Key takeaways

Nationwide residence costs rose 0.5% in August, marking the eighth consecutive month of progress and taking residence values to a contemporary document excessive.

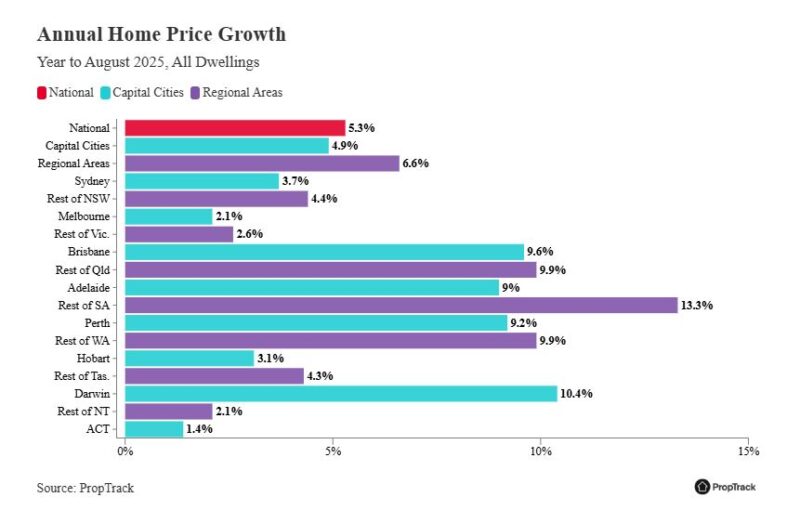

Nationwide residence costs are up 5.3% over the previous yr, including round $47,900 to the worth of the median residence, and have surged 50.4% prior to now 5 years.

Costs in capital metropolis markets rose 0.5% in August and are up 4.9% year-on-year, with values at document highs.

Among the many capitals, Darwin (+0.8%) and Sydney (+0.7%) led month-to-month progress, whereas Hobart was the one capital market to document a fall (-0.5%).

Over the previous yr, regional South Australia (+13.3%), Darwin (+10.4%), regional Queensland (+9.9%) and regional Western Australia (+9.9%) recorded the strongest positive aspects.

Costs in Melbourne rose 0.3% in August and at the moment are simply 0.6% beneath their earlier 2022 peak, virtually totally recovered after a number of years of underperformance.

Regional costs climbed 0.3% in August and are up 6.6% year-on-year, outpacing the capitals and sustaining a stronger five-year progress document (65.2% vs 46.0%), bolstered by affordability and way of life enchantment.

Nationwide residence costs rose 0.5% in August, marking the eighth consecutive month of progress and taking residence values to a contemporary document excessive, based on PropTrack.

PropTrack information exhibits that nationwide residence costs lifted in August, rising 0.5% to a brand new document excessive.

This marks eight straight months of progress because the housing market positive aspects momentum following the collection of rate of interest cuts this yr which have boosted borrowing capacities, improved sentiment and drawn consumers again.

Consequently, the housing upswing, as soon as narrowly led by a handful of cities, is broadening and shutting the hole between outperformers and laggards, ushering in a extra uniform section of value restoration throughout the capital cities.

Eleanor Creagh, Senior Economist at PropTrack explains:

“Demand has re‑accelerated in Sydney and Melbourne marking a turnaround from the slower circumstances noticed in late 2024.

Melbourne is closing in on its 2022 peak, with relative affordability and powerful inhabitants progress restoring its enchantment.

Darwin has swung from inertia in 2024 to main annual progress amongst the capitals. Over the previous yr, among the many capitals, Darwin (+10.4%) has recorded the strongest positive aspects amid a surge in investor curiosity.

Lending information from the ABS exhibits the variety of investor loans within the Northern Territory within the 2nd quarter of 2025 has double in comparison with the identical interval in 2024.

In contrast, Adelaide and Perth are nonetheless rising briskly, however at a slower tempo in comparison with the identical interval final yr.”

