Property Sentiment Index, September 2025

The OnTheMarket Property Sentiment Index explores how residence movers are feeling concerning the property market, supported by information from our personal platform. This version reveals that the general public anticipate each gross sales and rental proces to rise over the subsequent 12 months whereas these planning to purchase, promote or hire stay assured to make their transfer inside six months or much less.

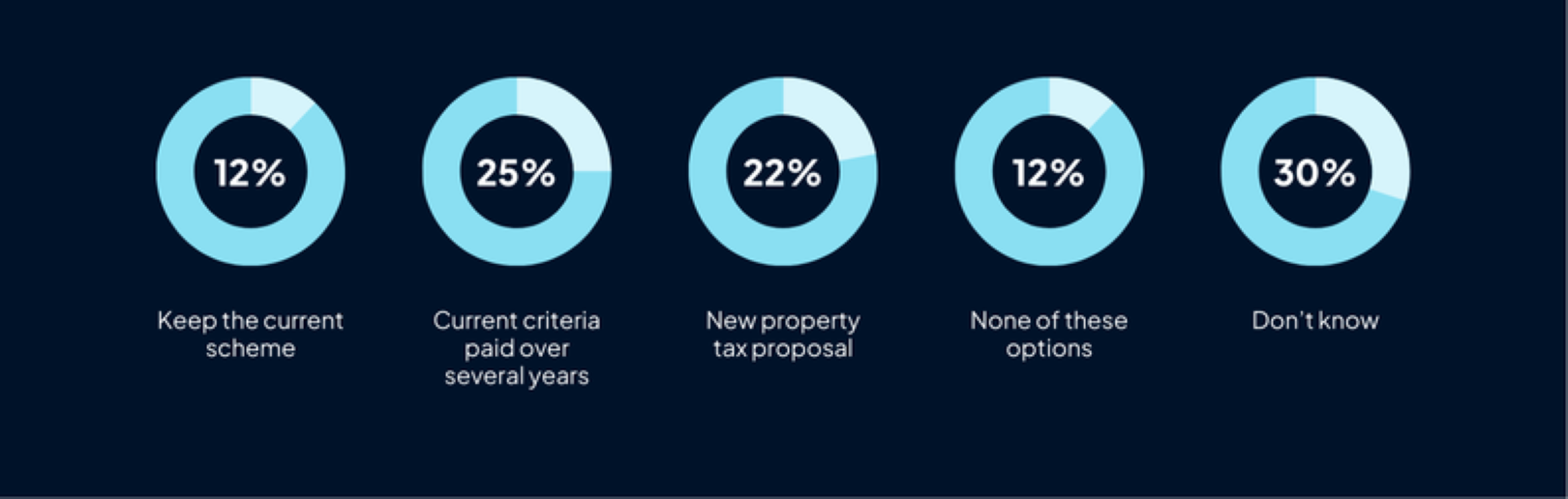

Moreover, there may be an urge for food for reform throughout the property tax system, with solely 12% wanting the present system to stay in place unchanged. Nonetheless, opinions are cut up with regards to selecting a substitute.

Sentiment in direction of the property market

Gross sales market expectations

When waiting for the subsequent 12 months, just below half of property seekers consider home costs will improve, a small fall from 51% who stated the identical three months in the past, suggesting a slight wavering in confidence within the UK property market. In the meantime, 24% consider costs will keep the identical, up from 21% within the earlier quarter, and solely 13% anticipate home costs to fall.

Vendor expectations

Amongst these trying to promote a property, 51% of all respondents, 4 in ten (38%) anticipate to obtain a suitable provide inside three months, whereas the identical proportion consider this may occur in three to 6 months (additionally 38%). Simply over one in ten (13%) predict they’ll settle for a suggestion inside six to 9 months and 6% say inside 9 to 12 months.

