Key takeaways

Capitals again on prime: After a nine-month run of regional dominance, capital metropolis house values have overtaken regional development, rising 1.8% over the quarter in comparison with 1.7% within the areas – a shift pushed by stronger sensitivity to rate of interest cuts.

Regional rents nonetheless rising: Regardless of the swing in worth development, regional rents proceed to outpace the capitals — up 5.6% yearly versus 3.0% in metro areas. Albany (WA) led the cost, including $82 per week to the median lease over the yr.

Lismore’s comeback: Lismore (NSW) leads the highest 50 regional markets with a 4.5% quarterly rise, marking a full restoration from its post-flood downturn and setting a brand new worth peak.

Victoria’s gross sales surge: Regional Victoria is seeing renewed purchaser momentum, reflecting a turnaround in sentiment.

Australia’s capital cities have reclaimed the expansion lead from the areas for the primary time in 9 months, with information from the newest Cotality Regional Market Replace exhibiting metro values are rising at a sooner tempo than their regional counterparts.

Over the three months to July, the Cotality capital metropolis Residence Worth Index rose 1.8%, whereas regional dwelling values elevated by 1.7%.

Whereas these outcomes mark the tip of regional dominance, they don’t seem to be indicative of a downturn within the tempo of regional development.

As an alternative, the shift displays the capital’s stronger sensitivity to adjustments in rates of interest.

All through each the speed tightening and chopping cycles, capital metropolis development charges have been extra aware of rate of interest adjustments, with the tempo of development exhibiting a noticeable leap following each the February and Might cuts.

Since bottoming out at -0.7% in January, the capital’s quarterly development has continued to realize momentum.

The mixed areas’ response to price cuts has been extra measured, with the quarterly development holding comparatively regular round 1.7% since April.

Beneath the regular headline quantity, outcomes have been extra diverse.

Throughout Australia’s largest 50 regional important city areas (SUAs), practically 60% noticed quarterly development traits ease between April and July, whereas the opposite 40% gained momentum.

Regional standouts and slower markets form development panorama

Lismore (NSW) was the standout performer throughout the highest 50 regional markets, rising 4.5% rise over the quarter to a brand new peak in July, making a full restoration from the practically -18% decline recorded amid the 2022 flood restoration and concurrent rate of interest hikes.

The remainder of the highest 5 was a blended bag, with only one useful resource market, Bunbury in Western Australia, made the listing, a major departure from the development seen over the previous few years.

Western Australia and Queensland’s mining markets have dominated worth development rankings over a lot of the previous two years.

Nevertheless, momentum has eased because the relative affordability benefit that these areas as soon as provided dissipates.

Whereas not the highest performers for quarterly development, Albany (23.1%) and Geraldton (20.8%) in WA, and Mackay (18.2%) and Townsville (16.7%) in QLD, nonetheless noticed the strongest annual will increase.

Albany additionally recorded the shortest promoting occasions (12 days) and among the lowest vendor discounting charges (-1.7%).

On the different finish of the dimensions, simply three areas noticed values decline over the yr, with the Bowral – Mittagong area within the central highlands recording the sharpest decline (-2.1%).

The picturesque tree-change market noticed important development all through the early pandemic upswing, nevertheless, that development noticed the area turn out to be the most costly market among the many largest 50 regional SUAs and, behind Byron Bay and Sydney, the third most unaffordable market nationally.

This unaffordable price ticket, coupled with normalised itemizing ranges and beneath common gross sales, has put downward strain on values.”

The Bowral – Mittagong area additionally recorded among the weakest promoting circumstances, with properties sitting available on the market for round 79 days and distributors providing a median low cost of 5.3% with the intention to safe a sale.

Gross sales momentum builds throughout Victorian areas

Regional gross sales exercise has steadily improved over the yr to Might, with annual gross sales rising in 36 of the highest 50 SUAs.

Victoria claimed the highest seven rungs on the scoreboard with gross sales counts in Shepparton – Mooroopna, Ballarat, and Bendigo leaping up 32.7%, 29.8%, and 26.4%.

Gross sales volumes throughout Melbourne and Regional Victoria have been considerably muted lately as a result of much less beneficial taxation, demographic and provide adjustments.

