Key takeaways

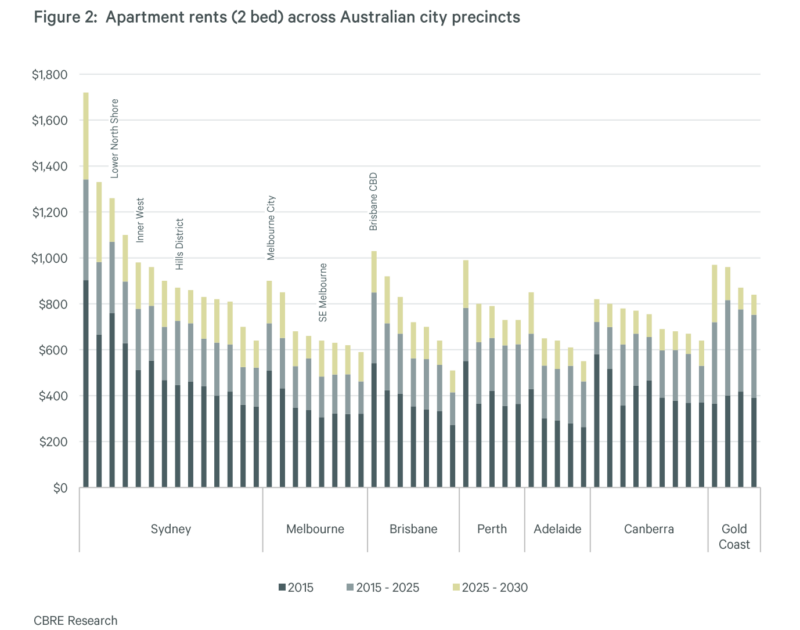

Median house rents throughout Australian capitals are forecast to rise 24% between 2025 and 2030.

By 2030, 92% of 2-bed residences will value greater than $700/week, with one-third topping $1,000/week.

Renters will proceed to face affordability challenges as demand closely outstrips provide.

Median house rents are prone to develop by 24% between 2025 and 2030, throughout Australian capital cities, based on the most recent report by Worldwide Property Consultancy, CBRE.

By 2030, 92% of 2-bed residences are forecast to have rents exceeding $700/week (33% exceeding $1000/week).

CBRE count on that capital metropolis emptiness charges will fall additional to 1.1% by 2030 from 1.8% in 2025.

These tight circumstances will endure as emptiness stays at round half of the earlier decade’s common of two.5%.

The report highlights how newly constructed residences commerce at a premium to older vintages.

For instance, newly constructed two-bedroom residences are at a 30% worth premium to older residences.

Excessive building prices and higher facilities have additionally put upward strain on rents for brand spanking new builds.

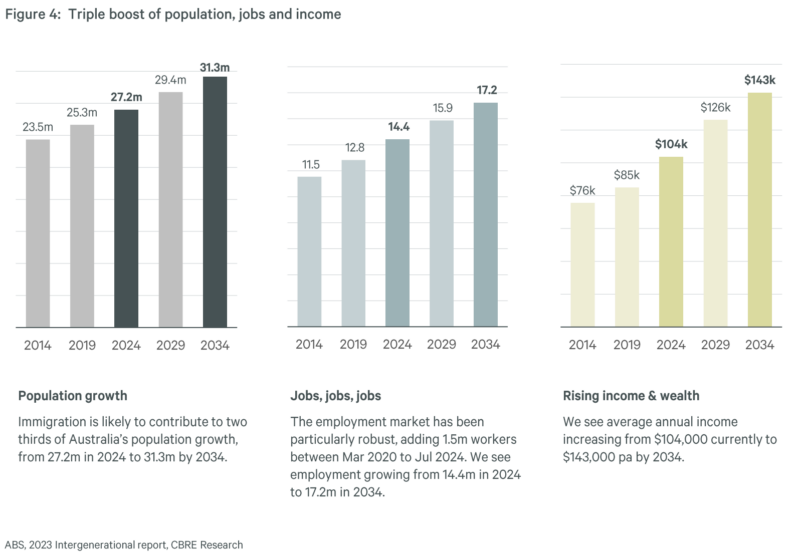

Over the subsequent 10 years, demand for housing is anticipated to learn from a triple enhance: rising inhabitants (+4.1 million), rising jobs (+2.8 million), and rising revenue (+$39k).

CBRE estimates round $960 billion of further revenue within the system to assist mortgage, hire, and different residing bills.

Based on the report, after accounting for on-costs comparable to municipal charges and strata charges, it’s cheaper to hire in all precincts throughout Australia.

Month-to-month rents are 30-40% cheaper than different purchase choices at present costs.

CBRE forecasts the longer term provide of residences is prone to hover round 60,000 p.a. over 2025-30.

Nevertheless, Australia’s projected inhabitants progress necessitates an house provide of roughly 75,000 yearly to forestall additional declines in emptiness charges.

- Sydney: Condominium supply will common 11,700 p.a. over 2025-30, nicely beneath 30,000 p.a. demand for complete housing inventory. Emptiness charges are set to fall from 2.0% to 1.2%.

- Melbourne: Condominium supply to common 9,000 p.a. over 2025-30, practically 25% beneath Sydney. Demand for housing inventory (residences and communities) is anticipated to common 38,000 models each year over the subsequent 5 years. This could proceed to drive down city-wide emptiness from 2.1% to 1.4%.

- Brisbane: Condominium supply to common 4,600 each year over 2025-2030. Demand for housing inventory (residences and communities) is prone to common 16,000 p.a., which can drive down city-wide emptiness from 1.1% to 0.7%.