Key takeaways

Australia’s housing market is heating up, with September delivering the strongest month-to-month rise in nationwide dwelling values since October 2023. The Cotality HVI jumped 0.8%, pushed by capital metropolis momentum and record-low listings.

Provide squeeze fuels worth progress as listings hit historic lows. From Darwin to Brisbane, marketed inventory ranges are nicely under average- down 53% in Darwin alone – whereas purchaser demand surges.

First dwelling patrons face fierce competitors as deposit assure launches. With practically half of suburbs sitting below new worth caps, the expanded Residence Deposit Assure is unlocking opportunity- but additionally intensifying purchaser competitors amid already tight provide.

Australian housing markets are gathering power as we head additional into spring, with September marking the strongest month-to-month achieve for nationwide dwelling values since October 2023.

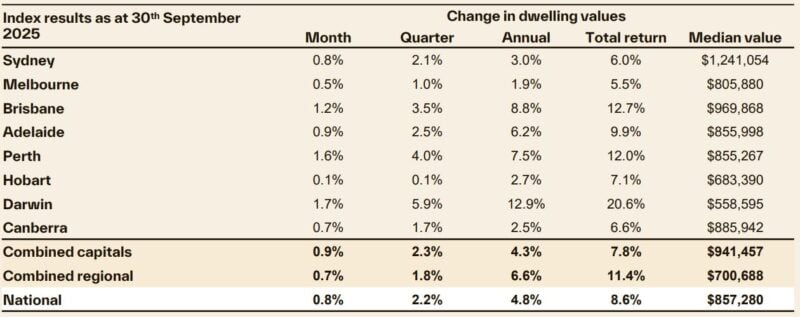

The Cotality Residence Worth Index (HVI) recorded a 0.8% improve in September, powered by sturdy progress circumstances throughout the capital cities, the place values rose 0.9% over the month.

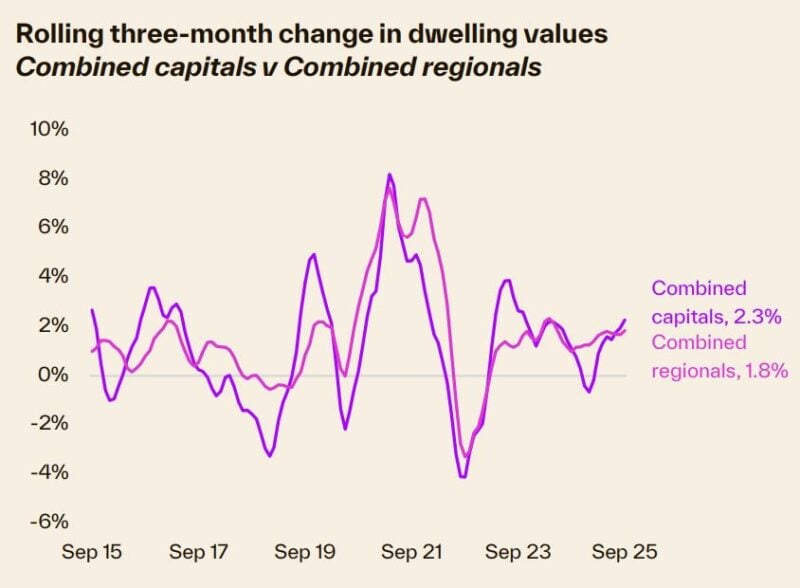

On a quarterly foundation, the nationwide HVI elevated 2.2%, up from a 1.5% elevate within the June quarter and double the 1.1% improve seen over the three months to March.

In greenback phrases, the September quarter rise was equal to a $18,215 improve within the median dwelling worth.

Development has as soon as once more turn into broad-based, with each capital metropolis and rest-of-state area recording a rise in dwelling values over the month, quarter and most up-to-date 12-month interval.

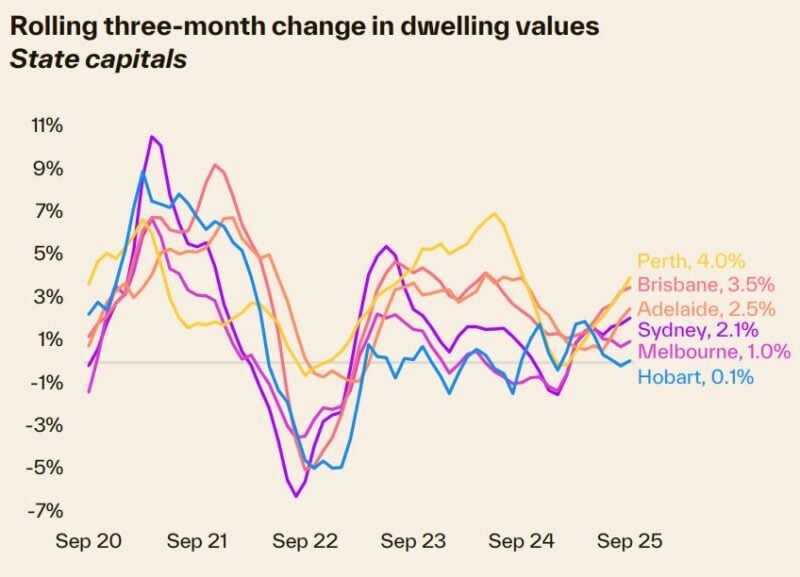

That being mentioned, some divergence within the tempo of progress is as soon as once more rising.

Perth and Brisbane are once more pulling forward of the bigger capitals

Their values are up 4.0% and three.5% respectively by way of the September quarter, with the tempo of features being led by the unit market.

Darwin is displaying a fair stronger run of progress with values leaping 5.9% greater over the previous three months.

