A luxurious condominium alongside Grange Street has simply made headlines with one of many greatest resale income in 2025. A 4-bedroom unit at Grange Residences was bought for S$10.2 million, netting its vendor a staggering S$6 million acquire. This record-setting deal not solely raised the bar for the event but additionally underlined how freehold houses in Singapore’s Core Central Area (CCR) proceed to draw deep-pocketed consumers regardless of hefty worth tags.

Desk of contents

4-bedder at Grange Residences bought for S$10.2 million

With the official transaction dated on 8 September 2025, this resale deal at Grange Residences concerned a spacious 2,852-sqft unit on the fifteenth flooring. At S$10.2 million, or S$3,576 psf, the unit fetched a 4.3% premium above the venture’s present common of S$3,428 psf.

Don’t guess your promoting worth – understand it. Use 99.co’s Property Worth Software for a quick, dependable estimate in underneath a minute, with as much as 98% accuracy.

In comparison with the broader District 10 (Tanglin/Holland/Bukit Timah) market, the place freehold condos are altering arms at about S$2,545 psf, the brand new proprietor of the 4-bedder at Grange Residences forked out a worth that was round 40% greater than the district common. Clearly, the acquisition wasn’t about chasing worth however about securing a trophy residence in certainly one of Singapore’s most unique enclaves.

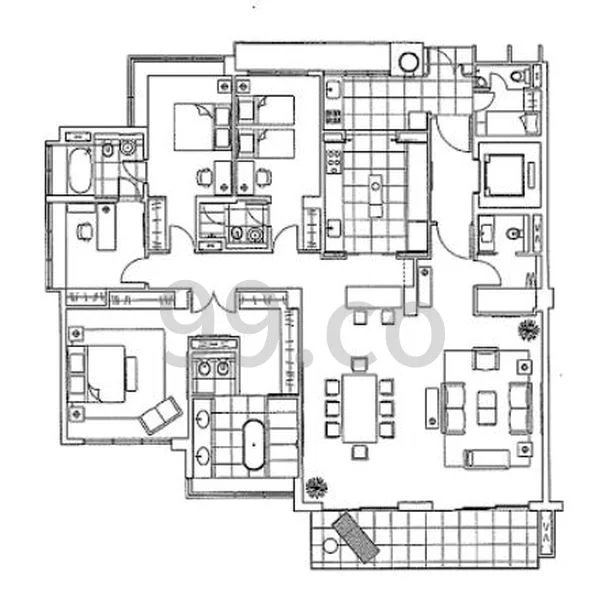

Grange Residences is a freehold improvement accomplished in 2004 with simply 164 models unfold throughout 18 storeys. Positioned minutes from Orchard Boulevard MRT, it options large-format 4-bedroom flats starting from 2,584 to 2,852 sqft. These luxurious houses are designed to enchantment to households in search of each privateness and area within the coronary heart of town.

The costliest unit ever transacted at Grange Residences

This newest sale has set a brand new benchmark for Grange Residences, each in absolute worth and psf worth. It’s the first time {that a} unit has been transacted above the S$10 million mark, with file S$3,576 psf. The earlier excessive was S$9.85 million (S$3,453 psf) achieved in June 2025 for one more 2,852-sqft unit on a decrease flooring.

Up to now this yr, 4 models of the identical format have modified arms between S$9.72 million and S$10.2 million, averaging S$3,463 psf. The newest deal was due to this fact 3.3% greater than this common — displaying how shortly costs can escalate inside months in an energetic resale cycle when consumers compete for restricted provide.

Excellent news: The same 2,852-sqft unit at Grange Residences is at present obtainable on 99.co for underneath S$10 million!

Vendor made S$6.002M in revenue holding long-term

The vendor on this September transaction walked away with an absolute acquire of S$6.002 million, after holding the property for barely over 20 years. The 4-bedroom unit was initially bought for S$4.2 million (S$1,472 psf) in 2005. This worth level was round 5.3% greater in comparison with the venture common of the time, which was recorded at S$1,398 psf.

Nonetheless, for the very same 2,852-sqft format, the 2005 common was about S$1,529 psf. Meaning the vendor really entered at a 3.7% lower cost in comparison with others. This barely decrease entry level turned out to be important, amplifying the eventual S$6 million revenue after they exited at right this moment’s file psf.

Capital appreciation at Grange Residences

Curiously, this S$6 million acquire isn’t even the best revenue recorded at Grange Residences. The earlier resale unit which fetched S$9.85 million in June 2025 delivered a fair greater capital acquire for the vendor. They’d purchased the unit in June 2004 for less than S$3.35 million (S$1,173 psf), so that they pocketed an absolute revenue of S$6.5 million after holding it for over 20 years. That is nonetheless the best resale acquire ever recorded in Grange Residences.

