Final Friday, Moody’s Scores downgraded the U.S. sovereign credit standing from Aaa to Aa1. In consequence, Treasury yields surged Monday morning, with the 10-year be aware leaping to 4.53% and the 30-year invoice surpassing 5%. The S&P 500 fell by about 50 factors, and the Nasdaq dropped 1.3%.

Whereas Moody’s downgrade definitely isn’t stunning, it’s one other stream of gasoline lighting an ever-engulfing firestorm of financial information this yr, and it’s one thing price speaking about. After all, with any piece of stories like this, there may be the potential for a cascading impact via the varied markets, together with actual property.

So, What’s a Sovereign Credit score Score, Anyway?

It’s best to consider America’s credit standing like your private credit score rating. TransUnion (Fitch) and Experian (S&P) have been already ranking us at an 825, however Equifax (Moody’s) simply dropped us from an 850 to an 825.

That issues loads as a result of it’s a measure of danger. Your credit score rating is just an evaluation of how dangerous it’s to lend to you. At 850, a creditor will give you the perfect rates of interest since you are primarily an ideal borrower who poses nearly no danger of default.

When you had a 550 rating, nevertheless, then the creditor would take an excessive amount of warning in working with you, if in any respect, and most definitely cost you the very best rates of interest to be able to get extra of their a reimbursement faster.

Now, for a rustic like america, comparable logic applies. The U.S. Treasury points debt within the type of Treasury bonds. These bonds don’t pay loads in curiosity, however they’re thought-about very secure. A ten-year Treasury invoice in good instances can pay perhaps 3%-4%, however usually, the yields are decrease when the economic system is doing properly as a result of buyers really feel like they will make more cash in different belongings like shares. When instances are dangerous, buyers flock to T-bills to guard their cash, driving yields up. It’s a supply-and-demand equation.

However with the newest downgrade from Moody’s, it’s suggesting, “Hey, perhaps the U.S. isn’t as reliable because it was once.”

What’s Behind Moody’s Downgrade?

Moody’s blamed “political dysfunction” and a ballooning deficit pushed by entitlement applications like Medicaid, Medicare, and Social Safety, in addition to a rising share of spending going towards curiosity funds.

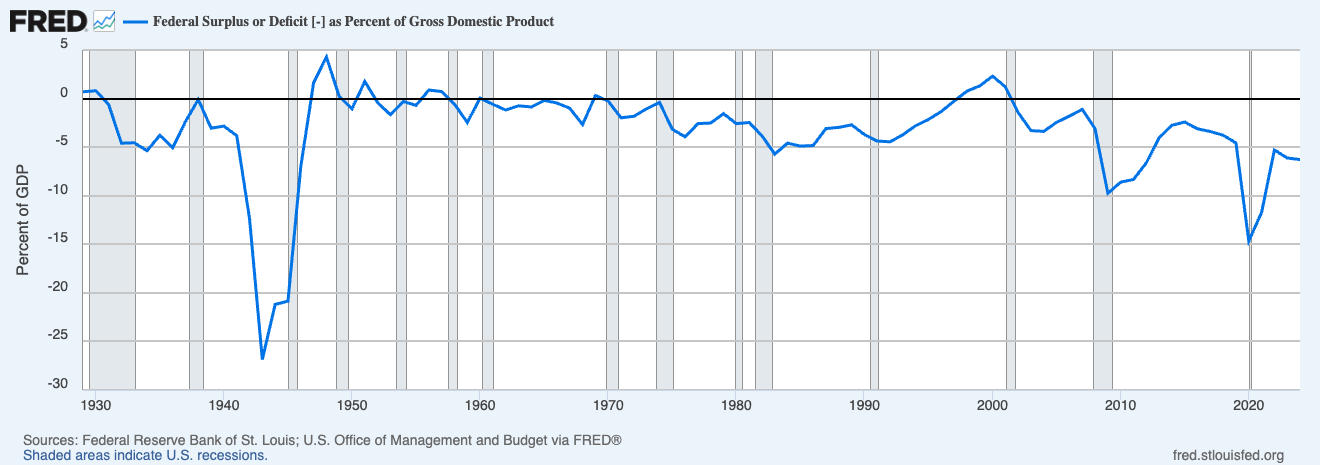

The actual perpetrator, as I’ll by no means fail to level out, is Congress. They spend an excessive amount of, battle too usually, and don’t have any actual plan to repair any of it. The U.S. deficit has topped 6% of GDP for 2 years in a row. For context, the one instances within the final 100 years when the deficit has made up 6% or extra of GDP was throughout World Warfare II, the Nice Recession, and 2020, when COVID-19 struck.

