After a quieter August, Singapore’s HDB resale market bounced again in September. Transaction exercise held regular regardless of a modest pullback in quantity, whereas costs reached a recent report excessive. The month additionally noticed a surge in high-value transactions — with 172 flats bought* for a minimum of S$1 million, setting a brand new all-time report.

*Offered transactions are primarily based on Resale Registration Date. Resale registered purposes are usually consultant of accomplished resale transactions.

At a look…

/* Fast Abstract – distinctive class to minimise theme conflicts */

.quick-summary-box-99co {

background: #E6F0FF;

coloration: #216BFF;

border-radius: 12px;

padding: 16px 18px;

font-family: -apple-system, BlinkMacSystemFont, “Segoe UI”, Roboto, “Helvetica Neue”, Arial, sans-serif;

box-shadow: 0 1px 0 rgba(33,107,255,0.06);

margin: 1rem 0;

overflow: hidden;

}

/* Grid format: two columns on extensive screens, single on cell */

.quick-summary-grid-99co {

show: grid;

grid-template-columns: repeat(2, 1fr);

hole: 10px 18px;

align-items: begin;

list-style: none;

padding: 0 !vital;

margin: 0 !vital;

}

/* Particular person checklist objects */

.quick-summary-grid-99co li {

show: flex;

hole: 8px;

align-items: flex-start;

line-height: 1.45;

font-size: 0.98rem;

word-break: break-word;

margin: 0 !vital;

padding: 0 !vital;

}

/* Emoji styling (constant sizing and spacing) */

.quick-summary-grid-99co .qs-emoji {

font-size: 1.25rem;

line-height: 1;

margin-top: 2px;

flex-shrink: 0;

}

/* Textual content formatting */

.quick-summary-grid-99co .qs-text {

font-weight: 600;

coloration: #216BFF;

margin: 0;

padding: 0;

}

/* Responsive: stack to at least one column on smaller screens */

@media (max-width: 600px) {

.quick-summary-grid-99co {

grid-template-columns: 1fr;

hole: 8px;

}

}

-

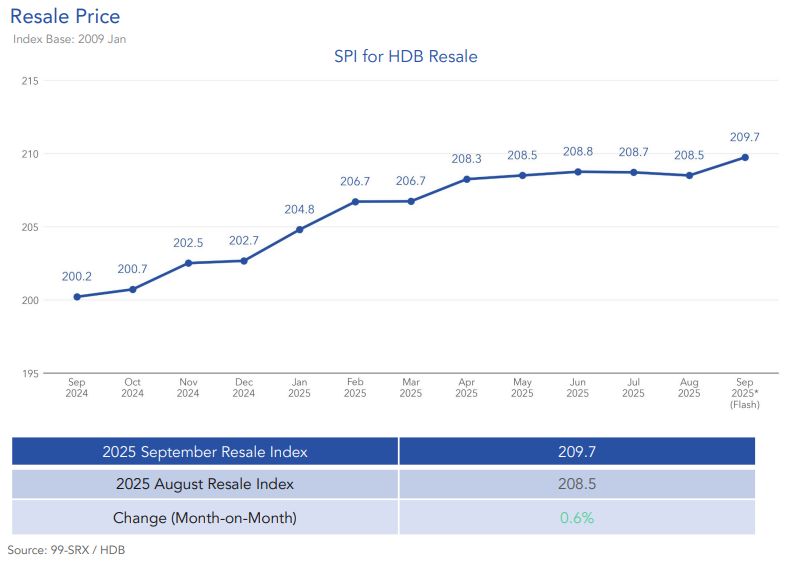

HDB resale costs: +0.6% MoM, +4.8% YoY (Index: 209.7) -

Gross sales quantity: 2,186 flats bought, down 1.2% MoM -

Million-dollar flats: 172 models, new report excessive (7.9% of whole gross sales) -

High cities with million-dollar gross sales: Toa Payoh (37 models), Queenstown (18), Bukit Merah (18) -

