Direct written premiums within the U.S. owners insurance coverage market rose greater than 13 % in 2024, and the online mixed ratio for the road fell beneath breakeven for the primary time in 5 years.

Increased costs defined a lot of the industrywide loss and mixed ratio enhancements, however not all owners insurers grew premiums final 12 months, a brand new report from S&P World Market Intelligence reveals.

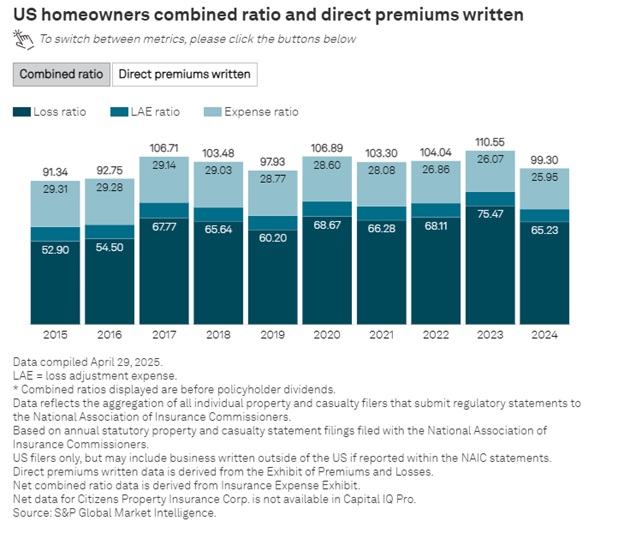

The brand new report, “Premiums rise, ratios recede for U.S. owners insurers in 2024,” reveals that regardless of 5 tropical cyclones and quite a few extreme climate occasions, the industrywide web mixed ratio for owners (excluding policyholder dividends) was 99.3 in 2024, 11.2 factors higher than the 110.5 ratio recorded in 2023.

The 99.3 marked the primary time since 2019 that the ratio was beneath 100, the report mentioned.

(Editor’s Observe: Earlier this month, Service Administration reported on a separate report from S&P GMI in an article titled “2024 P/C Insurance coverage Mixed Ratio: Finest in Extra Than a Decade,” which confirmed the owners web mixed ratio touchdown at 99.7 final 12 months. The 2024 mixed ratio within the prior report included policyholder dividends. The most recent report on simply the owners line doesn’t.)

The report reveals industrywide owners web mixed ratios (together with loss ratio and expense parts) for the final decade on an interactive chart, which additionally gives tallies of direct written premiums and year-over-year premium jumps for every year from 2015-2024. Total, direct premiums written within the sector rose 13.4 % to almost $173.1 billion. The rise marked the second-highest since 2015, behind a 14.1 % leap recorded in 2023.

The nationwide common rise in owner-occupied house owner charges in 2024 rose to 11 % from 9.7 % in 2023, in accordance with Market Intelligence’s RateWatch utility, the report mentioned.

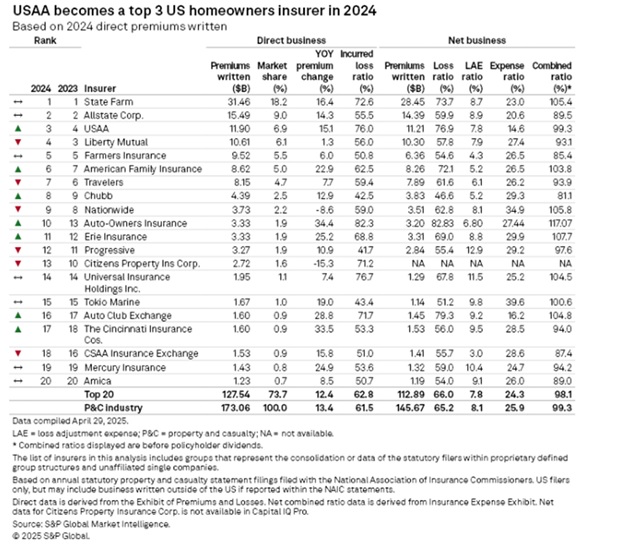

A rating of the highest 20 owners insurers based mostly on direct written premium quantity reveals the three largest gamers—State Farm, Allstate and USAA—every rising by double digits and reporting improved mixed ratios. However regardless of what S&P GMI calculates to be a 16.4 % bounce in direct premiums to $31.5 billion for the 12 months, State Farm’s web mixed ratio remained above 100, ending up at 105.4.

