Key takeaways

Approvals should not the issue; supply is. With 219,000 properties already beneath development and completion occasions ballooning, the actual bottleneck lies within the construct part, not planning reform.

Whereas state and native governments give attention to approvals and bettering the feasibility of recent initiatives, constructing corporations proceed to be stretched skinny throughout an already swollen pipeline and decreasing margins.

With completion occasions already above common, and development prices elevated, it appears an odd time to be incentivising extra dwelling approvals and commencements to the backlog of labor to be accomplished.

Forward of the Nationwide Productiveness Summit, the evaluation proposes it’s time to shift the coverage focus from demand stimulation and approvals to sustainable, scalable supply—earlier than turning up the faucet on a system already at capability.

Whereas state and native governments give attention to approvals and bettering the feasibility of recent initiatives, constructing corporations proceed to be stretched skinny throughout an already swollen pipeline and decreasing margins.

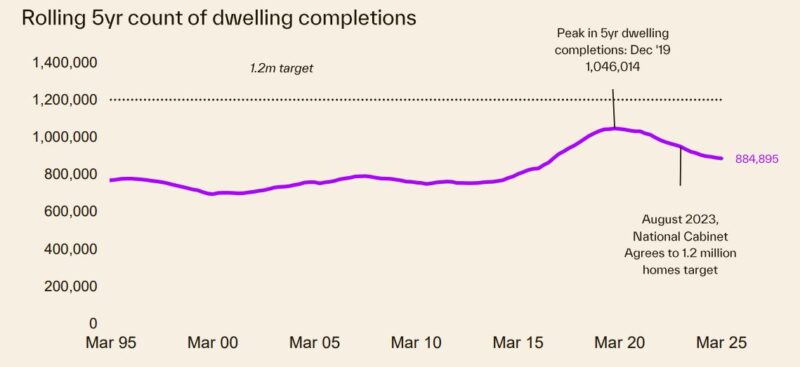

From the very announcement of the Nationwide Cupboard’s plan to construct 1.2 million new properties in 5 years in August 2023, many within the business thought it was unachievable.

The core of the issue with any authorities goal for brand new dwellings is that authorities can’t affect most of the components that decide demand and provide.

Whereas state and native governments give attention to approvals and bettering the feasibility of recent initiatives, constructing corporations proceed to be stretched skinny throughout an already swollen pipeline and decreasing margins.

Trying on the development pipeline exhibits that coverage change is urgently wanted within the enablement of high quality development, relatively than new dwelling approvals.

The teachings of 2019

The closest Australia got here to 1.2 million dwelling completions in 5 years was on the finish of 2019.

This was largely as a result of the market was very totally different to what it’s now:

The money charge averaged 1.6%, versus the typical 4.18% since July 2024.

Models made up a median 46% of approvals within the 5 years to 2019, versus 37% previously 5 years, so dwelling completion was extra scalable.

Buyers made up an even bigger a part of demand, supporting lots of presales in off-the-plan residence growth.

ABS information exhibits buyers peaked at 44.8% of recent housing finance within the June quarter of 2015 nationally, and 55% in NSW.

International funding in new residential properties was increased, with NAB reporting international purchaser purchasers of recent properties holding above 10% by means of a lot of the 2010s.

Whereas lots of new dwellings have been accomplished, this didn’t essentially result in good housing outcomes.

House possession charges fell between June 2014 (67.2%) and June 2020 (66.2%), capital development outcomes for buyers have typically been very poor for 2010s residences, and defects have been so rife that some new dwellings couldn’t even be lived in.

Extra dwelling completions should not essentially a mark of success for the Australian housing panorama.

State governments can convey us to water, however markets make us drink

Quick ahead to the 2020s, and a few classes have been clearly discovered from the 2010s.

Lending is extra prudent, construct high quality is best, and new residences are geared to bigger floorplans with owner-occupiers in thoughts.

To maneuver the dial on the numbers state and native governments have enacted adjustments to hurry up planning and approval processes and enhance new house purchases.

Lately, the NSW authorities has launched a sample guide for authorised designs, applied sweeping upzones for extra density, and flagged presales finance ensures for eligible builders.

Victoria has seen comparable sweeping upzones, is providing substantial stamp responsibility concessions on off-the-plan strata properties, and the Queensland authorities has additionally signalled initiatives to streamline growth approvals.

Regardless of these adjustments, dwelling approvals have typically remained very low.

Why? That is partially due to comparatively excessive rates of interest, affordability constraints, and new purchases being introduced ahead beneath the HomeBuilder Scheme (which was overlaid with different incentives such because the then just lately launched First House Assure).

Patrons can also be missing confidence in new builds following a surge in development prices between 2021 and 2023.

Whole dwellings authorised averaged 15,611 per thirty days over the 12 months to June, down from the last decade common of 16,770, and nicely beneath the typical 20,000 wanted for 1.2 million properties in 5 years.

That being mentioned, there was a giant soar in unit approvals by means of June, surging 34%.

Nonetheless, this has occurred in opposition to a 50-basis level reduce within the money charge, and follows a pointy drop in April.

State and native governments can affect dwelling approvals, however rates of interest are an especially essential issue as as to if there’s market demand for brand new housing and whether or not builders will search approval for brand new initiatives.