Purchaser outlook

These trying to purchase a property, 74% of complete respondents, are typically assured that it received’t take lengthy to discover a residence and have a suggestion accepted. Equally to the June version, 4 in ten consider this may occur in three to 6 months, whereas an additional 37% anticipate it to take even much less time. Just below a fifth (17%) anticipate their search to take between six and 9 months.

Monetary confidence

Whereas nonetheless a majority, the numer of residence movers feeling assured of their means to lift the mandatory funds to purchase their subsequent property has dropped from 70% in June to 65%, with 42% feeling very assured and an additional 23% pretty assured. In the meantime, 11% really feel not very assured or not assured in any respect.

New properties

Curiosity in new properties has remained regular amongst property seekers, with 42% more likely to contemplate one as their subsequent property, a small change from 46% in June. Whereas 38% say they’re unlikely, up from 37% in June.

Rental market sentiment

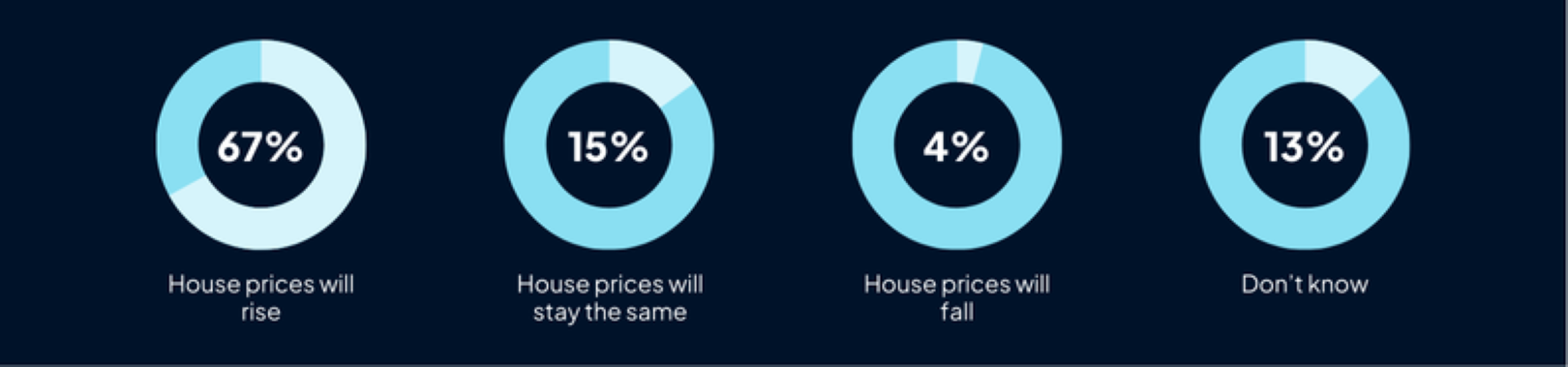

Contemplating rental costs, expectations replicate the dearth of provide and growing demand, as two-thirds (67%) anticipate costs to extend, an identical proportion to June’s determine of 65%. In the meantime, 15% consider rents will keep on the similar stage, and solely 4% suppose they are going to fall.

Renter outlook

Regardless of expectations for rents to extend, these trying to hire, 59% of complete respondents, stay assured of their means to discover a property and have a suggestion accepted rapidly. Half consider they’ll have a suggestion on a rental property accepted inside three months and an additional 29% anticipate it to take between three and 6 months. Lower than one in ten consider it should take six to 9 months (9%), 9 to 12 months (5%) or over a yr (6%).

