Key takeaways

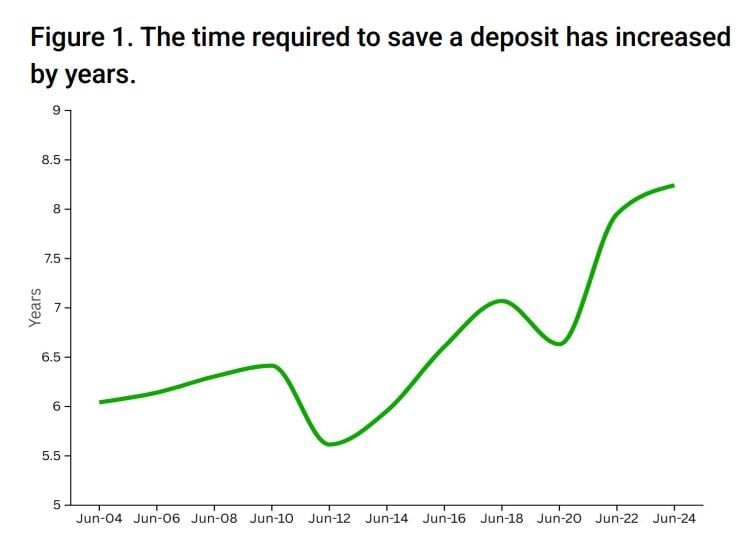

It now takes the median-income family over 8 years to save lots of for a 20% deposit, in comparison with simply 6 years within the early 2000s.

This “deposit hole” has grow to be the only greatest hurdle for first-home patrons.

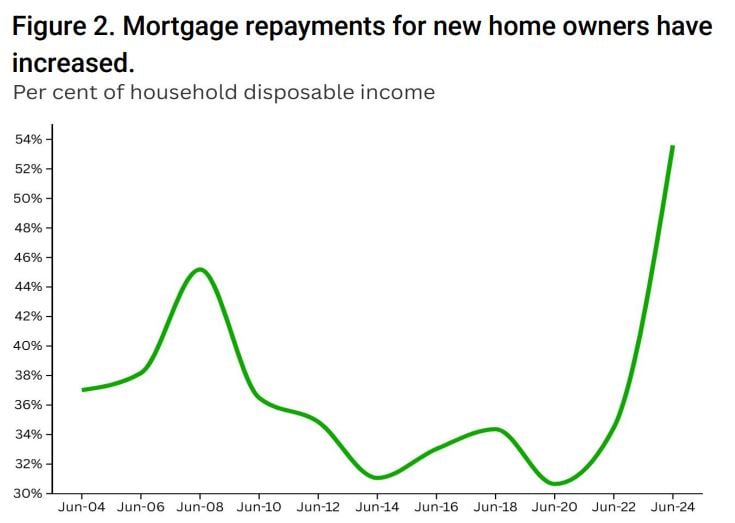

A typical new house mortgage consumes round 54% of family disposable earnings—the very best stage in not less than 20 years.

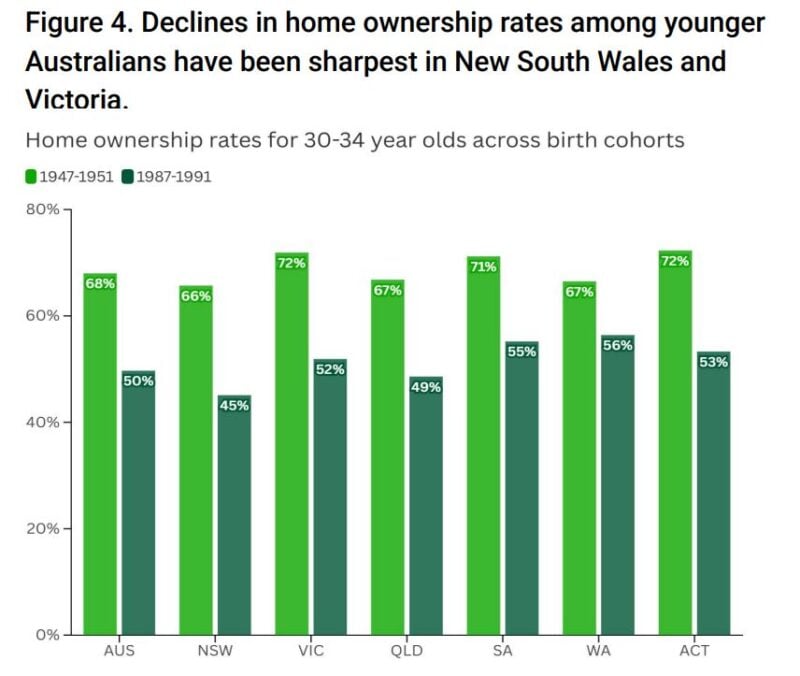

House possession charges for Australians beneath 34 have dropped sharply throughout each state, notably in NSW and Victoria.

