Singapore’s property market held regular within the second quarter of 2025, with costs persevering with to rise modestly regardless of a noticeable drop in transaction volumes. Patrons appeared extra selective, and builders launched fewer new tasks throughout the quarter – partly on account of faculty holidays and the lead-up to the overall elections.

Even so, the market wasn’t with out motion. Right here’s a better take a look at the second quarter actual property efficiency and what it may sign for the months forward.

Desk of contents

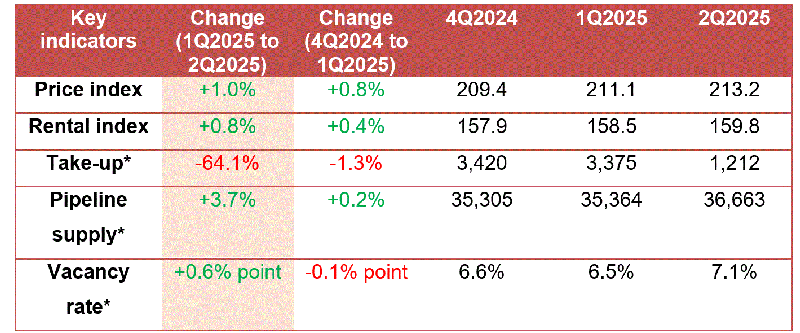

Headline figures and market overview

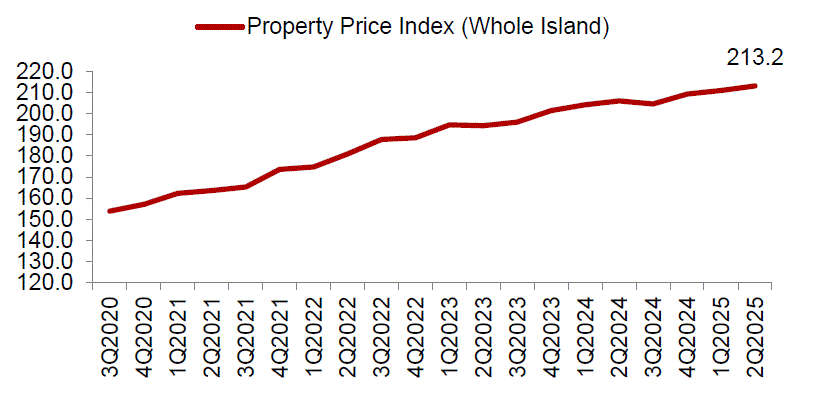

The Personal Residential Worth Index rose by 1.0%, barely greater than the 0.8% improve in Q1, although nonetheless decrease than the two.3% progress seen in This fall 2024. In the meantime, rental costs picked up, with the Residential Rental Index rising by 0.8%, doubling Q1’s progress.

Round 3,000 non-public residential models, together with Government Condominiums (ECs), have been accomplished within the first half of the yr. Wanting forward, you possibly can count on about 57,000 extra models to be accomplished within the coming years. The Authorities Land Gross sales (GLS) Confirmed Listing for 2025 presents round 10,000 models, a 50% improve in comparison with the 2021–2023 common. The federal government is continuous to watch provide and demand intently, guaranteeing there’s sufficient housing and workplace house to satisfy future wants.

Economically, GDP progress is anticipated to decelerate. On the identical time, indicators of weaker job demand have began to indicate. Because of this, households like yours are being inspired to stay cautious when shopping for property or taking over new mortgages.

In response to Marcus Chu, Chief Government Officer (CEO) of ERA Singapore, the numerous dip in transactions this quarter stemmed primarily from fewer launches and seasonal elements similar to faculty holidays and the election interval. Nevertheless, robust demand from native consumers and restricted completions stored costs regular.

Personal residential properties

Costs

In relation to the non-public property second quarter efficiency 2025, costs rose total by 1.0%. Landed houses noticed a robust 2.2% improve, pushed by a wave of Good Class Bungalow (GCB) gross sales. The truth is, 11 GCB offers price greater than S$300 million have been closed, in comparison with simply two in Q1.

For non-landed houses, costs went up by 0.7%. Throughout the Core Central Area (CCR), there was a 3.0% bounce. This was due to high-end undertaking launches similar to 21 Anderson, the place 5 models offered for a median of S$4,811 psf, and Skywaters Residences, which noticed a unit go for S$5,841 psf. July launches additionally carried out effectively, with UPPERHOUSE at Orchard Boulevard and The Robertson Opus displaying robust purchaser curiosity. Notably, native consumers continued to dominate the CCR market, even with decrease international participation.

Mr. Wong Xian Yang, Head of Analysis, Singapore & SEA at Cushman & Wakefield noticed that the CCR phase could also be gaining momentum once more after years of sluggish progress, with its worth hole over different areas narrowing considerably over the previous decade.