Present occasions and coverage developments

Housing targets

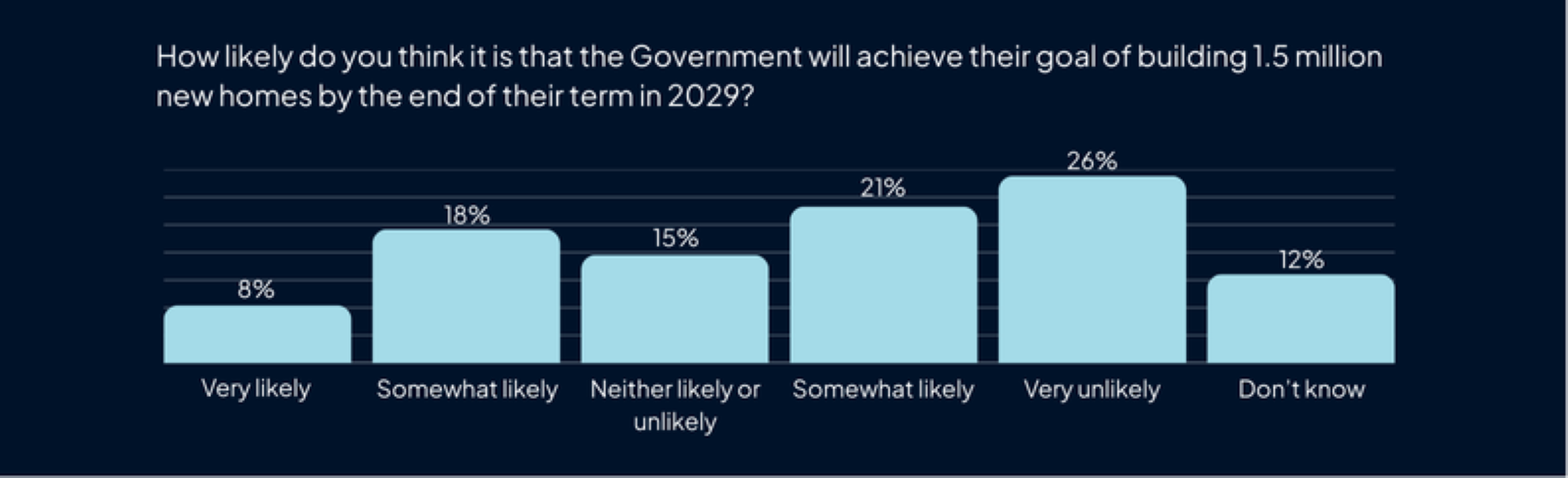

The federal government continues to face challenges in assembly its goal of 1.5 million new properties, with abilities and assets working low. It comes as no shock, due to this fact, that nearly half of respondents say the goal is unlikely to be met. 1 / 4 (26%) say it is vitally unlikely, whereas an additional 21% consider it to be pretty unlikely. This represents little change in comparison with June’s outcomes of 49%.

However, 1 / 4 of respondents consider the federal government is more likely to attain its goal of recent properties by the tip of its time period in 2029. Of those, 8% say it is vitally possible, whereas 18% consider it to be pretty possible.

Stamp responsibility

Because the finish of the Stamp Obligation vacation in March, there was a lot dialogue about whether or not the property tax system ought to evolve with a spread of concepts floated up to now. Amongst respondents, solely 12% consider the present system ought to keep in place unchanged. 1 / 4 are in favour of protecting the identical standards however spreading funds over a number of years reasonably than requiring them up entrance. In the meantime, an identical proportion (22%) help the newest proposition of introducing a property tax on any property valued over £500,000, with a better price utilized to properties price over £1 million. Solely 12% say they help none of those three insurance policies and 30% stated they don’t know.

Rates of interest

In the beginning of this yr, the Financial institution of England’s base price was set at 4.75% however has since dropped to 4%. In response, 30% of property In response,30% of property seekers say they’ve adjusted their search standards. The commonest change has been in searchers’ worth ranges (13%), whereas 6$ have modified the placement of their search and 4% have altered the variety of bedrooms of their potential properties. Some respondents choosing “different” defined they’d determined to hire reasonably than purchase.

Seeking to the longer term, opinions are combined on what’s going to occur to rates of interest. 1 / 4 of property seekers anticipate charges to proceed to fall (26%), whereas simply over a 3rd (35%) consider they’ll keep on the present stage. Lower than one in 5 (!7%) anticipate charges to rise once more. Round 1 / 4 (23%) say they don’t know.

