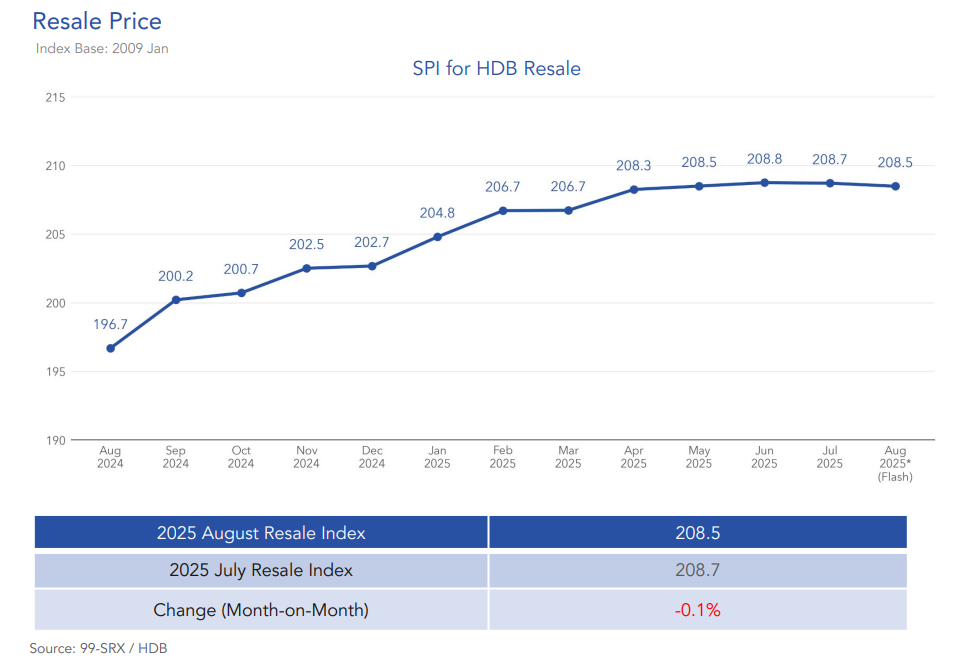

The most recent HDB resale flash report for August confirmed a slight slowdown out there. Costs dipped by 0.1% in comparison with the earlier month, whereas transaction volumes dropped 14.3% from July. Regardless of this softer displaying, the year-on-year image remained regular, with costs nonetheless greater by 6% in comparison with August 2024. Alongside these figures, 141 flats crossed the million-dollar mark in August, including to the continued pattern of high-value HDB transactions.

Desk of contents

TL;DR – Fast abstract

- 📉 Costs eased barely: General HDB resale costs dipped by 0.1% in August 2025.

- 🏘️ Volumes fell: 2,211 flats had been offered, down 14.3% from July and 15.2% decrease year-on-year.

- 🛋️ Room kind efficiency: 3-room flats dipped 0.1%, 4-room stayed flat, whereas 5-room (+0.8%) and govt flats (+0.2%) noticed good points.

- 📆 12 months-on-year development: Costs are nonetheless up 6% in comparison with August 2024.

- 🏙️ Mature vs non-mature estates: Costs in mature estates fell 0.3%, whereas non-mature estates dropped 0.1%.

- 💰 Highest transaction: An govt flat at The Pinnacle@Duxton offered for S$1.6M; an govt at Yishun Avenue 4 topped non-mature estates at S$1.26M.

- 🏡 Million-dollar offers: 141 million-dollar HDBs modified palms, making up 6.4% of August’s resale market.

/* TL;DR field kinds — embody in the identical Customized HTML block or web site stylesheet */

.hdb-tldr {

–bg: #e6f2fa; /* gentle mild blue */

–bg-accent: rgba(255,255,255,0.35);

–text: #0b3050; /* darkish navy for distinction */

–muted: rgba(11,48,80,0.92);

background: linear-gradient(180deg, var(–bg), #d4ebf7);

colour: var(–text);

padding: 20px;

border-radius: 10px;

box-shadow: 0 6px 18px rgba(8, 30, 75, 0.15);

max-width: 820px;

margin: 18px 0;

font-family: system-ui, -apple-system, “Segoe UI”, Roboto, “Helvetica Neue”, Arial;

}

.hdb-tldr__title {

margin: 0 0 10px;

font-size: 1.125rem;

letter-spacing: 0.2px;