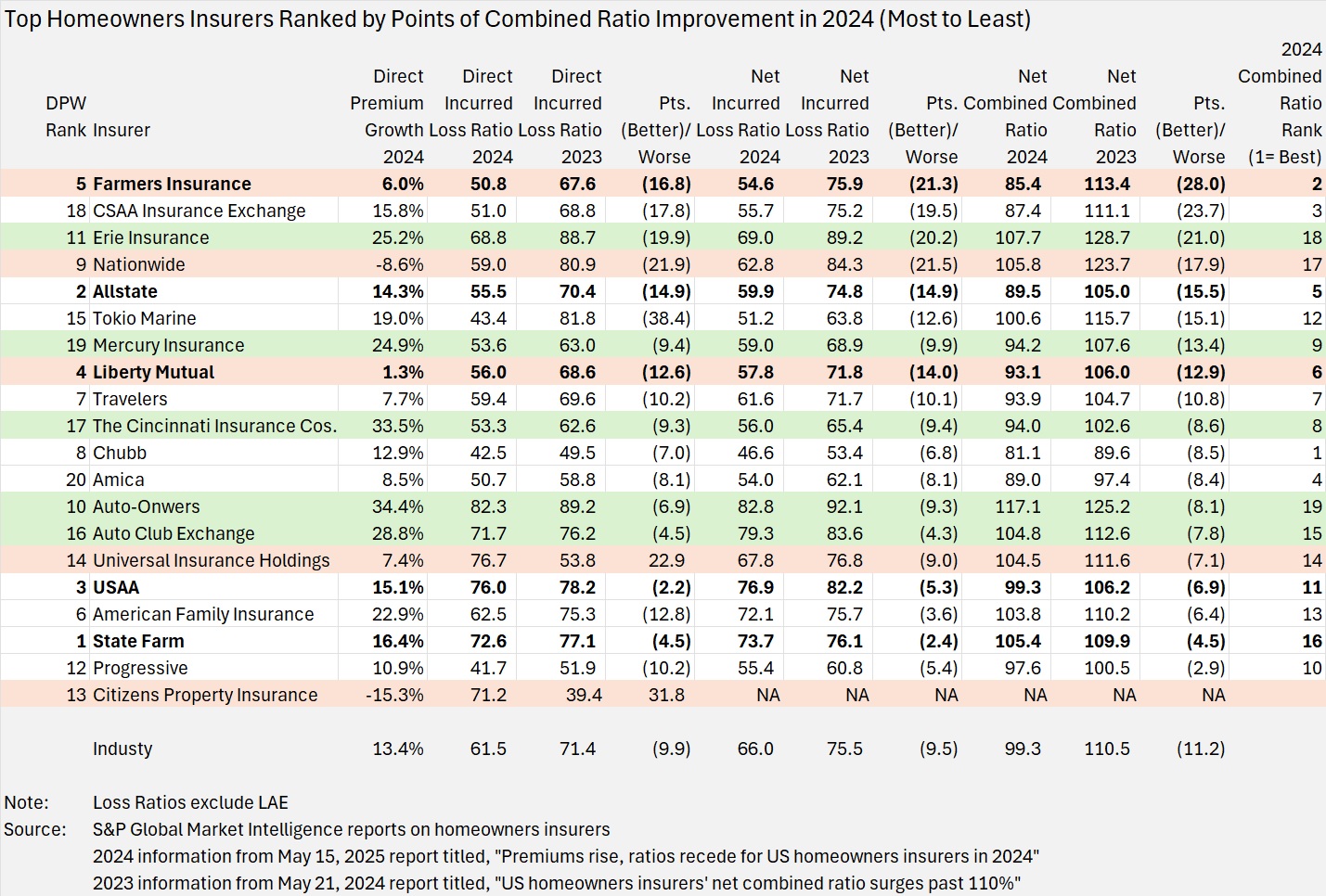

A comparability of particular person provider direct incurred loss ratios displayed within the newest S&P GMI report about owners insurance coverage outcomes with these set forth for a similar 20 insurers in an identical report revealed in Might final 12 months reveals that State Farm and USAA had the smallest direct loss ratio enhancements among the many 18 that reported higher ends in 2024 (4.5 factors for State Farm and a couple of.2 factors for USAA).

Solely two Florida regional insurers—Residents Property Ins. Corp. and Common Insurance coverage Holdings Inc.—reported deteriorating loss ratios for 2024.

Specializing in web mixed ratio enhancements (after the impacts of reinsurance) as a substitute of direct loss ratio modifications, State Farm and USAA nonetheless rank close to the underside. (Chart produced by Service Administration beneath shows the 20 insurers ranked by factors of mixed ratio enchancment from 2023 to 2024.)

Two different giant owners insurers—Farmers and Liberty Mutual—posted the smallest progress charges among the many 18 that reported extra direct written premiums in 2024 than 2023. In distinction to State Farm and USAA, nonetheless, these two corporations rank amongst these with probably the most improved mixed ratios, doubtless benefiting from initiatives to shrink their portfolios as they elevated charges.

Farmers, rising premiums by simply 6 %, noticed its web mixed ratio enhance by 28 factors to 85.4 in 2024. (That was the second greatest mixed ratio consequence among the many prime 20 carriers. Chubb posted an 81.1 web mixed ratio.)

In the meantime, Auto-Homeowners, which recorded the biggest 2024 direct premium progress charge among the many 20 largest carriers at 34.4 %, additionally ended up with the worst mixed ratio, 117.1.

