Singapore’s personal apartment resale market noticed a major cooldown in Could 2025, with resale volumes dropping 17.5% month-on-month. But, this slowdown in exercise didn’t translate into falling costs. In truth, sure segments just like the Core Central Area (CCR) and Outdoors Central Area (OCR) noticed modest features, reflecting the market’s ongoing resilience amid rising macroeconomic uncertainties.

Let’s unpack the info, uncover the developments behind the numbers, and perceive what it may imply for consumers, sellers, and traders alike.

Desk of Contents

- Value developments present stability amid world volatility

- Transaction quantity sees a noticeable pullback

- Sub-sales sluggish as early sellers maintain again

- Capital features and returns fluctuate broadly throughout districts

- High transactions spotlight worth at each ends

- What lies forward: New launches might reshape the panorama

Value developments present stability amid world volatility

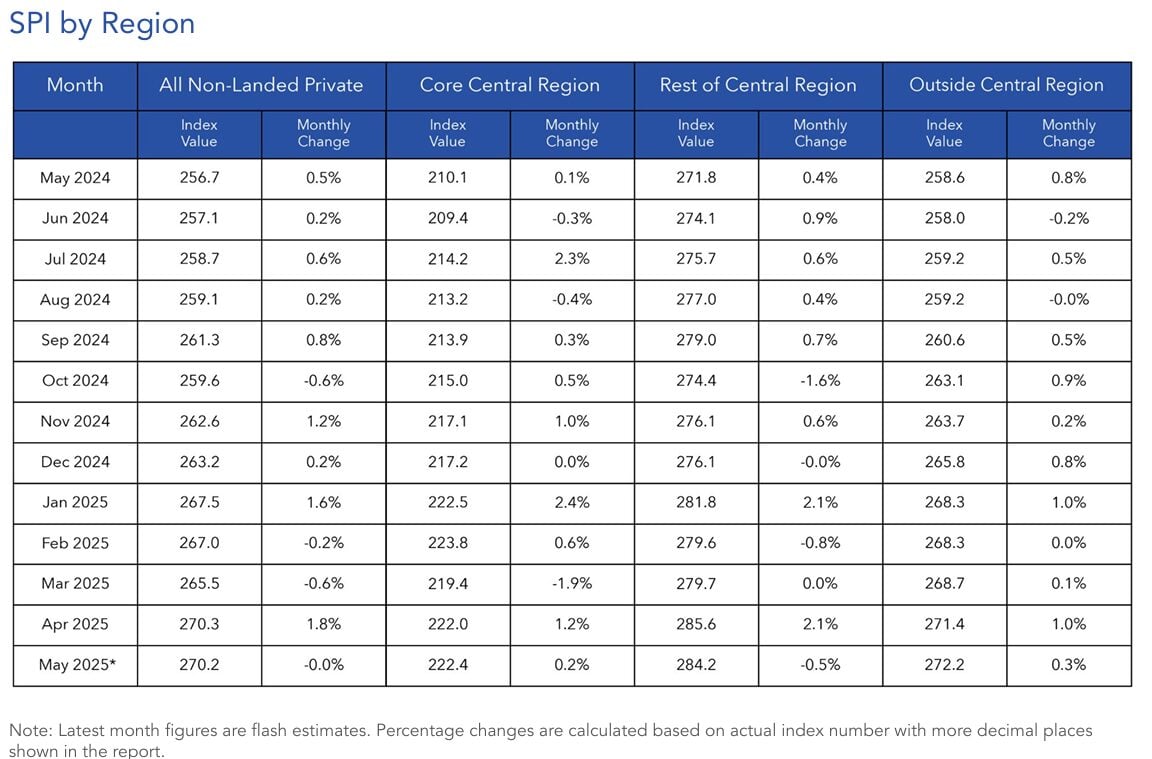

In Could 2025, resale apartment costs moved barely however not uniformly. The Core Central Area (CCR) rose by 0.2%, the Outdoors Central Area (OCR) noticed a 0.3% improve, whereas the Remainder of Central Area (RCR) skilled a 0.5% dip.

This unevenness indicators a market that’s steadying itself relatively than correcting. Patrons are nonetheless keen to pay a premium for prime and suburban houses, whereas mid-tier areas appear extra price-sensitive.

On a broader scale, the year-on-year numbers recommend continued resilience: apartment resale costs grew by 5.3% general in comparison with Could 2024. CCR led with a 5.9% improve, OCR matched the general pattern at 5.3%, and RCR noticed a 4.6% rise.

