Key takeaways

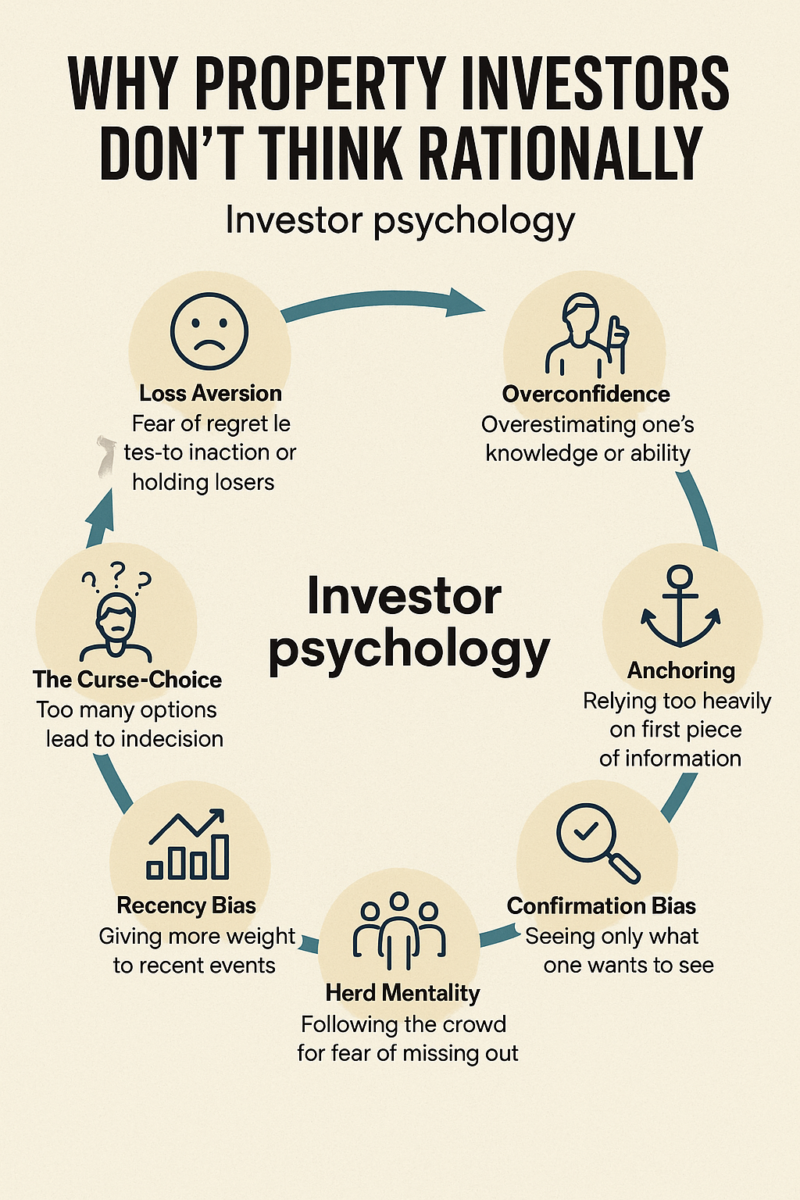

Most buyers usually are not rational — their choices are pushed by concern, emotion, and unconscious biases.

Emotion clouds judgment — and in property, the place the stakes are excessive, that may be particularly harmful.

Profitable property investing is as a lot about mindset as it’s about cash — self-awareness offers you an edge.

Impartial, skilled recommendation may also help override emotional reactions and convey readability in unsure markets.

Let me begin with a blunt fact: most property buyers assume they’re rational — however they’re not.

They imagine they’re making strategic choices primarily based on analysis, market fundamentals, and chilly, laborious information.

However the actuality?

Their choices are sometimes pushed by concern, greed, overconfidence, and a cocktail of unconscious biases they don’t even realise are at play.

This isn’t a criticism — it’s simply human nature.

You see… we’re all wired with behavioural biases that made sense within the caveman period however can significantly journey us up within the complicated world of investing.

And in property — the place feelings run excessive, stakes are large, and knowledge is usually noisy or contradictory — these biases change into much more harmful.