Whereas confidence within the velocity of transactions stays sturdy amongst consumers, sellers and renters, consumers are additionally feeling optimistic about their means to lift the funds wanted to buy their subsequent home.

Seeking to present occasions, opinions are combined on what the way forward for property tax appears to be like like, with property seekers cut up as as to if the present system needs to be maintained or reformed. The yr’s rates of interest drops have affected the way in which some are looking for property, as many predict charges to remain on the present stage or drop additional.

We’ll proceed to watch shifts in sentiment and market exercise within the months forward and supply up to date insights in our subsequent version. Preserve studying for insights from OnTheMarket’s information and feedback from brokers across the nation on their experiences over the previous few months.

Insights from the OnTheMarket web site

Key phrases

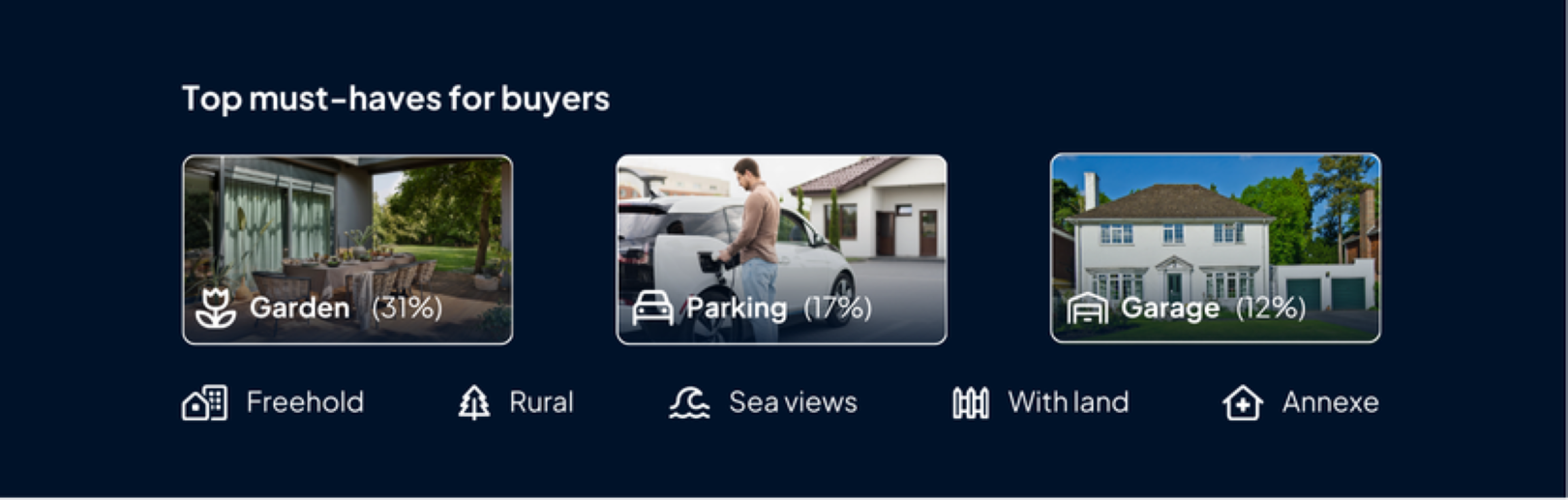

Our key phrase search instrument helps property seekers refine their search based mostly on particular options they need of their subsequent residence.

For consumers, outside area is a transparent prioerty with gardens that includes in 31% of key phrase searches. Parking can be extremely wanted (17%) together with garages (12%) whereas freehold properties and rural properties atrract comparable ranges of curiosity (each 7%).

Within the rental market, gardens once more prime the checklist, showing in 29% of key phrase searches, with parking as soon as once more shut behind at 21%). Renters, nevertheless, have further issues with 11% seek for “pets thought-about”, 10% for “payments included” and seven% for “furnished”.

