Key takeaways

Traders are again in cost. Their confidence available in the market alerts optimism for progress, but additionally raises affordability challenges for homebuyers.

Homebuyer exercise is shifting east. Queensland and the smaller states are benefiting most, whereas WA cools after its sturdy run.

Provide stays the Achilles’ heel. New builds are falling additional behind demand, setting the stage for continued worth pressures.

Refinancing is evolving. Extra debtors are negotiating higher offers with their current lenders, a pattern price watching as charges transfer decrease.

Australia’s housing market is displaying its standard resilience, however the panorama is shifting in some necessary methods.

The newest Mortgage Insights Report from Cash.com.au reveals that whereas general lending progress has slowed, buyers are roaring again into the market and, for the primary time in years, are nearly neck and neck with homebuyers in terms of new loans.

This clearly has vital implications for affordability, housing provide, and the steadiness of energy between buyers and proprietor occupiers.

Investor lending again in pressure

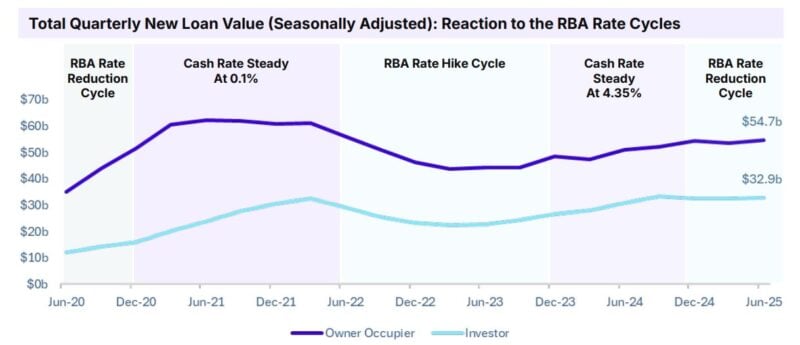

Investor lending rose 12% within the 12 months to June 2025, easing from final 12 months’s 19%, however nonetheless increasing at thrice the tempo of owner-occupier lending, which managed simply 4% progress.

Supply: Cash.com.au

In actual fact, buyers accounted for 38% of all new lending, the most important share since 2021.

With 196,699 loans issued, volumes are near their 2022 peak, clear proof that buyers see alternative as rates of interest come down and rental yields rise.

Tip: This shouldn’t shock us. Property buyers have a tendency to maneuver sooner than owner-occupiers once they see a window of alternative.

With falling charges, tighter rental markets, and expectations of capital progress, buyers are shifting in whereas many first house consumers stay on the sidelines.

Homebuyers shift again East

One of many extra fascinating shifts within the report is geographic.

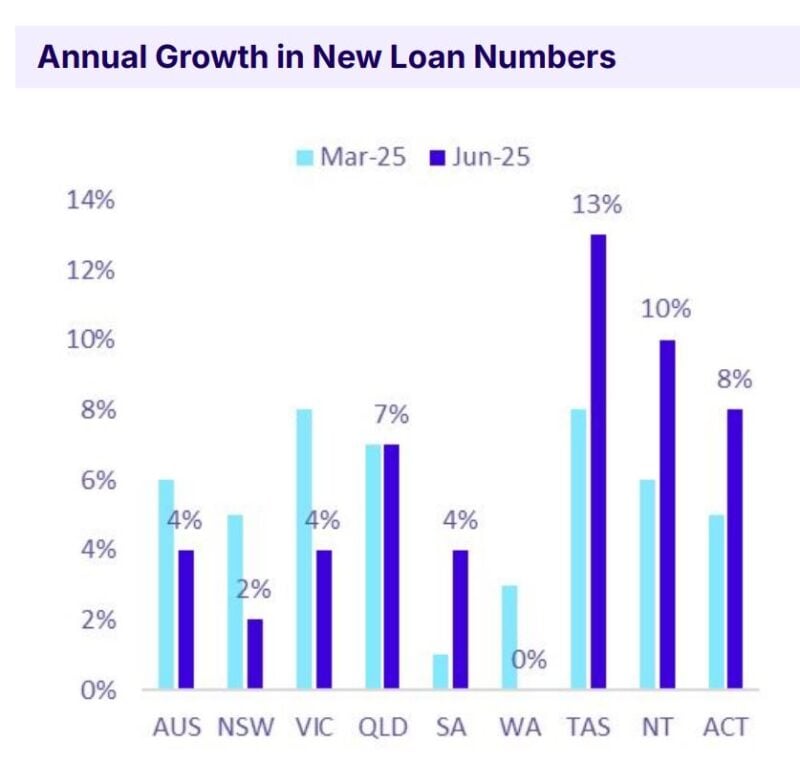

Queensland stood out with the strongest annual progress in owner-occupier loans at 7%, whereas Western Australia, the darling of the market over the previous few years, recorded no progress for the primary time since mid-2024.

Supply: Cash.com.au

We’re additionally seeing momentum in smaller markets like Tasmania (+13%), the Northern Territory (+10%), and the ACT (+8%).

This displays each affordability constraints within the larger cities and the continuing seek for liveability and worth.