}

.hdb-tldr__list {

margin: 0;

padding: 0;

list-style: none;

show: grid;

hole: 8px;

}

.hdb-tldr__list li {

padding: 10px;

background: var(–bg-accent);

border-radius: 8px;

colour: var(–muted);

line-height: 1.35;

font-size: 0.97rem;

}

.hdb-tldr__list sturdy {

colour: #0b3050;

}

@media (max-width:600px){

.hdb-tldr { padding:14px; border-radius:8px; }

.hdb-tldr__title { font-size:1rem; }

.hdb-tldr__list li { font-size:0.95rem; padding:8px; }

}

What’s behind the numbers?

As shared by Mr. Luqman Hakim, Chief Knowledge & Analytics Officer at 99.co, the HDB resale market slowed down in August, with transactions falling by 14.3% in comparison with July. He defined that this dip is usually seasonal, for the reason that Hungry Ghost Competition tends to make some patrons extra cautious about making main monetary commitments. Due to this, fewer offers are normally closed throughout this era.

Mr. Luqman additionally famous that costs edged barely decrease, however this isn’t uncommon. After months of regular good points, a small decline could merely imply the market is taking a brief breather. In truth, with costs showing to stage off, the market could possibly be shifting right into a plateau part reasonably than displaying weak spot.

He added that the broader image stays sturdy. Regardless that August noticed a month-to-month dip, resale costs had been nonetheless 6% greater than a 12 months in the past. This means that demand for HDB resale flats continues to carry regular, regardless of these short-term fluctuations.

A more in-depth take a look at costs

In August, costs total dipped barely. Mature estates recorded a 0.3% decline, whereas non-mature estates slipped 0.1%. When damaged down by flat kind, the numbers revealed a blended efficiency.

3-room flats dipped by 0.1%, whereas four-room flats stayed unchanged. Then again, 5-room flats gained 0.8%, and govt flats inched up by 0.2%.

12 months-on-year, nonetheless, all classes posted good points. 3-room flats rose 7.2%, 4-room flats climbed 6.3%, five-room flats gained 5.7%, and govt flats rose 3.3%. Costs in mature estates jumped 6.7% from final 12 months, whereas non-mature estates climbed 5.3%.

Fewer transactions in August

On the transaction aspect, there have been 2,211 HDB resale flats offered in August 2025. This was a 14.3% drop from July, displaying that fewer offers had been closed. In comparison with a 12 months in the past, resale volumes had been down 15.2%.

When taking a look at room sorts, 4-room flats remained the most well-liked, making up 45.3% of gross sales. 3-room flats adopted at 26.1%, whereas 5-room flats took up 22.9%. Government flats made up the remaining 5.7%.

When it comes to location, non-mature estates accounted for a lot of the exercise, with 58.2% of transactions. Mature estates contributed 41.8% of gross sales. This reveals that many patrons proceed to search for affordability in non-mature areas, even whereas mature estates stay in demand.

Document offers nonetheless occurred

Even with the slowdown, high-value offers had been nonetheless recorded.

The best transacted worth in August was S$1.6 million for an govt flat at The Pinnacle@Duxton. This iconic growth continues to attract sturdy curiosity, with patrons prepared to pay premium costs for its location and distinctive options.

In non-mature estates, the priciest flat offered was an govt unit at Yishun Avenue 4, which went for S$1.26 million. This reveals that even in areas farther from the central area, govt flats in Yishun can nonetheless appeal to patrons who worth measurement and house.

Million-dollar HDB resales in August 2025

The million-dollar membership additionally grew additional, although at a slower tempo in comparison with July. In August, 141 flats had been offered for at the least S$1 million, down from 169 items within the earlier month. These transactions made up about 6.4% of the month’s complete gross sales.

Bukit Merah led the best way with 25 million-dollar flat gross sales, adopted by Toa Payoh with 22 and Clementi with 15. Different cities that noticed such high-value transactions included Kallang/Whampoa, Bishan, Ang Mo Kio, Queenstown, Central Space, Geylang, Serangoon, Hougang, Tampines, Bukit Panjang, Bukit Timah, Bedok, Sengkang, Jurong East, Bukit Batok, and Yishun.

The put up HDB resale costs ease 0.1% in August 2025 as transactions fall 14.3% appeared first on .