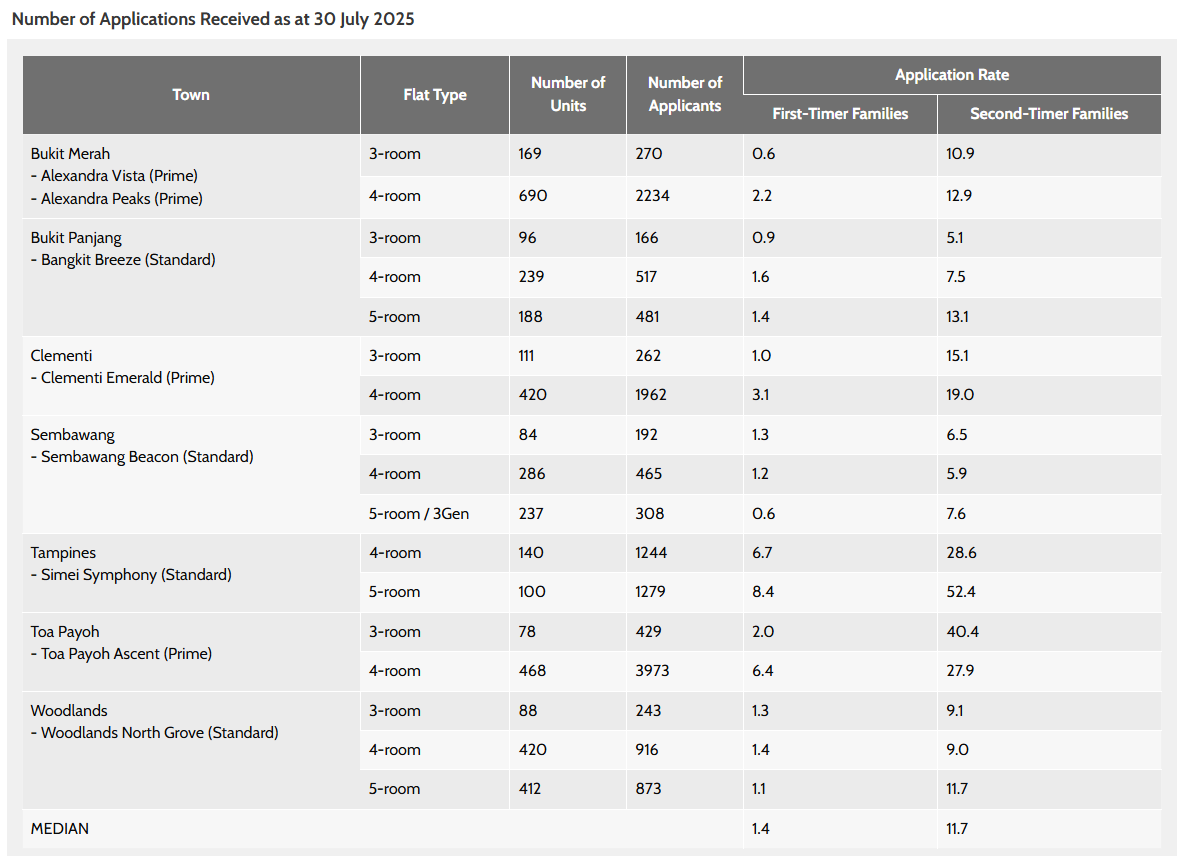

The HDB July BTO train has now formally closed. In line with the most recent numbers, 20,994 purposes have been acquired for the 5,547 flats on provide.

These figures replicate continued sturdy demand throughout a spread of flat varieties, notably in centrally positioned cities equivalent to Toa Payoh, Clementi, and Simei. The train additionally marked the primary rollout of the brand new Household Care Scheme, designed to present singles and households precedence when making use of to reside close to mother and father.

Along with the Deferred Earnings Evaluation and elevated second-timer quotas, these modifications have begun to form each utility patterns and demand.

Desk of Contents

- TL;DR: Key takeaways

- Demand stays excessive for 2-room Flexi flats

- Bigger flat varieties in Toa Payoh and Simei in highest demand

- Modest demand amongst different areas

TL;DR: Key takeaways

- Simei Symphony noticed the very best demand for 2-room Flexi flats amongst first-timer singles, with 38.7 candidates per unit.

- Toa Payoh Ascent 3-room flats noticed the second-highest second-timer price, at 40.4 per unit.

- 2-room Flexi demand remained sturdy, with 43.9 first-timer singles per unit at Simei.

- Clementi Emerald and Toa Payoh Ascent additionally drew heavy competitors for 4-room flats from second-timer households.

- Demand in non-mature cities remained reasonable, maintaining them viable for budget-conscious consumers.

Demand stays excessive for 2-room Flexi flats

2-room Flexi flats, designed primarily for seniors, noticed constant demand. Seniors aged 55 and above typically downsize from bigger flats to monetise their current properties and unlock retirement earnings. These models are supplied with versatile leases starting from 15 to 45 years, which makes them considerably extra inexpensive than the everyday 99-year lease.

Singles aged 35 and above, additionally subscribed closely to 2-room Flexi models because it stays the easiest way for them to get a model new BTO unit. Since October 2024, this group can apply for such flats throughout all property varieties—Normal, Plus, and Prime—which has significantly broadened their choices.