In distinction, the Remainder of Central Area (RCR) noticed costs dip by 1.1%, regardless of new launches like Amber Home, Arina East Residences, Bloomsbury Residences, and One Marina Gardens. Nonetheless, sure tasks carried out effectively. One Marina Gardens offered 479 models at a median of S$2,950 psf, whereas Bloomsbury Residences and The Hill @ one-north noticed median costs round S$2,470 to S$2,490 psf. Builders adjusted costs to remain aggressive, which may result in new benchmarks, particularly in fringe CCR-RCR areas.

The Outdoors Central Area (OCR) skilled a 1.1% worth improve, pushed principally by resale demand, since there have been no new launches within the quarter.

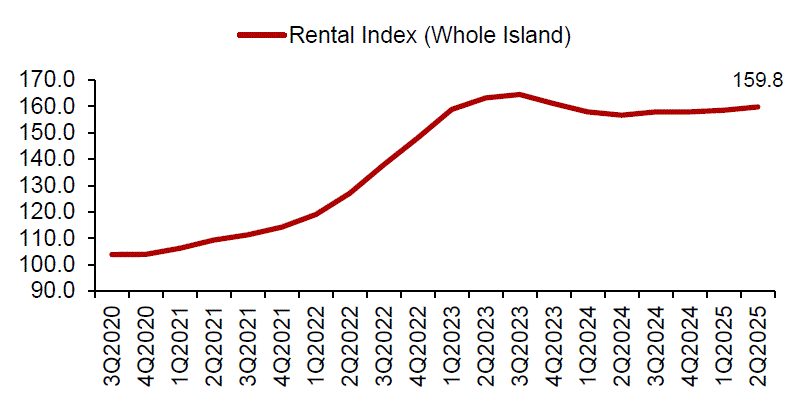

Leases

Leases continued to rise, displaying a 0.8% improve total. Non-landed leases additionally rose by 0.8%. The CCR led the cost with a 1.8% improve, whereas RCR leases remained flat. OCR leases edged up simply 0.1%. For landed houses, rents rose by 0.7%, greater than the 0.3% acquire in Q1.

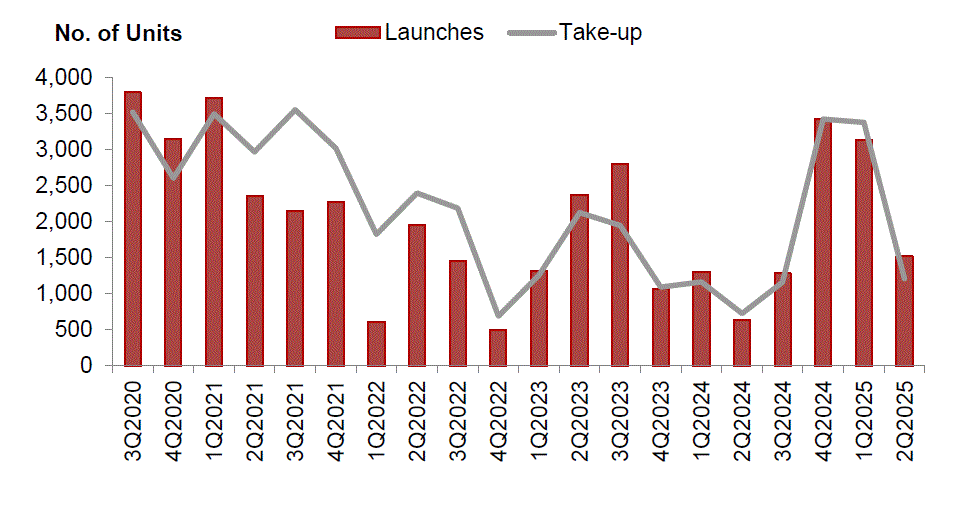

Launches and take-up charges

New launch second quarter efficiency 2025 noticed fewer actions. Builders launched simply 1,520 models, excluding ECs, in comparison with 3,139 within the first quarter. Gross sales adopted the identical development, dropping to 1,212 models from 3,375. No new ECs have been launched in Q2, and solely 149 models have been offered, down from 830 in Q1.

Marcus Chu famous that purchaser momentum is anticipated to return in Q3 with 10 new launches lined up, probably releasing 4,500 models.