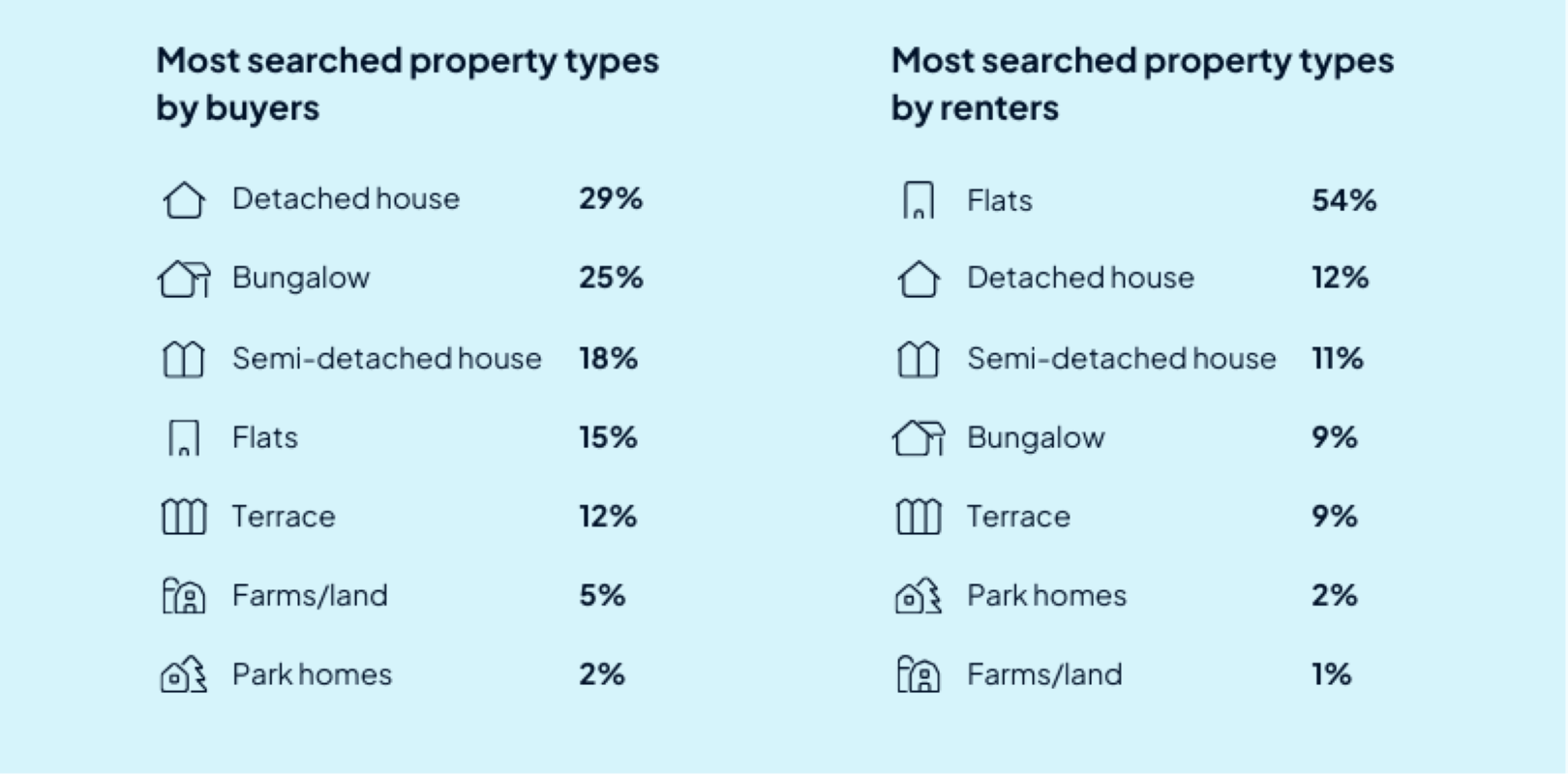

Property sorts

Filtering by property sorts stays on of probably the most extensively used search choices.

