Tampines gives a variety of 3-bedroom layouts, from 678 sqft to 1,087 sqft. The 1,033 sqft model is the second-largest, making it a beautiful possibility for households who need more room with out stretching into the biggest configurations.

Developed by Sim Lian Group, the 99-year leasehold undertaking at Tampines Avenue 11 obtained its Non permanent Occupation Allow (TOP) in 2023. With the lease beginning in 2018, this 3-bedder nonetheless had about 92 years left when it modified fingers for S$1.92 million (S$1,859 psf) in August.

Wanting past the undertaking, 3-bedroom condominium resales in Tampines are presently averaging S$1,470 psf. This implies the client of this Treasure at Tampines unit paid about 26.5% greater than the broader market norm.

The way it doubled in worth inside 2 years

On the vendor’s finish, this resale deal in August resulted in a capital achieve of over S$1 million in a comparatively quick holding interval. The unit’s worth was up by round 130% from the unique buy value.

The vendor had purchased the unit in July 2023 for less than S$835,000 (S$808 psf) earlier than the undertaking hit TOP. That unusually low value stemmed from a sub-sale transaction that was basically a hearth sale, contemplating that Treasure at Tampines sub-sales that yr averaged S$1,642 psf. In different phrases, the 2025 vendor obtained in at practically half-price.

One’s loss is one other one’s achieve – Right here’s the unit’s full transaction historical past:

| Transaction Date | Promoting Worth (S$) | PSF (S$) | Kind | Acquire/Loss |

| 15/08/25 | 1,920,000 | 1,858 | Resale | +1,085,000 |

| 14/07/23 | 835,000 | 808 | Sub Sale | -464,000 |

| 31/03/19 | 1,299,000 | 1,257 | New Sale | N/A |

The 2023 sub-sale vendor initially bought the unit for S$1.299 million from the developer in 2019. Despite the fact that their entry value was already beneath the undertaking’s common that yr (S$1,336 psf), the distressed exit made in 2023 nonetheless resulted in a lack of round S$464,000.

That transaction was certainly one of solely two unprofitable sub-sales in the complete undertaking that yr. The opposite concerned a modest S$90,000 loss from a 3-bedder held for less than 8 months for the reason that launch sale. In distinction, 198 different Treasure sub-sales in 2023 have been worthwhile, with good points as excessive as S$676,000.

Highest capital achieve in Treasure at Tampines

The August 2025 resale now stands as the best capital achieve ever recorded in Treasure at Tampines. With S$1.085 million pocketed, that works out to about S$519,000 in good points per yr, which is kind of extraordinary in comparison with the standard annual revenue for personal condos in Singapore.

It’s additionally price noting that as a result of the vendor held the unit for simply barely over two years, the transaction nonetheless falls inside the window of the SSD (Vendor’s Stamp Obligation) guidelines. A 4% cost is utilized on this explicit case. Which means a sizeable portion of the gross revenue will go towards taxes, lowering the vendor’s nett achieve.

Even after accounting for SSD, the vendor nonetheless walked away with a considerable windfall. This case additionally highlights how a lot timing issues in property funding. Getting into at an unusually low level, whether or not as a result of a distressed sale or market lull, can unlock huge upside when market situations shift. It’s a basic case of “purchase low, promote excessive,” however executed in a compressed timeline that solely skilled (or fortunate) traders handle to attain.

Nevertheless, regardless of this extremely worthwhile condominium sale that appears to be extra remoted, Treasure at Tampines has made headlines for delivering its condominium homeowners substantial good points. Final yr, Treasure achieved over 200 worthwhile transactions, the best quantity recorded inside a undertaking. This far in 2025, it has recorded 124 worthwhile transactions as of early September.

Probably the most worthwhile condos in 2024

| Challenge | District | TOP | No. of Worthwhile Transactions | Earnings (S$) |

| Treasure at Tampines | 18 | 2023 | 263 | 25K to 981K |

| The Florence Residences | 19 | 2023 | 156 | 29K to 728K |

| Parc Clematis | 5 | 2023 | 132 | 98K to 895K |

| Affinity at Serangoon | 19 | 2023 | 120 | 23K to 553K |

| Parc Esta | 14 | 2022 | 105 | 66K to 1.026M |

| Riverfront Residences | 19 | 2023 | 103 | 61K to 850K |

| Stirling Residences | 3 | 2022 | 99 | 76K to 1.198M |

| Penrose | 14 | 2024 | 95 | 62K to 770K |

| Excessive Park Residences | 28 | 2019 | 95 | 100K to 1.246M |

| Jadescape | 20 | 2022 | 83 | 55K to 4.35M |

In 2024, a complete of 26 condominiums recorded not less than 50 worthwhile transactions, with six tasks crossing the 100 mark. Jadescape posted the only highest revenue at S$4.35 million, however Treasure at Tampines stood out for quantity, topping the record with 263 worthwhile transactions.

