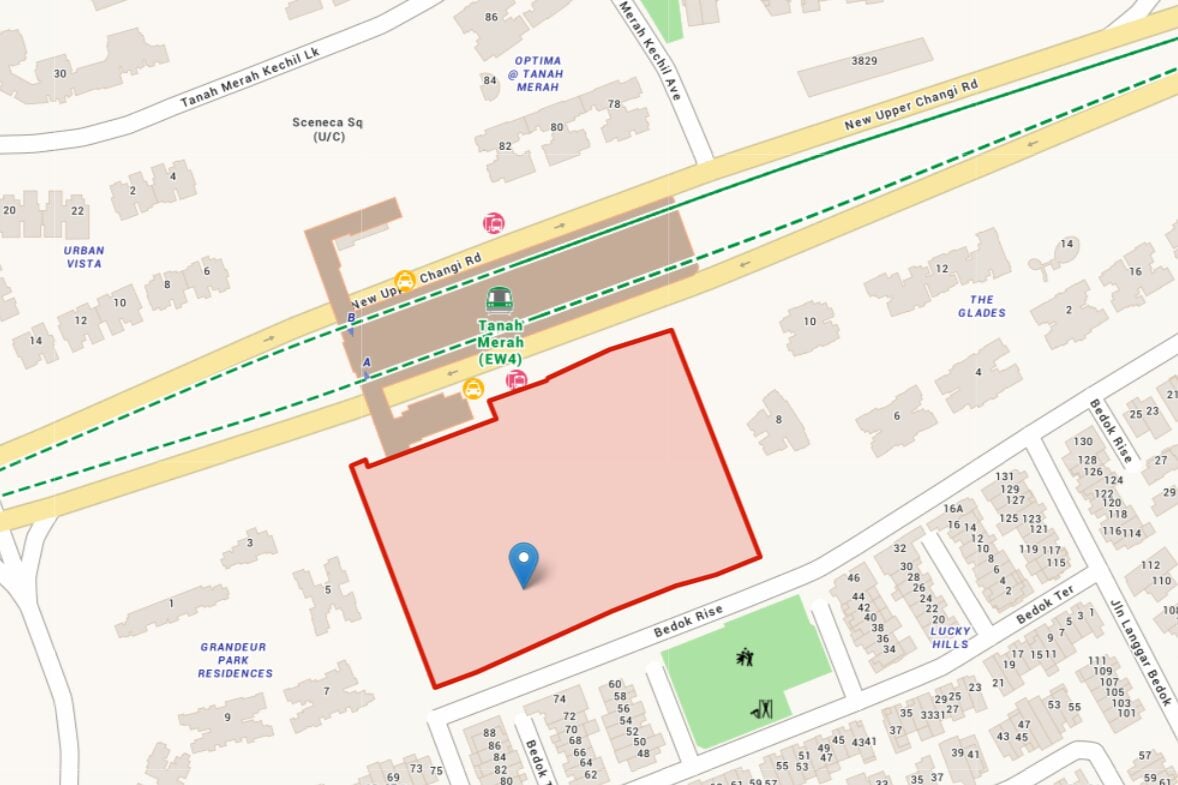

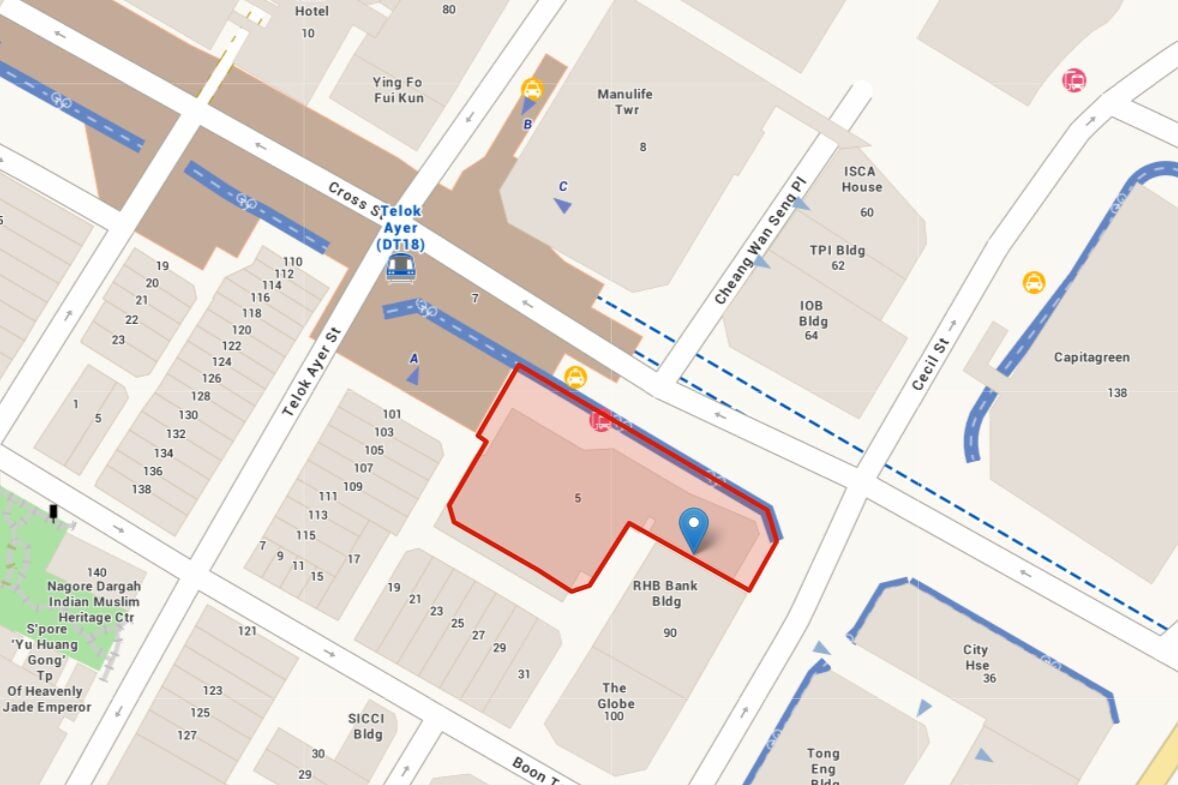

The City Redevelopment Authority (URA) has launched two land parcels beneath the Authorities Land Gross sales (GLS) Programme for the second half of 2025. One is a residential web site at Bedok Rise positioned on the Confirmed Checklist, whereas the opposite — a plot at Cross Road earmarked for long-stay serviced residences — is on the Reserve Checklist.

Test the complete record of 2H2025 GLS Programme right here!

Desk of contents

Key particulars of the September GLS web site launch

| Bedok Rise | Cross Road | |

| Location | Subsequent to Tanah Merah MRT | Former Market Road Interim Hawker Centre, close to Telok Ayer MRT |

| Website Space | 20,293.6 sqm | 2,388 sqm |

| Most GFA | 32,470 sqm | 15,045 sqm |

| Estimated Yield | ~380 personal properties | ~315 items + 500 sqm business house |

| Use | Residential | Lengthy-Keep Serviced Residences (SA2) |

| Tenure | 99 years | 99 years |

| Standing | Confirmed Checklist | Reserve Checklist |

| Tender Closing | 27 November 2025 | N/A |

Bedok Rise: The final doorstep plot to Tanah Merah MRT

The star of this spherical is undoubtedly the Bedok Rise parcel, a web site that may yield about 380 personal properties. Sitting proper subsequent to Tanah Merah MRT, it represents the ultimate GLS plot with true doorstep entry to the East–West Line station.

Builders will see sturdy locational benefits right here. Residents will seemingly take pleasure in sheltered entry to the Seneca Sq. mall simply throughout the highway, because of the present MRT underpass. The positioning can also be one cease away from Bedok city centre, which homes the built-in transport hub and a large unfold of retail, eating, and group facilities.

Schooling is one other pull issue. Households will discover a cluster of faculties close by, together with Bedok Inexperienced Major, St. Anthony’s Canossian Major, and Temasek Major, in addition to a number of secondary colleges and tertiary establishments like ITE Faculty East and the Singapore College of Know-how and Design.

This mixture of transport, retail, and colleges makes Bedok Rise a pure magnet for households and upgraders. The positioning’s connectivity enhance from the upcoming Thomson–East Coast Line (TEL) interchange will solely strengthen its enchantment to each homebuyers and buyers.