Amongst consumers, indifferent homes are the most well-liked alternative (27%), intently adopted by bungalows (23%). Semi-detached homes make up an additional 17% of searches whereas flats account for 15%.

Renters, then again, present a robust choice for studios, which dominate 55% of filtered searches. Indifferent and semi-detached homes share comparable demand with 12% every, adopted by bungalows and terraced homes, each with 9% of filtered searches.

New directions

OnTheMarket has typically seen a development in new listings in current months, growing by round 5% every month as much as August. Nonetheless, final month noticed a seasonal dip, with new instruction falling by 15%, a standard pattern throughout the summer time as many sellers delay transferring plans whereas they go on vacation or benefit from the climate at residence.

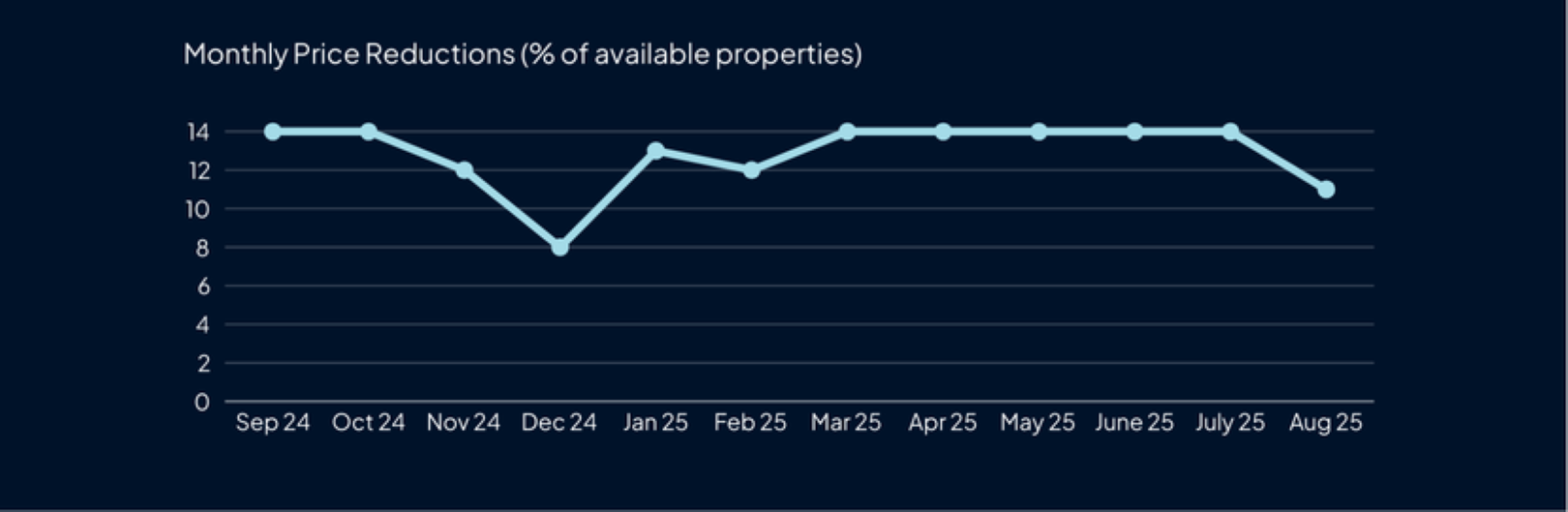

Worth reductions

The proportion of properties with worth reductions has remained comparatively steady in current months. In August, 11% of listings had been diminished, in contrast with 14% in each June and July. This consistency means that the small shifts following the tip of the Stamp Obligation vacation are regularly returning to extra acquainted ranges.