Amongst all cities, Simei Symphony stood out with 43.9 first-timer single candidates per unit, the very best ever recorded, surpassing Toa Payoh Ascent (34.4). Bangkit Breeze (33.6) and Clementi Emerald (29.6) additionally noticed elevated utility charges from singles.

For comparability, the final time demand reached related ranges was through the October 2024 BTO launch, when 2-room Flexi flats in Bukit Batok drew 33.4 candidates per unit, adopted by Kallang/Whampoa at 27.7.

Simei Symphony is positioned adjoining to Higher Changi MRT Station on the Downtown Line, with Exit D main on to the mission. All blocks are inside a brief stroll from the station.

Toa Payoh Ascent is inside a 10-minute stroll of each Caldecott MRT (Circle and Thomson-East Coast Traces) and Braddell MRT (North-South Line). These transport hyperlinks, mixed with their location in mature estates, improve their enchantment to each youthful consumers and seniors. Most significantly, this mission has a comparatively shorter wait time of 41 months which provides to its enchantment.

Beginning costs for 2-room Flexi flats start at S$212,000 at Toa Payoh Ascent and S$193,000 at Simei Symphony. Within the different tasks, 2-room Flexi models can vary from S$148,000 at Sembawang Beacon to S$214,000 at Clementi Emerald.

Bigger flat varieties in Toa Payoh and Simei in highest demand

4- and 5-room flats in Toa Payoh and Simei emerged as probably the most aggressive on this launch, with Simei taking the highest spot general.

At Simei Symphony, the 5-room flats noticed 1,161 purposes for simply 100 models. First-timers submitted 7.5 purposes per unit, whereas second-timers hit a outstanding 52.4 candidates per unit. That is the very best utility price throughout all classes!

One doable cause for this excessive demand could possibly be that Simei Symphony doesn’t provide 3-room flats, so consumers could also be shifting their curiosity to the bigger models. Regardless of the absence of a major college inside a 1km radius, many candidates seem prepared to miss this in favour of the mission’s proximity to an MRT station.

At Toa Payoh Ascent, the 4-room flats attracted 2,361 purposes for 375 models. For first-timers, the applying price was 6.4 candidates per unit, whereas second-timer utility price stood at 27.9 candidates per unit.

Toa Payoh Ascent’s 3-room flats additionally noticed excessive demand, with 5.4 candidates per unit amongst senior quota, and 40.4 purposes per unit amongst second-timers.

In the meantime, Clementi Emerald’s 4-room models (a Prime property) drew notable demand from first-timers (3.4 per unit) in addition to second-timers (19.0 per unit).

Bigger models at Toa Payoh Ascent and Simei Symphony begin at roughly S$528,000 and S$603,000 respectively. Whereas these costs are increased than these in northern estates like Woodlands or Sembawang, candidates seem prepared to pay a premium for centrality and long-term worth.

Modest demand amongst different areas

| Mission | Flat Kind | First-timer Fee | Second-timer Fee |

|---|---|---|---|

| Sembawang Beacon | 4-room (Normal) | 1.2 | 1.2 |

| Woodlands North Grove | 4-room | 1.3 | 1.2 |

| Bangkit Breeze | 4-room (Normal) | 1.6 | 1.1 |

| Sembawang Beacon | 5-room (Normal) | 0.7 | 0.5 |

| Sembawang Beacon | 3Gen (Normal) | 0.2 | – |

| Woodlands North Grove | 5-room | 0.6 | 0.4 |

Whereas demand remained red-hot in central areas, northern cities like Woodlands, Bukit Panjang, and Sembawang noticed extra modest utility charges. This was seemingly on account of a mixture of things equivalent to longer projected wait instances, fewer close by MRT stations, and fewer established neighbourhood facilities in comparison with mature estates. Moreover, youthful households or first-time consumers could prioritise proximity to workplaces and faculties, which tends to favour central or city-fringe areas.

These estates could enchantment extra to consumers in search of affordability, extra versatile lease choices, or these prepared to attend longer in trade for extra spacious layouts and quieter environment.

Broader developments

The July 2025 launch noticed increased utility charges than February’s train, rising from 3.2 to three.9 candidates per unit. This spike suggests renewed demand for public housing, seemingly pushed by rising resale flat costs and coverage modifications, together with elevated allocation for second-timers and the rollout of the Household Care Scheme.

In comparison with the Sale of Stability Flats (SBF), BTO flats drew extra consideration, particularly in high-demand areas equivalent to Bukit Merah, Clementi, Toa Payoh, and Tampines. That is seemingly on account of extra predictable completion timelines and eligibility advantages tied to new launches.

Notably, Prime Location Housing remained aggressive regardless of stricter resale circumstances and subsidy restoration guidelines. Over 12,000 candidates vied for PLH flats, the very best since November 2022.

The July 2025 BTO outcomes verify that location, property sort, and eligibility schemes are shaping demand greater than ever. With second-timer competitors intensifying, and singles more and more lively available in the market, the subsequent few launches will seemingly proceed to replicate these developments.

The publish July 2025 BTO Software charges soar as Simei Symphony’s 5-room flats see highest demand appeared first on .