Highest transaction: S$1.59M for a 5-room flat in Central Space

Desk of contents

HDB resale costs reached a brand new excessive in September 2025

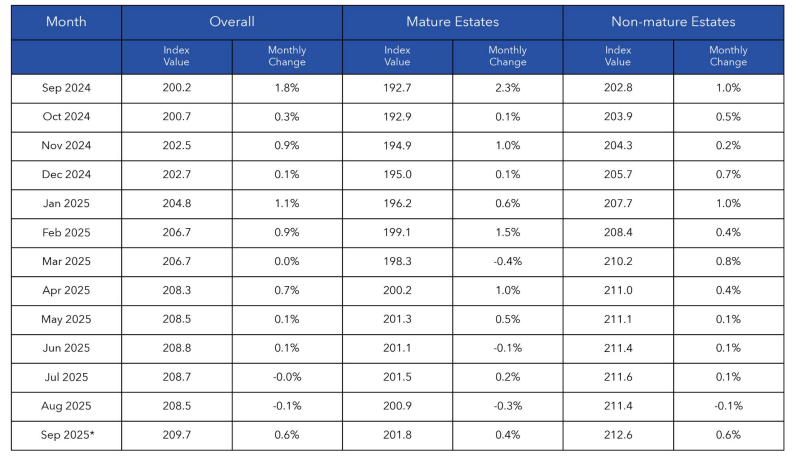

The HDB resale worth index reached a brand new excessive in September. Now at 209.7, it was a 0.6% month-on-month improve from 208.5 in August, and 4.8% larger than a 12 months in the past. This regular climb continues a pattern of moderated however persistent worth progress since early 2025, signalling that the market stays well-supported regardless of broader financial headwinds.

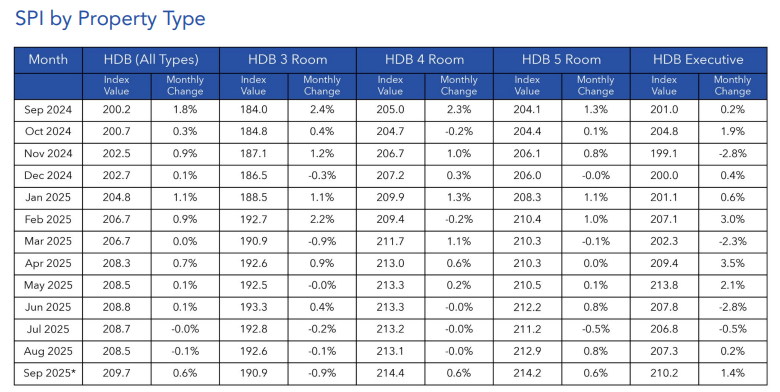

Each Mature and Non-Mature estates recorded worth positive aspects, rising 0.4% and 0.6%, respectively, since August. By room sort, Government flats led with a 1.4% month-to-month achieve, reflecting larger demand from multi-generational households. 4-room and 5-room flats additionally superior by 0.6%, whereas 3-room flats slipped 0.9%, suggesting smaller models could also be feeling the pinch from cautious first-time patrons affected by financing limits.

Over the previous 12 months, all flat classes have appreciated between 3.7% and 4.9%, underscoring steady demand throughout the board. Right here’s the breakdown of the year-on-year improve for every flat sort:

- 3-room: +3.7%

- 4-room: +4.6%

- 5-room: +4.9%

- Government: +4.6%

This regular efficiency indicators ongoing confidence within the HDB resale market, pushed by a mixture of upgrader demand, tight BTO provide in mature areas, and the widening hole between new launch and resale condominium costs.