In complete, 5 resale transactions have taken place on the improvement this yr. All 5 turned out to be worthwhile with positive factors starting from S$3 million to the best of S$6.5 million. House owners who cashed out in 2025 had held their properties between 15 to 21 years, counting on the power of long-term possession in freehold CCR tasks.

Six resale offers achieved income above S$5M

With regards to massive positive factors, this Tanglin condominium has seen six resale offers the place sellers walked away with income of over S$5 million. Half of the gross sales concerned the two,852-sqft models, which have grow to be the star performers of the venture.

| Date | Space (sqft) | Promoting Worth (S$) | Revenue (S$) | Years Held |

| 09/2025 | 2,852 | 10,200,000 | 6,002,000 | 20.2 |

| 07/2025 | 2,852 | 9,738,000 | 5,796,000 | 20.6 |

| 06/2025 | 2,852 | 9,850,000 | 6,504,000 | 21 |

| 10/2023 | 2,669 | 8,540,000 | 5,409,000 | 19.5 |

| 05/2023 | 2,669 | 8,880,000 | 5,584,000 | 19 |

| 03/2023 | 2,584 | 8,580,000 | 5,734,000 | 19 |

These resale transactions present an simple development: endurance pays. Each one of many S$5M+ revenue offers got here from homeowners who held their models for round twenty years — or on this case, those that entered throughout the venture’s early days.

Regardless of variations in flooring space, which vary from the smallest to the biggest layouts, the income achieved had been notably comparable. This means that consumers on the prime finish are pricing within the venture’s general status and placement quite than being overly delicate to minor variations in measurement.

Maybe most telling is the trajectory of offers in 2025. Of the 5 resale transactions recorded this yr, three have already delivered income above S$5M, suggesting renewed demand for large-format freehold houses. This might be a mirrored image of consumers in search of stability in land-scarce Singapore, the place trophy belongings like Grange Residences are seen as long-term wealth preservers.

Notable massive positive factors for short-term held models

Nonetheless, not all success tales at Grange Residences required a long time of endurance. The venture has additionally seen spectacular positive factors in short-term held models. In 2011, for example, a 2,853-sqft unit was flipped for S$8.1 million (S$2,840 psf), giving its vendor a S$1.7 million revenue after simply two years. That labored out to roughly S$850,000 per yr of holding — a staggering determine by any measure.

This sort of excellent end result, after all, rely closely on timing and market cycles. On this specific case, the vendor entered in 2009 throughout the World Monetary Disaster, when common psf costs for the venture had dipped by 15% in comparison with the earlier yr. By 2011, the market had rebounded, with values at Grange Residences leaping 22% since 2009. Basically, this investor capitalised on a low-entry level throughout a downturn and exited throughout restoration phases.

Remoted circumstances of unprofitable resale over time

Whereas the venture is likely one of the extremely regarded freehold condos within the space, not all sellers have been lucky sufficient to stroll away with income. Although very minimal, there have been a number of transactions over time the place homeowners suffered capital losses.

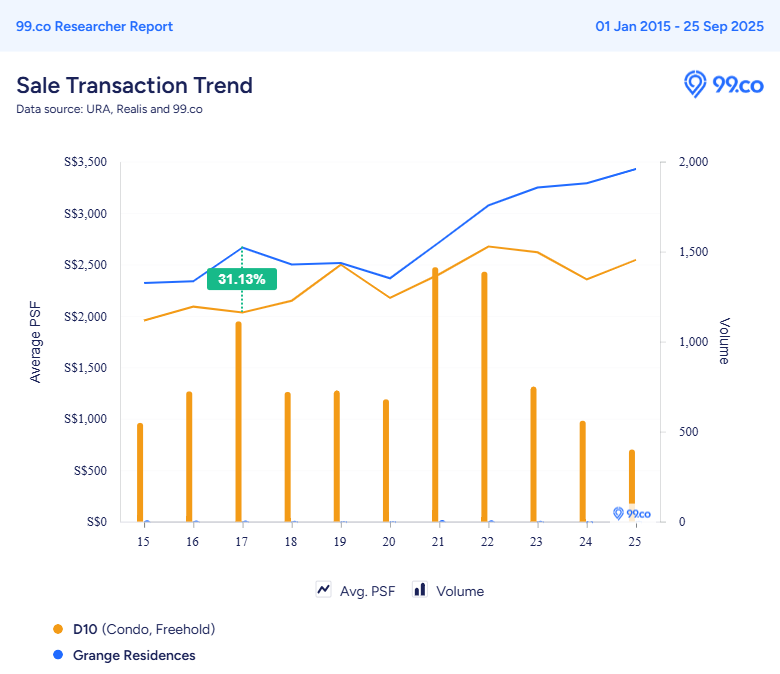

A complete of 12 unprofitable transactions has been recorded all through the venture’s historical past, with losses starting from S$50,000 to S$800,000. Nearly half of those unprofitable gross sales at Grange Residences occurred in 2017, when the general non-public property market had softened, particularly within the luxurious section.