As we speak, we simply casually spend that quantity.

Is it a Huge Deal?

As a response to the information, 10-year Treasury yields have spiked to 4.5%, whereas 30-year yields got here in above 5% for a interval. In the meantime, the S&P 500 fell 0.5%, the Nasdaq slid 0.7%, and even heavyweight blue chip shares like Apple and Walmart have been dragged down.

So, does the downgrade matter?

Kind of. Let’s be clear: Moody’s didn’t reveal some surprising new info. Everybody already knew the U.S. runs an enormous deficit and that the political local weather was dysfunctional. We’ve identified this for years.

However that’s not the purpose.

Markets are forward-looking, sure. However they’re additionally delicate to narrative shifts, as we now have been painfully reminded of final month. If all three main ranking companies now agree that the U.S. doesn’t deserve an ideal rating, that’s not only a technical change—it’s a message. One that might ripple into greater borrowing prices, jittery bond markets, and extra warning from overseas buyers.

This is the place issues get tough. In principle, a decrease credit standing ought to make it dearer for the U.S. authorities to borrow cash. Increased yields = greater curiosity funds = extra pressure on the funds.

However in follow? U.S. Treasuries are nonetheless the most secure asset round. When issues go south globally, buyers nonetheless purchase U.S. debt. Buyers continued to put money into america even after S&P downgraded our ranking in 2011. They continued to put money into 2023 after Fitch’s downgrade. The query is whether or not buyers will proceed to take action, and the reply to that’s sure, however in some unspecified time in the future, we’ll should cease taking that with no consideration.

To color my level, I feel within the case of 2011, we have been coming off a significant recession that was world. On a comparative foundation, the U.S. was a far safer place to maintain your cash than some other nation. However at present, we’re 5 years faraway from a pandemic-induced recession, two to a few years after an ideal inflation wave, and a surprisingly resilient job market. Most economies are doing high quality, together with ours.

So why would our credit standing get dropped now?

For one, the opposite two ranking corporations had dropped us a number of years again, so that is simply Moody’s catching up. Two, I feel it has to do with the newest turmoil over the tariff state of affairs and a few of the information about additional tax cuts coming down the pipe that might make the deficit much more stark.

And at last, mixed with basic political instability and the truth that the BRICS nations are exploring de-dollarization and a stronger-than-2011 China, which, regardless of its upside-down inhabitants pyramid and newest financial woes, presents a better problem to america as a world energy than ever earlier than, I feel it’s secure to say that the ranking drop is an instance of the U.S. being held to the next commonplace in a world with extra parity.

Is it the tip of the world? No. Does it change life at present? No. Might it change life tomorrow? Uncertain.

However is it a message? Sure. Ought to we pay attention? In all probability.

What About Actual Property?

At this level, what doesn’t have an effect on the housing market?

Probably the most apparent influence right here is mortgage charges. Your typical 30-year fastened price is tied to the 10-year Treasury yield, which, as I mentioned earlier, simply spiked. As long as that is still elevated, you’ll proceed to see mortgage charges circle that 7% quantity.

As for the opposite segments of the market, it simply provides one other layer to the narrative that the sky is falling. Shoppers are pulling again on spending, GDP development is damaging for the primary time in a couple of years, the tariff state of affairs final month didn’t assist with general financial confidence, the Fed doesn’t appear more likely to make a transfer on charges anytime quickly, and consequently, you’re seeing increasingly more would-be patrons maintain off from shopping for a property.

Not simply because it’s nonetheless costly however as a result of they, too, like every good investor, don’t wish to purchase on the high of the market after they really feel like the ground is about to fall out from underneath them.

Do I count on a housing crash? Under no circumstances. However to any bystander who isn’t as grossly invested in actual property knowledge as I’m, my colleagues at BiggerPockets, otherwise you—actual property is all the time one foreclosures away from mass hysteria.

A Actual Property Convention Constructed In another way

October 5-7, 2025 | Caesars Palace, Las Vegas

For 3 highly effective days, have interaction with elite actual property buyers actively constructing wealth now. No principle. No outdated recommendation. No empty guarantees—simply confirmed techniques from buyers closing offers at present. Each speaker delivers actionable methods you may implement instantly.