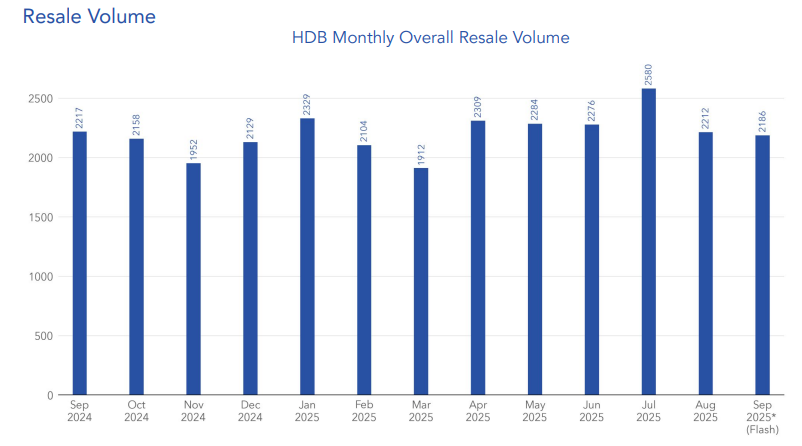

Resale quantity dipped barely, however demand stayed regular

In September, 2,186 resale flats have been transacted — a modest 1.2% drop from August and 1.4% under September 2024. Whereas this implies a gentle slowdown, the general quantity stays wholesome for a historically quieter interval following the Hungry Ghost Month.

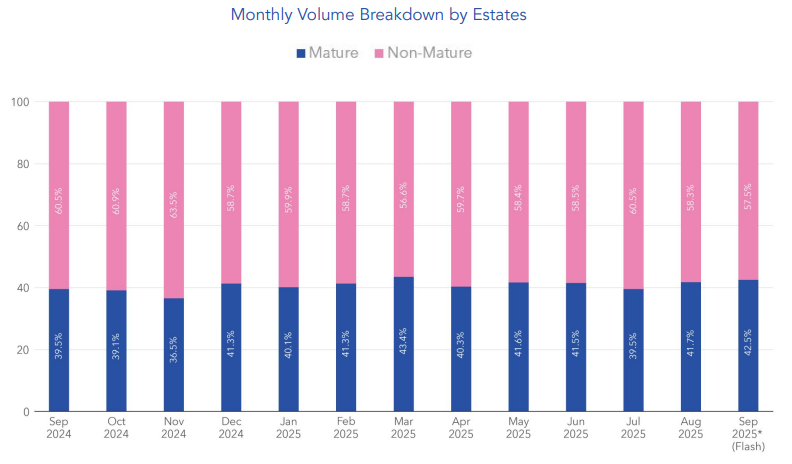

Greater than 57% of transactions got here from Non-Mature estates, highlighting how cities akin to Sengkang, Woodlands, and Jurong East proceed to soak up a good portion of market exercise. In the meantime, Mature estates accounted for 42.5%, reflecting restricted provide however regular curiosity from patrons keen to pay premiums for proximity to facilities and established neighbourhoods.

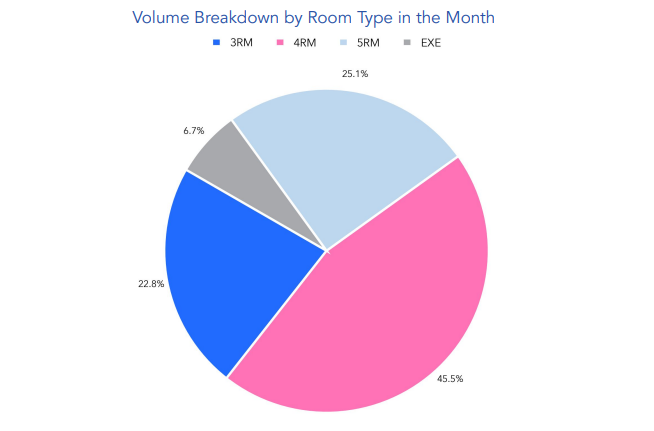

When it comes to flat sort, 4-room models dominated the market, contributing 45.5% of whole transactions, adopted by 5-room (25.1%), 3-room (22.8%), and Government flats (6.7%). This combine factors to the continued enchantment of mid-sized flats — giant sufficient for households, but comparatively inexpensive in comparison with condominiums.