Unit approvals are averaging about 7,000 a month, however that is nicely beneath the height discovered by means of the extra beneficial market situations of the 2010s (when month-to-month unit approvals peaked at virtually 13,000 in November 2017).

Early levels should not the place the main focus is required

Approvals may transfer increased within the coming months, as latest zoning reforms and incentives for brand new builds on the state degree coincide with falling rates of interest.

However this might current an issue for the development business: it could add extra new initiatives to an already swollen pipeline.

It’s like turning up the faucet on a shower that’s already full.

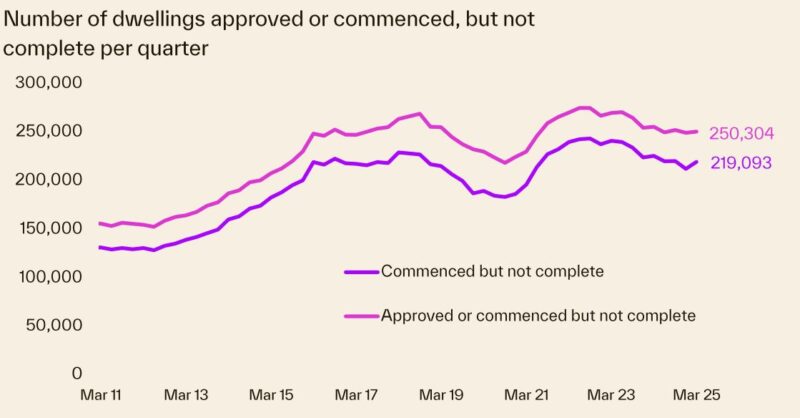

Constructing exercise information from the ABS exhibits there have been simply over 219,000 dwellings beneath development within the March quarter of 2025, and an additional 30,000 dwellings which have been authorised, however haven’t but commenced development.

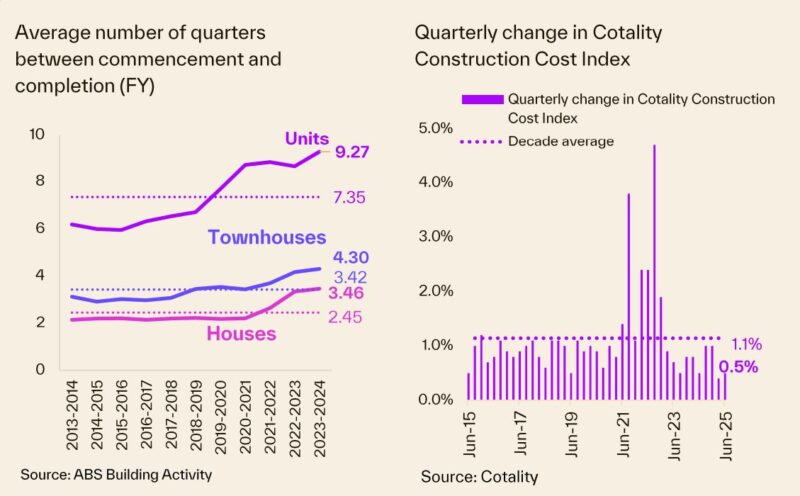

Whereas the variety of dwellings within the pipeline commenced and never full isn’t too dissimilar with the rise within the 2010s, it has been related to an irregular enhance in time to finish dwellings, a rise in development prices, and different capability constraints which isn’t seeing that quantity development down as rapidly because it did between 2018 and 2020.

Successfully, dwellings are being authorised however getting ‘caught’ within the graduation and development part.

With completion occasions already above common, and development prices elevated, it appears an odd time to be incentivising extra dwelling approvals and commencements to the backlog of labor to be accomplished.

In actual fact, with out growing the capability or productiveness inside the development sector to tackle this extra work, it may even current an upside danger to inflation, at a time when the business is crying out for charges to maneuver decrease.

What can the federal government actually do about housing provide?

Maybe the precedence for presidency coverage then needs to be on delivering the pipeline, relatively than including extra to it.

Enhancements to productiveness are rightfully getting a giant callout, with the Productiveness Fee estimating a 12% decline in dwelling development gross worth added per hour between the mid-90’s and 2023.

Making properties quicker and cheaper to construct, whereas nonetheless sustaining high quality, resilient properties is the important thing problem for policymakers to give attention to proper now.

One other consideration is the demand facet of the equation, which has misplaced some focus in recent times.

Winding again destructive gearing and capital features tax concessions for residential property, implementing broad-based land taxes or together with the household house within the pension asset take a look at are all examples of insurance policies that would cut back demand for housing, and doubtlessly the necessity for as a lot new provide altogether.

This might have the additional advantage of easing capability in new house development, relatively than risking extra inflationary pressures for brand new housing development.

All eyes now flip to the Nationwide Productiveness Summit, the place leaders throughout authorities, business and unions will debate the very reforms that would reshape parts of each provide and demand.

With calls mounting to revisit destructive gearing, capital features tax concessions, and different structural incentives driving housing demand, the dialog is lastly shifting past approvals and into the actual levers of change.

If governments are severe about delivering 1.2 million properties, they need to give attention to constructing capability, lifting productiveness, and making certain each authorised house really will get constructed.