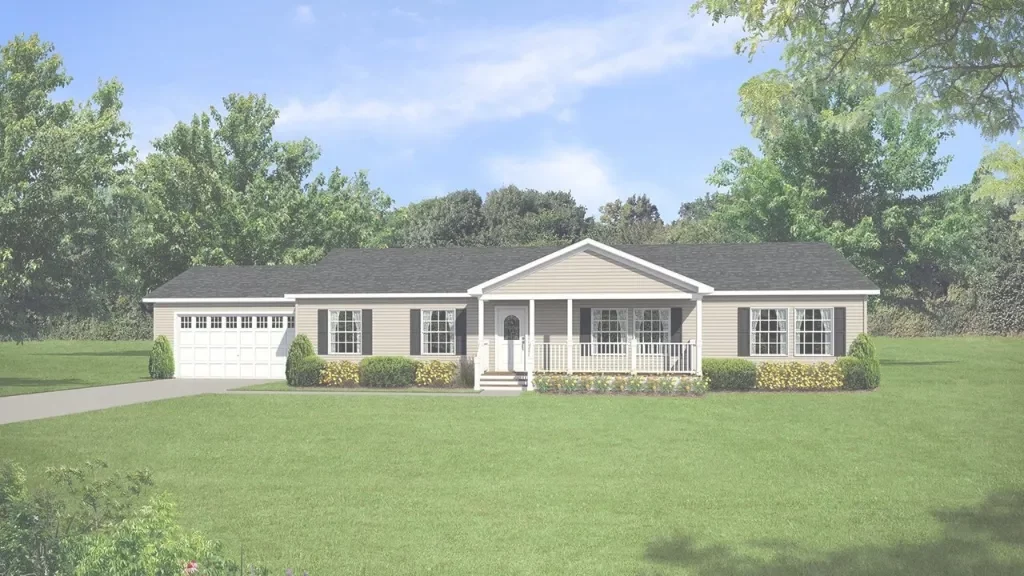

With more than 355,000 occupied mobile homes, South Carolina makes up for more than 20% of the state’s housing units. They also comprise more per capita mobile homes than other states. It’s always a great idea to get insurance to protect your investment. Mobile homes are no exception. Insurance covers your mobile home, personal property and liability claims. While you’re not legally inclined to get mobile home insurance, getting it is a good idea.

This post explores what mobile home insurance covers and whether you should invest in it.

Let’s dive in.

Do You Need Insurance For Your Mobile Home?

While getting insurance for your mobile home is not legally required, it is worth considering. If you’re planning to get a mortgage on your mobile home, you should at least look at mobile home insurance.

Considering that a mobile home averages around $83,000 it’s a good idea to take steps to protect your belongings and home. While it can seem costly, not having it puts you at a bigger risk of potential financial loss.

How Much Does Mobile Home Insurance Cost?

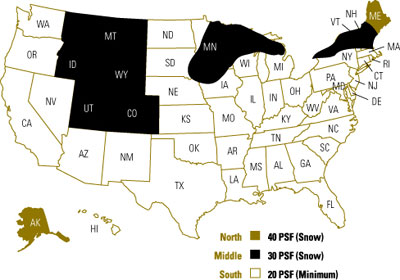

Usually, the average insurance cost is around $100 a month for a $50,000 policy. Making it $1,200 per year. But this depends on the mobile home’s value, where you live, and the age of the house.

Apart from the home’s features, the insurance cost will also depend on coverage limits and deductibles you opt for. Generally, more extensive coverage and lower deductibles will lead to a higher premium, while more basic coverage and higher deductibles will result in a lower premium.

The best way to get a great deal on mobile home insurance is through quotes which you can find online. But if you’re having a hard time with insurance quotes online, you can contact an independent agent in your area.

What Does Mobile Home Insurance Cover?

Mobile home insurance offers similar coverages that traditional homes offer. And you can also customize your policy by adjusting the coverage limits. Usually, mobile home coverage includes:

Physical Damage

This covers any accidental damage to your house, belongings, and other structures, like an outbuilding or an attached deck, caused by events like theft, fire, hail, vandalism, wind, or falling objects. But the coverage varies depending on the policies and the insurance provider.

Something to keep in mind is that regular homeowner insurance doesn’t cover flooding. If you live in a high-risk zone for natural disasters like earthquakes, wildfires, and floods, you must consider adding coverage.

Personal Property

Mobil home insurance also protects personal belongings if they’re stolen or damaged. While you will be covered for your stolen or damaged property, you must pay a deductible to make a claim.

Personal Liability

This insurance covers you if someone is hurt while on your property. For instance, if your neighbor gets hit by a falling tree branch on your property, he could hold you liable and sue you. But with this coverage, your insurance company will pay for all legal defense fees and damages if you’re found liable. The insurance company will provide any financial protection up to your coverage limit.

Other Structures:

Mobile home insurance typically includes coverage for structures not permanently attached to the home, such as a tool shed or a garage.

Living Expense

If you can’t live in your home because of a covered loss, this insurance offers you reimbursement for extra costs when living somewhere else. For example, if your mobile home catches fire, the insurance company will cover your hotel bills.

To Wrap It Up

Mobile homes are a great affordable alternative to traditional homes. Although getting insurance will increase your expenses, it’s an investment worth making. It’ll protect you from sudden accidents. The amount you’ll pay will pale compared to what you’d have to pay if you didn’t have an insurance plan.