So let’s unpack the foremost behavioural traps that sabotage property buyers (sure, even the good ones), and speak about keep away from them.

1. Loss Aversion — The Worry of Remorse

One of the vital highly effective biases we feature is loss aversion — we really feel the ache of a loss excess of we really feel the pleasure of an equal acquire.

This explains why so many property buyers hesitate to promote a dud property — they don’t wish to “lock in” the loss.

They’ll say issues like, “I’ll wait till it rebounds,” or “It’s solely a paper loss,” or “I am not out pf pocket a lot.”

In the meantime, it drags down their portfolio’s efficiency.

It additionally causes individuals to keep away from entering into the market within the first place.

Worry of shopping for the mistaken property, or concern of the market dipping after they purchase, paralyses them.

The repair? Perceive that not each choice shall be good.

However avoiding motion altogether is usually extra expensive in the long term.

2. Overconfidence — Considering You are Smarter Than the Market

Ever met somebody who purchased one property throughout a increase and now thinks they’re a property guru?

That’s overconfidence bias at work.

It’s the tendency to overestimate our information, expertise, or foresight.

In property, this results in harmful behaviours — like pondering you don’t want professional recommendation, ignoring fundamentals, or betting large on speculative areas as a result of “you realize it’ll increase”.

The answer? Humility.

Even after 50 years within the sport, I’m nonetheless studying.

Property investing is easy, however not straightforward. At all times search information, problem your assumptions, and lean on unbiased skilled funding advisors like our workforce at Metropole.

3. Anchoring — Sticking to the Fallacious Reference Level

Anchoring occurs once we latch onto a selected piece of data and use it as a reference — even when it’s irrelevant.

For instance:

“That property was listed for $900K, so something much less have to be a cut price.”

“I paid $1 million in Sydney, so this $800K home in Brisbane have to be low-cost.”

“My neighbour acquired $1,200 per week lease — I ought to too!”

However in property, each suburb, road, and residential is exclusive.

Anchoring to the mistaken benchmark can result in poor funding choices or unrealistic expectations.

The antidote? Base your choices on a property’s intrinsic worth, development drivers, and market dynamics — not arbitrary worth tags.

4. Affirmation Bias — Seeing Solely What You Need to See

Affirmation bias is the tendency to seek for, interpret, and keep in mind data in a manner that confirms our current beliefs.

It’s why somebody who believes “now’s a horrible time to purchase” will solely learn doom-and-gloom headlines… and ignore each signal of market restoration.

Or why somebody who loves a specific suburb will quote each stat that helps their view — whereas conveniently ignoring the world’s oversupply or demographic challenges.

The repair? Encompass your self with individuals who problem your pondering.

At Metropole, we encourage our shoppers to stress-test their concepts with information and opposing views. It retains you grounded.

5. The Herd Intuition — FOMO in Motion

People are social creatures. We assume if everyone seems to be doing one thing, it have to be proper.

So when media headlines scream “property costs are booming!” buyers rush in — typically paying an excessive amount of or shopping for in areas already peaking.

Throughout downturns, the alternative occurs — individuals maintain again as a result of “nobody’s shopping for proper now.”

However that’s typically when the most effective alternatives exist.

Sensible buyers go towards the herd. They’re calm when others panic, and cautious when others get grasping.

As Warren Buffett put it: “Be fearful when others are grasping and grasping when others are fearful.”

6. Hindsight Bias — Considering You “Knew It All Alongside”

After a property market cycle performs out, individuals typically say, “It was apparent costs have been going to rise in that suburb” — even when they took no motion on the time.

Hindsight bias distorts your reminiscence and makes you overestimate your predictive powers.

This results in overconfidence within the subsequent cycle.

It additionally fuels pointless remorse: “I ought to have purchased again then… I missed the boat.”

However guess what? There’s at all times one other alternative — if you realize what to search for.

7. Recency Bias — Assuming the Future Will Be Just like the Latest Previous

If the market’s been rising, we are likely to imagine it would hold rising.

If it’s falling, we assume the worst remains to be to return.

This is the reason property booms typically overshoot (fuelled by irrational exuberance), and downturns last more than they need to (as a result of everybody is just too scared to purchase).