Though rising from a low base, the uptick in annual gross sales exercise displays a turnaround in sentiment, with affordability benefits and capital beneficial properties prospects, reigniting purchaser curiosity.

Lismore noticed the alternative phenomenon, recording the steepest fall in annual gross sales exercise, with counts declining from the earlier yr’s elevated ranges.

Whereas down virtually 35% from final yr’s post-flood restoration surge, Lismore’s transaction counts over the 12 months to Might are down simply -5.3% from the earlier five-year common.

Regional rents nonetheless outpacing the capitals

Whereas worth development has swung again in the direction of the capitals, lease will increase stay stronger within the areas.

Regional rents rose 1.1% over the three months to July and 5.6% over the yr, in contrast with 0.9% and three.0% lifts in capital metropolis rents.

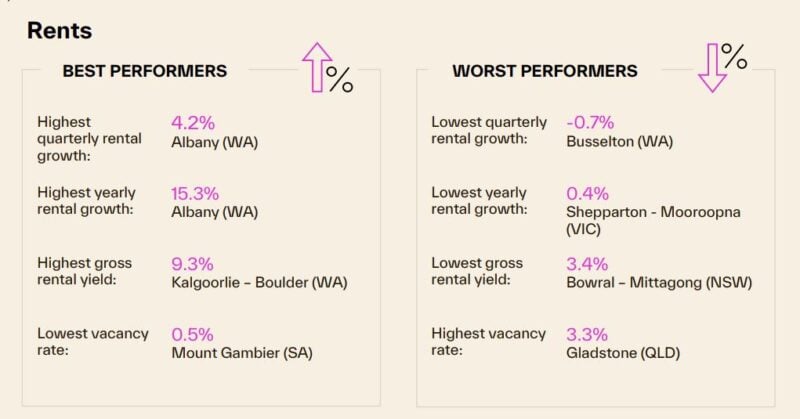

Albany (WA) was once more a standout, with rents up 4.2% within the quarter and 15.3% over the yr, including an extra $82 per week to the median rental worth over the yr.

Stable quarterly rises have been additionally recorded in Goulburn (NSW), Victor Harbour–Goolwa (SA), Mount Gambier (SA), and Devonport (TAS) with lease will increase starting from 2.6% to three.3%.

Regardless of a handful of markets posting gentle quarterly declines, all 50 regional SUAs noticed rents rise over the yr.

Tight emptiness charges proceed to underpin rental development.

Regardless of worsening affordability, elevated regional migration and below-average rental provide are putting sturdy upwards strain on rents.

As of July, simply two markets, the Mildura – Buronga area on the NSW/QLD border, and the Nowra – Bomaderry market in NSW’s Shoalhaven area, have seen emptiness charges rise above their pre-covid decade common.

Key Insights – August 2025 Regional Market Replace

- Regional dwelling values rose 7% over the quarter, falling behind the capital cities’ 1.8% rise.

- Throughout the nation’s largest 50 regional markets, Lismore recorded the strongest quarterly development with values rising 5%, whereas Forster – Tuncurry was the weakest, with values falling -1.5%.

- Albany, Geraldton, Mackay and Townsville remained the strongest annual performers, none though none of those markets featured within the prime 5 for quarterly development.

- Bowral – Mittagong recorded the steepest annual decline in values, down -2.1%, together with the weakest promoting circumstances.

- Victoria led the area for annual gross sales exercise, with Shepparton – Mooroopna, Ballarat, Bendigo and the Mildura – Buronga area all posting annual transaction development above 25%.

- Regional rents rose 1% over the quarter and 5.6% yearly, persevering with to outpace capital metropolis lease development of 0.9% and three.0% respectively.

- Simply three markets recorded a gentle decline in rents over the quarter, Busselton ( – 0.7%), Launceston (-0.6%) and (-0.4%).

- All 50 markets noticed rents rise over the yr. Albany noticed the strongest annual rental development, up 3% or $82 per week, whereas the Shepparton – Mooroopna area noticed the weakest (0.4%).

- Kalgoorlie-Boulder continued to document the very best gross rental yields at (9.3%), whereas yields throughout Bowral – Mittagong remined the bottom (3.4%).