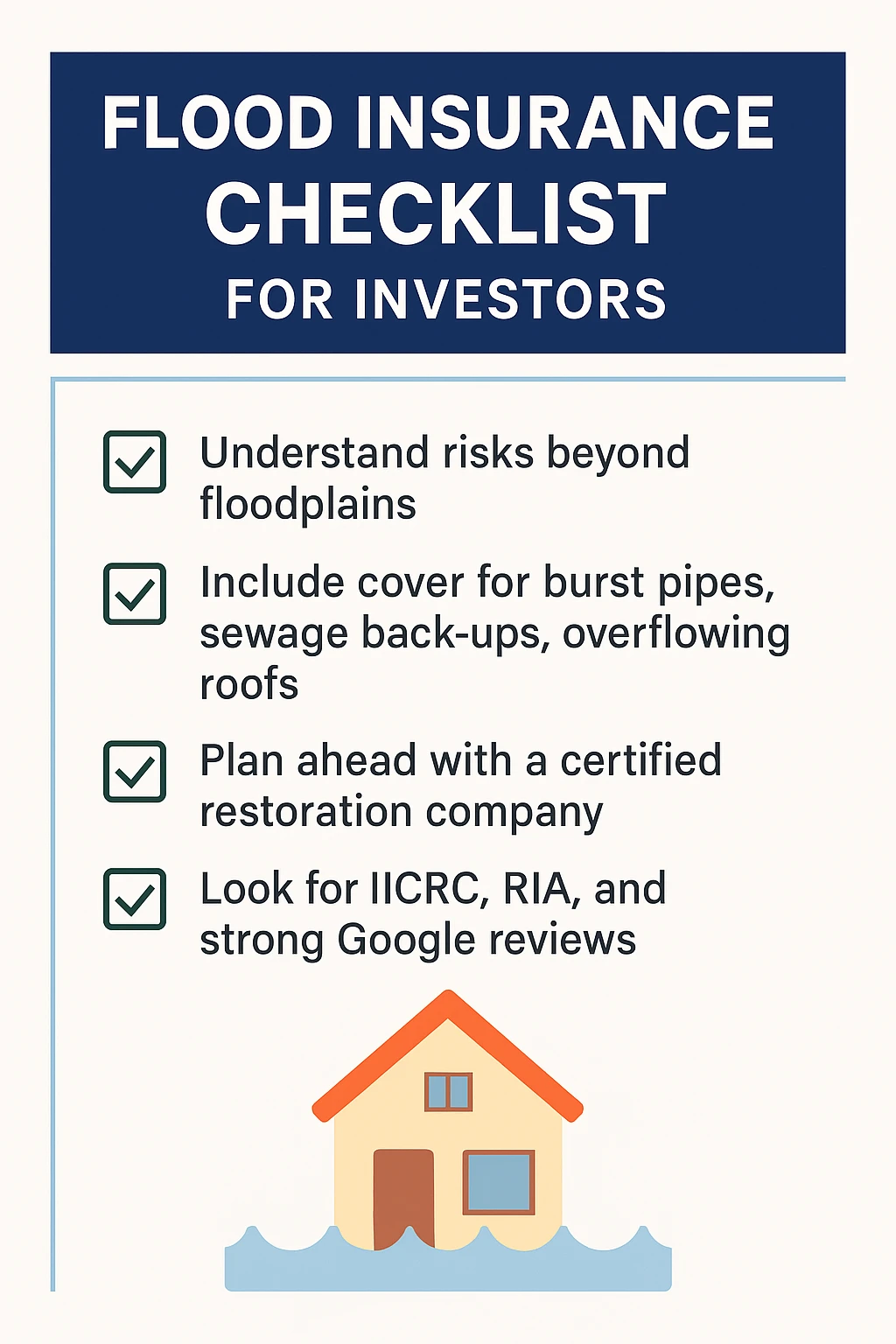

When most property buyers consider flood insurance coverage, they image rivers breaking their banks, storm surge on the coast, or homes inbuilt low-lying flood plains. However the actuality is much broader. Yearly, 1000’s of Australian properties undergo water harm not from pure floods, however from burst pipes, leaking home equipment, defective sprinkler techniques, sewage back-ups and overflowing roofs.

But many landlords stay uninsured for flood-related occasions — actually because they assume their properties aren’t “in danger.” The results might be devastating, with restore prices spiraling into the tens and even a whole bunch of 1000’s of {dollars}.

Why Flood Insurance coverage Issues for Each Investor

- Water Harm Isn’t Simply About Floodplains

Even residences on the fifth ground can undergo main harm from a burst pipe in an upstairs toilet. Insurance coverage claims for water harm are among the many most typical in Australia, and so they not often contain rivers or storm surges. - Tenant Security and Retention

A water-damaged property isn’t simply costly to restore — it disrupts tenants’ lives. Lack of hire, emergency relocations, and property disputes can comply with. With the suitable insurance coverage, landlords can minimise monetary loss and keep skilled relationships with tenants. - Defending Your Lengthy-Time period Asset Worth

Water intrusion left untreated rapidly results in mould, structural points, and long-term deterioration. With out protection, many landlords are pressured to chop corners, eroding the long-term worth of their funding.

Be Ready, Not Preyed Upon

Observe: Insurance coverage is one line of defence — however buyers additionally must be ready with the suitable skilled companions. Within the restoration trade, some operators prey on catastrophe conditions, charging double or triple customary charges when landlords are determined.

The higher technique is to arrange prematurely:

- Save the variety of a respected, licensed restoration firm earlier than catastrophe strikes.

- Search for suppliers which are IICRC-certified, members of the Restoration Trade Affiliation (RIA), and supported by sturdy Google critiques.

- Select firms which are trusted by main insurers, to keep away from disputes and inflated prices.

By doing this, landlords shield themselves from inflated payments and guarantee their property is restored correctly the primary time.

Ultimate Ideas

For property buyers, insurance coverage is not only about compliance — it’s about safety, planning, and peace of thoughts. Flood insurance coverage (within the broadest sense) is important, even when your property isn’t in a “flood zone.”

Tip: And simply as importantly, be ready with the suitable skilled help. The perfect time to decide on a trusted restoration associate is earlier than catastrophe strikes.

👉 To be taught extra about how skilled restoration works — and why buyers can’t afford to miss water harm —go to Reztor Restoration.