Transaction quantity sees a noticeable pullback

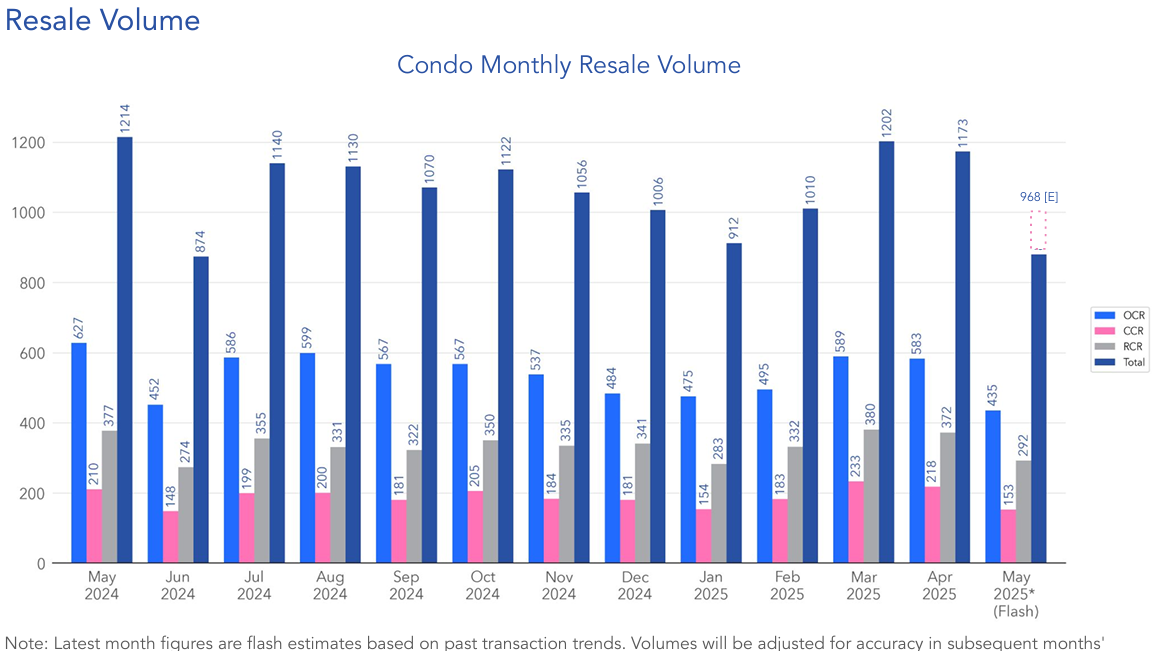

Resale exercise noticed a substantial slowdown. Simply 968 items have been resold in Could 2025, marking a 17.5% drop from April’s 1,173 items. The determine can also be 20.3% decrease year-on-year and three.4% beneath the five-year common for Could.

Patrons seem like stepping again amid rising geopolitical tensions, resumed US tariffs set for July, and common financial unease. Many are holding off on high-value choices in favour of readability.

Regionally, the Outdoors Central Area (OCR) dominated with 49.4% of transactions, adopted by the Remainder of Central Area (RCR) at 33.2%, and the Core Central Area (CCR) at 17.4%.

Sub-sales sluggish as early sellers maintain again

Sub-sale transactions, which discuss with gross sales of uncompleted properties, made up 6.7% of all secondary gross sales in Could; barely down from 6.8% in April. The drop means that early consumers are more and more inclined to carry, doubtlessly ready for higher market circumstances post-completion.

Capital features and returns fluctuate broadly throughout districts

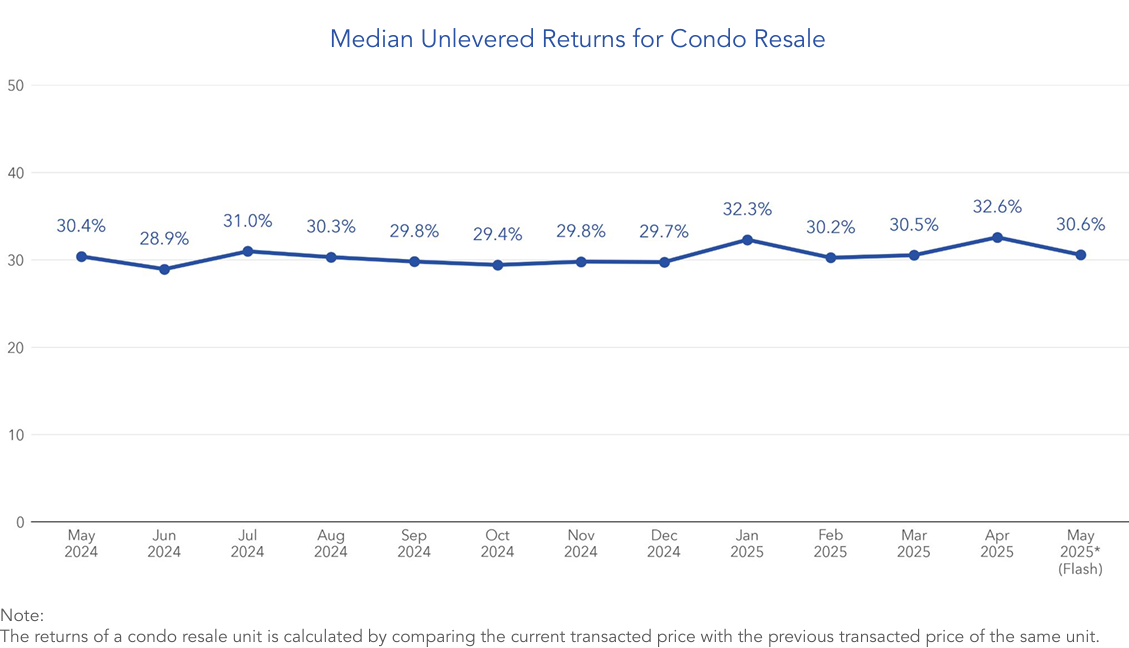

The median capital acquire in Could stood at S$365,000, down from S$400,000 in April. This means that whereas house owners are nonetheless profiting, features are moderating in tandem with purchaser warning.