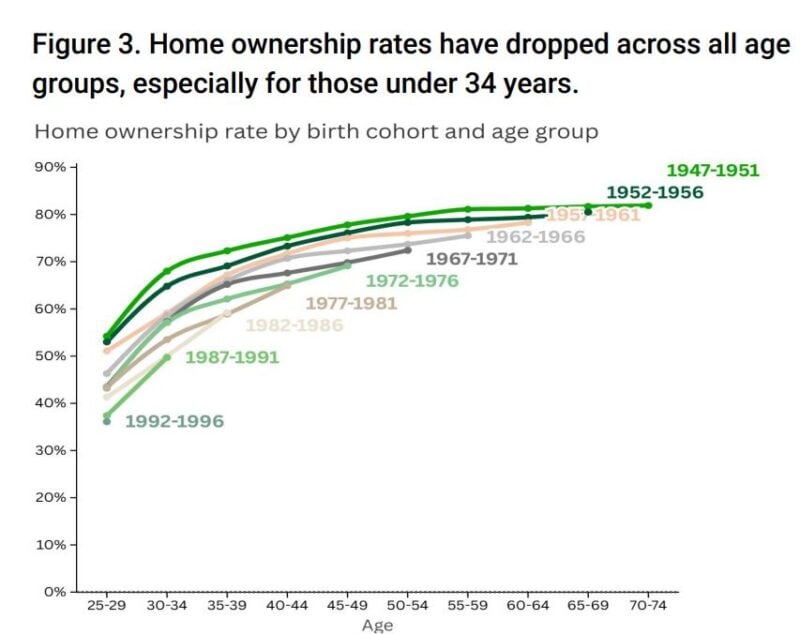

These born within the late Nineteen Eighties and early Nineties are considerably much less prone to personal a house in comparison with Child Boomers, highlighting a structural intergenerational inequality.

The decline in younger house possession is just not distinctive to Australia—it’s additionally seen within the UK, US, and Europe.

Contributing components embrace insecure work, later marriage, and fewer kids, which cut back the urgency or means to purchase a house.

Keep in mind when proudly owning a house was thought-about a ceremony of passage? A marker of stability and success?

At this time, for a lot of Australians, that milestone feels extra like a distant fantasy than a practical purpose.

What was as soon as seen because the cornerstone of economic safety has grow to be an uphill battle, with hovering property costs, stricter lending guidelines, and wages that merely haven’t stored tempo.

Proudly owning a house has at all times been the cornerstone of the Australian dream.

However for youthful generations, that dream is slipping additional out of attain.

“Reasonably priced” houses have gotten unaffordable

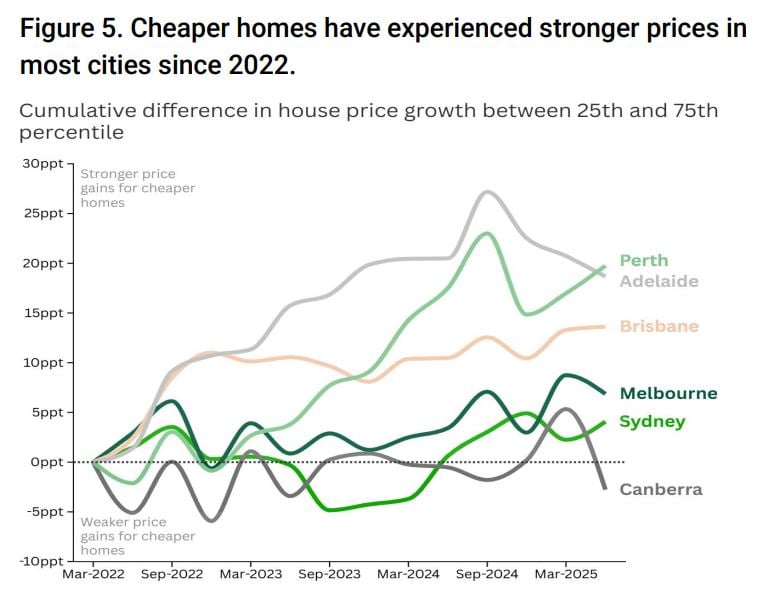

In line with analysis by Area, homes priced within the twenty fifth percentile – sometimes bought by first house patrons – have elevated in worth at a better price than premium homes (these within the seventy fifth percentile) throughout most main capitals since 2022 – because the figures under present.

