Key takeaways

Regardless of media noise about easing rental circumstances, the information clearly exhibits a persistent and extreme rental scarcity.

Whereas there’s been quite a lot of noise recently about rental progress slowing and affordability bettering, the information paints a really totally different, and rather more persistent image.

Regardless of slight upticks in rental emptiness charges in current months, Australia stays firmly in a landlord’s market.

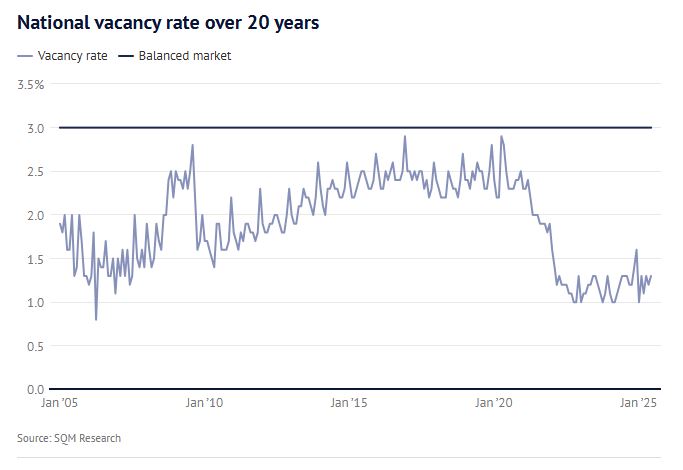

Emptiness charges stay properly beneath the balanced market benchmark of three%. As of June, the nationwide emptiness price was simply 1.3%.

Whereas there’s been quite a lot of noise recently about rental progress slowing and affordability bettering, the information paints a really totally different, and rather more persistent image.

Regardless of slight upticks in rental emptiness charges in current months, Australia stays firmly in a landlord’s market.

And this isn’t a short-term blip, it’s a structural pattern that’s been enjoying out for the higher a part of 20 years.

The rental market: out of stability for years

A wholesome, balanced rental market sometimes sees a emptiness price of round 3%.

That’s the extent the place provide and demand are roughly aligned, sufficient properties for renters to have selection, with out flooding the market and pushing landlords to drop rents.

However the actuality is, we haven’t seen these circumstances in fairly a while.

Based on SQM Analysis, the nationwide emptiness price sat at simply 1.3% in June—up barely from 1.2% in Might, however nonetheless dramatically beneath the long-term common.

