The Vendor’s Stamp Obligation (SSD) was first launched in 1996 to curb rampant short-term funding exercise in Singapore’s personal housing market. The framework has seen a number of modifications through the years; together with a rollback and a reintroduction in 2010. The 2025 revision, nonetheless, marks probably the most substantial tightening of SSD guidelines since 2017.

Now we have already captured the impression of the coverage change on new launches and the tertiary sub-sale market. On this deep dive, we study intimately what led to the SSD hike, the place the sub-sale market has grown disproportionately, and the way this newest replace hopes to reset purchaser behaviour.

Desk of contents

The anatomy of a sub-sale: The place, when, and the way

Earlier than diving into the causes behind the rise of sub-sales, it’s vital to know what defines a sub-sale and the way it differs from a resale.

A sub-sale refers back to the transaction of a non-public residential unit earlier than it obtains its Momentary Occupation Allow (TOP). In distinction, a resale happens after TOP, as soon as the property is accomplished and issued its official occupancy standing. The classification is dependent upon development standing of a given mission: If the unit remains to be underneath growth, the sale is logged as a sub-sale.

Sub-sales usually happen when a purchaser who initially bought a unit instantly from the developer decides to promote it to a different purchaser earlier than taking possession. The incoming purchaser inherits the unique Sale and Buy Settlement (S&PA) phrases, however the developer should now challenge a recent S&PA to this new social gathering.

In distinction, resale transactions contain accomplished models, usually a number of years post-TOP, and are dealt with instantly between the vendor and purchaser, with out the developer’s reissuance of contracts.

Okay, this sounds completely regular. Why is that this a difficulty, once more?

Sub-sales, at a look, are simply one other type of property transaction. You might even body it as savvy investing or portfolio reshuffling. The problem lies not within the act of sub-selling itself, however available in the market psychology it fuels.

Let’s say you’ve a apartment in a brand new launch mission which you wish to promote sooner or later. You see that somebody simply offered a unit in the identical mission for S$1.6 million, earlier than the unit was even accomplished!

Immediately, each different vendor in that space, together with you, begins to assume that their unit also needs to fetch the same worth, or increased. Costs begin to rise not due to actual demand, however due to an expectation of revenue.

And let’s be actual, sub-sales can herald actually good earnings

That’s as a result of sub-sellers usually purchase models at early-bird launch costs, when builders are nonetheless making an attempt to fulfill minimal gross sales quotas. These models usually include early reductions or incentives. If the mission sells out shortly or sentiment improves earlier than the TOP, sub-sellers can promote their models at a premium, with out ever dwelling in them or paying a lot in holding prices.

Let me placed on my realtor hat and show you how to with the mathematics.

Think about Mr. X picked up an OCR apartment unit at S$1.5 million in 2020 throughout a brand new launch, and offered it in 2023 earlier than the mission completes for S$1.8 million. There could be no mortgage to pay, because of the progressive cost scheme. And no ABSD, as that is Mr. X’s first buy. Even after factoring in Vendor’s Stamp Obligation at 4% (as per the previous 2017-2025 charges), authorized charges, agent fee, and different expenditures, that’s nonetheless a possible internet achieve of about S$250,000 in three years.

And this isn’t hypothetical.

Based on experiences, the typical revenue made on sub-sales in 2024 was round S$270,000. Some standout sub-sales embrace:

- A unit at Boulevard 88, bought in March 2019 and sub-sold in April 2023, which yielded a whopping S$3.9 million in good points

- A unit at Marina One Residences, offered for over S$2 million in revenue inside a couple of years of launch

However after all, not all sub-sales finish with champagne. In 2024, 17 sub-sale transactions had been unprofitable, with common losses of round S$90,000. A number of the extra painful examples embrace a S$297,600 loss at Riviere, and a S$132,000 loss at Sky Everton.

Apparently, 8 out of these 17 loss-making sub-sale occurred earlier than the SSD interval had expired, indicating that sellers had been probably underneath monetary stress and couldn’t wait out the minimal holding interval.

So are sub-sales a priority solely once they trigger losses?

Information reveals that 80–90% of householders maintain their property past 4 years. And sub-sales are lower than 10% of total transactions in most years. So, on the face of it, there actually shouldn’t be an issue.

Right here’s the factor although: sub-sales aren’t simply dangerous when somebody loses cash. The actual downside is once they have an effect on the remainder of the market. In economics, this can be a well-documented impact known as a “worth signalling distortion”, the place a small set of transactions disproportionately influences the broader market’s behaviour.

