South Carolina?

Mobile homes, like all other houses, are subject to property taxes. Property taxes are a significant source of revenue for local governments and they are used to pay for critical services such as schools, roads, and public safety.

In this article, we’ll look at how much property tax you may anticipate spending on a mobile home in South Carolina.

Generalized View Of Property Tax

Assessed Value

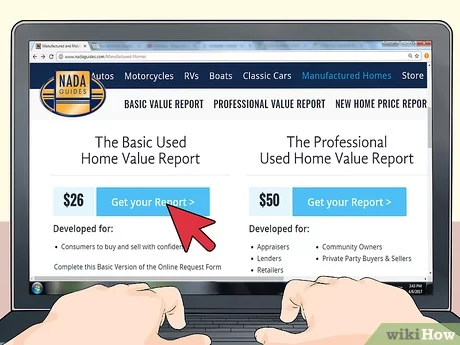

To begin, it is critical to understand how South Carolina property taxes are computed. The amount of property tax owed is determined by the state using what is known as the “assessed value.” The county assessor’s office determines the assessed value, which is based on the fair market value of the property.

While computing the assessed value, the assessor considers a number of variables, including the size and condition of the property, its location, and any renovations or additions that have been made.

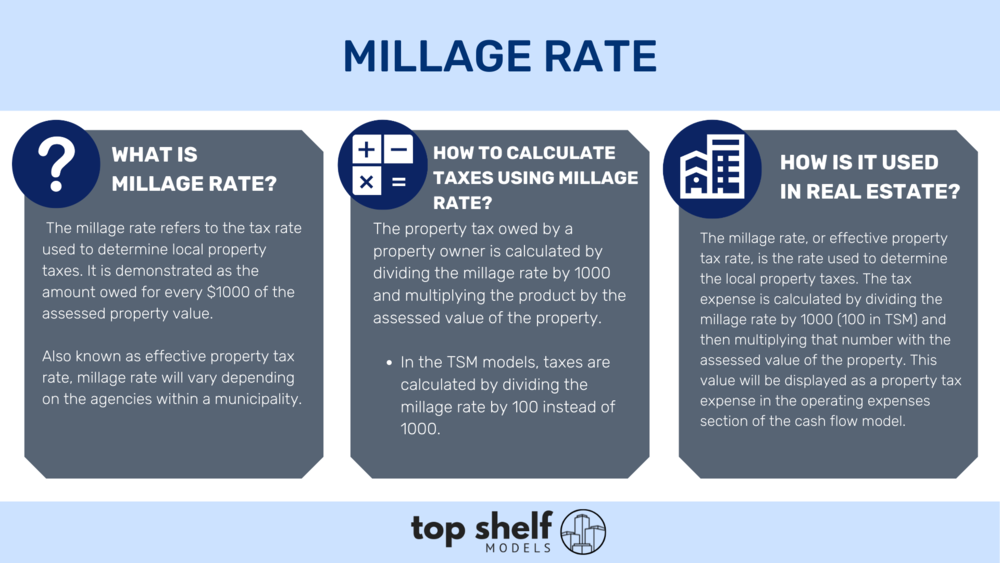

Millage Rate

After determining the assessed value, the county will apply a millage rate to determine the amount of property tax owed. The millage rate is the rate at which local property taxes are charged. The local government decides the millage rate in South Carolina and might vary based on the county or municipality. The millage rate is stated in mills, with one mill equaling one dollar for every thousand dollars assessed. For example, if the millage rate in a certain location is 100 mills and the assessed value of a mobile home is $50,000, the annual property tax would be $5,000.

In addition to assessed valuation and the millage rate, several factors might impact the property tax on a mobile home in South Carolina. They include the home’s location, lot size, and any renovations done to the residence. For example, the property tax may be greater if the mobile home is in a high-valued neighborhood. Likewise, the property tax may be greater if the mobile home is on a bigger lot.

The average millage rate for mobile homes in South Carolina is 166.8 percent, according to data from the South Carolina Association of Counties. However, it is crucial to note that millage rates vary greatly depending on the county in which you live. For example, the millage rate for mobile homes in Greenville County is 104.9, whereas it is 217.5 in Richland County.

General Tax Calculation

Let’s look at an example to see how much property tax you might anticipate spending on a mobile home in South Carolina. Assume you own a $50,000-as-assessed mobile home in Richland County. To get the amount of property tax owed, multiply the assessed value by the millage rate:

$50,000 x 0.2175 = $10,875

In this case, you would owe $10,875 in Richland County property tax on your mobile home.

Tax Exemption Opportunities

It’s worth mentioning that mobile homeowners in South Carolina may be eligible for several exemptions and deductions. For example, homeowners 65 years of age or older or permanently and fully handicapped are eligible for a homestead exemption. This exemption allows eligible homeowners to avoid paying property taxes on the first $50,000 of their home’s assessed value.

Assessment Differences

There are also unique assessments available for mobile homes placed on leased land. In some circumstances, the mobile home is not considered real property and hence is exempt from property tax. Instead, the owner of a mobile home must pay a particular assessment depending on the house’s worth.

Property Tax Due

It’s also worth mentioning that in South Carolina, property taxes for mobile homes are payable twice a year, on January 15th and June 15th. If you do not pay your property taxes on time, you may be penalized and charged interest.

In Conclusion

Property taxes on mobile homes in South Carolina are an important factor to consider for homeowners. While the amount of property tax owing varies based on a number of factors, including the assessed value of the property and the millage rate in your county, it’s critical to keep up with payments to avoid fines and interest charges.

By understanding how property taxes are calculated and taking advantage of any available exemptions or deductions, you can help minimize your property tax burden and ensure that you can enjoy your mobile home without any unexpected financial surprises.