Nationwide Mutual Insurance coverage Co., the one firm among the many prime 10 largest owners to report decrease premiums in 2024 than 2023—a drop of 8.6 % to only over $4 billion—nonetheless recorded 17.9 factors of mixed ratio enchancment. The improved ratio, nonetheless, remained above breakeven in 2024 at 105.8.

Residents Property Insurance coverage Corp. was the one different insurer among the many prime 20 to report a decline in direct premiums written final 12 months. The 15.3 % drop to $3.2 billion for Residents pushed Florida’s insurer of final resort out of the highest 10 to a Thirteenth-place rating based mostly on premium quantity. The S&P GMI report attributes this to the success of depopulation efforts. Nonetheless, Residents was certainly one of solely two insurers listed within the S&P GMI report back to report worse direct underwriting ends in 2024 than 2023—with its direct incurred loss ratio greater than 30 factors greater than the one listed in an identical report revealed by S&P GMI in Might 2024 laying out 2023 outcomes.

Florida-based Common Insurance coverage Holdings additionally noticed its direct loss ratio deteriorate by greater than 20 factors, however its web mixed ratios confirmed enchancment, after the impression of reinsurance. (Web mixed ratios for Residents weren’t out there within the S&P GMI stories.)

Florida, nonetheless, didn’t produce the worst loss ratio outcomes for insurers in 2024.

The most recent report additionally features a U.S. map color-coded to point the states with the worst and greatest industrywide direct loss ratios. Nebraska, which was impacted by tornadoes and hail in two separate storms final June, had the best direct loss ratio—136.6 (together with loss adjustment bills).

Matters

Carriers

Householders

Fascinated by Carriers?

Get automated alerts for this subject.