But, what’s hanging is that even at a loss, models right here nonetheless fetched properly above the market common — Grange Residences maintained a worth hole of over 31% towards different freehold condos in District 10 on the time. This underlines the resilience of the venture’s positioning. House owners who bought within the weak market absorbed some losses, however the improvement itself constantly held its premium standing relative to its friends.

Freehold condominium worth development in District 10

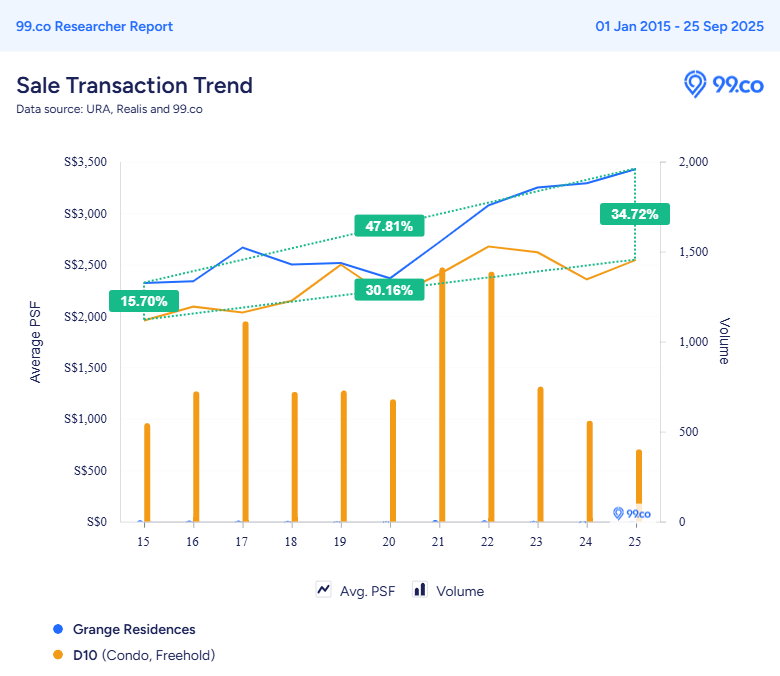

Over the previous decade, freehold condominium costs in District 10 have climbed about 30%. Grange Residences, nonetheless, has surged practically 48% in the identical interval. Again in 2015, the worth hole between Grange Residences and the district common was solely 15.7%. As of September 2025, that hole has greater than doubled to virtually 35%.

This widening premium displays how Grange Residences has positioned itself as a blue-chip property play. House owners who purchased early and held on have reaped multi-million-dollar rewards, with the venture constantly outperforming the broader District 10 market. Even throughout weaker cycles, it has maintained its worth benefit — a sign of each resilience and enduring desirability.

Nonetheless, not each purchaser is chasing record-breaking trophy houses. Whereas buyers proceed to prize Grange Residences for its long-term capital appreciation, real homebuyers may be drawn as an alternative to the extra accessible freehold choices close by.

On 99.co, energetic listings at present begin from S$825,000 for a 1-bedroom unit at RV Edge alongside Shanghai Street. Patrons in search of one thing bigger but nonetheless comparatively inexpensive also can discover choices like a 2-bedroom unit at Robin Residences, at present priced at S$1.48 million. Notably, this asking worth is about 28% under the typical itemizing worth for 2-bedroom condos in District 10 on 99.co

With District 10 freehold condos now averaging S$2,545 psf — nonetheless properly underneath Grange Residences’ S$3,428 psf — there stays a transparent spectrum of alternatives. For some consumers, the enchantment lies in proudly owning a confirmed, high-performing asset like Grange Residences. For others, the draw is securing a main location handle at a extra manageable entry level.

Having fun with this in-depth evaluation? 99.co Condominium Money or Crash covers month-to-month notable transactions in Singapore’s non-public property market.

The publish Grange Street 4-bedder bought for S$10.2M, securing a S$6M revenue appeared first on .