Key takeaways

The last word purpose isn’t simply proudly owning a number of properties – it’s reaching monetary freedom and selection later in life.

Your “finish recreation” portfolio ought to mean you can step away from the workforce and stay life by yourself phrases.

Success isn’t about constructing the largest portfolio, however the suitable portfolio.

Plan early for the “finish recreation” – whether or not that’s residing off money movement, promoting, downsizing, or residing off fairness.

In the end, property investing isn’t about property in any respect – it’s about creating monetary freedom and selection.

Most property buyers begin out with one easy aim – monetary freedom.

However the query I usually get requested is: “How do I truly stay off my property portfolio when the time comes?”

The reality is, proudly owning a number of properties isn’t sufficient.

To realize monetary freedom, you could construct a considerable, diversified, and well-structured asset base that gives you decisions later in life.

What ought to the tip recreation seem like?

Sooner or later, you’ll step away from the workforce.

You would possibly name it retirement, or it’s possible you’ll merely need the liberty to decide on the way you spend your days – travelling, pursuing hobbies, giving again, or spending extra time with household.

No matter your imaginative and prescient seems like, the last word goal of constructing a property portfolio is to offer you decisions.

Once you attain that stage, right here’s what I’d such as you to have in place:

- Your private home, debt-free. I don’t need you to hold non-tax-deductible debt into retirement. Your private home must be a monetary and emotional anchor, freed from the financial institution’s involvement.

- A portfolio of high quality residential properties with a comfortably low loan-to-value ratio, producing dependable money movement.

- Extra income-producing property, resembling shares, ETFs, and even business property, to offer diversification and resilience.

- Superannuation as one other pillar of your monetary safety.

Now we are able to’t predict precisely how the foundations of the sport will change over time.

Governments will come and go, rates of interest will fluctuate, taxation insurance policies will evolve, and who is aware of what age you’ll truly have the ability to entry your superannuation.

Even the provision of financial institution finance in later life stays unsure.

That’s why the secret is to construct a considerable, diversified asset base held in a versatile possession construction.

Over time, I’ve discovered that almost all buyers transfer via 4 levels:

- Schooling stage – studying the foundations, methods, and mindset of profitable investing.

- Accumulation stage – aggressively constructing your asset base via leverage and good property purchases.

- Transition stage – reducing your loan-to-value ratio and shifting focus towards money movement.

- Dwelling off your portfolio – the purpose the place your property turns into a money machine that funds your life-style.

The transition to money movement

So, how do you make that all-important transition from progress to money movement?

There isn’t any proper means, as everybody’s circumstances are completely different, however listed here are a few choices.

1. Decelerate the tempo of progress

As soon as your portfolio is substantial, resist the urge to maintain endlessly accumulating.

As a substitute, let time and capital progress do the heavy lifting.

By not refinancing to purchase extra, your loan-to-value ratio naturally falls.

Decrease debt means larger internet rental revenue, which turns into the passive revenue that fuels your life-style.

2. Convert to principal-and-interest loans

Throughout your accumulation stage, interest-only loans aid you maximise borrowing energy and adaptability.

However within the money movement stage, switching some loans to principal-and-interest permits your tenants to assist retire your debt.

Over time, this strengthens your money place – even when the principal repayments aren’t tax-deductible.

3. Think about business property

Residential property is a progress play.

Business property, in contrast, often delivers stronger yields however much less capital appreciation, since rents usually rise solely according to CPI.

Including one or two business property to a well-established portfolio can increase money movement with out derailing your progress technique.

4. Use superannuation or financial savings strategically

When you attain preservation age, it’s possible you’ll select, with recommendation, to promote some property in your SMSF.

Underneath present guidelines, good points within the pension section are tax-free, and you need to use proceeds to retire exterior debt or rebalance your revenue streams.

5. Redevelop to fabricate progress and revenue

If one among your properties has redevelopment potential, you would possibly unlock hidden worth.

By subdividing or creating, you possibly can both promote surplus dwellings to repay debt or retain them to take pleasure in larger rental returns from the identical landholding.