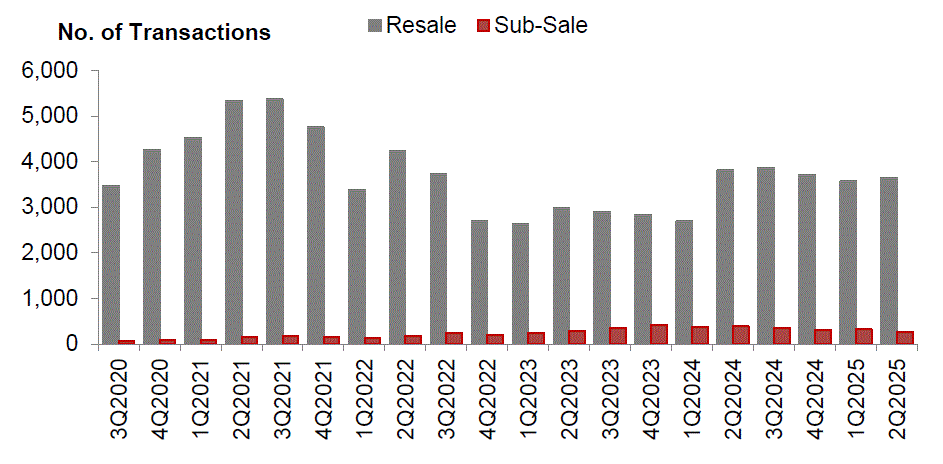

Resale and subsale exercise

Resales performed an even bigger position this quarter. With 3,647 resale transactions accomplished, they made up 71.1% of all gross sales, up from 49.1% in Q1. The subsale second quarter efficiency 2025 confirmed a decline in exercise. Solely 269 subsale transactions have been recorded, in comparison with 321 in Q1. Nevertheless, subsales fashioned a barely greater share of whole gross sales at 5.2%, as total transactions fell.

Mr. Wong Xian Yang noticed that resales have grow to be extra interesting to consumers on account of their worth proposition, particularly with rising rents and rates of interest.

Provide completions and pipeline

In Q2, about 980 models have been accomplished, bringing the H1 whole to 2,968 models. For the remainder of 2025 and past, the pipeline stays robust. The GLS Confirmed Listing for 2025 options 9,755 models. Latest bids, similar to S$1,410 psf ppr for Dunearn Highway and S$1,132 psf ppr for Lakeside Drive, counsel that builders are feeling extra assured.

You’ll discover over 41,000 models within the pipeline, together with ECs, with about 20,000 nonetheless unsold. Over the following 1 to 2 years, round 35,500 models may very well be accomplished. For the years 2025–2027, about 22,700 models are anticipated, and one other 34,300 might come after 2028.

Nonetheless, builders are anticipated to remain cautious with land acquisitions on account of tight margins and development prices, famous Mr. Wong Xian Yang.

Inventory and emptiness developments

The variety of accomplished non-public houses rose by 273 models in Q2. Nevertheless, occupied models dropped by 2,585, pushing the emptiness price as much as 7.1%. The CCR had the very best emptiness at 10.7%, adopted by the RCR at 7.2% and the OCR at 5.6%.

Workplace house second quarter efficiency 2025

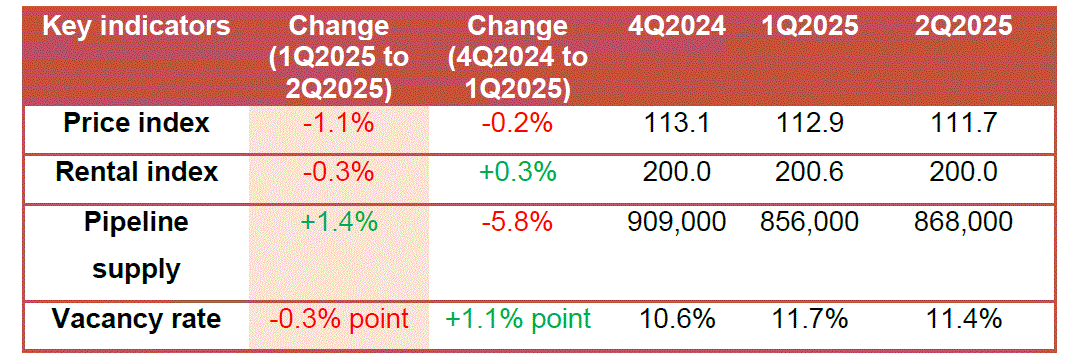

The workplace house second quarter efficiency 2025 mirrored a small dip in each costs and rents. Costs dropped by 1.1%, whereas leases edged down by 0.3%. The workplace provide pipeline grew barely to 868,000 sqm GFA. In the meantime, occupied house elevated by 9,000 sqm, at the same time as whole inventory fell. This introduced emptiness right down to 11.4%, from 11.7% in Q1.

In response to Mr. Wong Xian Yang, landlords of older buildings at the moment are extra versatile with lease phrases, and relocation exercise stays low as companies attempt to scale back capital spending. Nevertheless, prime workplace demand stays secure with restricted new provide forward.

Retail market replace

Retail house confirmed delicate enhancements. Costs rose by 0.1%, and leases picked up by 0.9%, recovering from a 0.5% dip in Q1. Provide within the pipeline additionally elevated marginally. Nonetheless, occupied house shrank by 16,000 sqm, elevating the emptiness price to 7.1%.

Mr. Wong Xian Yang additionally famous continued resilience in suburban retail, with life-style and F&B manufacturers increasing. Prime mall models are nonetheless attracting robust leasing demand, regardless of broader working challenges.

Ultimate ideas

All in all, the second quarter actual property efficiency paints a combined but regular image. In the event you’re planning your subsequent transfer, it’s clear that understanding developments by phase – whether or not it’s non-public property, workplace, or retail – is extra vital than ever. With worth adjustments, shifting purchaser calls for, and new launches on the horizon, protecting knowledgeable places you a step forward.

The put up Personal house costs up 1% in Q2 2025 as CCR leads progress appeared first on .