Sub-sale buyers are inclined to cluster in new, high-visibility tasks, which have a certain potential for appreciation. When these new models are offered at sharply increased costs earlier than accomplished, it raises the perceived market worth of the mission.

These super-high ‘benchmark’ costs aren’t based mostly on what folks can really afford or how a lot lease these properties would herald. It’s principally pushed by the optimistic investor’s notion that costs will simply maintain climbing.

So whereas most householders aren’t promoting early; the small group that does, nonetheless finally ends up steering the course of the market. And that’s the actual challenge.

So long as issues keep secure—low rates of interest, regular demand, few restrictions—this behaviour would possibly maintain the market buoyant. However the second one thing shifts—say, an rate of interest hike or a brand new tax—purchaser sentiment can flip shortly.

House owners who purchased on the peak, hoping to money out quick, would possibly discover themselves holding a property that’s price lower than what they paid for it. What was meant to be a fast revenue turns into unfavorable fairness.

And it doesn’t cease there. A pointy worth correction can hit not simply particular person homeowners, but additionally banks, builders, and purchaser confidence throughout the board; dragging the remainder of the economic system down with it.

Has Singapore ever gone by means of this bubble earlier than?

Sure!

One of the memorable market bubbles was within the mid-Nineteen Nineties, when sub-sales had been rampant. From 1986 to 1996, Singapore’s personal residential property index surged by roughly 440%, with roughly two-thirds of that development concentrated within the early Nineteen Nineties. In 1996 alone, almost 1 in 5 transactions was a sub-sale, prompting the federal government to introduce the primary model of Vendor’s Stamp Obligation (SSD). So rampant was the property mania that there was once midnight queues exterior new launches, and each espresso store proprietor was moonlighting as a property analyst.

One other spike got here throughout 2009 to 2013, after the World Monetary Disaster. Buoyed by low rates of interest and liquidity, buyers flooded again into the market. Sub-sale exercise surged once more, making up 13% of all personal non-landed dwelling gross sales. This prompted a number of rounds of cooling measures, together with the reintroduction of SSD in 2010, and the introduction of Extra Purchaser’s Stamp Obligation (ABSD) in 2011. These steps had been aimed exactly at lowering short-term shopping for and restoring worth stability.

And we’ve seen sub-sales spike just lately as properly.