Treasure at Tampines continues to be the only largest condominium undertaking in Singapore with 2,203 models. The massive variety of models might have contributed to its excessive quantity of worthwhile transactions. With extra models, the condominium naturally sees the next gross sales quantity in comparison with these with fewer models.

Nevertheless, on the similar time, the dimensions of the undertaking means resale sellers typically face stiffer competitors from inside the similar improvement. Even so, the constant stream of capital good points achieved by many sellers has strengthened Treasure at Tampines’ repute as some of the sought-after condos in Singapore, and a standout within the Tampines property market.

Uncommon finds: 3-bedroom models priced beneath S$1.7M

Regardless of the various worthwhile gross sales and up to date uptick in value for the 3-bedroom models in Treasure at Tampines, the undertaking has at all times been identified for being competitively priced; this was a part of the gross sales pitch since even earlier than the launch day.

In at the moment’s resale market, it’s one of many few tasks the place a 3-bedder could be had for beneath S$1.7 million – an more and more uncommon risk in 2025. Once more, Treasure at Tampines has a number of layouts for its 3-bedders, and the smaller ones naturally provide a lower cost and better worth for such bed room configurations. As an example, a 915 sqft, 3-bedroom unit in Treasure at Tampines is presently listed for S$1.5 million on 99.co.

In 2025 up to now, 3-bedroom models inside Treasure at Tampines have been transacted at a mean value of S$1.514 million. The identical unit sort within the broader Exterior of Central Area (OCR) market, however, averaged at over S$1.7 million, round 12% greater in comparison with Treasure at Tampines’ 3-bedders.

Upward value pattern for Treasure at Tampines

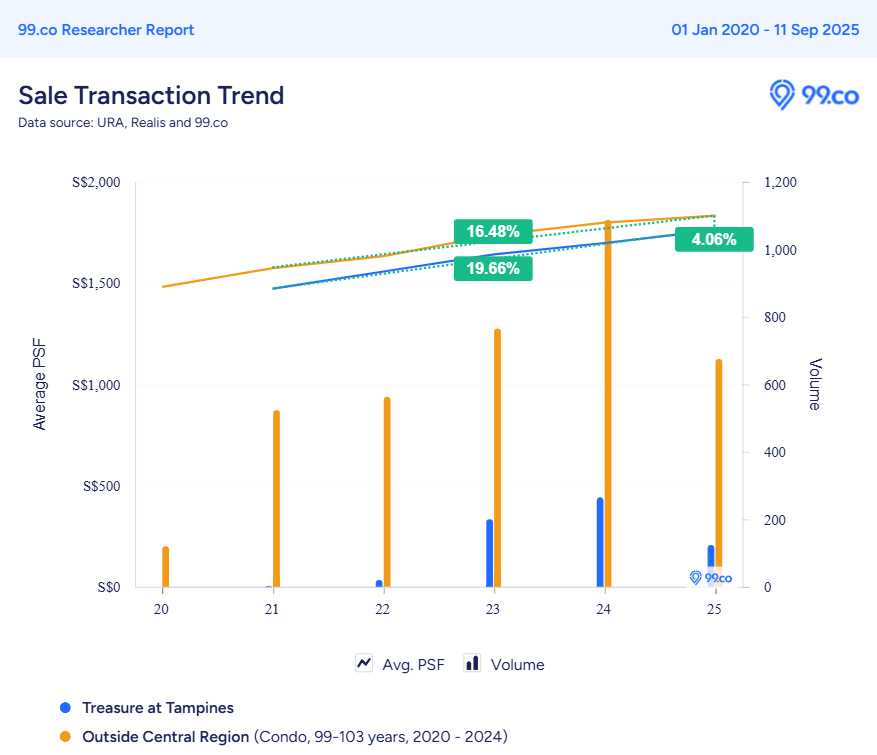

Zooming out on the resale value progress in Treasure at Tampines, the undertaking actualy outpaced the broader OCR market by round 19% for leasehold developments with comparable TOP. Since 2021, the undertaking’s common psf has climbed nearly 20%, in comparison with 16.48% for different comparable developments.