Home and unit costs elevate in August

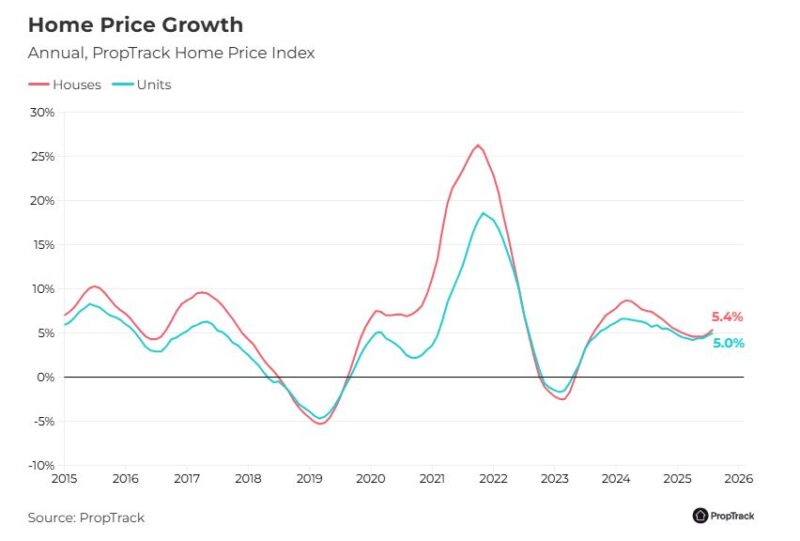

The report additionally exhibits that nationally, home and unit costs lifted 0.48% in August.

Nationwide home costs have lifted 5.43% over the previous yr, an increase equating to virtually $55,000.

Development in unit values (5.04%) has been comparable by means of the identical interval, with annual progress of $33,600.

Key findings from the August 2025 Report:

- Nationwide residence costs rose 0.5% in August, marking the eighth consecutive month of progress and taking residence values to a contemporary document excessive.

- Nationwide residence costs are up 5.3% over the previous yr, including round $47,900 to the worth of the median residence, and have surged 50.4% prior to now 5 years.

- Costs in capital metropolis markets rose 0.5% in August and are up 4.9% year-on-year, with values at document highs.

- Among the many capitals, Darwin (+0.8%) and Sydney (+0.7%) led month-to-month progress, whereas Hobart was the one capital market to document a fall (-0.5%).

- Over the previous yr, regional South Australia (+13.3%), Darwin (+10.4%), regional Queensland (+9.9%) and regional Western Australia (+9.9%) recorded the strongest positive aspects.

- Costs in Melbourne rose 0.3% in August and at the moment are simply 0.6% beneath their earlier 2022 peak, virtually totally recovered after a number of years of underperformance.

- Regional costs climbed 0.3% in August and are up 6.6% year-on-year, outpacing the capitals and sustaining a stronger five-year progress document (65.2% vs 46.0%), bolstered by affordability and way of life enchantment.

Outlook

Proptrack experiences that with three RBA fee cuts delivered this yr and additional reductions anticipated, borrowing prices are easing, sentiment has improved, and demand is rebuilding as we head into the spring promoting season.

Public sale clearance charges have strengthened and nationally enquiries per itemizing are at a three-year excessive, signalling renewed competitors.

Ms Creagh additional mentioned:

“Purchaser curiosity is accelerating in Melbourne, Darwin and Hobart, with enquiries surging and competitors broadening throughout suburbs. Melbourne is now closing in on its 2022 peak, supported by relative affordability and powerful inhabitants progress. Within the areas, demand is strengthening most in Victoria and New South Wales, the place affordability and way of life enchantment are drawing consumers.

In contrast, purchaser demand is normalising in Perth, Adelaide and Brisbane after a number of years of outperformance, aided by a elevate in listings. This stabilisation suggests value progress in these markets is prone to average, whereas beforehand lagging markets collect momentum.

Stretched affordability continues to restrict the depth of the upswing, however inhabitants progress, constrained new housing provide and the growth of the Dwelling Assure Scheme from October will preserve upward stress on costs.

As we enter spring, circumstances level to continued value progress, although the tempo will differ throughout markets.”