“With the November Finances on the horizon and ongoing financial uncertainty, consumers stay cautious and worth delicate. This yr we have now achieved report costs, each on a £ per sq. foot foundation and when it comes to actual values in sure roads, the place all properties have been turn-key.

“Many consumers are extremely knowledgeable, usually utilizing £ per sq. foot as a benchmark earlier than deciding which properties to view. Whereas some are ready to supply, persuading them to enhance their bids might be difficult, as they need reassurance that their buy will nonetheless symbolize good worth after the Finances or in just a few years’ time.

“With inventory ranges throughout London remaining excessive, bridging the hole between asking worth and achievable sale worth has been key. Wise pricing not solely reduces time available on the market however can even assist safe stronger outcomes. In truth, we have now achieved report costs for shoppers who adopted this method.

“Conveyancing is at the moment taking round 6–8 weeks. We strongly suggest that sellers instruct solicitors early and put together documentation prematurely to keep away from delays, which solely add to purchaser uncertainty.”

“What we’re seeing throughout the market are centered consumers eager to get offers over the road, with exchanges and new purchaser registration ranges on par with 2024, regardless of an unsure financial and political panorama. The current choice by the Financial institution of England to carry rates of interest at 4% has demonstrated a give attention to stability: a pause that enables the market to regulate regularly and with higher confidence over the longer-term.

“While costs have adjusted in some native markets, others stay underpinned by excessive demand, creating a really regionalised image. Way of life-led strikes proceed to drive demand in places like Tunbridge Wells, Chester and Colchester, the place long-term worth outweighs short-term volatility. Completions stay sturdy in commuter hubs like Sevenoaks and Hale, reflecting the resilience of micro-markets that supply connectivity, group and high quality of life. Whereas these decided to finish earlier than Christmas are already deep into their transactions, money consumers now have a invaluable alternative, with a wide array of properties accessible to them.

“Homemovers are more and more centered on the tangible realities of at the moment’s housing panorama. Our current analysis revealed that of the 15% of over 55s who plan to downsize would accomplish that throughout the subsequent yr if stamp responsibility had been eliminated or diminished on their onward buy, reflective of pent-up demand and a doable wave of movers topic to the outcomes of the Autumn Finances.

“As we enter the ultimate quarter of the yr, the message is obvious; consumers are dedicated however now extra discerning. The precedence for coverage makers should be to supply additional stability that may breed confidence, gasoline transactions, and help homemovers on their journey.”

“After a surprisingly busy few months of transactional exercise in any respect ranges of the agricultural property company market, the drip feed of potential modifications to the taxation of each housing and housing transactions has introduced a layer of warning into {the marketplace}.

“On the greater finish of the market – particularly round properties price in extra of £1.5m – there may be extra warning as the potential of introducing capital positive factors tax to precept non-public residences has been rumoured to be introduced in November’s Finances.

“Nonetheless, the marketplace for properties price lower than £1.5m is standing up very properly. Doable reforms to stamp responsibility are more likely to be unlock exercise amongst consumers, and our New Houses workforce are additionally very busy, which bodes properly for the way forward for home constructing and residential possession.”

Methodology

Between Friday 22 and Saturday 30 August, over 2,500 lively property seekers who’ve just lately signed up for property alerts or despatched a property enquiry at OnTheMarket participated in our survey. This group represents engaged people at the moment navigating the UK property market. Breaking respondents down into:

- 1331 (50%) are actively in search of a property to purchase

- 1345 (51%) have a property to promote

- 1571 (59%) are actively in search of a property to hire

The place totals don’t add as much as 100%, this is because of rounding.

Information on key phrases, property sorts, new directions and diminished properties is for June to September and is drawn from OnTheMarket’s information compiled from 1000’s of property agent branches and housebuilders who checklist their properties with OnTheMarket each month.

The info for key phrases and property sorts is expounded to all searches which have used these filters and doesn’t embody info referring to searches with out them.

For all enquiries, please contact Amelia Collins (acollins@onthemarket.com)