District 22 (Boon Lay / Jurong / Tuas) topped the charts with a capital acquire of S$861,000 and an unlevered return of 112.9%, highlighting the long-term worth seen in Singapore’s upcoming second CBD, Jurong Lake District.

District 4 (Sentosa / Harbourfront), against this, recorded the bottom capital acquire at S$100,000 and a muted return of 5%, underscoring how way of life enchantment doesn’t at all times equate to robust returns.

Extra illuminating, nonetheless, was the breakdown of median unlevered return, which stood at 30.6% throughout all resale transactions in Could. This metric displays the uncooked return from resale, excluding financing and leverage, and is a dependable indicator of long-term asset appreciation.

Zooming into district-level efficiency reveals a dramatic unfold.

District 22 posted the best median unlevered return at 112.9%. Which means that on common, sellers greater than doubled their preliminary buy costs. The world has benefitted immensely from the federal government’s sustained funding in reworking Jurong into Singapore’s second CBD, now translating into outsized returns for property house owners.

On the reverse finish of the spectrum, District 4 (Sentosa / Harbourfront) noticed a median unlevered return of simply 5%.

The broad vary of returns additionally displays how essential entry timing, location fundamentals, and macro sentiment are in influencing property profitability. Whereas central and luxurious areas nonetheless command aspirational enchantment, the actual cash, not less than in Could, was made in districts backed by main public investments and long-term grasp planning.

High transactions spotlight worth at each ends

Regardless of a common slowdown in general transaction quantity, the highest finish of the market remained energetic, with a number of eye-catching resale offers crossing the million-dollar mark.

The most costly resale in Could 2025 was a unit at Wing on Life Backyard, which modified arms for a powerful S$9,000,888.

Situated within the ultra-exclusive Anderson Street enclave of District 10, this improvement is freehold property accomplished within the early Nineteen Eighties. Wing on Life Backyard is understood for its bigger items. The excessive resale value displays not simply the rarity of such spacious, legacy freehold items in a central location, but additionally a broader pattern of ultra-high-net-worth consumers favouring older, low-density initiatives in prime districts.

Within the RCR, a resale unit at Pebble Bay in Tanjong Rhu fetched S$5.5 million. This waterfront condominium combines resort-style dwelling with metropolis comfort. Its enchantment lies in its expansive layouts, unobstructed sea views, and proximity to high faculties and the upcoming Katong Park MRT station.

The neighbourhood’s transformation into a way of life and leisure hub, particularly with the Kallang Alive! sports activities and leisure district taking form close by, has additional bolstered its desirability.

In the meantime, within the OCR, a unit at Kovan Residences commanded S$4.399 million, an exceptionally excessive value for a suburban apartment. Located instantly above Kovan MRT station, this venture has change into a standout within the northeast because of its enviable transport connectivity, spacious items, and mature facilities within the space.

The event presents a mixture of large-format household items and penthouses, that are particularly enticing to multi-generational households and upgraders searching for house with out sacrificing location.

These high apartment resale transactions reveal that whereas the mass market could also be hesitating, consumers on the high finish stay energetic, selective, and keen to pay a premium for properties that provide shortage, high quality, and long-term worth.

Searching for resale condos within the above areas? Allow us to assist!

What lies forward: New launches might reshape the panorama

Trying forward, a contemporary wave of recent developments is predicted to invigorate the market. In River Valley, The Robertson Opus is prone to entice luxurious consumers with its upscale choices and central location. In the meantime, The Sen in Higher Bukit Timah will enchantment to households and nature lovers who need each serenity and connectivity.

Over in Higher Thomson, Springleaf Residence is being positioned as a tranquil, low-density enclave for consumers searching for proximity to nature with out sacrificing accessibility. And for consumers priced out of the personal resale section, the launch of govt condominium Otto Place in Tengah presents a horny possibility. Tengah’s transformation into a sensible and inexperienced township is already nicely underneath method, making it a hotspot for younger households and HDB upgraders.

These launches are prone to supply aggressive alternate options to apartment resale choices, notably if they’re attractively priced or characteristic compelling way of life choices. Whether or not that results in softer resale pricing stays to be seen, but it surely actually provides extra variables to an already shifting market.

The put up Condominium resales present a quantity dip in Could ’25, however costs maintain regular appeared first on .