Observe: In easy phrases: WA is cooling, the East Coast is heating up once more, and the smaller states are attracting consumers who can’t or gained’t stretch for Sydney or Melbourne.

New builds nonetheless in bother

Should you’re hoping that new development will remedy Australia’s continual housing scarcity, the info isn’t encouraging.

Loans for brand spanking new dwellings fell sharply, down 8% within the 12 months to June 2025.

Development loans slowed from 9% progress to only 3%, and land loans slid additional into damaging territory.

That is the fact of our provide drawback: whilst demand rebounds, supply-side constraints stay.

With no main turnaround in development capability, elevated demand dangers driving costs larger relatively than bringing steadiness to the market.

Refinancing returns, however with a twist

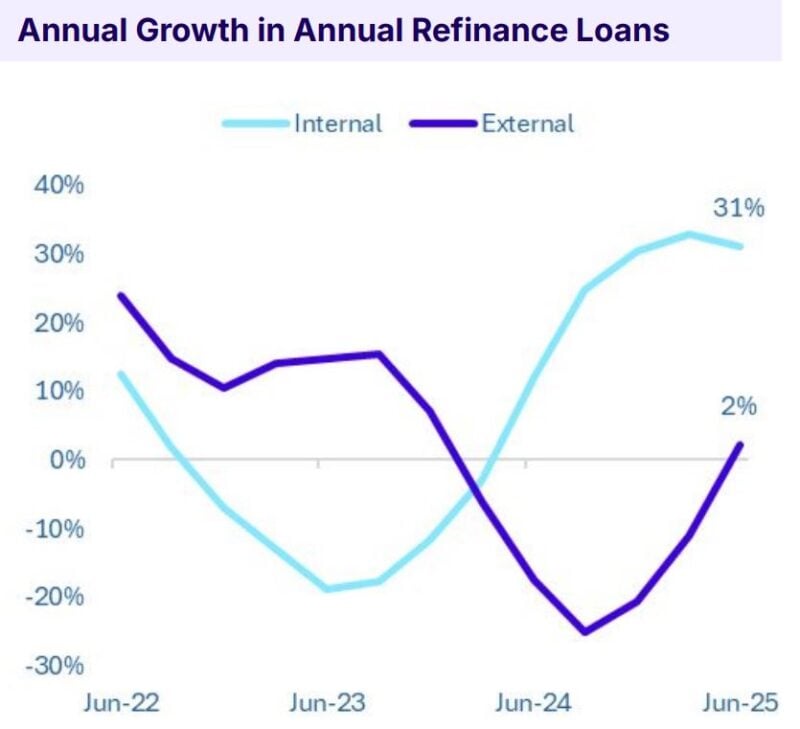

Refinancing is again close to report highs, with 585,317 loans over the 12 months, simply shy of the 2023 peak.

However right here’s the twist: debtors are more and more refinancing with their current lender, relatively than procuring round.

Inner refinancing jumped 31% in comparison with simply 2% progress externally.

Supply: Cash.com.au

That means banks are working tougher to carry onto their prospects, whereas many debtors choose the comfort of staying put relatively than switching lenders.

The underside line

Australia’s property market is getting into a brand new section.

Traders are again in pressure, owner-occupiers are re-emerging, however with out an enchancment in housing provide, we threat repeating the identical cycle of rising costs and affordability challenges.

For seasoned buyers, this surroundings represents alternative with strategic property funding being the important thing to constructing long-term wealth whereas contributing positively to the broader housing market.

Should you’re like many property buyers, you are most likely questioning what’s the suitable factor to do at current.

Do you have to purchase, must you promote, or must you simply wait?

You possibly can belief the workforce at Metropole to give you course, steerage, and outcomes.

Whether or not you’re a newbie or an skilled investor, at occasions like we’re presently experiencing you want an advisor who takes a holistic strategy to your wealth creation and that’s precisely what you get from the multi-award-winning workforce at Metropole.

We assist our shoppers develop, defend and go on their wealth via a spread of providers together with:

- Strategic property recommendation – Enable us to construct a Strategic Property Plan for you and your loved ones. Planning is bringing the long run into the current so you are able to do one thing about it now! Click on right here to study extra

- Purchaser’s company – As Australia’s most trusted consumers’ brokers we’ve been concerned in over $4Billion price of transactions creating wealth for our shoppers and we will do the identical for you. Our on the bottom groups in Melbourne, Sydney, and Brisbane carry you years of expertise and perspective – that’s one thing cash simply can’t purchase. We’ll enable you to discover your subsequent house or an investment-grade property. Click on right here to find out how we may also help you.

- Property Improvement – We allow you to grow to be an “armchair developer” and get all the advantages of property growth with out getting your arms soiled. We take the hassles out of your funding by helping you with all of the experience you want, from idea to completion, together with development. Click on right here to see if it’s the suitable means so that you can develop your portfolio.

- Wealth Advisory – We will give you strategic tailor-made monetary planning and wealth recommendation. Click on right here to study extra about we may also help you.

- Property Administration – Our stress-free property administration providers enable you to maximise your property returns. Click on right here to search out out why our shoppers get pleasure from a emptiness fee significantly beneath the market common, our tenants keep a mean of three years, and our properties lease 10 days sooner than the market common.