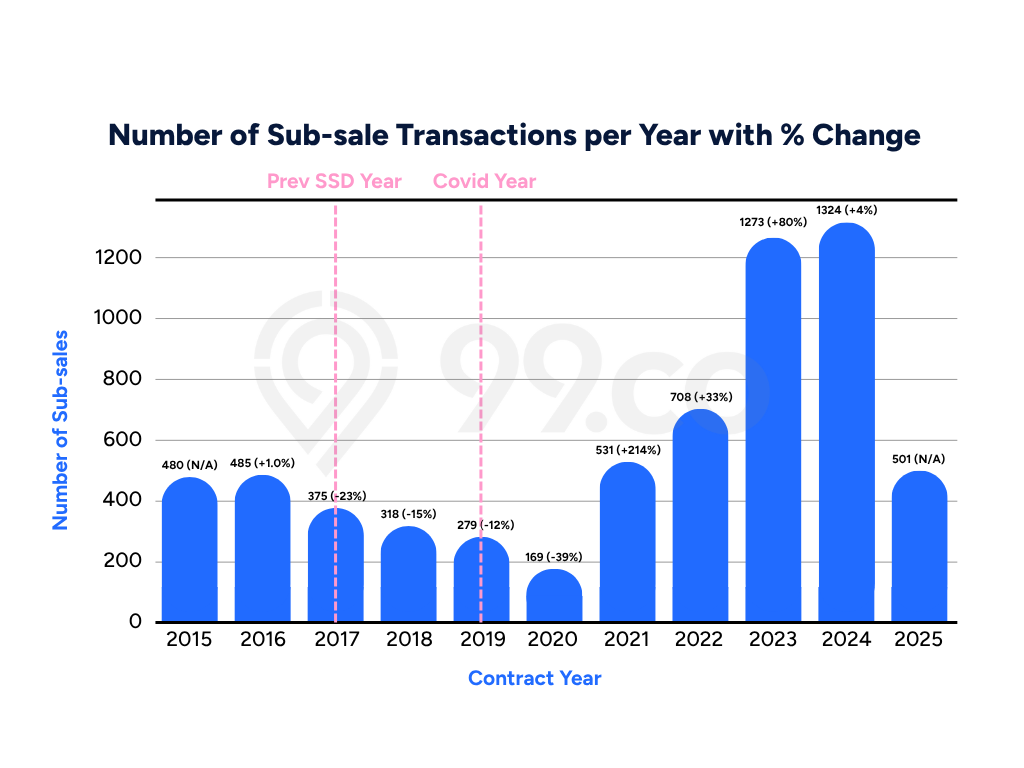

Between 2020 and 2024, the URA’s personal property index surged by roughly 33.4%. On the identical time, owners who had been going through TOP delays because of the pandemic, noticed a transparent alternative to exit for revenue. Sub-sale volumes rose sharply after 2020, climbing from simply 169 transactions in 2020 to 1,324 by 2024, the best in almost a decade. In total proportion phrases, sub-sales surged from 1.1% of all transactions in This autumn 2020 to 9.8% by This autumn 2023.

| Area | Share of sub-sales | Items offered | Key drivers |

| OCR (Outdoors Central Area) | 57.8% | 755 models | Extra inexpensive launch costs, bigger purchaser pool, investor-friendly developments |

| RCR (Remainder of Central Area) | 38.4% | 502 models | Enticing mid-tier tasks close to MRT strains and metropolis fringe development areas |

| CCR (Core Central Area) | 3.8% | 49 models | Excessive entry costs restrict demand; fewer short-term patrons |

A big chunk of this sub-sale exercise got here from condos within the Outdoors Central Area (OCR). In 2024, this area alone accounted for 57.8% of all sub-sale transactions, adopted by Remainder of Central Area (RCR) tasks, which contributed 38.4% or 502 models. The Core Central Area (CCR), with its increased worth obstacles, noticed simply 3.8% or 49 models sub-sold in the course of the yr.

Let’s additionally have a look at the highest 10 tasks that noticed the best variety of sub-sale transactions in 2024, together with their common capital good points:

| Mission title | Common capital achieve | Sub-sale depend (2024) |

| Clavon | S$375,581 | 72 |

| Penrose | S$370,013 | 72 |

| Parc Clematis | S$408,878 | 64 |

| Normanton Park | S$263,581 | 61 |

| The Florence Residences | S$170,691 | 55 |

| Sengkang Grand Residences | S$295,030 | 38 |

| Affinity at Serangoon | S$238,822 | 32 |

| Treasure at Tampines | S$302,686 | 29 |

| KI Residences at Brookvale | S$407,894 | 20 |

| Riverfront Residences | S$258,216 | 17 |

The highest three developments every noticed over 60 sub-sales, with good points averaging properly over S$350K. These models offered after being held for simply over 3 years however earlier than reaching the 4-year mark, permitting sellers to minimise their SSD legal responsibility underneath the pre–July 2025 guidelines.

Mega-developments like Normanton Park and Treasure at Tampines additionally noticed excessive volumes. These tasks launched over 1,000 models every and attracted short-term patrons who may exit simply on account of measurement, demand, and powerful worth appreciation.

So, if the most recent spike was principally on account of COVID, then was a coverage revision obligatory?

Sure, development delays gave homeowners a uncommon loophole, permitting them to promote earlier than TOP with out incurring prices. Nonetheless, as we’ve famous on this piece, the SSD hike isn’t only a response to a couple high-profile sub-sales, or a COVID-era loophole. It’s a mirrored image of how briskly the sub-sale market has developed in recent times, and the potential of a 90’s fashion bubble distorting the market.

In a rising market, earnings from sub-sales can seem to be an inevitable a part of the cycle. However once they begin to form pricing psychology and outpace owner-occupier demand, it turns into clear that some correction is required.

The most recent SSD revision doesn’t “punish” buyers. It solely encourages longer holding durations, steadier development, and removes synthetic worth surges from the market. As with previous cycles, the aim isn’t to get rid of short-term investments altogether, however to maintain them in verify. In order that the system can maintain working for many who want properties, not simply these chasing returns.

With this revision, policymakers are as soon as once more nudging the stability again towards sustainable possession, and reiterating that real-estate in Singapore is just not simply an asset class meant for simple good points.

The publish Vendor Stamp Obligation again up on account of new launch sub-sales? We deep-dive into the main points of this coverage hike appeared first on .