Cumulative distinction in home worth progress for entry-level houses in contrast with premium houses:

- Sydney: 4.1 ppts

- Melbourne: 6.9 ppts

- Brisbane: 13.6 ppts

- Adelaide: 18.7 ppts

- Perth: 19.8 ppts

The deposit mountain

The most important barrier for first-home patrons isn’t servicing the mortgage—it’s scraping collectively the deposit.

In line with Area, a median-income family now wants greater than eight years to save lots of for a 20% deposit, in comparison with simply six years within the early 2000s.

Supply: Area

Dr Nicola Powell, Area’s Chief of Analysis and Economics, says this has reshaped the entry level into the market:

“The time it takes to save lots of a deposit has blown out dramatically.

For a lot of first-home patrons, it’s not the repayments that hold them out of the market, it’s the sheer problem of getting a foothold with such a big upfront value.”

Mortgage stress at report highs

Even as soon as patrons leap the deposit hurdle, they face a lot harder repayments.

A typical new mortgage now consumes round 54% of disposable family earnings, the very best stage in additional than 20 years.

Supply: Area

This shift has been pushed by the double blow of quickly rising property costs and the sharp carry in rates of interest after 2022.

Whereas price cuts in 2025 supplied some reduction, costs stored surging, offsetting a lot of the profit.

Dr Powell notes:

“We’ve moved right into a world the place house possession is turning into extra unique.

Decrease rates of interest in recent times did assist with repayments, however as a result of costs rose even quicker, the affordability equation truly worsened for a lot of.”

A widening generational divide

The impression is starkest amongst youthful Australians.

House possession charges for under-34s have dropped throughout each state, with the sharpest falls in New South Wales and Victoria.

Supply: Area

The info reveals that these born within the late Nineteen Eighties and early Nineties are far much less prone to personal a house than these born only a era earlier.

In distinction, many Child Boomers benefited from many years of rising values, cheaper credit score, and decrease deposit hurdles.

Supply: Area

As Dr. Powell places it:

“The generational divide in house possession is the widest we’ve seen in fashionable historical past.

Youthful Australians are being locked out, whereas current house owners see their wealth develop.”

A world pattern with native penalties

This isn’t simply an Australian story.

Research present related declines in house possession amongst youthful households throughout the UK, US, and Europe.

Contributing components embrace later marriage, fewer kids, better earnings volatility, and the rise of insecure work.

Right here in Australia, affordability pressures are additionally altering purchaser behaviour.

Decrease-priced houses have outperformed premium properties in worth progress since 2022, notably in Perth, Brisbane, and Adelaide.

Supply: Area

Search tendencies reveal extra Australians now in search of “twin”, “granny” and “duplex” properties, reflecting rising curiosity in higher-density and extra reasonably priced housing choices.

What wants to vary?

The affordability problem is structural, not cyclical.

It’s not nearly the place rates of interest sit at the moment.

Boundaries like stamp obligation, restrictive lending requirements, and surging deposit necessities are locking extra folks out annually.

Potential reforms flagged by Area embrace:

Changing stamp obligation with a broad-based land tax, to cut back upfront prices and enhance mobility.

Increasing shared-equity and low-deposit schemes, to bridge the deposit hole for first-home patrons.

Reviewing lending requirements, to strike the fitting stability between stability and entry to credit score.

Dr Powell concludes:

“If we need to restore the Australian dream of house possession, we want coordinated reform.

With out it, the divide between the housing haves and have-nots will solely deepen.”

Ultimate ideas

The numbers are clear: affordability has reached breaking level.

For first-home patrons, the problem isn’t simply paying off a mortgage, it’s discovering a technique to even get within the recreation.

And until structural reforms are made, house possession dangers turning into a privilege for the few, moderately than the muse of economic safety it has lengthy been in Australia.