Within the aftermath of wildfires, when households are left sifting by way of ashes and making an attempt to rebuild their lives, the true high quality of an insurance coverage coverage comes sharply into focus. Too usually, we hear from policyholders who thought they have been adequately insured. Then they file a declare and study that their coverage doesn’t absolutely pay for the loss.

They’re shocked to study that what they believed to be complete safety seems to be riddled with limitations, exclusions, and superb print that advantages the insurer way over the insured. This disconnect is a direct results of the widespread false impression that every one insurance coverage is identical, a commodity differentiated solely by worth. That perception is just not solely unsuitable; it’s harmful.

There’s a motive why some insurance coverage insurance policies price much less. It’s not as a result of the insurer has discovered a magical manner to offer the identical advantages extra effectively. It’s as a result of they’re providing much less protection, much less flexibility, much less assist, and infrequently much less of an ethical dedication to face by the policyholder when catastrophe strikes. The distinction is just not all the time seen in a quote comparability, nevertheless it turns into painfully clear when a declare is filed and denied or underpaid based mostly on narrowly worded endorsements or hidden exclusions.

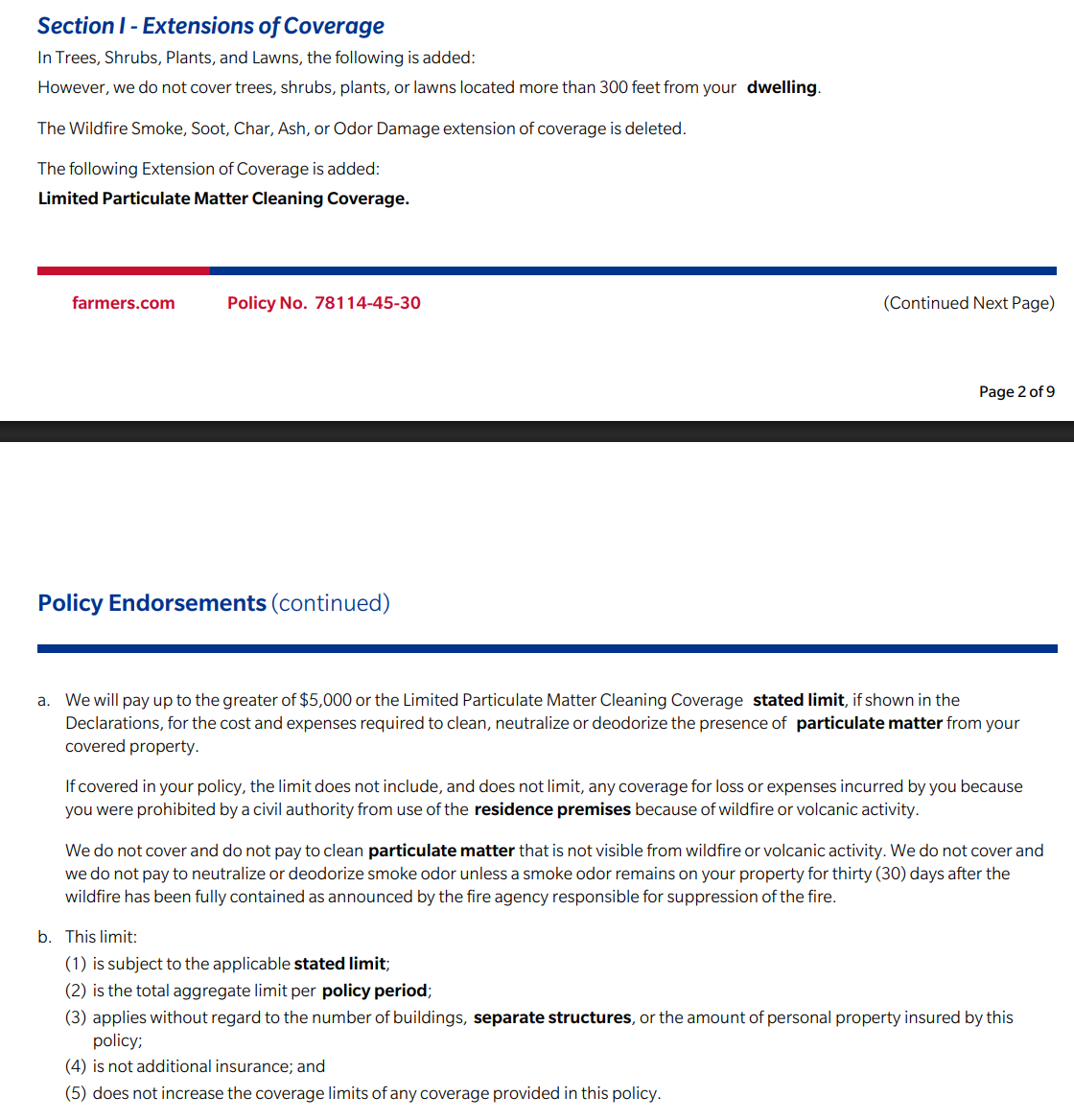

I’ve beforehand written concerning the flaws in Farmers Good Plan insurance coverage and its alarming contribution to the rising safety hole in property insurance coverage in “The Safety Hole in Property Insurance coverage—Why No person Ought to Purchase Farmers Good Plan Insurance coverage.” Sadly, current coverage endorsements, such because the so-called Restricted Particulate Matter Cleansing Protection, underscore simply how deeply this downside runs. These endorsements usually seem benign and even helpful at first look, however in actuality, they substitute broader protections with extra restrictive phrases. In some instances, they restrict protection to such a level that the coverage provides little actual assist after a wildfire. As an example, when protection for wildfire smoke, ash, and soot harm is capped, topic to visibility necessities, and even excluded totally except odors persist for 30 days, the promise of economic restoration turns into an phantasm.

Shopping for insurance coverage ought to by no means be a race to the underside. The stakes are too excessive. A house is usually the biggest asset an individual owns, and insurance coverage is meant to be the security web that protects it. When that security web is constructed with cut-rate supplies, it fails exactly when it’s wanted most. Customers deserve higher than to be bought stripped-down insurance policies disguised as sensible financial savings. They deserve honesty, readability, and protection that may stand the take a look at of catastrophe.

The reality is, not all insurance coverage firms write insurance policies with the identical intention. Some design insurance policies to guard policyholders. Others design insurance policies to guard income. When purchasing for insurance coverage, the query ought to by no means be “What’s the most cost effective choice?” however “Who will likely be there for me when it issues most?” The reply usually lies not within the premium, however within the ideas behind the coverage. And relating to firms like Farmers, the warning indicators are too many to disregard.

Insurance coverage regulators must be conscious that small wording adjustments considerably change advantages below the coverage. They need to bear in mind that adjustments such because the one Farmers has made will cut back the quantity of protection policyholders have obtained for fireplace losses for over 100 years. But, these endorsements and adjustments proceed to be permitted as a result of insurers don’t absolutely clarify the change and its full impression on the endorsement. Insurers like Farmers achieve a market benefit by offering much less protection and increasing safety gaps. This must be addressed.

Thought For The Day

“Be a yardstick of high quality. Some folks aren’t used to an atmosphere the place excellence is predicted.”

Steve Jobs