A connectivity enhance with Changi on the horizon

The TEL extension will rework Tanah Merah right into a dual-line interchange by the mid-2030s, linking the East–West Line to new locations like Expo, Changi Airport, and ultimately the upcoming Changi Terminal 5. Terminal 5 itself may also connect with the long run Cross Island Line, making Tanah Merah a crucial gateway.

For builders, which means the Bedok Rise undertaking gained’t simply cater to present commuter demand — will probably be driving on Singapore’s long-term infrastructure push. With Changi East slated for redevelopment and the airport increasing to deal with future site visitors, the positioning may appeal to consumers who see upside within the space’s evolving connectivity and progress.

How the market is prone to reply

The final GLS tender within the neighborhood was the Tanah Merah Kechil Hyperlink plot, which birthed Sceneca Residence and Sceneca Sq.. Again in November 2020, that web site drew 15 bids and was awarded at S$930 psf ppr. Sceneca Residence launched in January 2023 with sturdy gross sales momentum, shifting 60% of its 268 items within the launch weekend. As of September 2025, it’s practically totally offered at a median worth of round S$2,100 psf.

Given this backdrop, analysts anticipate wholesome however extra measured competitors for Bedok Rise. Huttons Asia tasks 4 to 5 bidders with high bids between S$1,100 and S$1,200 psf ppr. OrangeTee foresees as much as seven bidders, with a barely greater high vary of S$1,200 to S$1,300 psf ppr. PropNex echoes this outlook, anticipating 5 to seven bidders with comparable pricing.

For comparability, SingHaiyi Group gained the primary GLS web site within the upcoming Bayshore precinct in March 2025 at S$1,388 psf ppr. That web site drew eight bidders as a result of its first-mover benefit in a brand new waterfront district. Bedok Rise might not attain the identical ranges of depth, however tight OCR provide may maintain competitors eager.

Presently, unsold stock within the OCR is hovering at round 2,000 items — a comparatively low determine after sturdy take-up at launches like Springleaf Residence, which was 94% offered inside a month. Builders eyeing Bedok Rise will see the undertaking as well-timed to fulfill pent-up demand.

The tender for Bedok Rise will shut on November 27, giving builders about two months to weigh their methods.

Cross Road: A brand new try at long-stay serviced residences

Alongside Bedok Rise, URA has additionally launched a web site at Cross Road on the Reserve Checklist. This parcel, situated within the CBD close to Telok Ayer MRT, is designated for Lengthy-Keep Serviced Residences (SA2), a class launched to fulfill rental housing demand.

If triggered on the market, the positioning may home a 30-storey improvement with as much as 315 serviced items and a few business house on the primary flooring. Not like the Bedok plot, nonetheless, the Cross Road web site will solely proceed if a developer makes a suitable minimal bid.

Lengthy-stay serviced residences are nonetheless comparatively untested in Singapore. The primary awarded GLS web site on this class was Zion Street in April 2024, which Metropolis Developments Restricted and Mitsui Fudosan secured for S$1.1 billion, or S$1,202 psf ppr. That undertaking, Zyon Grand, is ready to launch in late 2025 with greater than 1,100 properties, together with 435 serviced residences.

Test the complete record of New Launches in 2025 right here!

However not all tenders have discovered success. An Higher Thomson web site noticed no bids in June 2025, whereas a Media Circle web site acquired only one lowball bid that URA rejected. Given this combined observe document, market watchers recommend the Cross Road web site might not be triggered quickly.

What this implies for the market

If Bedok Rise meets expectations, it would reinforce District 16’s observe document as a gentle performer. Non-landed personal dwelling costs within the district have already risen 45.3% from 2020 to 2025, shifting from S$1,126 psf to S$1,636 psf. That trajectory, mixed with new MRT connections and Changi’s growth, suggests sturdy fundamentals for future tasks within the space. For homebuyers, the Bedok Rise undertaking will probably be one to observe. It affords MRT comfort, faculty proximity, and a share within the east’s future progress story.

Cross Road’s final result, however, will probably be extra unsure. Nonetheless, if the Zion Street launch later this yr proves profitable, it may encourage extra builders to step into the SA2 market — maybe even triggering this downtown web site.

The submit Two GLS websites launched in September 2025: Bedok Rise and Cross Road appeared first on .