A few of these comparable developments embrace Kandis Residence (TOP 2021), Whistler Grand (TOP 2023), Parc Clematis (TOP 2023), Seaside Residences (TOP 2021), and Twin VEW (TOP 2022), amongst others.

By way of common psf, Treasure at Tampines nonetheless sits beneath its market phase, which suggests it’s nonetheless comparatively afforable in comparison with the others. As of early September 2025, the undertaking’s common psf is at S$1,761, round 4% decrease than the market’s common of S$1,833 psf.

Total leasehold market within the OCR

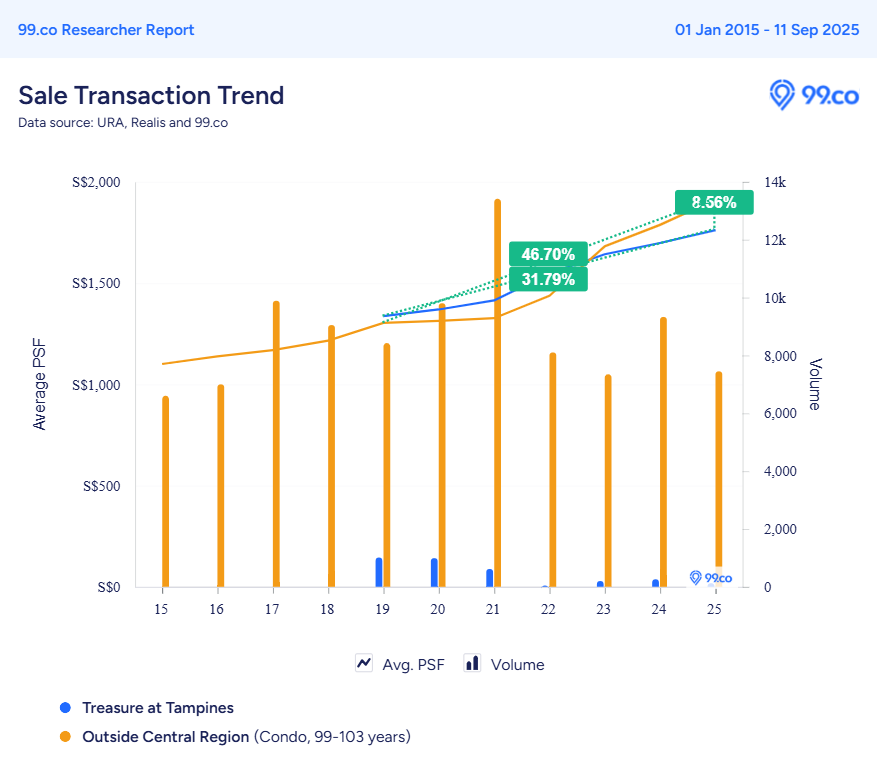

Taking all gross sales sorts under consideration (together with new gross sales), Treasure has appreciated by 31.8% since its launch in 2019. Again then, its common was simply S$1,336 psf. For comparability, leasehold condos within the OCR have risen by 46.7% in the identical interval, reaching a mean of S$1,912 psf, or greater than 8% greater than Treasure at Tampines.

The stronger value progress seen within the OCR, nevertheless, was boosted by a number of new launches over the previous years. Consider Chuan Park, Jden, and the more moderen ELTA and Parktown Residence which entered the market at greater psf. This widened the value hole between the brand new tasks and the resale models present in market.

Worth-sensitive patrons might wish to reassess their decisions — balancing newer however dearer launches towards barely older, extra inexpensive tasks and their potential for future progress. In any case, a decrease entry level in just lately TOP-ed developments like Treasure at Tampines typically provide better room for capital appreciation.

Having fun with this in-depth evaluation? 99.co Rental Money or Crash covers month-to-month notable transactions in Singapore’s personal property market.

The submit Just lately TOP-ed Tampines condominium bought at a S$1.085M revenue after 2 years appeared first on .