A number of the pullback in quantity may stem from shifting purchaser behaviour. As 99.co’s Chief Information & Analytics Officer, Mr. Luqman Hakim, famous, “In August, solely two new launches have been rolled out – Springleaf Residences on the sixteenth and One Holland Village Residences on the twenty first – and September had none, with Skye at Holland solely previewing on the twenty fifth.”

These fewer non-public choices may divert patrons’ consideration to the HDB resale section in September, sustaining demand whilst general transactions ease.

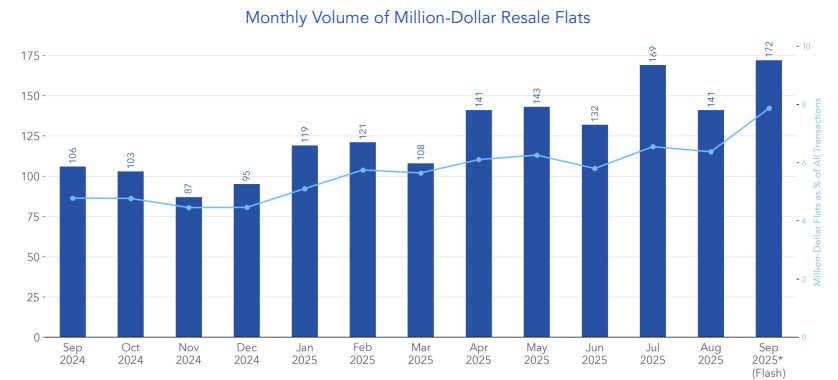

Million-dollar flats surged to a report excessive of 172 models

Some of the putting developments in September was the surge in million-dollar HDB flat transactions. The month noticed 172 such gross sales, a pointy bounce from 141 in August. They account for 7.9% of all resale transactions, the best month-to-month proportion ever recorded.

The highest transaction of the month was a 5-room flat within the Central Space, which fetched S$1.59 million — a mirrored image of how central, uncommon flat sorts proceed to command distinctive worth. Within the Non-Mature estates, Woodlands noticed an Government flat bought for S$1.12 million. This exhibits how demand for spacious properties is spreading past the city-centre places.

JUST IN: Woodlands government HDB flat units city’s new excessive at S$1.27 million in October 2025

Toa Payoh emerged because the top-performing city with 37 million-dollar flats in September, adopted by Queenstown and Bukit Merah with 18 every. These mature estates, identified for his or her central places and proximity to MRT traces, stay prime decisions for patrons keen to pay a premium for comfort and shortage.

Mr. Luqman Hakim noticed that, “With fewer condominium choices, some patrons, significantly potential HDB upgraders, could have returned to resale flats as a substitute, as even at S$1M and above they nonetheless supply more room at decrease costs than close by condos.”

This angle sheds mild on why the million-dollar section stays sturdy — it’s not nearly status, but in addition practicality. For a lot of, the trade-off between area and worth makes these premium flats an interesting different to compact new condominiums.

Market interpretation: Confidence regardless of a softer backdrop

Whereas the broader property market has seen combined indicators, the HDB resale section continues to reveal outstanding stability. The record-high worth index and historic variety of million-dollar flats mirror sustained purchaser confidence, particularly amongst owners in search of ready-to-move-in choices.

Government and bigger flats are seeing significantly resilient demand, fuelled by households upgrading from smaller models or non-public owners cashing out and re-entering the marketplace for long-term safety. Whilst transaction quantity slipped barely in September, the sustained high-value exercise means that critical patrons are nonetheless lively — although more and more selective.

The market now appears to be splitting into two teams. First-time patrons are scuffling with affordability as costs climb, whereas higher-income patrons are paying extra consideration to location, situation, and area. This combine helps costs whereas protecting hypothesis in verify.

On prime of that, the focus of million-dollar transactions in central cities akin to Toa Payoh, Queenstown, and Bukit Merah additionally underscores a structural actuality: older estates with sturdy facilities and transport connectivity stay evergreen favourites, significantly when newer provide is proscribed.

Learn the HDB flash estimate for the whole Q3 2025 resale market right here.

The submit Report 172 million-dollar HDB flats bought in September 2025 as costs hit new peak appeared first on .