Properly, summer season is formally over and it’s now September. And we’ve obtained a Federal Reserve assembly arising in two weeks!

It’s doubtlessly a giant one due to all of the strain exerted on the Fed currently from the Trump administration to decrease charges.

He has requested Powell to resign and extra just lately “fired” Fed governor Lisa Prepare dinner for occupancy fraud.

On the identical time, there’s a brand new statistician in control of the month-to-month labor report, which might drive a Fed determination.

So will an anticipated Fed charge reduce on September seventeenth decrease mortgage charges?

Mortgage Charges Went Up Final Time the Fed Lower

Recent in everybody’s minds is the truth that mortgage charges went up the final time the Fed reduce.

Or a minimum of that’s how the story goes with none context. Folks like to say this.

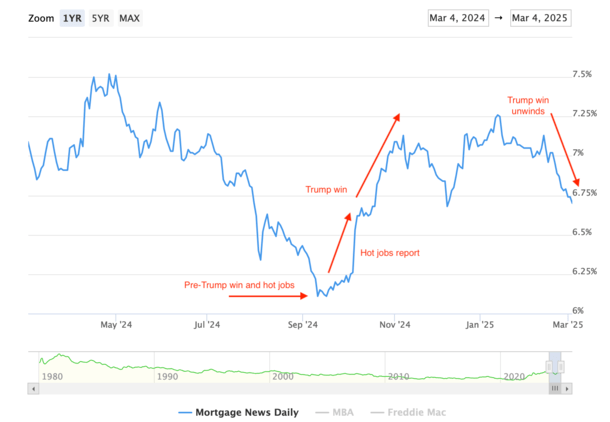

Sure, 30-year fastened mortgage charges rose when the Fed made its first reduce final September after elevating charges 11 instances in a row.

However what did mortgage charges do previous to that reduce? Properly, I ought to remind everybody that mortgage charges had been at a ~19-month low when that much-anticipated reduce was lastly introduced.

The 30-year fastened had fallen from a excessive of simply over 8% in October 2023 to simply above 6% lower than a yr later.

That’s fairly the transfer for mortgage charges in a such a brief span of time, solely actually matched by the extraordinary ascent that preceded it.

Then if we take the time to contemplate that Fed coverage strikes are largely telegraphed forward of time, it’s under no circumstances stunning that charges bounced a contact.

What actually made them go up although had nothing to do with the Fed or its reduce. It needed to do with an awkwardly timed jobs report that got here in super-hot.

The roles report is what reversed the development for mortgage charges, not the Fed reduce.

This was adopted by a Trump presidential victory, which pushed up charges even additional.

So What Will Occur This Time?

- Mortgage charges had been at a ~19-month low when the Fed reduce a yr in the past

- They bounced a bit of on the information however primarily went up due to a sizzling jobs report shortly after

- What occurs this time will rely on the information that’s launched previous to and after the report

- At all times observe the information because the Fed follows the information too!

It feels a bit of like déjà vu given it’s the identical month the place we might see a Fed charge reduce.

We obtained one final September, and now it’s the upcoming September assembly that would carry one other.

For the file, there have been additionally two cuts in November and December final yr, however there’s been a niche ever since as a result of labor and inflation (and tariffs) and different unknowns gave the Fed pause. Actually.

Then we obtained that actually dangerous jobs report for July and the Fed rapidly modified their tune to a extra dovish stance as soon as extra.

Nevertheless, it’s the identical deal this time. The 30-year fastened is now round 6.50%, its lowest level since round final October, earlier than the recent jobs report.

Sarcastically, it’s principally on the identical degree it was proper after that jobs report got here out for September 2024.

That’s what pushed the 30-year fastened as much as 6.50% from 6.25%. Not the Fed charge reduce on the time.

The identical factor might occur this time if a sizzling jobs report or CPI report had been to be launched shortly after they reduce, assuming they reduce on September seventeenth.

Granted, extra cool knowledge launched across the identical time might push mortgage charges down even additional and make the Fed reduce seem like the explanation why.

And that’s precisely what I’m attempting as an example right here. It’s not the Fed, however the financial knowledge that comes out each week or month.

The Fed solely meets eight instances per yr, whereas mortgage charges can change each day.

In different phrases, the underlying knowledge issues much more than the Fed, and it’s that very knowledge that drives the Fed’s coverage anyway.

So with the Fed you’re actually simply getting a reinforcement of the information, not a novel or opposing opinion on the place issues are going.

Learn on: How are mortgage charges decided?