6. Promote strategically

Whereas I usually advocate holding for the long run, generally the suitable transfer is to promote one or two properties to cut back debt and improve revenue.

The secret is to weigh the impression of capital good points tax and construction your sale properly – for instance, inside an SMSF throughout pension section, the place good points could also be tax-free.

7. Dwelling off fairness – my favorite technique:

Personally, I choose to not promote in any respect.

As a substitute, I’ve lived off the rising fairness in my portfolio.

By fastidiously drawing on fairness, I’ve been in a position to retain high-growth property, keep away from triggering capital good points tax, and nonetheless generate the revenue I want.

It’s a means of getting your cake and consuming it too – having fun with at the moment whereas preserving tomorrow for the longer term.

Word: That is the “finish recreation” – constructing a life the place your cash works tougher than you do, the place your properties present not simply wealth on paper however freedom in observe.

Dwelling off fairness – the way it works

Right here’s the concept: as a substitute of promoting properties, you draw on the fairness they’ve created as a tax-free means of producing revenue.

You see, whenever you promote a property, you set off capital good points tax. However whenever you borrow in opposition to the fairness in a property, the funds you entry aren’t thought of taxable revenue.

Meaning you possibly can preserve your high-growth property working for you whereas nonetheless having fun with the money movement you could fund your life-style.

It’s like having your cake and consuming it too. In fact, the curiosity paid on this technique just isn’t tax deductible, as the aim of the borrowing just isn’t for funding.

An instance

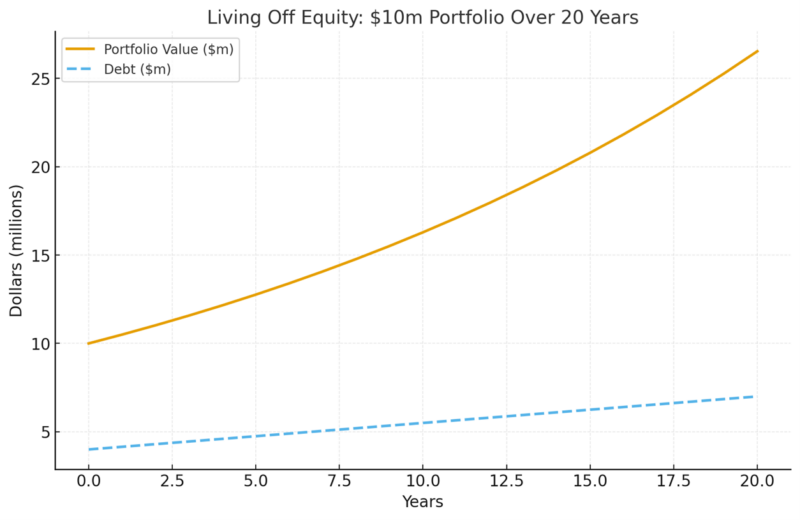

Let’s say you’ve constructed a $10 million portfolio of well-located properties.

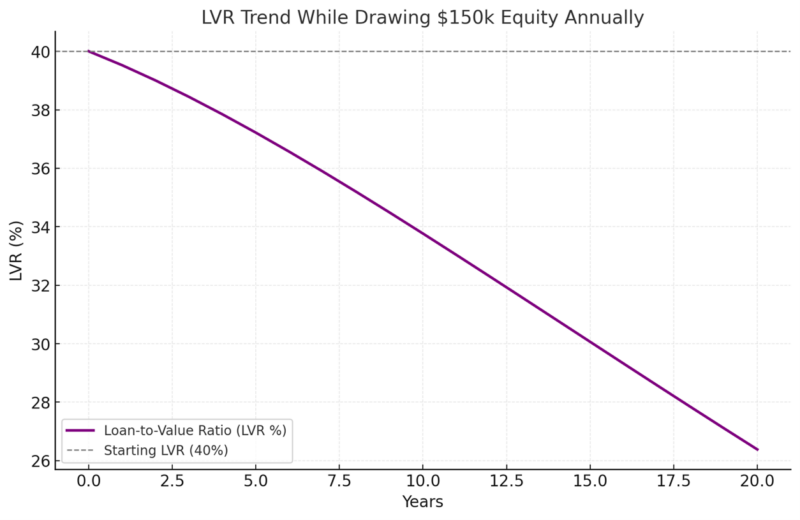

Over time, you’ve lowered your debt to $4 million – a conservative 40% LVR.