Every of those cities proceed to point out a extreme lack of marketed provide.

The variety of houses on the market on the finish of September was about 53% decrease than common in Darwin, 45% under common in Perth and down 31% in Brisbane.

On the identical time, estimates for quarterly dwelling gross sales are monitoring above common, demonstrating a transparent disconnect between demand and provide.

Most cities are seeing stronger progress charges for homes than items, with capital metropolis values up 2.4% and 1.7% respectively by way of the September quarter.

Nonetheless, Brisbane is the outlier, with unit values constantly rising at a quicker tempo than home values over the previous seven quarters on account of a extreme provide scarcity.

Perth and Hobart have additionally seen unit values outpace homes within the September quarter, although this pattern has been much less constant than in Brisbane.

Residence values have risen throughout every of the broad worth tiers

Nonetheless, the strongest tempo of progress has rippled from the decrease quartile of the market to the broad center.

That is seemingly a mirrored image of elevated borrowing capability because of decrease rates of interest, which in flip is supporting demand at barely greater worth factors.

Throughout the mixed capitals, decrease quartile dwelling values had been up 2.6% by way of the September quarter, in contrast with a 2.7% rise throughout the center of the market and a 1.8% improve in higher quartile values.

Marketed inventory ranges are under common throughout each capital metropolis including to the momentum in dwelling worth progress.

Over the 4 weeks to September twenty eighth, capital metropolis listings tracked about 18% under the earlier five-year common.

In the meantime, estimates of gross sales exercise by way of the September quarter had been 7.3% above the earlier five-year common.

The disconnect between provide and demand has seen promoting circumstances strengthen.

Public sale clearance charges have been holding across the 70% mark since midAugust, up from a mean of roughly 63% by way of the June quarter and 62% within the three months to March.

Outlook

The spring promoting season is shaping as much as be a robust one, with distributors claiming the driving force’s seat.

Low marketed inventory ranges and better purchaser demand are a recipe for stable promoting circumstances that can seemingly see costs elevate additional by way of spring and into the tip of the 12 months.

Demand is supported by decrease rates of interest, rising actual earnings progress, tight labour markets and a gradual rise in sentiment.

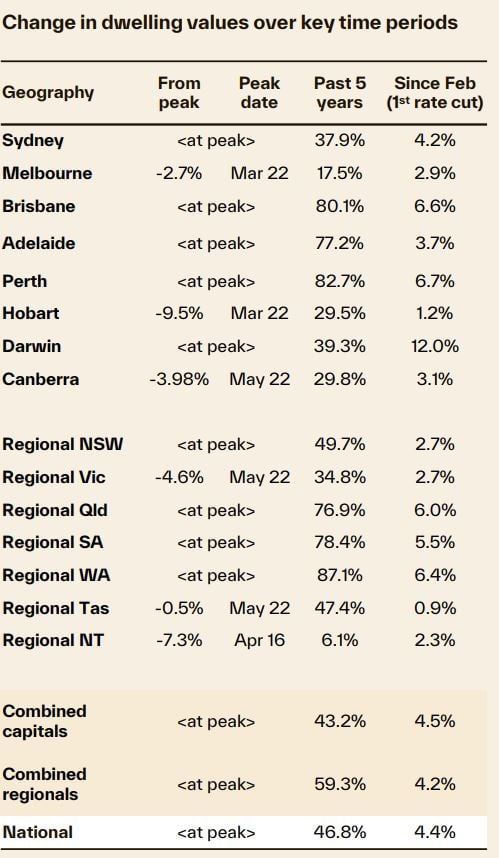

The seventy-five foundation level minimize to the money fee has performed a key position in supporting housing exercise.

Borrowing capability (based mostly on the median family earnings of $106,000) has elevated by round 7.0% for the reason that first fee minimize in February, and decrease rates of interest have supported a elevate in shopper sentiment, which is necessary for high-commitment decision-making.

Regardless of a minor slip in September, the month-to-month shopper sentiment index from Westpac and the Melbourne Institute is 12.8% greater than a 12 months in the past, with the upswing in confidence accompanied by an increase in buying exercise.

Actual wages progress, at 1.3% each year, is at its highest stage since June 2020 and is about 2 ½ occasions the preCOVID decade common of simply 0.5% each year.

Stronger wages progress, alongside decrease debt servicing prices, ought to assist to additional help buying exercise and sentiment.

The roles market stays tight, with the unemployment fee holding at 4.2% in August.

The under-employment fee, at 5.7%, hasn’t been this low since 1991.

Though labour markets are anticipated to loosen a bit, labour market circumstances are anticipated to stay tight, which can additional help housing demand and better costs.

With the expanded Residence Deposit Assure going dwell right now, the chance to get into the market early with as little as a 5% deposit, with out the added price of LMI, is more likely to be standard with potential first dwelling patrons.

We count on to see greater ranges of demand concentrated across the new worth caps within the coming months.

Amid already scarce provide, potential first dwelling patrons trying to utilise the deposit assure could also be feeling anxious as competitors amongst patrons picks up.

We might see the worth of homes in well-located areas, just lately unlocked by the expanded caps, surpass these new worth caps fairly quickly.

As on the finish of September, 49.9% of Australian suburbs had a median home worth at or below the brand new worth caps, whereas 93.2% of suburbs had a median unit worth at or below the brand new worth caps.

Though the outlook for housing markets is wanting more and more optimistic, some headwinds stay that can seemingly maintain the speed of progress in verify.

Stretched affordability is arguably probably the most vital issue conserving a lid on worth progress.

Primarily based on information to June, the median nationwide dwelling worth to family earnings ratio was solely marginally off document highs at 7.9, with Sydney recording a ratio as excessive as 9.6.