Supply: The Age

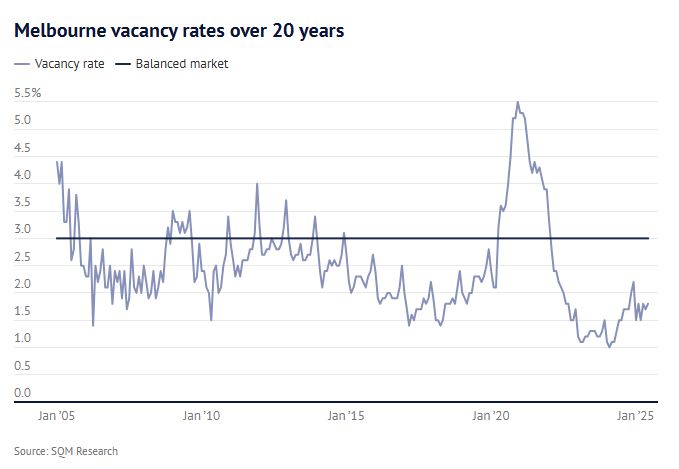

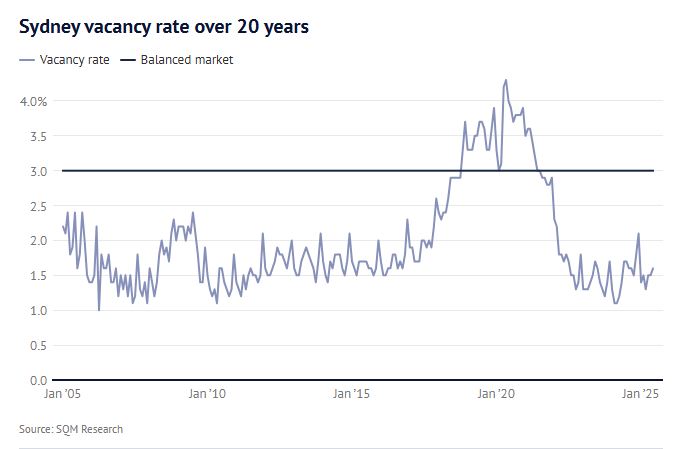

Sydney and Melbourne each skilled minor will increase, however stay deeply undersupplied, with emptiness charges of 1.6% and 1.8% respectively.

In actual fact, the tightest market on document got here simply earlier this yr, in February 2024, when emptiness charges hit 1% nationwide and simply over 5,000 properties had been accessible for lease throughout the nation.

That’s a dire degree of provide.

Why it is nonetheless a landlord’s market

There are two sides to the rental equation: demand and provide.

Sadly, each are pulling in the identical path—and neither is providing a lot reduction for renters.

On the demand facet, we’ve had a tidal wave of returning migration. Worldwide college students, expert migrants, and Australians coming back from regional strikes or abroad relocations have flooded again into our capital cities.

However not like earlier cycles, we weren’t ready this time round.

Inhabitants progress has outpaced our skill to ship new housing inventory, particularly leases.

On the availability facet, development has didn’t sustain.

Rising constructing prices, labour shortages, planning bottlenecks, and diminishing developer confidence have all contributed to a shortfall in new dwelling completions.

And let’s not neglect the mounting strain on mum-and-dad traders: land tax will increase, tenancy reform, increased mortgage prices, and regulatory danger have compelled many to promote up.

The outcome? Fewer properties to lease and skyrocketing rents in lots of places.

How does this examine to the previous?

It’s value historical past for context.

In June 2005, Melbourne’s rental emptiness price was 3.9%—a renter’s market.

Supply: The Age

Sydney was at 2.4%. We had been constructing strongly then.

Supply: The Age

Main city renewal tasks like Docklands and Southbank had been coming on-line, and inhabitants progress was extra subdued.

Quick ahead to as we speak, and never solely are emptiness charges considerably tighter, however our housing pipeline has slowed to a trickle in lots of areas.

The identical cities now have emptiness charges underneath 2%, with no signal of a fast repair.

Are Authorities targets sufficient?

Sure, there are housing targets.

The federal authorities desires to see 1.2 million properties in-built 5 years.

Victoria has set its personal objective of 800,000 over a decade.

And NSW is aggressively rezoning land to spice up density round transport hubs.

However right here’s the catch: these targets are aspirational.

They require coordination, non-public sector funding, sooner approvals, and an easing of price pressures throughout the board.

That’s a tall order.

Even when Victoria meets its nationwide housing objective, that received’t be sufficient to immediately unwind years of undersupply.

The pipeline is lengthy, and the bottlenecks are structural.

What it means for property traders

In the event you’re a landlord, that is possible music to your ears. A good rental market with robust tenant demand means:

Nevertheless it’s not all clean crusing.

Many traders are additionally coping with rising rates of interest, increased holding prices, and extra aggressive land tax payments, notably in states like Victoria.

And with the push towards better tenant protections, you might want to be strategic and selective in your property purchases and administration practices.

For the astute investor, these circumstances create a possibility, not simply to journey the present wave, however to plan for the following decade.

Proudly owning the suitable sort of property in the suitable location, the place demand will stay excessive and provide constrained, would be the key to long-term success.

The larger image: housing as infrastructure

What’s turning into more and more clear is that housing isn’t only a social situation, it’s financial infrastructure.

With out sufficient properties, folks can’t relocate for jobs. College students can’t afford to review.

Households are compelled into unsuitable residing preparations.

We’re already seeing households double up: two {couples} sharing a two-bedroom condo simply to afford the lease.

This squeeze isn’t going away anytime quickly. And except we radically enhance the availability of high quality, reasonably priced rental housing, Australia will stay a landlord’s marketplace for the foreseeable future.