Recency bias causes individuals to extrapolate short-term tendencies indefinitely — a harmful mistake in a cyclical market like actual property.

Answer? Zoom out.

Take a look at the long-term fundamentals: inhabitants development, provide constraints, affordability tendencies, infrastructure funding. These matter excess of short-term blips.

8. The Curse of Alternative — Paralysis by Evaluation

With so many funding choices, suburbs, property varieties, and techniques, many buyers change into overwhelmed — and find yourself doing… nothing.

That is what behavioural economists name “alternative paralysis”. It feels safer to remain on the sidelines than threat getting it mistaken.

However keep in mind: not making a choice is a choice — and infrequently the most costly one.

That’s why we imagine in having a documented Strategic Property Plan.

It simplifies decision-making by clarifying your objectives, timelines, threat profile, and motion steps. No extra guesswork.

Observe: Attaining wealth doesn’t simply occur, it’s the results of a nicely executed plan. Planning is bringing the longer term into the current so you are able to do one thing about it now!

Learn how to Beat These Biases and Make investments Smarter

Understanding these biases is step one. However what are you able to do about them?

Right here’s what I like to recommend:

1. Have a Plan

A transparent, long-term technique — not reactive choices primarily based on emotion or headlines — is the important thing to sustainable wealth by property.

2. Use Impartial, Trusted Advisors

At Metropole, we act as an exterior “mind” for our shoppers — giving them the unemotional perspective they typically can’t give themselves.

3. Don’t Attempt to Time the Market

Even professionals wrestle with market timing. Give attention to “time in the market” with high quality belongings in investment-grade places.

4. Embrace Schooling, however Keep away from Info Overload

There’s by no means been extra property content material on-line — however a lot of it’s noise. Persist with respected sources (like the numerous consultants right here on Property Replace) and keep away from leaping from one technique to a different.

5. Replicate, Evaluate, Repeat

Profitable buyers don’t simply “set and neglect”.

They overview their portfolios, replace their plans, and mirror on their decision-making patterns.

Remaining Ideas

Property funding is not only about numbers, rates of interest, or emptiness charges.

It’s about you, your mindset, your beliefs, your skill to remain calm, rational, and centered when others are panicking or partying.

For those who can perceive your individual psychological tendencies — and put the best techniques, methods, and help in place to override them — you’ll be manner forward of the common investor.

As a result of the reality is, the largest risk to your monetary future isn’t the market… It’s the way you react to it.

For those who’re like many property buyers, you are most likely questioning what’s the best factor to do at current.

Do you have to purchase, do you have to promote, or do you have to simply wait?

You’ll be able to belief the workforce at Metropole to offer you route, steering, and outcomes.

Whether or not you’re a newbie or an skilled investor, at instances like we’re at the moment experiencing you want an advisor who takes a holistic strategy to your wealth creation and that’s precisely what you get from the multi-award-winning workforce at Metropole.

We assist our shoppers develop, shield and move on their wealth by a spread of providers together with:

- Strategic property recommendation – Permit us to construct a Strategic Property Plan for you and your loved ones. Planning is bringing the longer term into the current so you are able to do one thing about it now! Click on right here to be taught extra

- Purchaser’s company – As Australia’s most trusted consumers’ brokers we’ve been concerned in over $4Billion price of transactions creating wealth for our shoppers and we will do the identical for you. Our on the bottom groups in Melbourne, Sydney, and Brisbane carry you years of expertise and perspective – that’s one thing cash simply can’t purchase. We’ll aid you discover your subsequent house or an investment-grade property. Click on right here to find out how we may also help you.

- Property Improvement – We allow you to change into an “armchair developer” and get all the advantages of property improvement with out getting your palms soiled. We take the hassles out of your funding by helping you with all of the experience you want, from idea to completion, together with building. Click on right here to see if it’s the best manner so that you can develop your portfolio.

- Wealth Advisory – We will offer you strategic tailor-made monetary planning and wealth recommendation. Click on right here to be taught extra about we may also help you.

- Property Administration – Our stress-free property administration providers aid you maximise your property returns. Click on right here to seek out out why our shoppers take pleasure in a emptiness fee significantly beneath the market common, our tenants keep a mean of three years, and our properties lease 10 days quicker than the market common.