At this stage, your properties would possibly generate round $150,000 per yr in rental revenue after bills and mortgage prices.

That’s a stable revenue; however maybe not sufficient to fund the approach to life you aspire to.

So, you complement it with an annual fairness drawdown of $150,000 from the financial institution.

Now take a look at what occurs:

- Your portfolio remains to be compounding in worth. At simply 5% annual progress, your $10 million portfolio will increase by $500,000 every year.

- You’re solely drawing $150,000 of that improve every year.

- Your LVR hardly modifications, as a result of the portfolio’s progress far outpaces the fairness you’re accessing.

So on this instance, you’d take pleasure in $300,000 per yr in life-style revenue – $150,000 from rents plus $150,000 from fairness – whereas nonetheless holding onto your total high-growth portfolio.

Over time, it’s possible you’ll finally rebalance by promoting one property, downsizing, or utilizing superannuation to cut back debt.

Nonetheless, for a major interval – usually a decade or extra – this strategy permits you to stay abundantly whereas your wealth continues to compound within the background.

Why this technique works greatest with a robust basis

In fact, this technique solely works in case you’ve constructed a giant sufficient portfolio of investment-grade properties to start with.

You want the suitable property in the suitable areas, and you could handle your borrowings so banks are comfy letting you entry that fairness.

That’s why I all the time inform buyers: concentrate on high quality over amount.

The true wealth comes from well-located, high-demand property that may proceed to understand strongly over the long run.

Now, it’s possible you’ll be questioning: “That every one sounds nice, Michael, however will the banks nonetheless let me stay off fairness?”

The reality is, within the outdated days it was straightforward.

You could possibly stroll right into a financial institution, get a low-doc mortgage, and so long as your properties had been growing in worth, it was easy crusing. At this time it’s tougher – a lot tougher.

However it’s nonetheless very doable in case you personal the suitable sort of property and also you’ve lowered your loan-to-value ratio sufficient to display robust serviceability.

In fact, you possibly can’t obtain this in a single day.

It takes years of constructing a considerable asset base, lowering your LVR, and utilizing the facility of leverage, compounding, and time.

However keep in mind that in case you observe this mannequin, you continue to are incomes revenue – in actual fact you’re getting it from various sources:

1. Capital progress is passive revenue – however banks don’t depend it.

Sure, your properties could also be rising by a whole bunch of hundreds of {dollars} every year, however lenders received’t recognise this progress as “revenue.” The excellent news is that you just don’t pay tax on it both.

2. Rental revenue is the important thing.

Because of this I like to recommend reducing your LVR so your rental revenue comfortably covers your property bills and mortgage repayments and have enough surplus revenue in order that the banks are pleased to increase extra credit score.

3. Diversified revenue streams.

In the event you can display further revenue from shares, dividends, or superannuation, you’ll be in a stronger place.

On the time of writing, banks are conservative.

They’re not ready to refinance a portfolio primarily based purely on the prospect of capital progress.

What this implies is that by the point you attain the “residing off fairness” stage, you’ll must have shifted your technique as I’ve outlined and turned your portfolio into a real Money Machine, providing you with the monetary freedom to stay life in your phrases.

Ultimate ideas

The aim isn’t to construct the largest portfolio. It’s to construct the suitable portfolio – one that may finally fund the life you need.

Whether or not you select to stay off money movement, downsize, promote strategically, or (like me) stay off fairness, the necessary factor is to plan for the tip recreation early.

In spite of everything, property investing isn’t actually about property. It’s about creating the monetary freedom to stay life in your phrases.